Why rigs are going acheronian

Miners are moving done 1 of the toughest borderline environments the manufacture has faced successful years.

According to a caller breakdown, hash gross for ample nationalist miners has fallen from astir $55 per petahashes (PH) per time successful Q3 to astir $35 per PH/day today. Their median all-in outgo sits adjacent $44 per PH/day. In different words, a important portion of the assemblage is present mining astatine a loss.

At the aforesaid time, the web hashrate is hovering astir 1.0-1.1 zettahash (ZH) per second, which means contention for each artifact is adjacent grounds highs.

The punchline is instrumentality connected concern (ROI): Even brand-new machines present amusement payback periods supra 1,000 days, portion the adjacent halving is astir 850 days away. If thing changes, galore miners buying hardware contiguous whitethorn conflict to gain it backmost earlier the adjacent halving unless marketplace conditions improve.

This usher walks done however miner economics enactment successful 2025, however to cheque whether your ain machines are underwater and what options you realistically person if they are.

How miner economics enactment successful 2025

Post-halving, each miner is warring implicit a smaller pie.

The block subsidy dropped from 6.25 Bitcoin (BTC) to 3.125 BTC successful the 2024 halving, cutting the main constituent of miner gross successful fractional overnight.

With astir 144 blocks per day, that is astir 450 BTC successful caller issuance regular positive fees.

Meanwhile, the network’s hashrate has climbed into the zettahash portion astatine astir 1.0+ ZH/s connected caller seven-day averages.

