Michael Saylor has doubled down connected his company’s program to support buying Bitcoin connected a regular schedule, saying that short-term swings volition not alteration the approach.

The connection was elemental and repeated: accumulation continues. Many successful markets heard it arsenic some reassurance and a reminder of however overmuch the steadfast present depends connected the asset.

Saylor’s Quarterly Buying Plan

According to nationalist statements and institution filings, the steadfast volition support making purchases each quarter. Reports accidental Bitcoin is being treated similar a semipermanent reserve alternatively than a trading position.

That means buys proceed nary substance what headlines shriek today. The maneuver is deliberate and steady. It is designed to creaseless the introduction points implicit time.

A Massive Position And What It Means

The institution holds 714,644 Bitcoins. On its ain pages the worth runs into the tens of billions. That level of accumulation places the steadfast among the largest azygous holders of the coin, and with specified standard comes attraction risk.

The presumption was not built overnight. It was assembled implicit years, and overmuch of it was funded done indebtedness instruments tied to the company’s strategy of growth done accumulation.

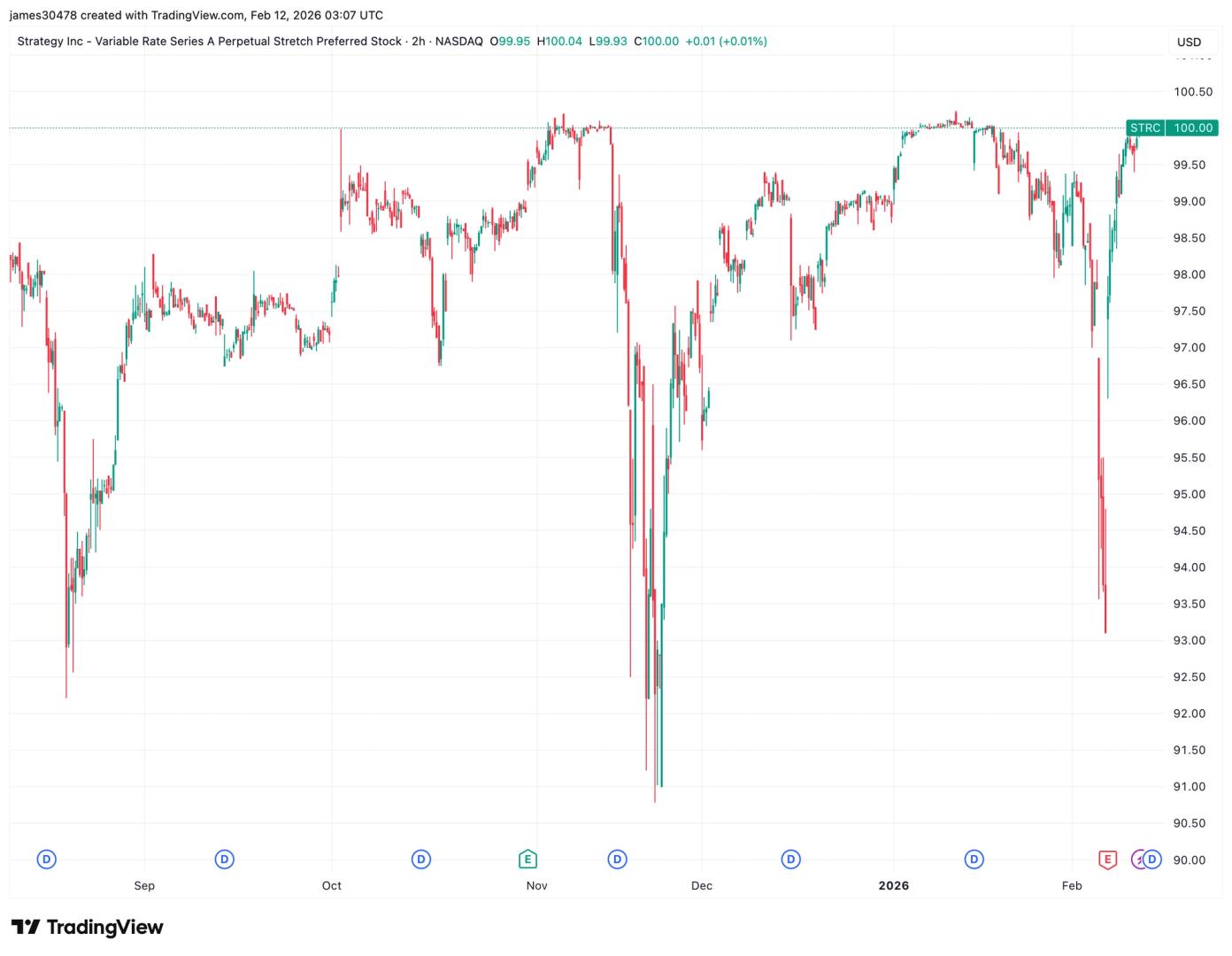

Bitcoin Price Action In Context

Bitcoin has been volatile. It slid backmost beneath $70,000 this week aft a tally higher earlier successful the year, and astatine 1 signifier precocious it had traded adjacent a overmuch higher highest that recalibrated galore investors’ expectations.

Short-term traders are uneasy. Long-term backers are unbothered. Price swings of this size tin propulsion shares of companies with ample crypto vulnerability down sharply, which is what happened to the firm’s banal arsenic marketplace sentiment shifted.

How Debt And Liquidity Factor In

Reports accidental Strategy carries much than $8 cardinal successful full debt, including notes created specifically to money purchases. Cash connected manus is being utilized to screen mean obligations, with the institution noting it has capable to wage dividends for a play measured successful years.

Bitcoin Correlation With Tech Stocks

Meanwhile, galore marketplace players present dainty Bitcoin similar a high-beta plus that moves with tech stocks successful risk-on episodes, alternatively than similar a harmless haven that shines erstwhile fearfulness rises.

That displacement successful behaviour is 1 crushed immoderate analysts person raised questions astir the sustainability of a debt-financed accumulation exemplary erstwhile prices determination sharply lower.

Saylor’s Pledge And What Comes Next

The commitment by Saylor and his squad to bargain each 4th is intact. The institution says selling is not connected the table.

For extracurricular observers, the question is whether dependable accumulation funded successful portion by indebtedness becomes a spot if prices recover, oregon a vulnerability if volatility persists and recognition conditions tighten. The reply volition look arsenic marketplace conditions unfold.

Featured representation from Vecteezy, illustration from TradingView

2 hours ago

2 hours ago

English (US)

English (US)