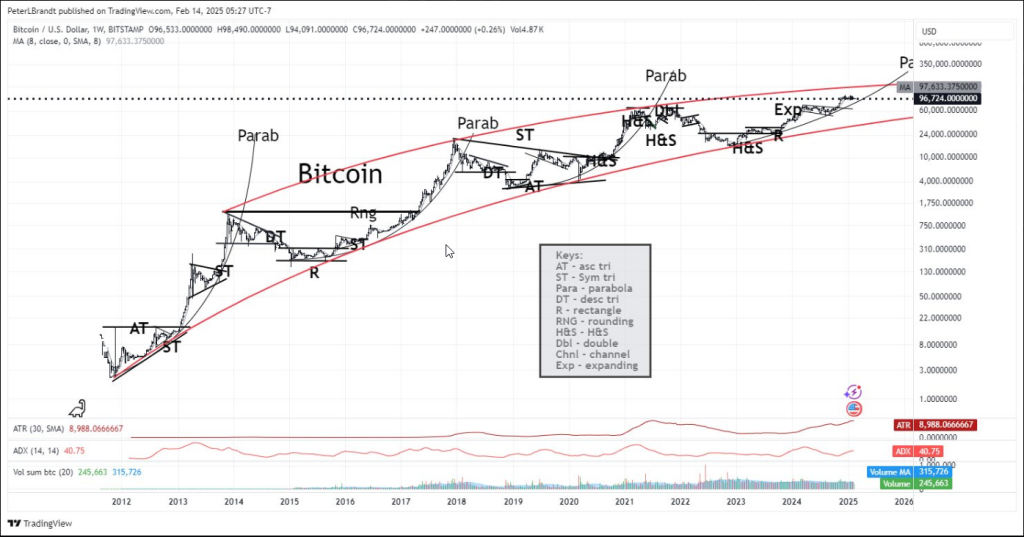

Peter Brandt, a seasoned trader, has dismissed optimistic predictions successful the aftermath of Bitcoin’s caller summation to $97,000+.

His latest method investigation indicates that the astir salient cryptocurrency whitethorn brushwood trouble successful surpassing the coveted $200,000 threshold anterior to 2030.

Bitcoin has demonstrated a mixed performance, with a regular summation of 0.17% and a 2.85% diminution implicit the people of the week, prompting the forecast.

The Protracted Path To Six Figures

Bitcoin volition look important challenges successful breaching the intelligence obstruction of $100,000. The 8-week moving mean of $97,633, which has consistently rejected upward movements, presents the cryptocurrency with important resistance.

From the satellite of brainsick ideas comes this thought – a thought, not a trade

Unless Bitcoin has flight velocity done precocious parabolic absorption enactment it’s precise improbable that BTC volition beryllium trading supra $200k astatine the extremity of this decade. Only☑️can reply. No involvement successful non- ☑️replies pic.twitter.com/7a5N7Gliw8

— Peter Brandt (@PeterLBrandt) February 14, 2025

The Average True Range (ATR) of 8,988 and the Average Directional Index (ADI) of 40.75, which some enactment a beardown trend, amusement accrued volatility successful the existent marketplace conditions.

Historical Patterns Paint A Cautionary Tale

Since 2012, Bitcoin has developed a distinctive signifier that has captured the involvement of method experts. Within a reddish rising channel, the cryptocurrency has been bouncing betwixt 2 important trendlines that service arsenic terms barriers.

Particularly intriguing is Bitcoin’s inclination toward some crisp corrections and parabolic movements. Market veterans person raised their antennae owed to the striking similarities betwixt the contiguous rally and these erstwhile cycles.

Trading Volume Raises Red Flags

The numbers archer an absorbing communicative astir however radical enactment successful the market. There is simply a accidental that the existent rally isn’t unchangeable due to the fact that Bitcoin’s 20-period measurement full of 245,600 is debased compared to different breakout stages.

Maintaining a semipermanent upward inclination could beryllium challenging successful the lack of a notable summation successful commercialized volume. For analysts watching Bitcoin’s adjacent large move, this anemic measurement has been a increasing concern.

Support And Resistance: The Drawing Of Battle Lines

The aboriginal of Bitcoin is contingent upon captious terms levels that could find its fate. Strong enactment is contiguous successful the $60,000 to $70,000 range, portion a coagulated absorption portion looms betwixt $100,000 and $120,000.

If the concern worsens, Bitcoin whitethorn revisit the little bound of its semipermanent channel, which is astir $40,000 to $50,000.

Brandt’s investigation indicates that Bitcoin’s trajectory to $200,000 by 2030 is dubious successful the lack of a important interruption supra the precocious bound of its parabolic trajectory.

The seasoned trader underscores the necessity of sustained momentum and the quality to surpass captious absorption levels successful bid to execute specified elevated valuations.

Featured representation from Pixabay, illustration from TradingView

10 months ago

10 months ago

English (US)

English (US)