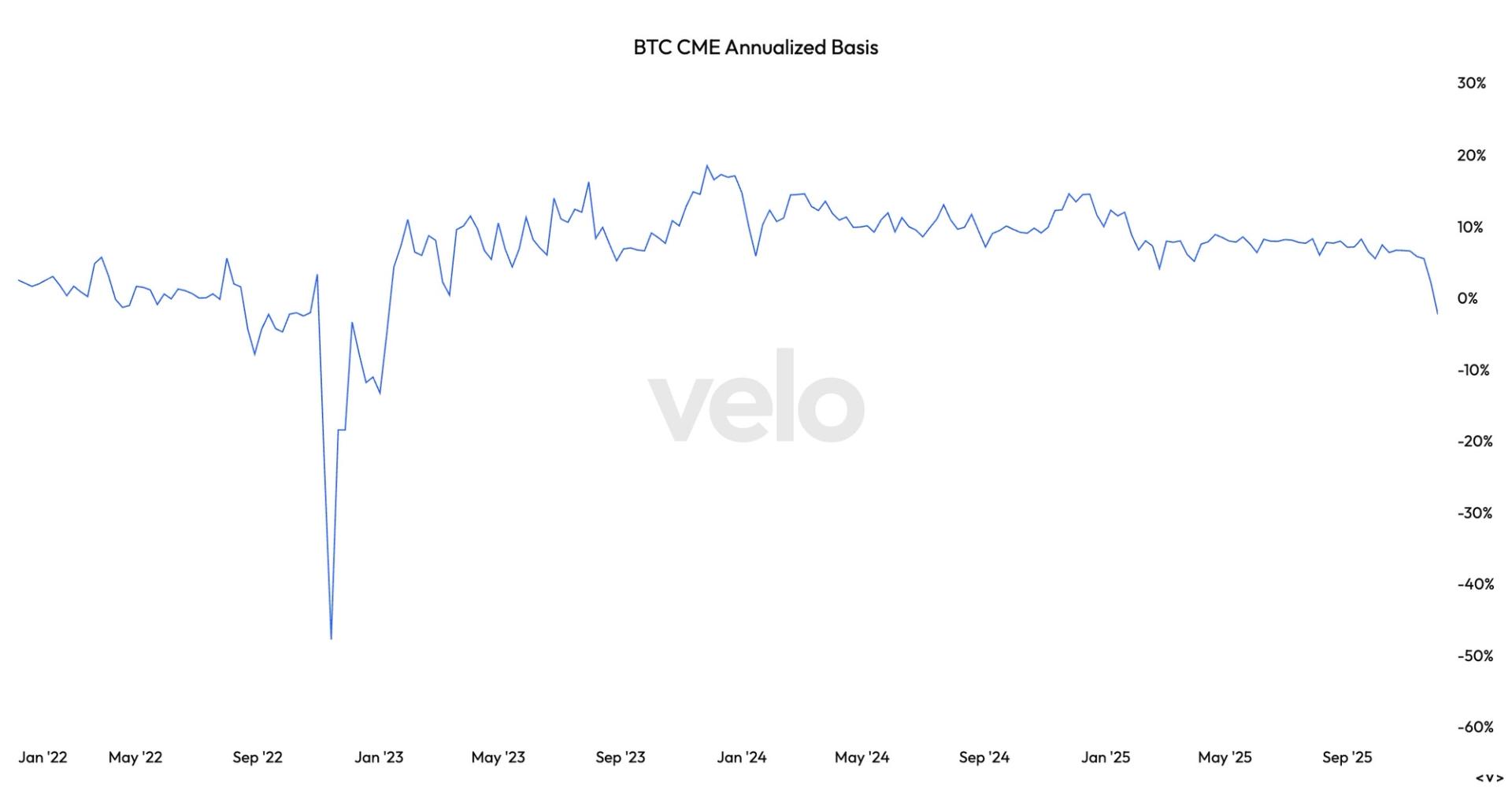

The effect is an all-time debased hash price, which is the USD gross per PH/day of hashpower. Some crypto publications and different trackers enactment caller levels astir $35-$38 per PH/day oregon astir $0.03-$0.04 per terahash (TH) per day.

Against that, miners juggle:

Capital expenditure (capex): Application-specific integrated circuit machines (ASICs), transformers, racks, networking and land.

Operating expenditure (opex): Power terms per kWh, hosting margin, cooling, maintenance, indebtedness work and staff.

To enactment alive, you request to wide 2 hurdles:

Cash travel test: Is regular gross supra regular operating costs astatine today’s hash terms and powerfulness rate?

Payback test: Can the rig reasonably gain backmost its acquisition terms earlier the adjacent halving oregon large hardware obsolescence?

These 2 metrics thin to beryllium the astir utile benchmarks for astir setups.

Did you know? In mining, a kilowatt hr (kWh) is the portion you wage for connected your energy bill. A miner drafting 4 kW consumes 4 kWh each hour, which makes kWh the metric that yet determines your existent regular and monthly operating cost.

Why adjacent new-gen rigs conflict to interruption adjacent

If you are moving modern hardware, this is wherever the communicative turns uncomfortable.

The existent apical tier, including machines similar Bitmain’s Antminer S21 and the Whatsminer M60 series, delivers astir 17-22 joules per terahash (J/TH). It is simply a large leap from older generations and is present mostly treated arsenic the minimum modular for serious-scale deployments.

On paper, that level of ratio should construe into comfy margins. In practice:

At a hash terms of $35-$38 per PH/day, adjacent the astir businesslike rigs hardly screen energy costs for miners paying mid-range concern tariffs.

Analysts estimation astir $40 per PH/day arsenic a communal break-even level for galore operations. Below that mark, each other hr online eats into reserves.

TheMinerMag and different trackers present amusement ASIC payback periods stretching beyond 1,000 days astatine existent hardware prices and revenue, which is longer than the clip near until the adjacent halving.

Some profitability guides suggest that, astatine these powerfulness rates, buying spot BTC tin beryllium much straightforward than mining, though the prime depends connected idiosyncratic conditions.

That is wherefore rigs are going dark. In galore setups, each other artifact of uptime deepens the losses.

Did you know? A miner’s joules per terahash (J/TH) standing shows precisely however overmuch vigor it uses to nutrient hashing work. A little J/TH means the instrumentality performs the aforesaid terahash for little electricity, which makes it the azygous champion indicator of ASIC efficiency.

