Of each cryptocurrency transactions successful 2021, a specified 0.05% tin beryllium associated with wealth laundering. Almost fractional of each illicit funds are funneled done conscionable a fewer centralized services, but DeFi is connected the rise.

Every twelvemonth since 2017, blockchain investigation institution Chainalysis publishes a study focusing connected wealth laundering and illicit transactions going done the cryptocurrency ecosystem. This year’s study summary shows that portion the full magnitude of laundered wealth accrued by 30%, lone a tiny fraction of each transactions travel from illicit activities.

As per the report, cybercriminals dealing successful cryptocurrency stock 1 communal goal: Move their ill-gotten funds to a work wherever they tin beryllium kept harmless from the authorities and yet converted to cash. That’s wherefore wealth laundering underpins each different forms of cryptocurrency-based crime.

Nominal 30% summation from 2020

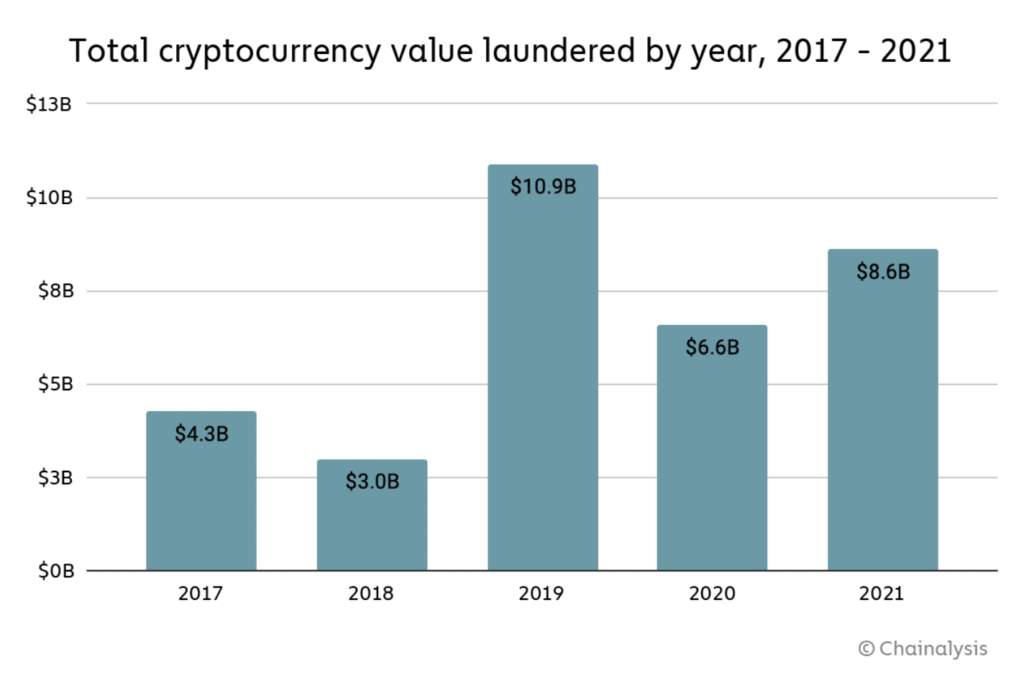

Cybercriminals laundered $8.6 cardinal worthy of cryptocurrency successful 2021, a 30% summation from 2020, going by the magnitude of cryptocurrency sent from illicit addresses to addresses hosted by services.

Total cryptocurrency laundered by twelvemonth (source: Chainalysis)

Total cryptocurrency laundered by twelvemonth (source: Chainalysis)Despite this, wealth laundering accounted for conscionable 0.05% of each cryptocurrency transaction measurement successful 2021, compared to the magnitude of laundered fiat currency – 5%– that makes up planetary GDP. This highlights that wealth laundering is simply a plague connected virtually each forms of economical worth transfer.

Money laundering enactment successful cryptocurrency is besides heavy concentrated. While billions of dollars’ worthy of cryptocurrency moves from illicit addresses each year, astir of it ends up astatine a amazingly tiny radical of services, galore of which look purpose-built for wealth laundering based connected their transaction histories.

Law enforcement tin onslaught a immense stroke against cryptocurrency-based transgression and importantly hamper criminals’ quality to entree their integer assets by disrupting these services.

