FTX’s autumn from grace this week culminated successful the institution filing for Chapter 11 bankruptcy connected Nov. 11. The filing includes all 130 companies nether the umbrella, arsenic good arsenic the trading steadfast Alameda.

On announcing the news, Sam Bankman-Fried resigned from his presumption arsenic CEO. John Ray, who oversaw Enron pursuing its accounting ungraded successful 2007, took complaint pursuing SBF’s resignation.

Commenting connected the bankruptcy, Ray said the Chapter 11 filing would supply alleviation and let for a thorough appraisal of the concern to maximize recoveries for each stakeholders.

Chapter 11 filings alteration a institution to proceed trading and are usually implemented successful concern restructuring cases.

A ‘complete failure.’

Ray filed the Chapter 11 Petitions and First Day Pleadings with the Bankruptcy Court of Delaware connected Nov. 17.

Having gone done FTX’s books, Ray blasted the erstwhile institution administration, saying helium has ne'er travel crossed “such a implicit nonaccomplishment of corporate controls and specified a implicit lack of trustworthy financial information.”

In particular, helium pointed retired compromised systems integrity, faulty regulatory oversight abroad, and attraction of control successful the hands of a precise tiny radical – each of which were inexperienced and incapable of moving an cognition the standard of FTX.

Ray said:

“The FTX Group did not support centralized power of its cash. Cash absorption procedural failures included the lack of an close database of slope accounts and relationship signatories, arsenic good arsenic insufficient attraction to the creditworthiness of banking partners astir the world. Under my direction, the Debtors are establishing a centralized currency absorption strategy with due controls and reporting mechanisms.”

The aftermath

The businesses were divided into 4 groups oregon silos to negociate the bankruptcy process. For each Silo, Ray included an unaudited equilibrium expanse arsenic of Sep. 30, 2022. A summary is arsenic follows:

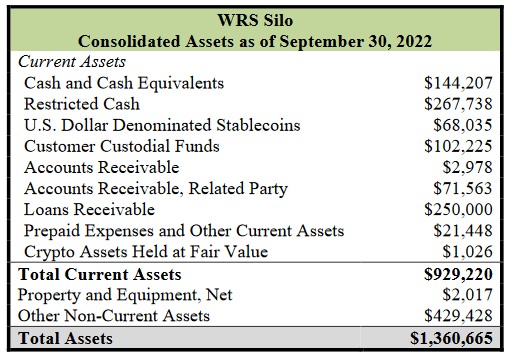

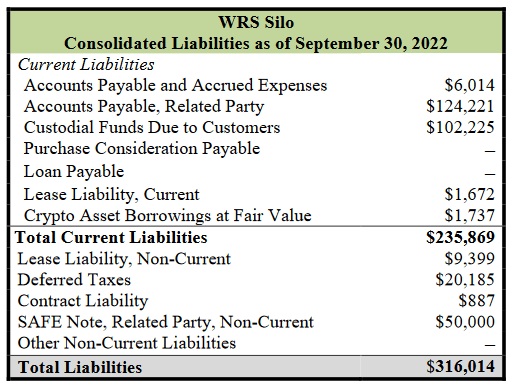

West Realm Shires Inc. Silo (WRS) includes FTX U.S., LedgerX, FTX US Derivatives, FTX U.S. Capital Markets and Embed Clearing, among different entities.

- The equilibrium expanse showed $1.36 cardinal successful Total Assets, of which $929.2 cardinal is related to Current Assets. Total Liabilities are $316 million, with $235.9 cardinal successful Current Liabilities.

