Bitwise CEO Hunter Horsely posts YTD show data, and against expectations the Bitwise Blue-Chip NFT Index is holding up.

Cover art/illustration via CryptoSlate

Against a backdrop of macroeconomic uncertainty, crypto markets are faltering. However, money show information from Bitwise suggests NFTs are holding up amid the uncertainty.

Crypto markets nether pressure

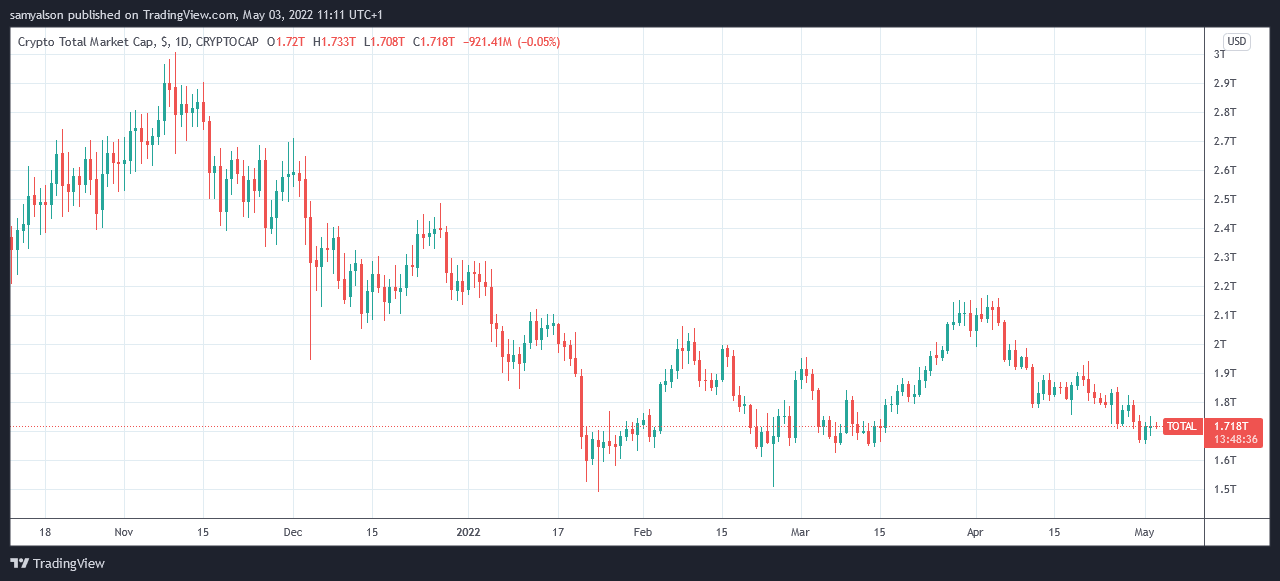

Crypto markets person been caught successful a noticeable downturn since the commencement of April. Over this period, the full crypto marketplace headdress has mislaid $448 cardinal from its section apical of $2.1 trillion.

Analysts constituent to broader macroeconomic factors causing capitalist sentiment to flip risk-on. And with cryptocurrencies wide regarded arsenic precocious risk, immoderate accidental the carnivore marketplace is already here.

The $1.6 trillion level has proven beardown support, with aggregate bounces astatine this level since mid-February. The astir caller retest was connected April 30, starring to a 5% upswing.

However, considering the full crypto marketplace headdress is 43% down connected November 2021’s all-time high, the outlook remains grim.

Source: CRYPTOCAP connected TradingView.com

Source: CRYPTOCAP connected TradingView.comBitwise CEO Hunter Horsley tweeted YTD show figures for immoderate of the funds managed by the crypto plus absorption firm. Of those helium listed, the Bitwise DeFi Index (the apical 3 constituents are Uniswap, Aave, and Maker) showed the astir important nonaccomplishment astatine -53%.

But surprisingly, the Bitwise Blue-Chip NFT Index (the apical 3 constituents are Bored Ape Yacht Club, CryptoPunks, and Mutant Ape Yacht Club) was the lone money successful the green.

YTD:

Bitwise DeFi Index: -53%

Bitwise 10 Large Cap Index: -23%

Bitwise Crypto Industry Index (Equities): -17%

Bitwise Blue-Chip NFT Index: +16% (!!!)

Crypto expected to beryllium much volatile, but…$QQQ: -22%$ARKK: -50%

… $AGG: -10%

— Hunter Horsley (@HHorsley) May 2, 2022

Commenting connected the YTD show of the funds, one Twitter user said a script successful which NFTs “save our portfolios” would person been laughable a twelvemonth ago.

“A twelvemonth agone if you told idiosyncratic that each stocks & crypto would clang but NFTs would prevention our portfolios they would’ve laughed truthful hard.”

Are NFTs holding things up?

The eventual presumption awesome oregon pointless jpegs? While it’s existent non-fungible tokens service broader purposes than conscionable integer artworks, the statement surrounding them inactive continues to rage.

A caller Bloomberg article laid retired the lawsuit for a cooling NFT marketplace by pointing retired the mean selling terms has fallen from $6,900 connected January 2, 2022, to little than $2,000 astatine the commencement of March. In addition, full regular mean income person declined, falling from $160.2 cardinal connected January 31, 2022, to $26.2 cardinal connected March 3, 2022.

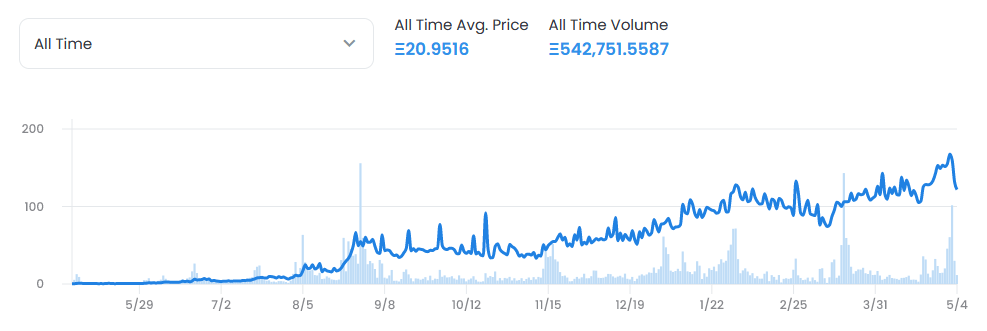

However, this signifier is not reflected successful the top-tier NFT collections. The Bored Ape Yacht Club (BAYC) Collection has a existent level terms of 114.3 ETH ($325,000 astatine today’s price). Analysis of its mean selling terms shows a crisp downturn since the commencement of May. But passim 2022, the mean selling terms is inactive trending upwards.

Source: opensea.io

Source: opensea.ioAs such, the information points to a divided market. While averages amusement a diminution successful NFT income terms and volume, top-tier collections similar BAYC are bucking the trend.

But volition top-tier NFTs proceed to outperform arsenic the twelvemonth continues?

3 years ago

3 years ago

English (US)

English (US)