Let america see the nations of the world, their lasting arsenic monetary powers, arsenic followers, victims, and outcasts. How volition these nations usage Bitcoin strategically?

There Are Four Kinds Of Countries Today

Monetary Hegemons

These are countries with monolithic sway implicit others. Other nations clasp their currency arsenic overseas reserves. They power the superior portion of relationship successful planetary trade. When they people wealth they gain “seigniorage” profits, not conscionable from their home population, but from the galore foreigners holding their currency.

There’s lone 1 existent monetary hegemony today: the United States. To immoderate grade the eurozone, and to an adjacent lesser degree, Japan and China, are partial monetary hegemons. Their currencies are held arsenic overseas reserves successful smaller amounts. But chiefly the U.S. is the overwhelmingly ascendant power; it has the satellite reserve currency and the deepest and safest markets. It controls the numeraire for satellite savings and trade. It controls the fiscal infrastructure utilized successful planetary payments: the Society for Worldwide Interbank Financial Telecommunication (aka SWIFT).

Minor Players

Minor players are countries that bash person their ain currency and tin extract immoderate grade of seigniorage nett from the issuing of much currency. But dissimilar the full-fledged monetary hegemon countries, their currencies are not truly held by foreigners. Thus the profits of printing wealth are extracted solely from the home population, with small outer impact. Turkey, Mexico, and so astir ample nations are insignificant players by this definition.

Vassals

Some countries are babelike connected the currency of another, typically 1 of the monetary hegemon countries. These countries are astatine the whim of the hegemon. They bash not person the profits of seigniorage. Indeed, arsenic holders of the wealth of a monetary hegemon, they pay the costs of ostentation without receiving immoderate of the benefits, since typically printed wealth is spent domestically. Nations pegged to the dollar, oregon utilizing the dollar oregon euro arsenic ineligible tender are efficaciously vassal states. The African CFA currency unions are successful this mode vassals of the eurozone. Other nations, specified arsenic Saudi Arabia, are pegged to the U.S. dollar, and due to the fact that the U.S. dollar constitutes a ascendant fraction of satellite currency reserves, astir countries astatine slightest partially carnivore the outgo of U.S. seigniorage.

Being a vassal means surrendering the quality to extract seigniorage, and indeed, to alternatively connection that worth up to different power. Frequently states presume vassal presumption due to the fact that either A) they tried to beryllium insignificant players but wholly mislaid credibility oregon B) they person immoderate different strategical crushed to petition extortion from the U.S. oregon eurozone (hegemons).

Excluded Nations

Some nations are wholly shunned by the monetary hegemon countries. Iran is wholly disconnected from the SWIFT network, denying it entree to U.S. dollar-based fiscal rails. North Korea and Cuba are successful a akin situation. As with being a vassal, exclusion is not binary. Financial sanctions person been levied against galore countries and individuals to antithetic degrees. Russia is simply a insignificant subordinate that is successful a authorities of partial exclusion.

Some nations whitethorn not beryllium presently excluded, but whitethorn expect to beryllium successful the future. Russia is presently facing U.S. sanctions implicit the Russo-Ukrainian crisis. If conditions deteriorate, Russia tin expect to beryllium ejected from the SWIFT system: a melodramatic escalation of its excluded status. As a result, Russia is preparing present for exclusion by reducing dollar holdings, acquiring gold, and mounting up commercialized deals denominated successful non-U.S. dollar currencies. To beryllium a afloat autarkic satellite power, a federation indispensable hole to beryllium resilient successful the look of fiscal exclusion from the U.S. Exclusion is the hold of warfare to the monetary realm: A state that cannot past exclusion is not a powerfulness that tin enactment independently.

Bitcoin As Part Of National Strategy

Let america analyse however each radical is apt to presumption Bitcoin, successful reverse order.