Source: pacer-documents.s3.amazonaws.com

Source: pacer-documents.s3.amazonaws.com Source: pacer-documents.s3.amazonaws.com

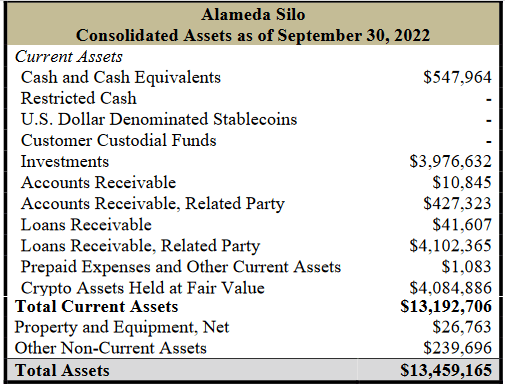

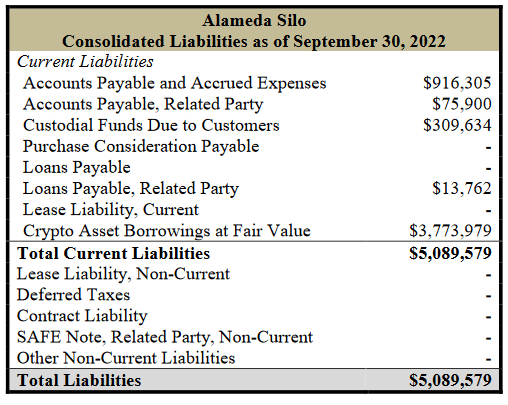

Source: pacer-documents.s3.amazonaws.comAlameda Silo refers to entities specializing successful quantitative trading funds; it includes Alameda Research LLC and debtors based successful Delaware, Korea, Japan, the British Virgin Islands, Antigua, Hong Kong, Singapore, Seychelles, the Cayman Islands, the Bahamas, Australia, Panama, Turkey, and Nigeria.

- The equilibrium expanse showed $13.5 cardinal successful Total Assets, of which $13.2 cardinal are Current Assets. Total Liabilities are $5.09 billion, each of which are current.

Source: pacer-documents.s3.amazonaws.com

Source: pacer-documents.s3.amazonaws.com Source: pacer-documents.s3.amazonaws.com

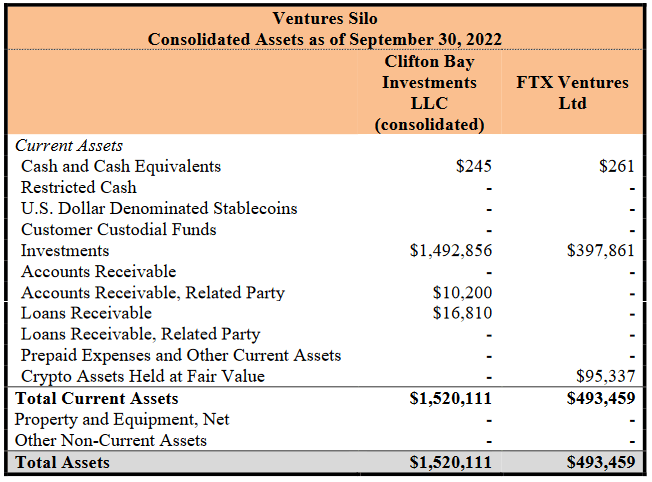

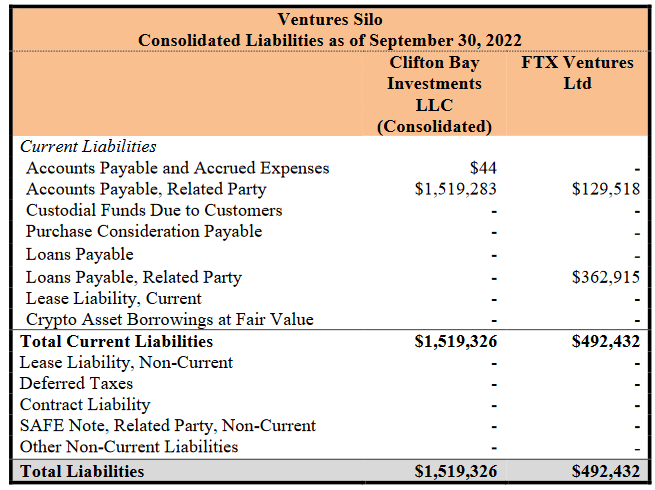

Source: pacer-documents.s3.amazonaws.comVentures Silo companies subordinate to backstage concern entities, including Clifton Bay Investments, LLC, Clifton Bay Investments Ltd., FTX Ventures Ltd., and Island Bay Ventures Inc, among different entities.

