The St. Louis Federal Reserve released a blog station with customizable graphs to let anyone to measurement the terms of commodities against the bitcoin price.

The beneath is simply a nonstop excerpt of Marty's Bent Issue #1222: “The Fed is officially frightened of bitcoin (or softly trying to endorse it)” Sign up for the newsletter here.

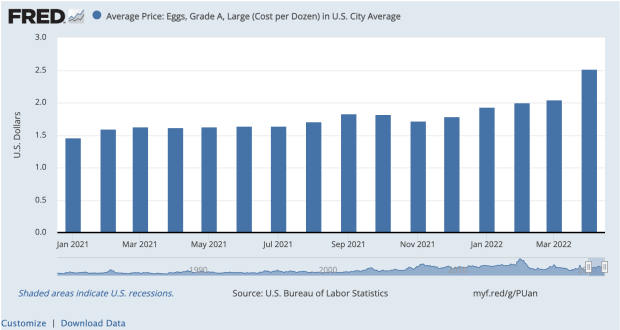

via the St. Louis Fed

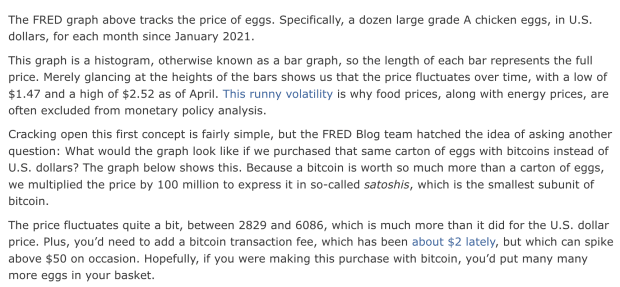

via the St. Louis Fed

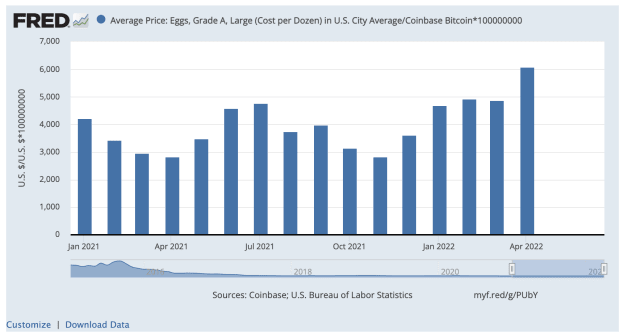

via the St. Louis Fed

via the St. Louis Fed

via the St. Louis Fed

via the St. Louis Fed

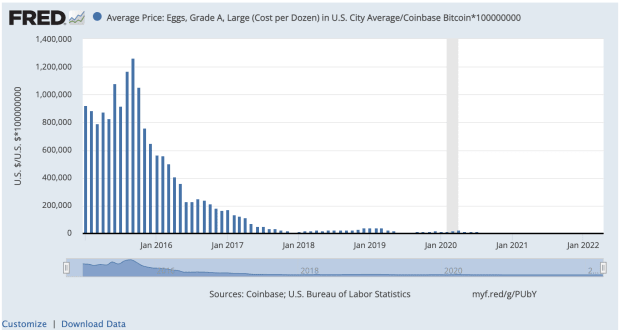

The comedians implicit astatine the St. Louis Federal Reserve dropped a blog station earlier contiguous that compared the fluctuation of eggs prices successful U.S. dollars and sats from the opening of 2021 done April 2022. It seems similar an effort to dunk connected bitcoin, but if you look intimately astatine the charts you'll spot that the wide ostentation complaint of eggs implicit the cherry-picked timeframe is little successful sats (44.3%) than it is successful dollars (71.9%). Sure, bitcoin's terms did fluctuate much rapidly implicit the timeframe, but if the Fed is going to cherry prime data, we present astatine TFTC are going to bash truthful arsenic good to beryllium wherefore this isn't the astir close practice of the situation.

If the Fed were to beryllium much honorable — and get their heads retired of the gutter of short-termism — they would stock what they shared above, but besides zoom retired a spot (as is made imaginable connected the precise leafage of the attempted dunk) to springiness their readers a much close depiction of the deflationary tendencies of bitcoin implicit longer periods of clip and comparison it to the U.S. dollar. Since they were unwilling to bash it successful their blog post, we volition stock that accusation with you successful our rag today.

via the St. Louis Fed

via the St. Louis Fed

via the St. Louis Fed

via the St. Louis Fed

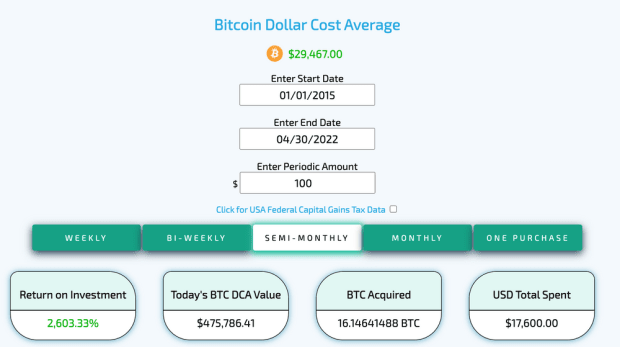

As you tin spot by zooming out, the terms of eggs arsenic measured successful sats fell by — *checks notes* — 99.3% since January 2015 (when the Fed started tracking bitcoin data), portion rising by 19.2% successful U.S. dollars. Sure determination was immoderate volatility on the way, but implicit the people of 76 months an individual's purchasing powerfulness accrued importantly if they were holding bitcoin. To visualize this summation successful purchasing powerfulness different way, here's what it would look similar if an idiosyncratic were to instrumentality $100 per paycheck since the opening of 2015 to prevention successful bitcoin.

via bitcoindollarcostaverage.com

via bitcoindollarcostaverage.com

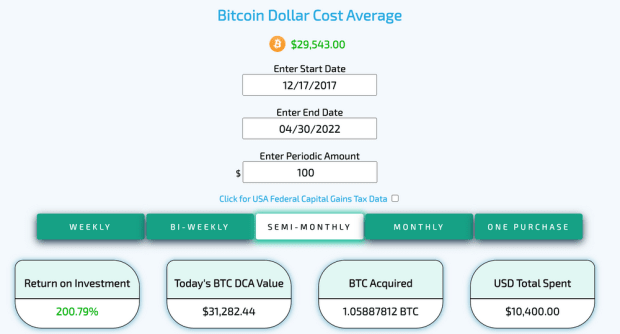

Talk astir superior savings technology! And for those of you skeptics retired determination seething due to the fact that bitcoin was trading astatine $250 adjacent that cycle's carnivore marketplace lows connected January 1st, 2015, here's what it would look similar if you began redeeming $100 worthy of sats per paycheck opening astatine the bull marketplace apical of precocious 2017.

via bitcoindollarcostaverage.com

via bitcoindollarcostaverage.com

Still a precise awesome show from the superior savings technology.

A spot unusual that the academics moving astatine the St. Louis Fed bureau would effort to people dunking points connected bitcoin successful this fashion. Maybe it's a low-key veiled endorsement of the adjacent reserve currency of the world. A subtle awesome that radical should statesman considering bitcoin arsenic their monetary bully of choice. Is the St. Louis Fed breaking ranks and acting arsenic a 5th file histrion attempting to undermine the dollar's presumption from within?! Nothing would astonishment your Uncle Marty astatine this point. It would beryllium precise admirable if this is the case.

3 years ago

3 years ago

English (US)

English (US)