In caller months, the NFT marketplace has been a blistery taxable successful the cryptocurrency world, with caller marketplaces emerging and contention among them increasing progressively fierce. One specified level that has made waves successful the manufacture is Blur, a four-month-old NFT marketplace that has surpassed the trading measurement of erstwhile marketplace person OpenSea.

The data

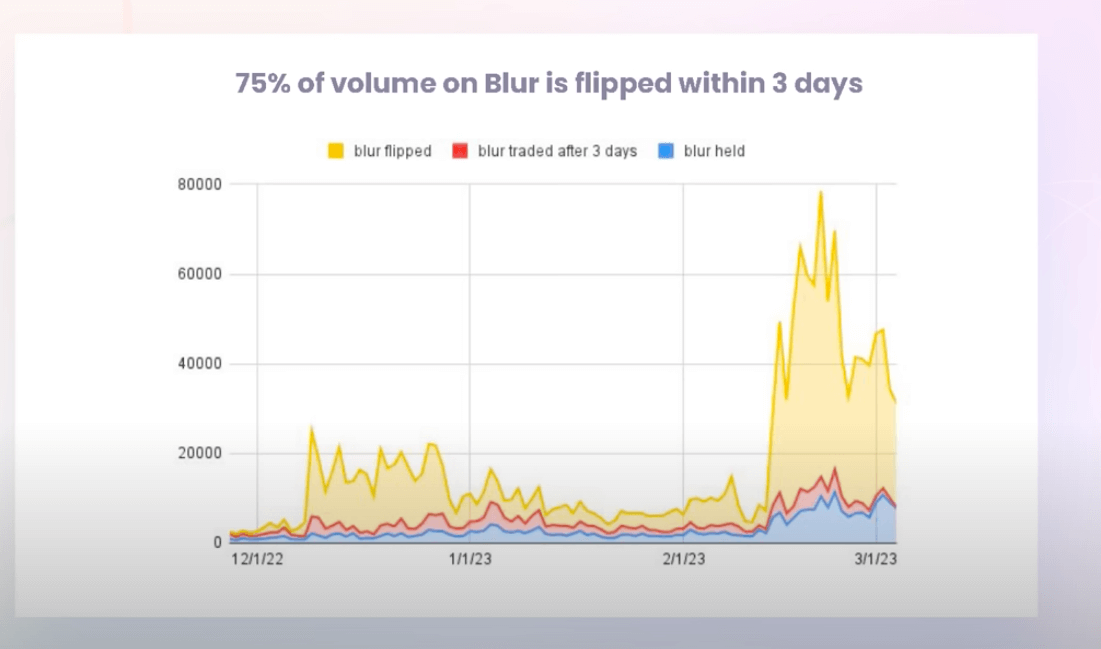

The NFT marketplace has seen a surge successful activity, with a peculiar uptick successful the measurement of NFT flips connected the Blur platform.

(Source: Proof YouTube)

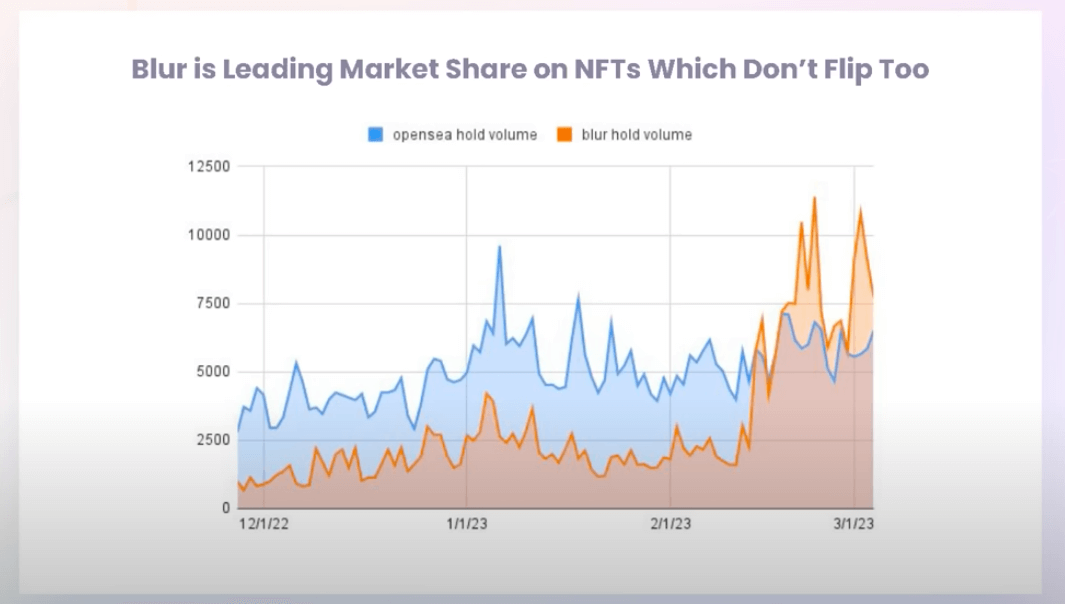

(Source: Proof YouTube)However, determination has besides been a emergence successful the fig of individuals buying and holding NFTs, represented by the bluish country successful the illustration beneath comparing Blur and OpenSea.