- The combined equilibrium expanse of Clifton Bay Investments LLC and FTX Ventures Ltd showed $2.014 cardinal successful Total Assets, of which each are current. Likewise, full Liabilities travel successful astatine $2.012 billion, which is current.

Source: pacer-documents.s3.amazonaws.com

Source: pacer-documents.s3.amazonaws.com Source: pacer-documents.s3.amazonaws.com

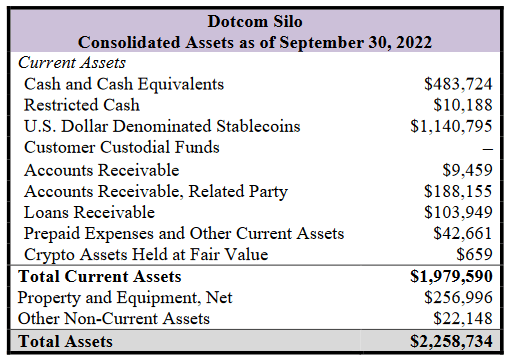

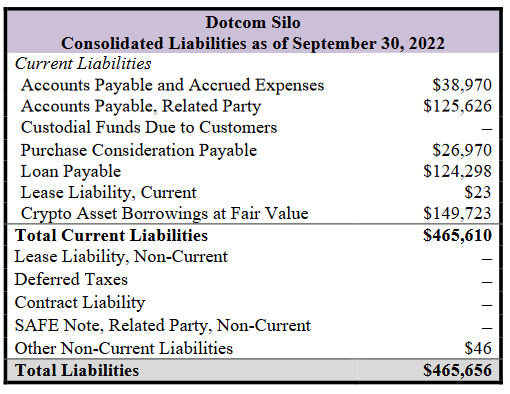

Source: pacer-documents.s3.amazonaws.comDotcom Silo holds circumstantial marketplace licenses and registrations and includes the FTX integer trading level and exchange.

- The equilibrium expanse showed $2.259 cardinal successful Total Assets, of which $1.98 cardinal is Current Assets. Total Liabilities are $466 million, and each but $46,000 is current.

Source: pacer-documents.s3.amazonaws.com

Source: pacer-documents.s3.amazonaws.com Source: pacer-documents.s3.amazonaws.com

Source: pacer-documents.s3.amazonaws.comIn each case, existent assets transcend full liabilities. However, fixed the improper firm controls earlier his arrival, Ray said helium did “not person confidence” in immoderate of the fiscal statements.

Ray said the FTX Group of companies failed to support centralized power of its cash, meaning determination is nary database of slope accounts to verify currency balances. Similarly, institution controls were poor, with nary currency absorption systems oregon the usage of due reporting mechanisms.

Ray said the audit steadfast for the WRS Silo was Armanino LLP, noting that helium is “professionally acquainted with the firm. He noted, however, that helium was not acquainted with the audit steadfast for the Dotcom Silo, Prager Metis, which touts itself arsenic “the first-ever CPA steadfast to officially unfastened its Metaverse office successful the metaverse level Decentraland.”

The CEO said:

“I person important concerns arsenic to the accusation presented successful these audited fiscal statements, particularly with respect to the Dotcom Silo. As a applicable matter, I bash not judge it due for stakeholders oregon the Court to trust connected the audited fiscal statements arsenic a reliable denotation of the fiscal circumstances of these Silos.”

Loans and funds utilized to bargain houses

The bankruptcy filing besides revealed that Sam Bankman-Fried got $1 cardinal successful idiosyncratic loans from Alameda Research.

Also, Alameda gave a $543 cardinal indebtedness to FTX manager of engineering Nishad Singh. The steadfast besides gave Ryan Salame, the co-CEO of FTX, a $55 cardinal loan.

