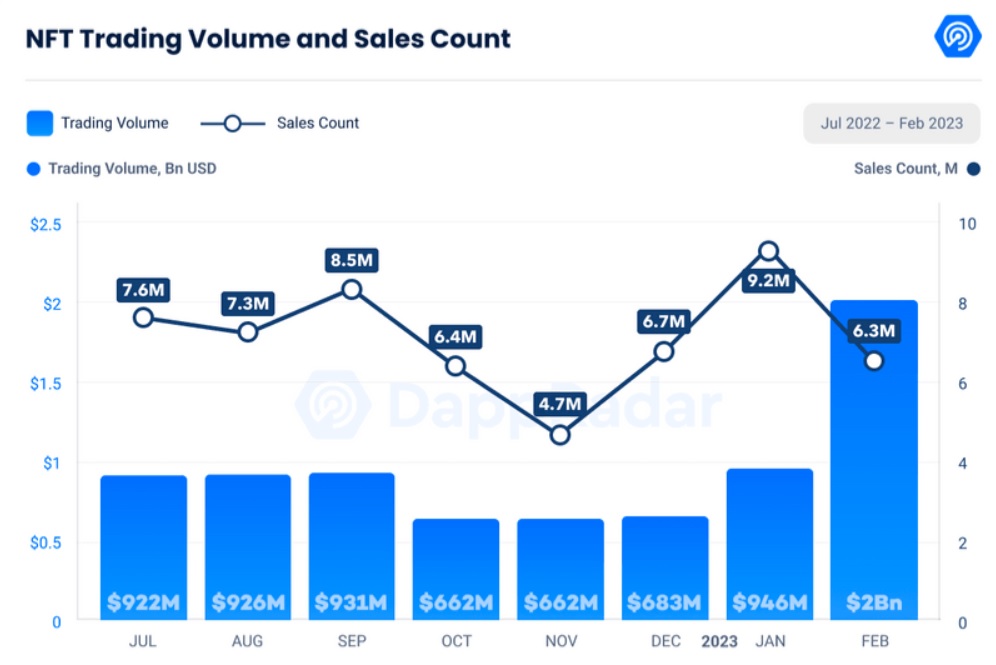

Non-fungible token (NFT) market’s trading measurement accrued to $2 cardinal successful February, reaching its pre-LUNA clang levels, according to DappRadar’s Industry Report.

The NFT trading measurement recorded a 117% spike from January’s $956 million, arsenic the DappRadar data shows.

NFT trading measurement and income number (Source: DappRadar)

NFT trading measurement and income number (Source: DappRadar)Despite the important surge successful the NFT trading volume, the income number recorded a 31.46% decrease, falling to 6.3 cardinal from January’s 9.2 million.

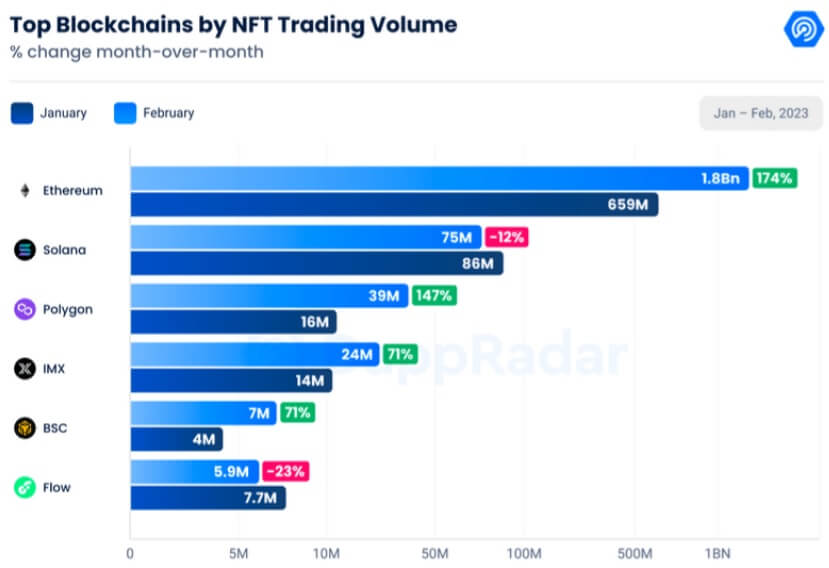

In February, Ethereum (ETH) remained the apical blockchain by NFT trading volume. The concatenation recorded $1.8 cardinal successful trading volume, which marks a 174% summation from the $659 cardinal successful January. Based connected these numbers, ETH represents 83.36% of the full NFT market.

Top blockchains by NFT trading measurement (Source: DappRadar)

Top blockchains by NFT trading measurement (Source: DappRadar)Solana (SOL) and Polygon (MATIC) followed ETH arsenic the 2nd and 3rd chain, with the highest NFT trading measurement successful February. Even though SOL ranked 2nd by facilitating $75 cardinal successful trading volume, it inactive recorded a 12% alteration from January’s $86 million. MATIC, connected the different hand, marked a 147% summation successful February, reaching $39 cardinal from the $16 cardinal of the erstwhile month.

Blur vs. OpenSea

In February, Blur triumphed implicit OpenSea successful presumption of trading volume. Blur facilitated implicit $1.3 cardinal successful trading measurement passim the month, portion OpenSea came 2nd with $587 million. These numbers bespeak that Blur accounted for 64.8% of the full NFT marketplace trading volume, portion OpenSea represented 28.7% of it.

X2Y2 and LooksRare followed OpenSea arsenic 3rd and 4th successful the ranking by signaling $39 cardinal and $29 cardinal successful trading volume, representing 1.9% and 1.4% of the full market, respectively.

Profit chasers vs. creation lovers

Even though the quality successful trading volumes points to Blur arsenic the busiest NFT marketplace, OpenSea inactive holds the astir important fig of users. Currently, Blur has 96,856 users arsenic opposed to OpenSea’s 316,199. To drawback up with OpenSea connected that front, Blur has besides been trying to turn its idiosyncratic number by issuing airdrops to loyal users.

Referring to this opposition successful idiosyncratic counts and trading volume, DappRadar stated:

“This [the opposition successful numbers] confirms that the trading patterns connected Blur are mostly driven by NFT whales farming connected the level alternatively than emblematic trading activity.”

In enactment of this cognition of Blur, a whale precocious sold 139 NFTs and earned $9.6 million.

A circumstantial portion of the assemblage besides criticizes Blur for stripping the creation from NFTs and luring radical by promoting large returns. A typical of this crowd, Aaron Sage, precocious wrote:

“I conscionable privation the NFT abstraction could power it’s lens to however we utilized to beryllium – astir the creation and civilization (i.e. ape noises successful clubhouse and adjacent the lazy lion twitter raids), but not what it is contiguous with Blur.“

The station NFT trading measurement returns to pre-LUNA clang levels successful February appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)