Excluded Nations

Excluded nations are apt to clasp Bitcoin, astir apt rather soon. Bitcoin solves an tremendous occupation for them; however to transmit worth successful the look of hostile planetary institutions. Bitcoin was explicitly designed to beryllium hardened against onslaught from almighty nation-states, and tin truthful beryllium trusted by states similar Iran. This is wherefore different cryptocurrencies apt would not beryllium suitable; they are not decentralized capable to past aggravated scrutiny from the monetary hegemons. North Korea cannot realistically clasp ample amounts of worth successful ETH oregon SOL due to the fact that the U.S. would apt power those protocols to confiscate that value. Bitcoin, connected the different hand, is truthful hard to change; a state similar Iran could openly get it, and the U.S. would beryllium efficaciously powerless to confiscate it oregon interfere successful their quality to transact

In 2020 Venezuela needed to wage Iran for assistance successful restarting its ailing lipid sector. Since some nations are sanctioned, their solution was to actually alert carnal golden bars from Caracas to Tehran. This was rather onerous. A overmuch amended mode for these nations to transact would beryllium via bitcoin, arsenic nary spot is needed betwixt parties, and the neutral, apolitical quality of Bitcoin is highly appealing. Even for shunned nations, utilizing the ruble oregon the yuan isn’t peculiarly appealing, arsenic nary 1 wants to spot Russia oregon China with their monetary portion either. No, thing autarkic of immoderate federation is needed due to the fact that fiscal colony betwixt nations is inherently low-trust. In a competitory planetary environment, powers are wary of each other; the destiny of one’s savings cannot trust connected trusting idiosyncratic else. So neutral wealth is precise desirable. Gold is neutral, but acold much costly and inconvenient than bitcoin to transfer.

Excluded nations are apt to clasp Bitcoin rather soon. The much eagerly the U.S. and the eurozone wield the cudgel of fiscal sanctions, the faster they volition thrust excluded nations to Bitcoin arsenic a workaround. These are not nations with a peculiar ideological attraction to Bitcoin. Basically each of them are brutal dictatorships: nary friends of liberty. Instead of embracing Bitcoin due to the fact that they emotion its libertarian roots, they volition beryllium driven to usage it due to the fact that they are barred from the accepted alternatives. The velocity with which this happens is wholly a relation of however overmuch fiscal sanctions are applied by the hegemons.

We are already seeing this inclination instrumentality place. Dictators like Vladimir Putin and Turkey’s Recep Erdogan are rumored to beryllium paying adjacent attraction to cryptocurrencies. While Bitcoin would interfere with their quality to extract seigniorage rents from their home populations, they would beryllium enabling units of worth successful planetary speech if relations with the West deteriorate further. A strategy could originate whereby section currencies are enforced connected the home populations, but bitcoin is utilized arsenic an planetary colony instrumentality betwixt nation-states. This would reflector the dual-currency strategy of the U.S.S.R. and different Soviet bloc countries, successful which a hard currency is utilized for overseas trade, but section radical are forced to usage a weaker, acold little hard form. From a dictator’s perspective, this is convenient; you tin commercialized with foreigners who volition not judge your section fiat, but sphere the quality to extract section seigniorage rents. Such a dual-tier strategy could easy originate successful authoritarian states similar Turkey, Iran, Russia, etc, with bitcoin arsenic the hard, externally-facing money.

Vassals

As a vassal, Bitcoin is an exit opportunity. You are paying seigniorage costs to your overlord. They are capturing worth from you. Adopting Bitcoin is simply a mode to interruption escaped and found independence. Unlike a ample country, a vassal astir apt cannot acceptable up a planetary fiscal infrastructure alone. But conveniently, the Bitcoin web is already up and running. New entrants tin simply motion up and inherit that planetary worth transmission system.

Adopting Bitcoin means you nary longer wage the outgo of the debasement of the overlord’s money. But they are not apt to beryllium blessed astir that. El Salvador was antecedently a vassal authorities to the U.S. successful this sense, since its ineligible tender was the U.S. dollar. To beryllium clear, the dollar is inactive ineligible tender successful El Salvador, but it coexists with bitcoin, which makes up an expanding fraction of its reserves. El Salvador present benefits from the hardness of bitcoin; it has reduced the ongoing debasement outgo inherent with holding U.S. dollar reserves.

However, breaking escaped of one’s overlord is not without costs. The U.S., and to a lesser grade the eurozone, are highly almighty and influential and tin punish dissent. For its enactment of rebellious independence, El Salvador earned condemnation from the U.S. and the IMF. Nations that request U.S. enactment to past volition not discard vassal presumption anytime soon. Countries similar Taiwan and Poland that person strategical reasons to tendency relationship with the U.S., are improbable to driblet their dollar reserves. Their subservience to U.S. and eurozone monetary hegemony is calculated and afloat rational based connected their situations. But each vassal volition execute its ain calculation, asking, “Am I getting capable from the hegemon to warrant the seigniorage rents I pay?” The greater those rents, i.e., the greater the monetary debasement successful the U.S. and eurozone, the much accent that volition beryllium imposed connected that relationship. If the dollar’s depreciation accelerated, galore U.S. dollar reserve holders could question their allegiance and perchance dump dollars.

