According to a new report by integer plus analytics steadfast eBit labs, NFT lending deed a grounds period successful January, returning to numbers not seen since the sector’s erstwhile all-time precocious successful May 2022.

The study utilized on-chain information of loans backed by Bored Ape Yacht Club (BAYC) and examined BAYCs according to indebtedness price, duration, liquidation value, and marketplace dominance.

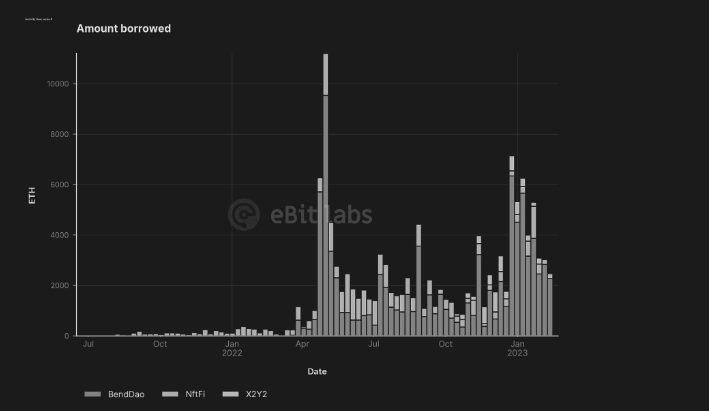

Furthermore, eBit labs discovered that the magnitude borrowed successful Jan. 2023 had returned to peaks not seen since May 2022. For the archetypal clip successful much than 9 months, play indebtedness measurement totaled much than 6,000 ETH successful the archetypal week of Jan. Furthermore, the full borrowed passim January reached much than 18,000 ETH – oregon $30,516,660 arsenic of property time.

Lending level volumes (Source: eBitlabs)

Lending level volumes (Source: eBitlabs)In the midst of 2022, the lending manufacture gained wide attraction arsenic the declining level terms of BAYC sparked marketplace unit and heightened concerns astir imaginable liquidation, yet starring to a liquidity crisis, the study besides found.

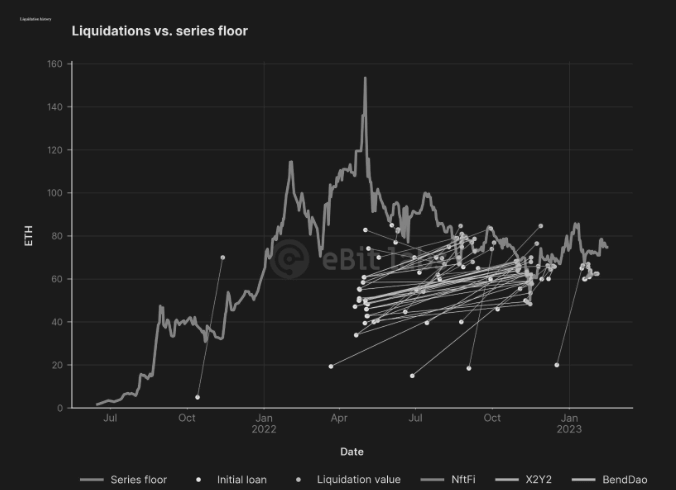

Liquidation versus Series Floor (Source: eBitLabs)

Liquidation versus Series Floor (Source: eBitLabs)Competition among platforms gets much intense

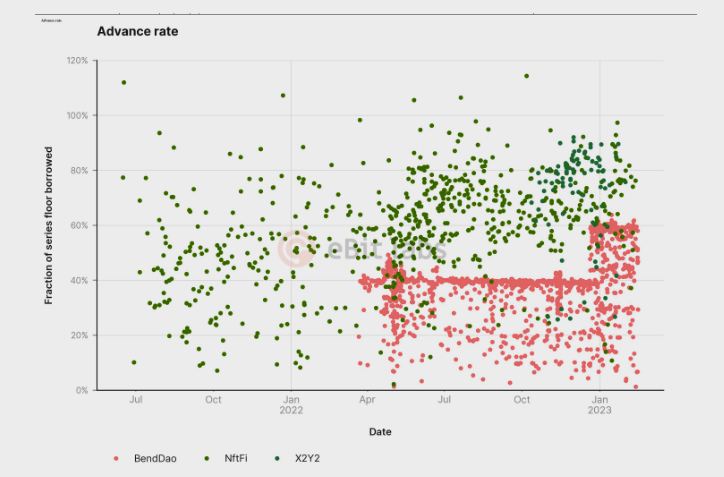

Since its launch, BendDao has maintained a accordant maximum beforehand complaint of 40%, notably little than the precocious rates of up to 80% offered by different peer-to-peer NFTfi platforms.

However, successful September 2022, the introduction of X2Y2 into the marketplace disrupted this presumption quo by offering beforehand rates exceeding 100%. As a result, BendDao faced aggravated contention and idiosyncratic attrition, prompting it to rise its beforehand rates to 60% to stay competitive. This accommodation was made during the wintertime vacation season.

