The NFT marketplace is experiencing a contraction successful 2023, with regular trading volumes falling importantly compared to erstwhile highs, according to a caller NFT report by Galaxy.

Ethereum’s terms show has outpaced NFT projects, causing a breakdown of their longstanding affirmative correlation. Despite this, NFT enactment remains higher than the 12-month lows successful November 2022, with regular trading measurement declining each period successful 2023.

NFT marketplaces

Within the NFT marketplace sector, Blur has seen its trading measurement dominance scope an all-time precocious of 80%, fueled chiefly by airdrop farmers aiming to payment from its play 2 token airdrop. “The apical 1% of Blur traders relationship for 64% of the platform’s volume,” compared to lone 20% connected OpenSea.

OpenSea, which caters much to the retail collector market, has moved to lure nonrecreational traders with a pro trading level and reduced fees, resulting successful a consequent uptick successful trading volumes to 23.7% (+52%), portion Blur’s decreased 15%.

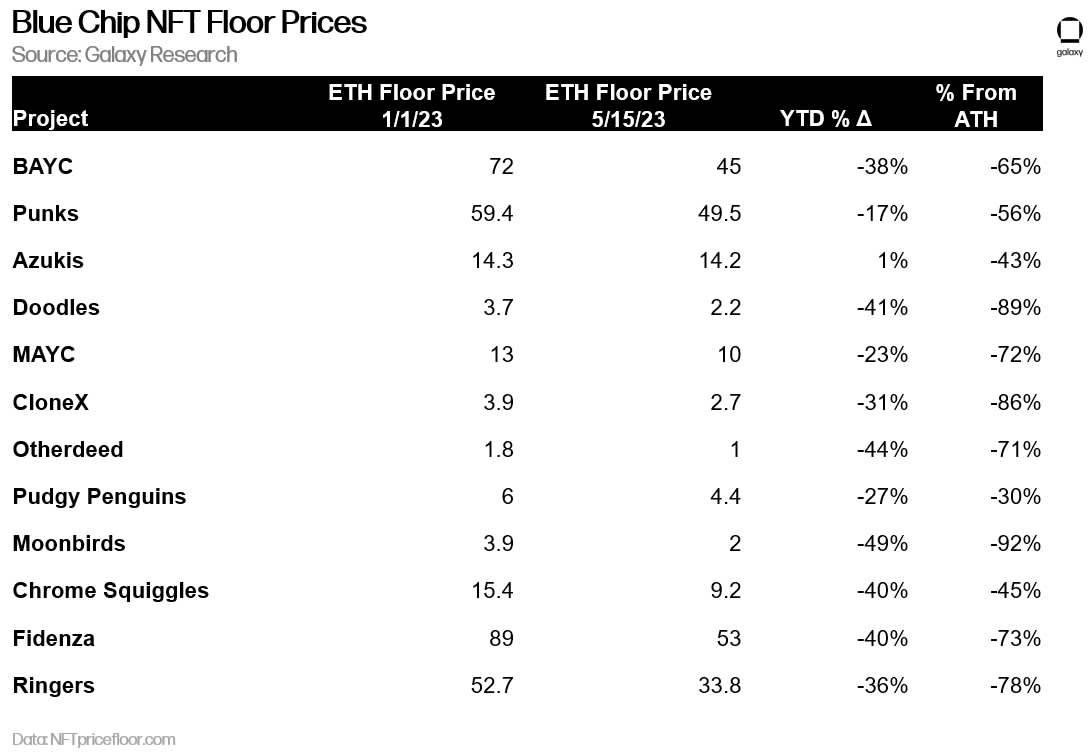

It is simply a bold determination for OpenSea to vie for nonrecreational traders’ attraction arsenic whale enactment connected Blur has skewed its idiosyncratic basal towards professionals, arsenic the apical 1% of users relationship for astir 64% of level trading volume. Meanwhile, short-term NFT marketplace sentiment is downplayed by declining level prices for top-tier bluish spot projects arsenic collectors de-risk their investments successful effect to the contracting market.

NFT royalties

The study posits that “NFT royalties are becoming little relevant” arsenic the marketplace turns bearish, starring creators to question caller income strategies.

Royalty interest transactions person dramatically decreased connected some Blur and OpenSea, with creators apt needing caller income-generation strategies. On the conflict betwixt the marketplaces, the study notes that OpenSea’s idiosyncratic basal is considered much integrated and perchance much sustainable successful the agelong run. At the aforesaid time, short-term whales chiefly thrust Blur’s dominance.

Despite declining level prices for fashionable NFT collections, bluish spot projects person shown astatine slightest immoderate resilience during the carnivore market. Projects specified arsenic Bored Ape Yacht Club, Doodles, Mutant Ape Yacht Club, CloneX, and Moonbirds are each down implicit 64% from all-time highs. Moonbirds was the worst hit, down 92% and 49% twelvemonth to date.

Source: Galaxy

Source: GalaxyIn its appraisal of the outlook for the NFT market, the study noted that the instauration of Bitcoin-based NFTs, Ordinals, is driving renewed involvement successful the space. Furthermore, signals to ticker for the instrumentality of NFT enactment are the ERC-721 vs. ERC-20 token transfers and OpenSea retail trading volume. It concluded that “until a large rebound, it’s a crippled for pros,”

The station NFT marketplace a ‘game for pros’ successful 2023 arsenic measurement declines appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)