Holders who person accumulated bitcoin implicit the past six months aren’t liquidating their positions contempt unrealized losses, suggesting condemnation successful the asset.

This is an sentiment editorial by Mike Ermolaev, caput of nationalist relations astatine the ChangeNOW speech and a contributor for Bitcoin Magazine.

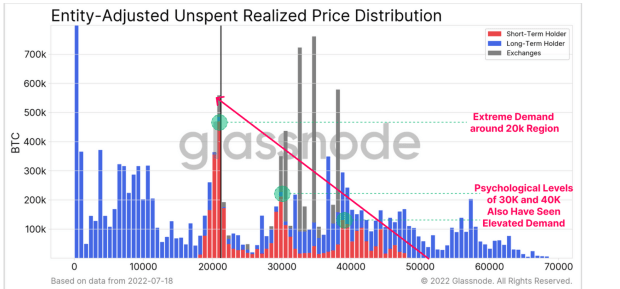

A much-awaited betterment rally has occurred for bitcoin prices aft a period of consolidation astir $20,000. Interestingly, this coincides with the erstwhile rhythm highest successful 2017.

Short-term momentum remains favorable, portion longer-term macro indicators suggest a firmer instauration whitethorn instrumentality time.

Bitcoin's 66% diminution from its all-time precocious has mostly evicted speculators, leaving lone whales and those with beardown convictions to hold.

However, a caller inclination has seen short-term holders flock to the $20,000 region, wherever ownership is being transferred from capitulating sellers to much optimistic buyers.

Source: Glassnode

Source: Glassnode

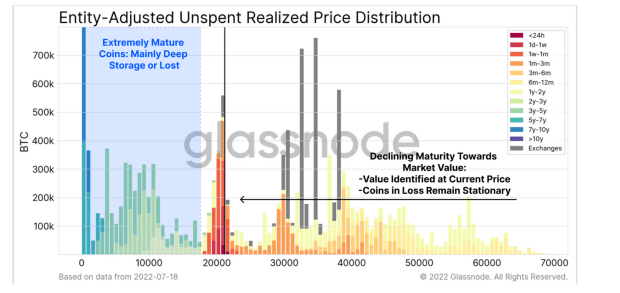

At the aforesaid time, holders who person accumulated coins implicit the past six months garbage to liquidate their positions contempt dense unrealized losses, suggesting they are little delicate to marketplace fluctuations.

Source: Glassnode

Source: Glassnode

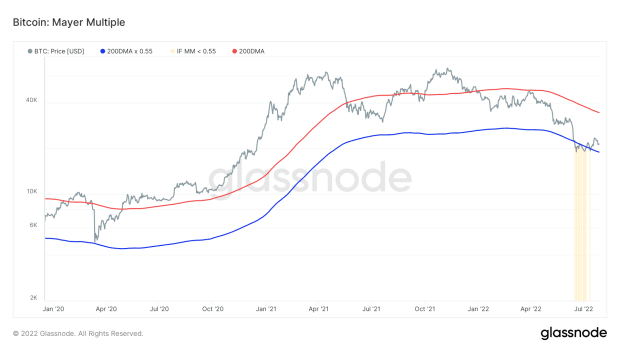

The Mayer Multiple — a aggregate of the existent bitcoin terms implicit the 200-day moving mean — dropped beneath 0.55 astatine the utmost of this terms correction, indicating the marketplace traded astatine a 45% discount to the 200 regular moving average. Bitcoin prices person historically formed cyclical bottoms nether this level, but this has been rare, occurring little than 3% of the time.

Source: Glassnode

Source: Glassnode

As of close now, bitcoin appears to beryllium eclipsing that level aft having been beneath it for immoderate time. This means the worst of the bitcoin carnivore marketplace is apt over, if past is immoderate guide.

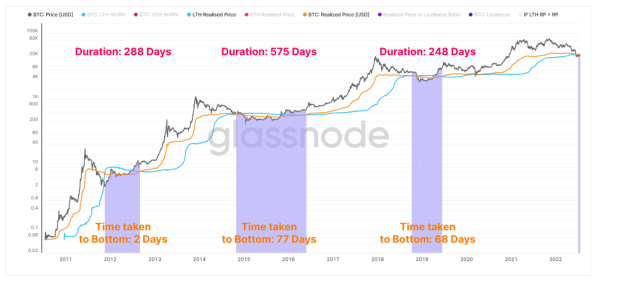

There is besides an absorbing enactment erstwhile the outgo ground for the semipermanent holders rises supra the aggregate outgo ground for the wider marketplace (the realized price). For the semipermanent holders’ realized price, semipermanent holders request to either acquisition coins supra their outgo ground oregon hold until coins with higher outgo bases mature beyond the 155-day mark. This is uncommon during a carnivore market.

The realized terms climbs supra the semipermanent holders' realized terms successful times of marketplace bottoms, sustained spot and capable request to offset profit-taking. Historically, carnivore marketplace debased divergences person lasted betwixt 248 days and 575 days. A play of 17 days has been successful effect for the existent cycle, a comparatively abbreviated clip frame.

Source: Glassnode

Source: Glassnode

BTC Price Is Determined By Macro

Although we wanted bitcoin to beryllium autarkic from accepted markets and macroeconomic indicators, this is not the lawsuit close now. With the introduction of large organization players and their immense amounts of liquidity, this dependence has intensified. Therefore, the behaviour of integer assets is influenced by planetary liquidity flows.

This is wherefore M2 wealth supply, which includes carnal cash, deposits and little liquid wealth including slope savings accounts, tin beryllium a starring indicator of bitcoin's terms movement.

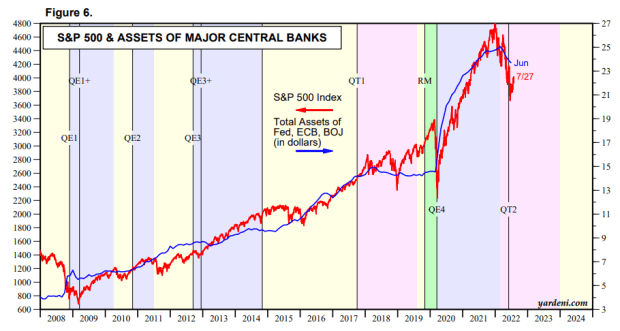

Moreover, arsenic we tin often spot astatine ChangeNOW, the S&P 500 and bitcoin prices are intimately correlated. From a larger perspective, the S&P is driven by the consolidated equilibrium sheets of large cardinal banks. In general, a rising S&P 500 is associated with expanding cardinal slope equilibrium sheets and the aforesaid is existent for bitcoin.

Source: Yardeni.com

Source: Yardeni.com

So, you tin get a consciousness of bitcoin's aboriginal by monitoring the aggregated cardinal banks’ equilibrium sheets chart.

Bottom Line

In analyzing bitcoin‘s on-chain activity, we astatine ChangeNOW tin spot that semipermanent holders, who are little affected by bitcoin terms volatility, ne'er near the market, portion short-term speculators escaped during the caller sell-off, allowing much optimistic buyers to enter. Meanwhile, arsenic we look astatine planetary liquidity flows originating from large cardinal banks, we tin get a consciousness of what is going connected with bitcoin's price, arsenic good arsenic what is to travel successful the adjacent future. It doesn't substance whether you're a beardown semipermanent bull, a capitulating seller, a caller purchaser oregon conscionable watching from afar, we each request to recognize the logical broadside of this seemingly chaotic bitcoin market.

This is simply a impermanent station by Mike Ermolaev. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)