In a caller analysis, James Coutts, Chief Crypto Analyst astatine Realvision, signaled a imaginable bullish crook successful Bitcoin’s adjacent future, attributing the forecasted alteration to shifts successful planetary liquidity measures, specifically the Global Money Supply (M2) scale which is wide seen arsenic astir important terms catalyst. Coutts elaborate this anticipation successful a thread connected X, wherever helium examined the narration betwixt large economical indicators and Bitcoin’s terms cycles.

Global Money Supply And Its Correlation With Bitcoin

Coutts’ investigation begins with the M2 wealth aggregates, which dwell of cash, checking deposits, and easy convertible adjacent money. He tracks these aggregates crossed the 12 largest economies, each adjusted to USD. This measure, helium suggests, is cardinal to knowing liquidity flows wrong the planetary fiat, credit-based fiscal system. According to Coutts, “The wealth banal often moves successful 1 direction, with important drops similar those seen successful 2022 being uncommon and typically brief.”

Currently, the Global M2 is neutral, but Coutts predicts imminent changes: “There is simply a oversea of reddish crossed my macro & liquidity dashboard, but signs are emerging that this is astir to change. Global M2 holds the cardinal for the adjacent limb of the rhythm owed to its precocious correlation with $BTC bull cycles.”

The complaint of alteration successful M2 wealth proviso is much captious than its nominal value. Coutts noted, “The illustration confirms what our MSI show array suggests: Bitcoin usually moves with shifts successful M2 momentum.” He explained that contempt the planetary wealth proviso MSI indicator being successful an uptrend, the momentum remains sluggish, maintaining a Neutral MSI. For a displacement to a bullish MSI signal, an summation successful momentum is necessary, requiring a operation of dollar depreciation, recognition expansion, and accrued authorities indebtedness issuance.

Coutts pointed retired the important relation of recognition conditions, arsenic evidenced by firm enslaved spreads (BBB/Baa) compared to the US 10-year Treasury yield, which person historically aligned with important inflections successful Bitcoin’s cycle. “These spreads are presently narrowing, indicating that corporations are managing to contented and rotation implicit indebtedness contempt the precocious involvement rates resulting from the grounds hikes successful 2022 and 2023,” helium observed.

Using the chameleon inclination indicator connected the firm dispersed index, Coutts suggests a strategy: “Long Bitcoin erstwhile the scale shows a bearish inclination (red) and enactment alert for imaginable inclination reversals (turning green).”

The Role Of the Dollar And Future Outlook

A cardinal to this cycle, according to Coutts, is the behavior of the DXY (Dollar Index), which measures the US dollar against a handbasket of overseas currencies. “The Dollar is range-bound. A interruption beneath 101 would beryllium rocket substance for Bitcoin,” helium asserted, emphasizing that marketplace sentiment connected liquidity is often reflected successful real-time by DXY movements.

Coutts besides touched upon the US indebtedness situation, suggesting that without a blimpish displacement successful Congress advocating for fiscal responsibility, much shortage spending is apt connected the horizon, which could further power liquidity conditions favorable to Bitcoin.

Coutts concluded with a enactment of caution mixed with optimism: “While my model needs 2/3 MSI indicators to crook Bullish for macro headwinds to crook into tailwinds, Bitcoin terms enactment volition astir apt sniff retired this inflection successful the macro earlier astir indicators react.”

His investigation suggests that if Bitcoin breaks supra its all-time highs, it would beryllium unwise to stake against it, anticipating imaginable climbs towards $150,000 successful this cycle. “The DXY holds the cardinal to the Bitcoin rhythm arsenic it prices successful mkt expectations connected liquidity successful existent time. And liquidity is coming. Watch the 101/102 level connected DXY If that breaks, past we should spot ~$150k btc this cycle,” helium remarked.

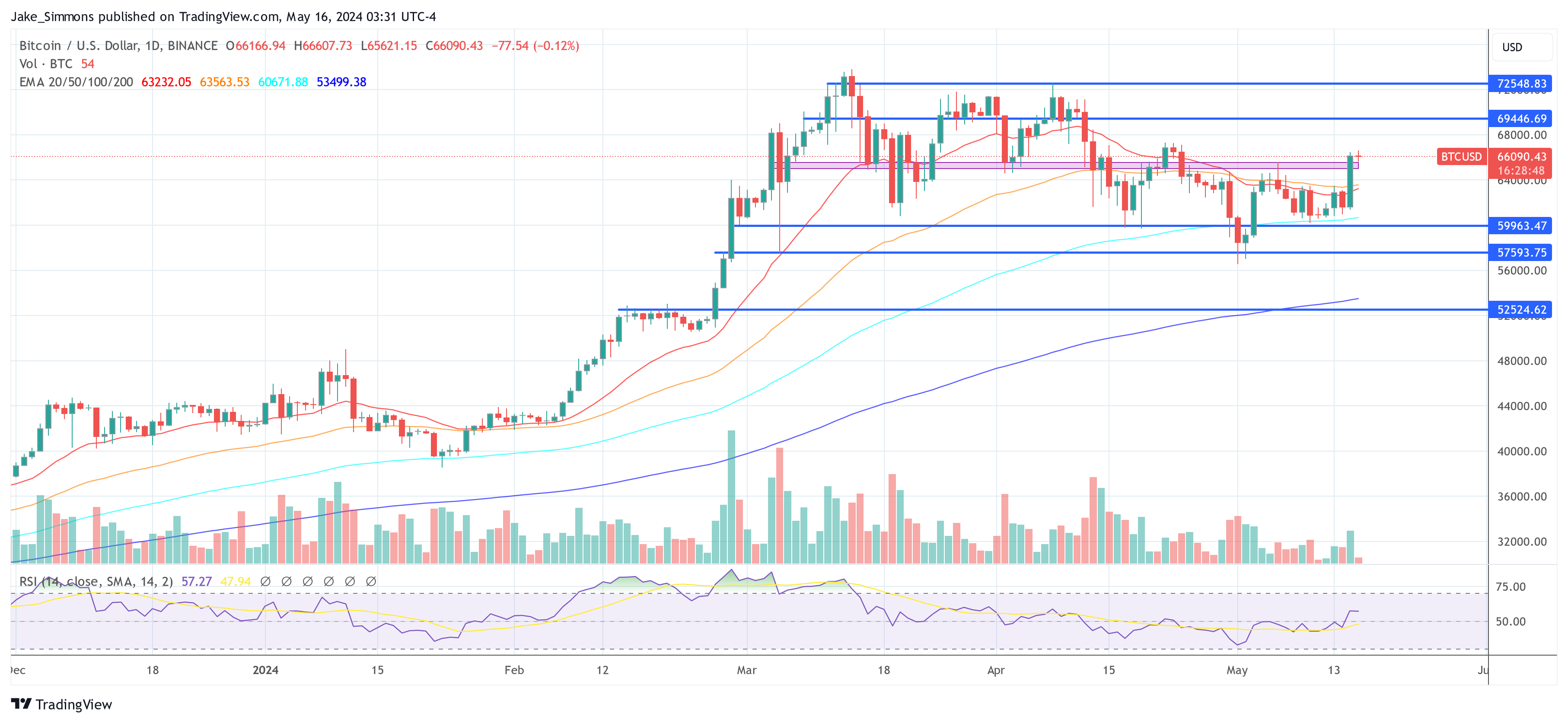

At property time, BTC traded astatine $66,090.

BTC terms surpasses $66,000 again, 1-day hart | Source: BTCUSD connected TradingView.com

BTC terms surpasses $66,000 again, 1-day hart | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)