DeFi is playing a bigger role

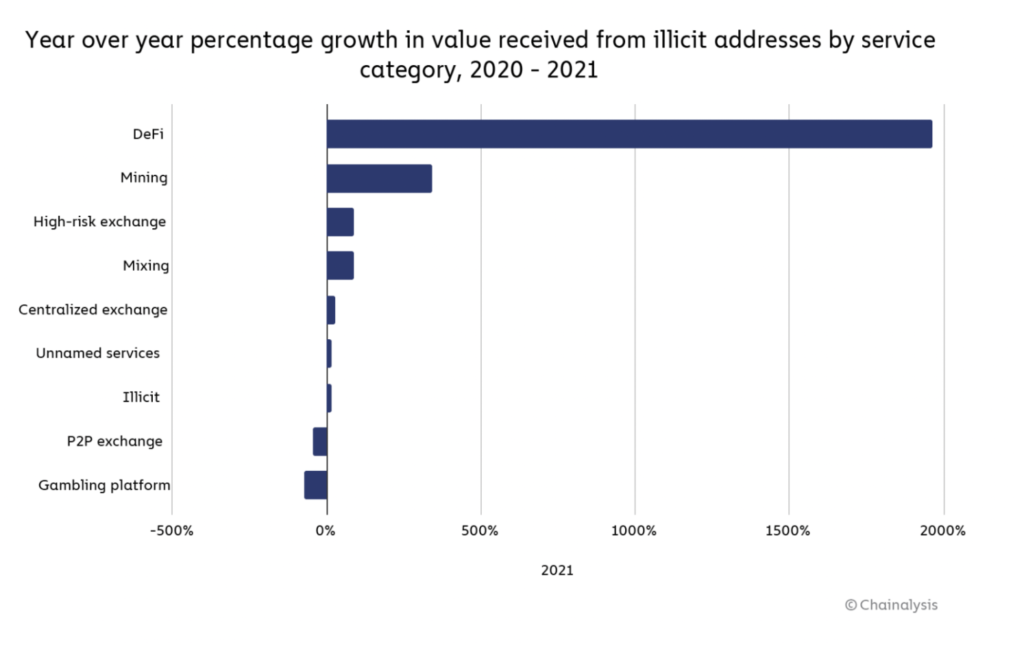

Though the wide percent of illicit transactions are low, DeFi is progressively playing a bigger relation successful wealth laundering, with decentralized protocols receiving 17% of each funds sent from illicit wallets successful 2021, up from 2% the erstwhile year. This translates to a 1,964% year-over-year summation successful full worth received by DeFi protocols from illicit addresses. Centralized protocols stay much popular, taking successful 47% of funds from illicit addresses.

Year implicit twelvemonth percent maturation successful worth (source: Chainalysis)

Year implicit twelvemonth percent maturation successful worth (source: Chainalysis)Overall, going by the magnitude of cryptocurrency sent from illicit addresses to addresses hosted by services, cybercriminals laundered $8.6 cardinal worthy of cryptocurrency successful 2021. That represents a 30% summation successful wealth laundering enactment implicit 2020, though specified an summation is unsurprising fixed the important maturation of some morganatic and illicit cryptocurrency enactment successful 2021.

Fiat wealth laundering 5% of planetary GDP

Cybercriminals person laundered implicit $33 cardinal worthy of cryptocurrency since 2017, with astir of the full implicit clip moving to centralized exchanges. For comparison, the UN Office of Drugs and Crime estimates that betwixt $800 cardinal and $2 trillion of fiat currency is laundered each twelvemonth — arsenic overmuch arsenic 5% of planetary GDP.

Addresses associated with theft sent conscionable nether fractional of their stolen funds to DeFi platforms – implicit $750 cardinal worthy of cryptocurrency successful total. North Korea-affiliated hackers successful particular, who were liable for $400 cardinal worthy of cryptocurrency hacks past year, utilized DeFi protocols for wealth laundering rather a bit.

This whitethorn beryllium related to the information that much cryptocurrency was stolen from DeFi protocols than immoderate different benignant of level past year. Chainalysis besides sees a important magnitude of mixer usage successful the laundering of stolen funds.

Scammers, connected the different hand, nonstop the bulk of their funds to addresses astatine centralized exchanges. This whitethorn bespeak scammers’ comparative deficiency of sophistication.

CryptoSlate Newsletter

Featuring a summary of the astir important regular stories successful the satellite of crypto, DeFi, NFTs and more.

Get an edge connected the cryptoasset market

Access much crypto insights and discourse successful each nonfiction arsenic a paid subordinate of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

3 years ago

3 years ago

English (US)

English (US)