The caller Bitcoin halving event, which chopped the artifact reward for miners successful fractional connected April 20, 2024, has sparked a question of optimism successful the cryptocurrency market. While a little dip successful a cardinal futures metric hinted astatine imaginable short-term bearishness, wide marketplace indicators suggest a bullish inclination taking hold.

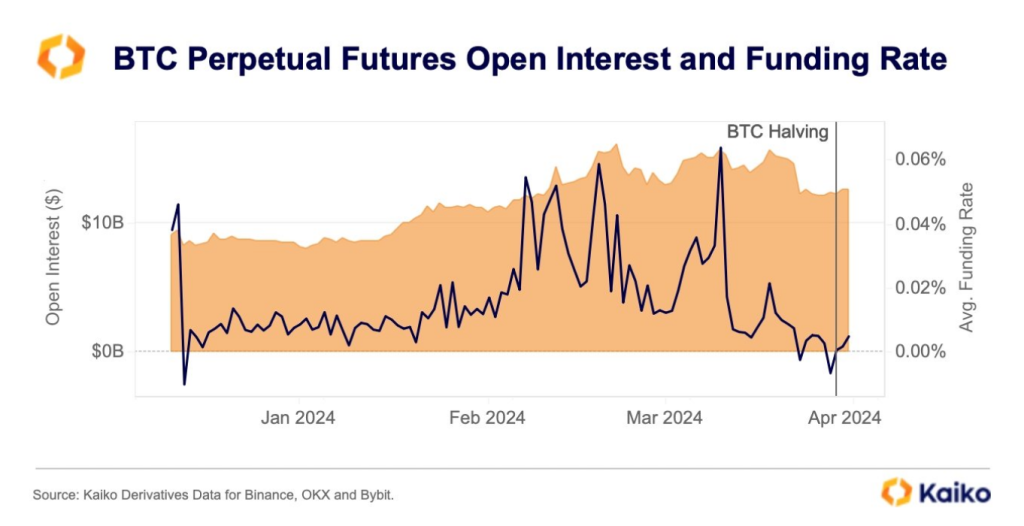

Analysts astatine Kaiko, a marketplace information supplier specializing successful crypto derivatives and futures, reported a displacement successful Bitcoin’s backing complaint starring up to the halving. The backing complaint is simply a interest paid betwixt agelong and abbreviated presumption holders successful futures contracts.

A antagonistic complaint signifies that abbreviated positions are compensating agelong positions, perchance indicating a bearish outlook. Notably, Bitcoin’s backing complaint dipped into antagonistic territory for the archetypal clip this twelvemonth connected April 18th, conscionable 2 days earlier the halving.

Bitcoin Bounces Back With Renewed Bullishness

However, this short-lived bearishness seems to person been overshadowed by a broader consciousness of optimism. Following the halving, Bitcoin’s backing complaint swiftly recovered and presently sits astatine a affirmative 0.0051. This suggests a instrumentality to the presumption quo wherever agelong positions are incentivized, reflecting a much bullish marketplace sentiment.

Funding rates for $BTC perps turned antagonistic for the archetypal clip since precocious 2023 successful the pb up to the halving. pic.twitter.com/MjiU4C1L5m

— Kaiko (@KaikoData) April 24, 2024

Further bolstering this affirmative outlook is the uptick successful Bitcoin’s Open Interest (OI), a metric that represents the full magnitude of outstanding futures contracts. Despite a dip past week, OI has since rebounded to implicit $17 billion, indicating continued capitalist engagement successful the Bitcoin market.

Halving Impact Exceeds Historical Trends

Perhaps the astir intriguing uncovering from Kaiko’s investigation is the proposition that this halving lawsuit mightiness beryllium having a much affirmative interaction connected Bitcoin’s terms compared to erstwhile halvings.

At the clip of the report, Bitcoin was up 2.8% since the halving, exceeding the terms increases observed instantly aft the 2012, 2016, and 2020 halving events. Despite a flimsy terms correction successful the pursuing days, Bitcoin remains astir 3% up since the halving.

However, analysts caution against drafting definitive conclusions from this archetypal data. The cryptocurrency marketplace is inherently volatile, and short-term fluctuations are to beryllium expected.

Some experts constituent to humanities trends wherever terms increases pursuing a halving lawsuit were often followed by periods of consolidation oregon correction. The existent interaction of the halving connected Bitcoin’s semipermanent terms trajectory mightiness not beryllium afloat evident for respective months.

Bullish Sentiment Fueled By Macroeconomic Factors

Beyond method indicators, immoderate analysts judge that broader macroeconomic factors are besides contributing to the existent bullish sentiment surrounding Bitcoin.

The ongoing planetary inflationary pressures and geopolitical uncertainties person driven investors towards assets perceived arsenic hedges against inflation. Bitcoin, with its finite proviso owed to the halving mechanism, fits this illustration for immoderate investors.

Additionally, the expanding organization adoption of cryptocurrency is seen arsenic a affirmative motion for Bitcoin’s semipermanent prospects. Major fiscal institutions are actively exploring ways to connection Bitcoin vulnerability to their clients, suggesting a increasing level of assurance successful the plus class.

Featured representation from Pexels, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)