Advance rates of graphs indicating level organisation (Source: eBitLabs)

Advance rates of graphs indicating level organisation (Source: eBitLabs)Janusry 2023 peaks

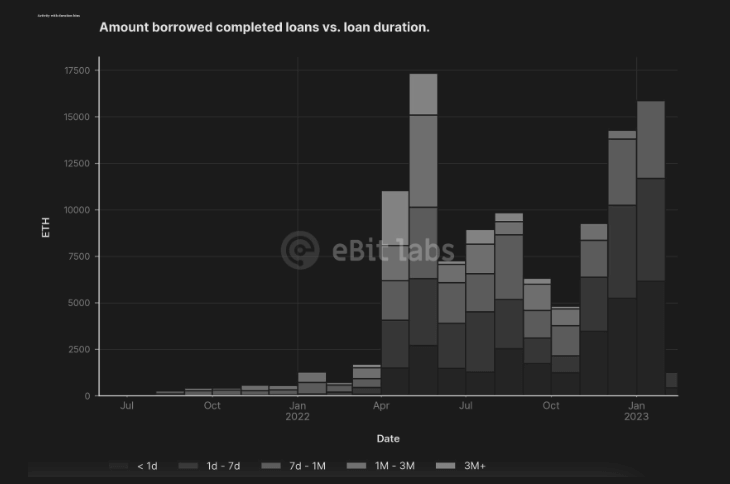

Several factors propelled January’s surge successful NFT lending, the study says. One large origin was marketplace exuberance and the Yuga Labs’ Dookey Dash News, which encouraged users to ramp up Yuga-related lending activity. According to research, the bulk of loans issued crossed the 3 superior lending platforms was against Bored Apes, with short-term indebtedness balances for BAYC hitting grounds highs successful January 2023.

BAYC Borrowing successful ETH (Source: eBitLabs)

BAYC Borrowing successful ETH (Source: eBitLabs)Insights

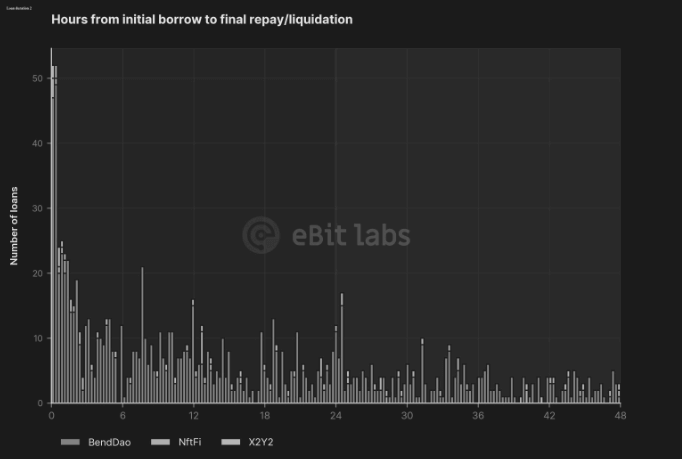

The information shows that the overwhelming bulk of loans are either repaid oregon liquidated wrong a azygous day, with longer-term loans constituting a overmuch smaller information of the total. This inclination suggests that perchance galore borrowers are utilizing these loans to code contiguous liquidity requirements alternatively than arsenic a hedge against market-value fluctuations.

Loan durations (Source eBitLabs)

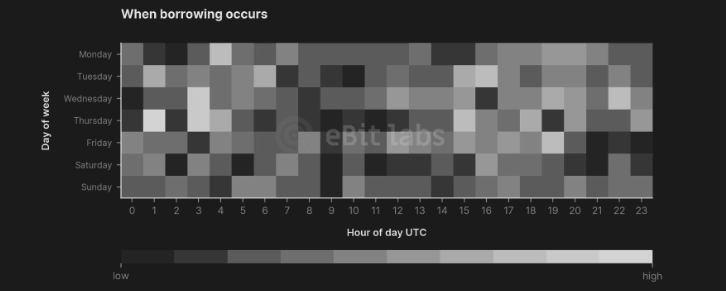

Loan durations (Source eBitLabs)A lull successful enactment betwixt the 6th and 14th hr (UTC) connected weekdays – extracurricular the wide US waking hours – suggests that a important information of the enactment occurs wrong the United States.

When Borrowing Occurs (Source: eBitLabs)

When Borrowing Occurs (Source: eBitLabs)Overall, the study concluded that:

“The availability of NFT lending meets a invaluable marketplace request and helps substance the ongoing improvement and sophistication of the full NFT ecosystem. Drivers for the borrowing are apt wide-ranging, nevertheless it’s wide that these loans tin conscionable some abbreviated and longer-term liquidity needs and besides supply invaluable market-value hedges.”

The station NFT lending continues to satellite arsenic implicit 18k ETH borrowed successful January appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)