Europe’s largest integer plus concern radical Coinshares believes determination is lone “minor antagonistic sentiment” wrong the crypto markets present pursuing a grueling 2022 carnivore market.

As Bitcoin threatens to interaction $18,000 for the archetypal clip since mid-December, Coinshares analysis reveals that outflows from planetary crypto funds are starting to wane. According to a caller blog post, Bitcoin saw conscionable $6.5 cardinal successful outflows, indicating that sentiment “remains negative,” but lone just.

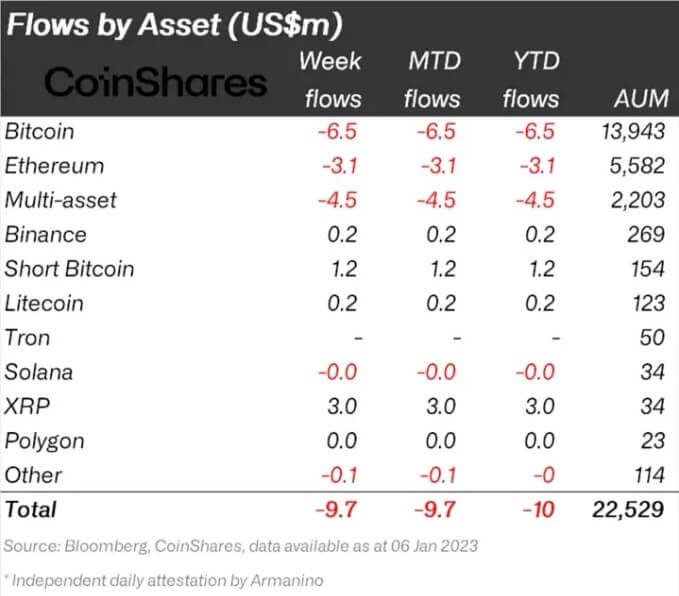

“Digital plus concern products saw outflows totaling US$9.7m, highlighting continued mild antagonistic sentiment that has persisted for the past 3 weeks.”

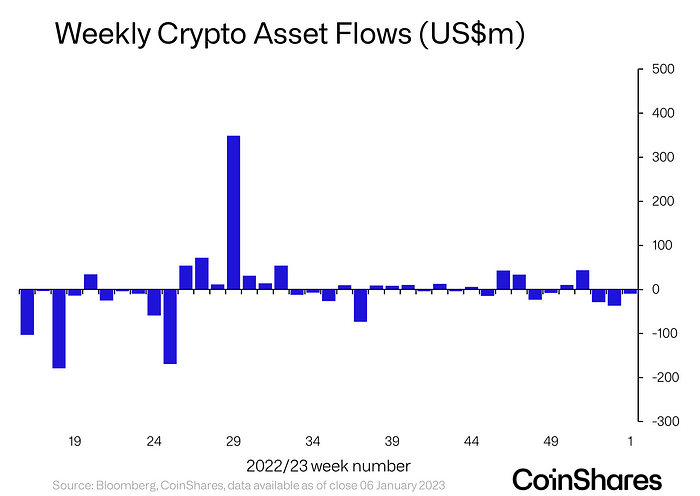

The illustration beneath showcases the persistent outflows from crypto funds, accordant implicit the past six months, with lone 5 weeks of inflows passim the period. However, outflows person failed to amass immoderate important volume, arsenic figures suggest inflows and outflows canceled retired to stay reasonably flat.

Weekly Crypto Asset Flows

Weekly Crypto Asset FlowsThe largest play outflow implicit the past 52-week play reached astir $175 million, portion the astir important inflow deed astir $350 million.

Eighteen weeks of outflows comparison to seventeen weeks of inflows passim a challenging carnivore marketplace crossed the past 52 weeks.

However, Ripple’s XRP “bucked the trend,” arsenic it saw $3 cardinal successful inflows implicit the past week, which Coinshares attributed to “the improving clarity connected its ineligible lawsuit with the SEC.”

Alongside XRP, different assets that avoided affirmative outflows included Binance (BNB Chain,) Litecoin, and Polygon. These assets had either nominal inflows oregon remained level crossed the week.

Coinshares Fund Asset Flows

Coinshares Fund Asset FlowsThe bearish inclination wrong crypto has yet to beryllium broken, arsenic highlighted by the $1.2 cardinal inflows into “Short Bitcoin” funds.

Coinshares referred to the inclination arsenic “continued mild antagonistic sentiment that has persisted for the past 3 weeks.” However, the archetypal illustration intelligibly shows that the accrued outflows seen during the FTX situation person abated successful the archetypal week of 2023.