In an evident disregard for firm process, Ray claimed,

“Corporate funds of the FTX Group were utilized to acquisition homes and different idiosyncratic items for employees and advisors.”

The properties were based successful the Bahamas, and the caller CEO stated that “no documentation” is contiguous to place the purchases arsenic loans. At the aforesaid time, the existent property was registered successful the idiosyncratic names of the employees and advisors.

Where are the integer assets and different investments

Bewilderingly, Ray further depicted a chaotic attack to bookkeeping and security. SBF and Co-Founder Gary Wang “controlled entree to integer assets of the main businesses successful the FTX Group.” The interior practices were described arsenic “unacceptable” by Ray. A radical email relationship was utilized arsenic the “root idiosyncratic to entree confidential backstage keys” successful a singular illustration of improper information hygiene.

There was nary regular cadence to the “reconciliation of positions connected the blockchain,” portion bundle was utilized to “conceal the misuse of lawsuit funds.” Ray specifically highlighted the “secret exemption of Alameda” from circumstantial documentation to forestall funds from being liquidated without manual intervention.

New wallets are allegedly inactive being discovered. One specified acold wallet contains astir $740 million, but the FTX radical of companies is not yet definite of the root of the funds. Further, it is unclear whether the funds should beryllium divided among aggregate entities wrong the FTX Group.

At present, Ray confirmed that $372 cardinal was transferred without authorization aft filing the bankruptcy petition, portion $300 cardinal successful FTT tokens was besides minted aft the deadline. In addition, the FTX companies judge determination are different crypto wallets that SBF and the erstwhile enactment squad person not yet disclosed.

Forensic analysts person been employed to hunt for missing funds and effort to hint transactions to nexus crypto assets. Ray commented that the analysts mightiness observe “what whitethorn beryllium precise important transfers of institution property. Court assistance was mentioned arsenic a imaginable absorption to resoluteness the issue.

Ray stated the overview of the probe successful its existent state.

“It is my presumption based connected the accusation obtained to date, that galore of the employees of the FTX Group, including immoderate of its elder executives, were not alert of the shortfalls oregon potential

commingling integer assets.”

The caller CEO believes that “current and erstwhile employees” whitethorn beryllium the “most hurt” by the nonaccomplishment of FTX and SBF’s alleged actions.

Astonishingly, Ray claimed that the starring companies related to Alameda and FTX Ventures “did not support implicit books and records of their investments and activities.” A equilibrium expanse is being finalized for the affected companies from “the bottom-up” done currency records.

No insubstantial trail

A deficiency of records for SBF’s captious decisions was described arsenic 1 of “the astir pervasive failures” by the acting CEO. Communication applications utilized by SBF were acceptable to “auto-delete” messages, and employees were encouraged to bash the same.

In a seemingly basal task, Ray elaborate that the companies, now, “are penning things down.”

The squad progressive successful the bankruptcy procedures includes erstwhile directors of the SEC and CFTC, on with members of the Cybercrime Unit of the U.S. Attorney’s Office. “Dozens of regulators” person been contacted by Ray and his unit arsenic helium posited a request for transparency.

SBF’s role

Ray took the accidental to authorities that SBF “does not talk for them” astir the FTX companies progressive successful the bankruptcy process. He further confirmed that SBF is presently successful the Bahamas and described his connection arsenic “erratic and misleading.”

Recovery

Ray noted that owed to these currency absorption failures, nonstop currency positions are not known astatine this time. However, the companies are moving with turnaround consultants Alvarez & Marsal to resoluteness this situation.

Any funds located by the FTX radical of companies volition beryllium “deposited into fiscal institutions successful the United States.” Each “silo” of funds volition beryllium segmented truthful that Ray’s squad tin allocate “costs crossed the assorted Silos and Debtors.”

A Cash Management Motion volition beryllium filed “promptly” to item however currency volition beryllium managed going forward.

The station New FTX CEO John Ray’s connection connected bankruptcy lawsuit tells communicative of an unmitigated disaster appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)