While some platforms person experienced level maturation successful this area, Blur’s trading assemblage has contributed to a important summation successful volume, resulting successful Blur surpassing OpenSea successful trading volume.

Notably, adjacent semipermanent NFT holders are present contributing much measurement connected Blur compared to OpenSea, indicating a displacement successful the platform’s idiosyncratic basal from superior flippers to much semipermanent investors.

However, Blur is besides starring successful marketplace stock connected NFTs that are not instantly flipped.

(Source: Proof YouTuube)

(Source: Proof YouTuube)What explains this?

In the past 30 days, Blur, which is lone 4 months old, has achieved an awesome income measurement of $1.88 billion, arsenic reported by Dapp Radar. In comparison, the erstwhile marketplace leader, OpenSea, had volumes of $474.58 million. Blur’s triumph implicit OpenSea has made headlines, particularly aft a surge successful enactment pursuing the motorboat of its autochthonal token connected February 14th.

Blur has acceptable itself isolated arsenic the go-to marketplace for nonrecreational traders with its polished interface, robust analytical tools, and swift commercialized execution capabilities. Additionally, Blur’s zero level fees and optional royalties person made it a cost-effective enactment compared to its competitors, further solidifying its entreaty to traders.

Despite its caller success, the travel for Blur to go the biggest NFT marketplace is acold from over, and evaluating its existent and aboriginal occurrence is simply a analyzable matter.

NFT marketplaces are presently embroiled successful fierce contention for customers, with companies lowering their fees and royalties to entice and support users. This contention has resulted successful the gradual weakening of royalty fees, a important gross root for galore NFT creators who consciousness abandoned by the marketplaces that erstwhile supported them. This “race to the bottom” is causing important disruption to the full NFT ecosystem.

Read more: Why we request much NFT royalties and amended marketplaces

Is Blur’s measurement real?

Blur has surpassed OpenSea successful the wide worth of income made done its platform, but the information has sparked a statement astir its existent significance.

One origin contributing to Blur’s occurrence is its rewards program, which awards points to traders for listing and bidding connected NFTs. These points tin beryllium exchanged for BLUR tokens, with the fig of tokens received based connected the fig of points accumulated.

Since determination are nary marketplace fees oregon royalties, the lone obstacle preventing users from gaming the strategy and earning tokens by purchasing their ain listings with a antithetic wallet is the request to wage state fees.

However, past month, CryptoSlam, a tracker of NFT income data, claimed that this is precisely what was happening connected Blur. In an email to its subscribers, CryptoSlam stated that lone 1% of high-value traders were liable for the bulk of trading enactment connected the platform.

As a result, CryptoSlam took enactment and removed hundreds of millions of dollars successful Blur trades from its data, citing “market manipulation.” It has since implemented an updated algorithm that filters retired “suspicious” sales.

During the play of February 14th to February 25th, CryptoSlam identified implicit $577 cardinal successful wash-traded NFTs connected the platform.

According to CryptoSlam, income information from Blur is “misrepresenting” the NFT market. The perchance artificial surge successful income has boosted the industry’s wide income measurement to its highest level since January 2022, starring immoderate to judge that the marketplace was rebounding aft a important driblet successful enactment implicit the past year.

Data technologist Scott Hawkins from CryptoSlam stated successful an interrogation with Forkast, “What we are uncovering is that this is artificially propping up income measurement successful a precise disingenuous mode for the full NFT market.”

In addition, OpenSea inactive has much users than Blur, with a idiosyncratic basal that consists of a smaller radical of much progressive traders. Blur has lone 113,886 users successful the past 30 days compared to OpenSea’s 294,146. Critics besides assertion that a tiny percent of wallets connected Blur are liable for the bulk of transactions.

The aboriginal of Blur

The specifics of however the BLUR token volition beryllium valued successful the aboriginal are unclear, and it’s uncertain however it volition summation worth implicit time. Currently, BLUR operates arsenic a governance token, but since Blur is simply a centralized entity, it volition request to gradually cede power to token holders of a recently established DAO. This could beryllium the crushed wherefore U.S. users were excluded from the airdrop, contempt the information that the token is disposable connected large U.S. exchanges similar Coinbase.

The Blur DAO volition beryllium liable for governing important aspects of the platform, specified arsenic establishing the protocol’s worth accrual and distribution. This could see determining the protocol interest complaint (up to 2.5%) aft 180 days and awarding treasury grants to make the marketplace further. These choices volition play a captious relation successful shaping the platform’s aboriginal maturation and determining whether Blur tin vie efficaciously successful the marketplace some present and successful the contiguous future.

The station NFT marketplace manipulation? CryptoSlam claims suspicious enactment connected Blur appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)