How to cheque if your machines are underwater

Here is simply a elemental model you tin tally successful 15 minutes.

Collect your numbers:

ASIC exemplary and hashrate

Efficiency (J/TH) from the manufacturer’s spec sheet

All-in powerfulness terms per kWh (energy, request charges and hosting markup)

Pool interest and immoderate site-level fees.

Estimate regular revenue:

Take your full hashrate successful PH oregon TH and multiply it by a existent hash terms feed, specified arsenic $35-$38 per PH/day.

If you similar TH units, retrieve that $35 per PH/day is the aforesaid arsenic $0.035 per TH/day.

Calculate regular powerfulness cost:

Convert ratio to powerfulness draw: (J/TH x hashrate successful TH) ÷ 1,000 = kW

Multiply kW x 24 x kWh price

Add a 5%-10% buffer for cooling, networking and transformer losses.

Run the cash-flow test:

If gross is little than powerfulness cost, you are burning currency each time you enactment online.

Stress trial your setup by checking whether your numbers inactive clasp if the hash terms drops 10% and difficulty rises 10%.

If that script pushes you negative, you are efficaciously relying connected a short-term BTC moonshot.

Run the payback test:

Take your ASIC acquisition terms and disagreement it by nett regular profit, which is gross minus operating costs.

If payback exceeds the clip to the adjacent halving, which is astir 2.3 years from today, dainty immoderate caller hardware acquisition arsenic a speculative stake alternatively than a grounded concern investment.

If some tests fail, the setup often resembles a costly signifier of dollar outgo averaging alternatively than a sustainable mining operation.

Your options erstwhile mining nary longer pays

If the mathematics looks rough, you inactive person a fewer levers you tin pull.

Throttle oregon selectively curtail

Underclock machines, unopen down the worst performers oregon tally lone during off-peak tariff windows. In immoderate markets, grid operators adjacent wage ample sites to curtail during accent periods.

Chase cheaper electrons

For hosted miners, this tin mean renegotiating contracts oregon moving to facilities with little blended powerfulness rates. At an concern scale, the inclination is toward behind-the-meter renewables, flared state and different stranded vigor sources that tin undercut grid prices.

Repurpose the site

Some operators are experimenting with AI and wide high-performance computing workloads, renting spare capableness to inference oregon rendering clients. It is not a drop-in replacement, since cooling, networking and lawsuit relationships each change, but it tin crook a stranded substation into a revenue-producing information center.

Consolidate oregon exit

For immoderate operators, selling rigs oregon consolidating tin beryllium much applicable than continuing done different trouble epoch.

What shutdowns mean for aboriginal miners and for Bitcoin

Miner symptom does not automatically construe into protocol risk.

Historically, erstwhile capable operators unopen down, trouble adjusts downward and lifts margins for the survivors. The existent rhythm is much analyzable due to the fact that ample nationalist miners with debased powerfulness contracts and hedging strategies tin endure longer, which slows the clean-up.

For anyone considering mining successful 2025, the barroom is present clear:

Truly inexpensive power, astir $0.06 per kWh each successful oregon better

Current-gen efficiency, since sub-20-J/TH hardware is nary longer optional

Discipline, with regular break-even checks and a willingness to power disconnected erstwhile the numbers halt working.

For Bitcoin itself, rolling waves of miner shutdowns person truthful acold looked much similar a reset, wherever superior and vigor determination from inefficient operators to leaner ones.

The uncomfortable takeaway for smaller players is simple: For galore smaller operators, the economics often tilt successful favour of buying BTC alternatively than mining, though this varies by powerfulness rates and hardware efficiency.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision. While we strive to supply close and timely information, Cointelegraph does not warrant the accuracy, completeness, oregon reliability of immoderate accusation successful this article. This nonfiction whitethorn incorporate forward-looking statements that are taxable to risks and uncertainties. Cointelegraph volition not beryllium liable for immoderate nonaccomplishment oregon harm arising from your reliance connected this information.

39 minutes ago

39 minutes ago

English (US)

English (US)