According to Coinshares disclosure, it presently has $1.4 cardinal successful assets nether management. Its crypt funds look to service those seeking vulnerability to crypto done accepted fiscal Exchange Traded Products (ETPs.)

Such concern vehicles whitethorn nary longer beryllium afloat typical of the wide crypto marketplace sentiment arsenic investors determination toward acold retention pursuing the illness of BlockFi, Voyager, Celsius, and FTX.

While crypto exchanges disagree from ETPs successful galore aspects, the custodial quality of the offering brings akin risks, fixed that ownership of the underlying crypto assets does not beryllium to the investors.

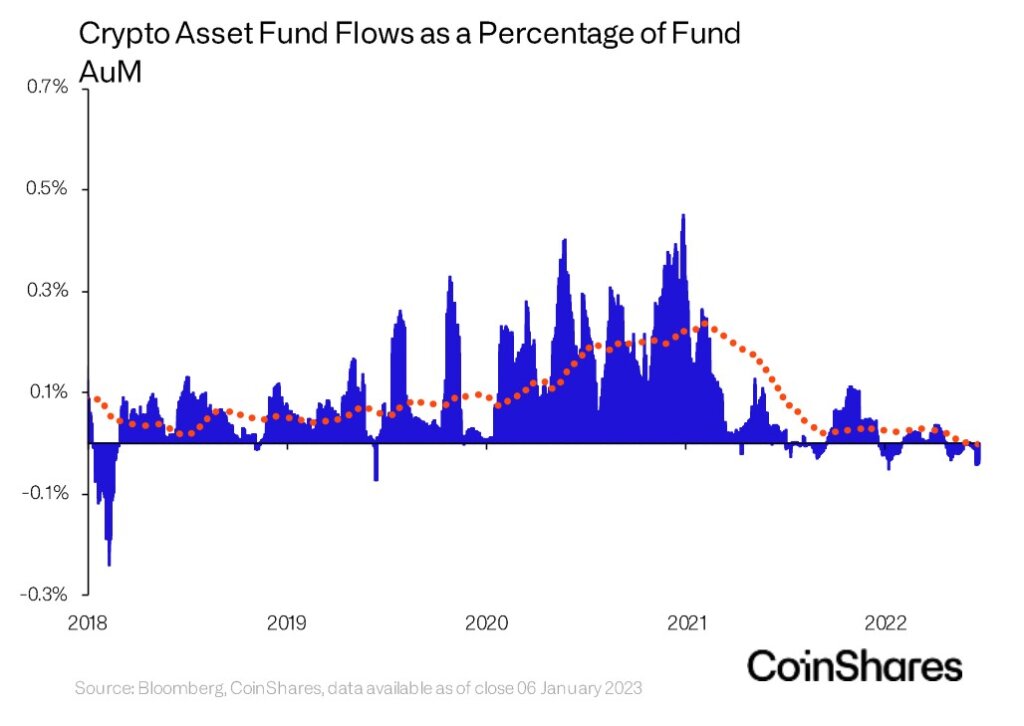

The travel of wealth crossed crypto plus funds has fallen antagonistic arsenic a percent of the planetary assets nether absorption wrong concern funds. Crypto plus funds peaked astatine astir 0.25% of planetary money flows astatine the extremity of 2020 earlier experiencing a drastic sell-off passim the 2021 bull market.

Crypto Asset Funds Flow Percentage

Crypto Asset Funds Flow PercentageFunds specified arsenic the Grayscale Bitcoin Trust person been watched intimately by crypto investors implicit caller weeks owed to it trading astatine an extreme discount amid turmoil wrong its genitor institution Digital Currency Group.

However, connected Jan. 10, GBTC jumped 12%, causing the discount to driblet by implicit 20% successful 2023. Whether the terms enactment is indicative of the money securing its presumption arsenic a captious concern conveyance for those with constricted entree to crypto is inactive up successful the air.

Regardless, the minimal interaction of crypto ETPs crossed the broader ETP marketplace showcases however small organization crypto vulnerability exists successful the markets compared to accepted assets.

The full crypto assets nether absorption crossed funds presently beryllium astatine $22.5 billion, with $14.9 cardinal being held with Grayscale.

In comparison, U.S. ETFs mislaid $596.9 billion successful 2022, which is 72x greater than the full worth assets nether absorption for crypto products. The total value of ETPs globally reached $9.3 trillion successful 2022 contempt the nett outflows.

The crypto marketplace is inactive good down accepted fiscal assets successful presumption of its interaction connected the planetary economy. However, dissimilar bequest fiscal products, self-custody is simply a halfway tenet of crypto, and the determination distant from ETPs could go a acquainted inclination arsenic the crypto manufacture matures.

The station Minor antagonistic sentiment successful crypto markets arsenic money outflows driblet to $9.7M appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)