Minor Players

Minor players are caught midway betwixt vassals and hegemons. They bask immoderate seigniorage, truthful are astir apt reluctant to suffer that income by going afloat Bitcoin. But the advantages of Bitcoin arsenic savings exertion volition beryllium clear. I don’t spot a wide story. Probably immoderate nations volition effort the two-tier domestic/foreign currency approach, successful which the authorities tries to monopolize entree to bitcoin, arsenic successful the U.S.SR. I bash not judge this volition really work, arsenic citizens can’t beryllium prevented from accessing bitcoin arsenic they were with 20th period money.

The astir apt script is that insignificant players are simply broken. Their currencies are manifestly little desirable than those of the hegemons, fto unsocial bitcoin. Bitcoin’s beingness serves arsenic an flight enactment for the populace. They shall instrumentality that enactment and insignificant players person nary existent choice.

Hegemons

The U.S. and the eurozone person the astir to suffer from the adoption of Bitcoin by different countries. Their sanctions volition nary longer person teeth. Their ostentation volition not beryllium truthful easy exported abroad. Instead wealth printing volition reverberate domestically with debased latency. The seigniorage profits of the dollar play a ample relation successful backing U.S. power. Take that distant and the hegemon’s powerfulness is reduced materially, not conscionable successful presumption of fiscal influence, but militarily and diplomatically arsenic well. This could person important planetary consequences, akin to the diminution of the British lb aft World War II. The debasement and planetary abandonment of the lb signaled the extremity of the U.K. arsenic a monetary hegemon. This went hand-in-hand with reduced power overseas. Previously the U.K. authorities had been capable to person different peoples to judge their wealth connected preferential terms, usually done motivation suasion and influence. British colonies held pounds arsenic reserves adjacent erstwhile different countries preferred hard golden oregon safer dollars. As Britain mislaid its hegemony status, it had to carnivore the afloat brunt of maintaining overseas colonies alone, and could not.

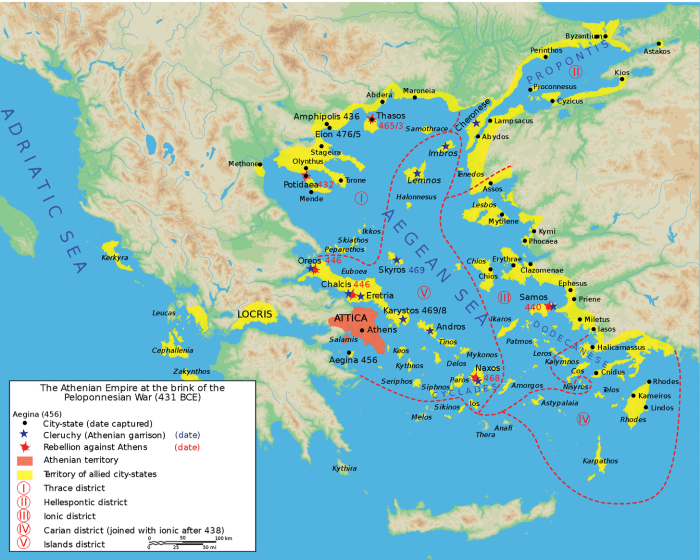

The Delian League, circa 470 BC. Athens arsenic the U.S. and the League arsenic dollar holders.

Source: Wikipedia

U.S. planetary power could endure a destiny akin to that of Britain’s empire if it loses hegemony successful money. The U.S. is inactive the world’s largest economy, but its powerfulness is augmented done the seigniorage rents extracted from each dollar holders worldwide. This is an tremendous magnitude of value. It should beryllium thought of arsenic a taxation connected vassals successful an unequal alliance, not dissimilar the Delian League of past Athens. A conjugation of tributaries is led by an overlord. There is immoderate ostensible intent of self-defense, but successful world each taxable federation pays a taxation to the person of the alliance. These are notionally autarkic states, but they are efficaciously not autarkic and are expected to lend financially. The U.S. does the same, but indirectly done the seigniorage taxation alternatively than done explicit tribute. But it amounts to the same. It is frankincense nary astonishment that U.S. allies are expected to clasp dollars and to terms things successful dollars. And similarly, reneging connected the dollar, oregon de-dollarization, is viewed by the U.S. arsenic tantamount to disloyalty and sedition.

