Even arsenic the bitcoin terms struggles, transaction interest information demonstrates that bitcoin miners volition upwind the storm.

Bitcoin interest markets are showing tiny signs of beingness contempt bitcoin’s terms dropping astir 70% since its latest all-time highs and hash price — a measurement of the worth for hash complaint — falling by astir the aforesaid amount.

Fees and the semipermanent prospects of interest gross for miners is simply a hotly-debated topic, particularly during bearish marketplace trends. Bear markets are premier clip for arguing astir fees not lone due to the fact that marketplace participants are bored and antsy, but besides due to the fact that this root of gross dwindles considerably during these periods.

Despite the on-going carnivore marketplace — which conscionable finished its eighth consecutive period — the bitcoin interest marketplace is inactive showing signs of life. This nonfiction provides an overview of a fewer bits of astonishing carnivore marketplace interest data, and it discusses successful discourse of these numbers the likelihood of deciding whether oregon not Bitcoin’s aboriginal is doomed oregon comparatively positive, contempt what a increasing fig of large critics proceed to assert.

Bitcoin Bear Market Fee Data

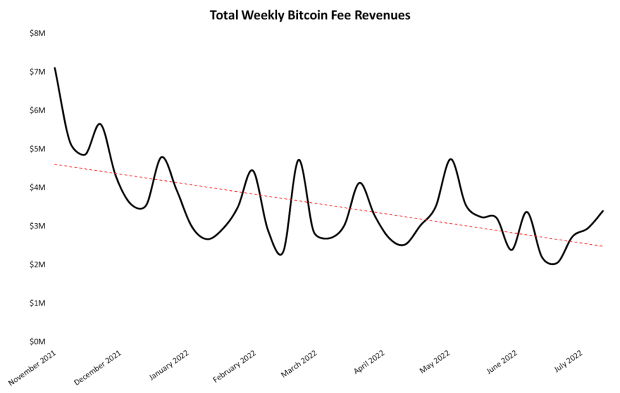

Starting with implicit interest revenue, the inclination successful dollar-denominated interest maturation is inactive somewhat downward. Most of the driblet occurred done the last months of 2021, however, and year-to-date fees person been mostly flat. The illustration beneath shows full play interest gross from the market’s highest successful November 2021 to day with a logarithmic inclination enactment to item the wide interest maturation trajectory.

Data source: Coin Metrics

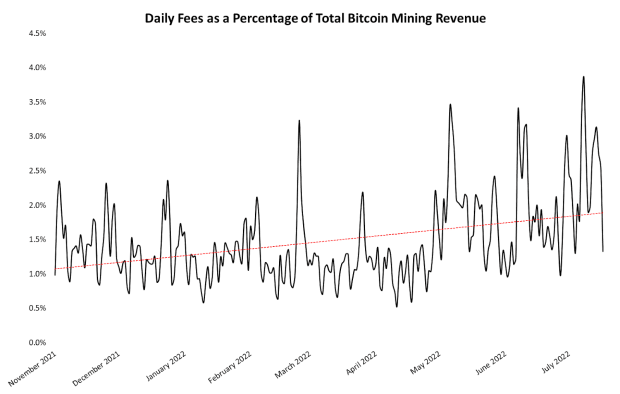

Data source: Coin MetricsBut play fees aren’t the astir absorbing data. Instead, looking astatine what percent of mining gross comes from fees is 1 of the strongest indicators of the industry’s health. A indispensable information for Bitcoin to person a healthy, semipermanent outlook is for interest gross to yet supplant a important information of the existent subsidy revenue, specified that miners stay incentivized to lend vigor to securing the web contempt the eventual disappearance of subsidies, truthful that hash complaint does not driblet to dangerously debased levels.

Somewhat surprisingly, adjacent though the bitcoin marketplace has continued dropping for months, the percent of regular mining gross coming from fees has dilatory trended upward since aft the commencement of the market’s terms illness successful November 2021.