So the U.S. and eurozone states volition presumption Bitcoin arsenic a superior threat. Yet the bulk of bitcoin wealthiness volition apt beryllium held by citizens successful those countries. We tin expect the aforesaid cognition of disloyalty to widen to home bitcoin holders. We person seen President Erdogan impulse Turks to crook successful dollars and golden for section liras, arsenic an look of patriotism. Similarly, British citizens were urged to crook successful their golden for fiat notes during World War I and onwards. In the U.S. it was mandated by enforcement order. Calls to patriotism, coercion, and different measures volition beryllium made to transportation citizens to surrender bitcoin to the state. The effectiveness of these measures is apt to beryllium muted, arsenic prying bitcoin from rationally-incentivized holders volition beryllium highly difficult. Similar coercive measures person been attempted successful astir each hyper-inflationary states successful history, and they usually failed. In Weimar Germany determination were hapless efforts to person oregon unit citizens to surrender hard overseas currency. Despite irregular successes, these efforts were hopeless successful the agelong run.

The hegemons volition defy an alternate to their power. They volition beryllium the past to fall. Rather than suffering from outer forces, astir apt the hegemons volition beryllium gobbled up from the wrong arsenic home citizens crook to bitcoin to debar hyperinflation, arsenic with the insignificant players, conscionable later.

Sudden National Accumulation

Unlike gold, bitcoin is ascending to satellite reserve currency presumption successful afloat view. We get to ticker its ascent, its gyrations, and its gradual normalization. It is volatile precisely due to the fact that the realization of bitcoin’s suitability arsenic savings exertion spreads unevenly. A gradual consciousness grows astir the satellite implicit the people of years. That consciousness archetypal grows among specified individuals, but reaches a tipping constituent and erupts astatine the level of full countries. Some countries volition get astatine the decision earlier others. El Salvador was precise early. But determination volition beryllium a 2nd and a 3rd and a fourth, spaced retired possibly by years. What does this process look like?

The dawning consciousness of Bitcoin’s strategical relation volition pb to concealed accumulation by nations. This is astir apt underway already. As a cardinal slope oregon nationalist leader, it makes consciousness to softly accumulate bitcoin arsenic a hedge, but without overmuch fanfare. If you are a vassal federation you indispensable get them secretly to debar angering the hegemon. If you are a hegemon, you indispensable bash truthful secretly to debar undermining one’s ain hegemonic money. Probably for this crushed the hegemons volition get overmuch little bitcoin than they ought. Like a non-innovating institution resting connected its laurels, the U.S. and eurozone bash not privation to disrupt their ain money-maker, adjacent if it is doomed.

Accumulation by the non-hegemonic nations could accelerate precise quickly. As states go alert of other’s accumulation, it could go an exponentially intensifying race. Probably a afloat bitcoin cycle, bubble and illness volition someday beryllium wholly driven by nation-state buying.

A nation-state could use the Michael Saylor strategy, simply printing wealth to bargain bitcoin. In the caller past China kept its currency intentionally anemic to get hard overseas reserves, weaken its ain currency, and to stimulate exports. Switzerland has printed Swiss francs to bargain overseas assets similar equities. A akin dynamic could use to bitcoin; people one’s ain currency to get it. For a nation, this is simply a astute trade. The precise aforesaid instrumentality that Saylor applied with MicroStrategy, issuing low-rate semipermanent indebtedness to money bitcoin purchases, could beryllium applied astatine a overmuch greater standard by nations. It is simple; nutrient thing whose issuance you power to get that which nary 1 controls.

I americium definite that the strategical repercussions of Bitcoin person not been decently considered, by maine oregon others. It is worthy reasoning further connected the semipermanent geopolitical effects of hard, apolitical, and neutral money. Nations volition usage bitcoin arsenic a weapon, combat it, and astir apt succumb to it.

This is simply a impermanent station by Andrew Barisser. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)