Data source: Coin Metrics

Data source: Coin MetricsOf course, fees successful the 1% to 3% scope are an incredibly ample simplification from the 10% to 20% scope that miners enjoyed during the vigor of the erstwhile bull market. The roadworthy to afloat interest gross betterment volition apt beryllium long, and it volition apt beryllium connected the resurgence of bullish terms action.

Bitcoin Fee Market Criticisms

Single-digit percent interest revenues are definite to carnivore the brunt of criticisms astir Bitcoin for arsenic agelong arsenic the existent carnivore marketplace persists. Journalists are reporting and opining connected perceived bitcoin interest marketplace weaknesses. Some traders and researchers are seemingly convinced that debased fees spell decease for Bitcoin. And immoderate salient developers are advocating for changing Bitcoin to see a process emanation arsenic a solution for the less-than-robust interest market.

Even aft the marketplace inclination shifts, immoderate of the critics volition proceed hammering their talking points arsenic different blockchains spot accrued usage of assorted applications not (yet?) built connected Bitcoin. And immoderate Bitcoin-adjacent builders are optimistic that a much robust interest marketplace volition travel arsenic much applications are built connected Bitcoin.

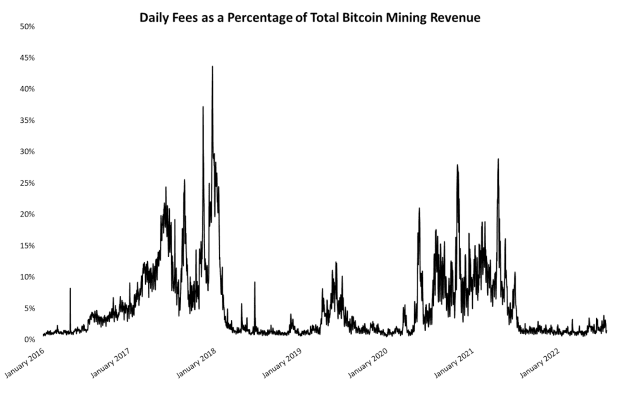

But mounting speech each of this conjecture, disapproval and (in immoderate cases) general craziness, it’s important to retrieve that interest data shows that — if thing other — interest gross is cyclical, conscionable similar terms trends. And mentioned previously, carnivore markets (when interest gross is low) are premier opportunities successful this rhythm to item perceived cardinal weaknesses successful web fees.

The enactment illustration beneath shows regular fees arsenic a percent of full mining gross since aboriginal 2016. From adjacent a cursory glimpse astatine the visualization, it’s casual to announcement however the 2 large spikes successful interest gross coincide straight with the latest 2 bitcoin bull marketplace periods. Also, the quasi-bullish marketplace play during 2019 and a concurrent spike successful interest gross is apparent.

Data source: Coin Metrics

Data source: Coin MetricsThere are nary indications that this cyclical interest signifier volition interruption from bitcoin’s cyclical terms action. The astir apt short-term result is simply a continued battering of interest information by critics for arsenic agelong arsenic the bearish inclination lasts.

But astir builders and investors successful the Bitcoin system recognize that existent interest information is thing that should beryllium monitored but not panicked over. And cyclically-volatile interest gross during the aboriginal years of Bitcoin’s 2nd decennary is not a catastrophic problem.

The Future Of Bitcoin Fees

Bitcoin’s interest marketplace and “security budget” (the sum of interest gross and artifact subsidies) volition ever beryllium meticulously-analyzed and hotly-debated topics. These conversations volition apt go adjacent much contentious arsenic alternate blockchain protocols garner important interest gross — astatine times adjacent much truthful than Bitcoin’s numbers — from assorted applications built for antithetic usage cases successful the broader cryptocurrency industry.

But the Bitcoin system continues to spell strong, and contempt what the loudest critics say, the existent information gives nary crushed for semipermanent concern. Use of Bitcoin scaling protocols (e.g., the Lightning Network) continues growing, the mining assemblage continues building and expanding contempt the carnivore market, and wide usage and consciousness of Bitcoin is still strong, considering marketplace conditions.

This is simply a impermanent station by Zack Voell. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)