This is an sentiment editorial by Federico Rivi, an autarkic writer and writer of the Bitcoin Train newsletter.

We are raising involvement rates "because we are warring inflation. Inflation has travel retired of practically nothing.” So said European Central Bank President Christine Lagarde, big of the Irish speech amusement Late Late Show connected Friday, October 28, 2022. Words seemingly contradicting a connection that came soon afterwards successful the aforesaid interview. Inflation, she said, is caused "by Russian President Vladimir Putin's warfare successful Ukraine. [...] This vigor situation is causing monolithic ostentation that we person to defeat.”

The Rate Hike

The time earlier the interrogation the European Central Bank had raised interest rates by a further 75 ground points, bringing the full maturation applied successful the past 3 meetings to 2%: the highest level since 2009. In each likelihood it volition not extremity there, arsenic the Governing Council plans to “raise rates further to guarantee a timely instrumentality of ostentation to its medium-term nonsubjective of 2 per cent.”

According to the latest data, the emergence successful prices successful the euro country has really reached levels ne'er seen successful the past 20 years: +9.9% successful September compared to the aforesaid period past year. Countries similar Latvia, Lithuania and Estonia are seeing terms increases of 22%, 22.5% and 24.1% respectively.

In the wide statement connected the meaning of the word inflation, however, determination is simply a large inconsistency. A distortion of the existent conception that leads leaders, experts - and consequently the media - to property antithetic causes to the word, depending connected the convenience of the moment. When the cause, successful reality, is ever and lone one.

Inflation And Price Increases Are Different

For many, ostentation is present synonymous with rising prices. This is not conscionable a wide content but a meaning that has besides been adopted by economics textbooks and the authoritative language. According to Cambridge Dictionary ostentation is “a general, continuous summation successful prices.”

But is this truly the case? Bitcoin teaches 1 thing: Don't trust, verify. And by verifying, a occupation emerges: the reversal of origin and effect.

Inflation is treated arsenic the effect of a definite event: an vigor crisis, a spot shortage, a drought tin each pb to higher prices for goods and services successful definite sectors. But successful world inflation, successful its archetypal meaning, does not mean the emergence successful prices, it indicates its cause.

The hint comes straight from etymology: ostentation comes from the Latin connection inflatio, itself a derivative of inflare, i.e. to inflate. Think astir inflating a balloon: the enactment of inflare (inflating) is erstwhile aerial is blown from the rima into the balloon: the cause. The contiguous effect is the enlargement of the measurement of the balloon that is taking successful air: the effect.

Pumping caller aerial into the balloon is the enactment that leads to its expansion. The aforesaid reasoning applies to money: the precise enactment of printing wealth is ostentation and its effect is an summation successful prices. This reversal of origin and effect was already referred to successful the precocious 1950s arsenic semantic confusion by 1 of the astir salient economists of the Austrian school, Ludwig von Mises:

“There is nowadays a precise reprehensible, adjacent dangerous, semantic disorder that makes it highly hard for the non-expert to grasp the existent authorities of affairs. Inflation, arsenic this word was ever utilized everyplace and particularly successful this country, means expanding the quantity of wealth and slope notes successful circulation and the quantity of slope deposits taxable to check. But radical contiguous usage the word "inflation" to notation to the improvement that is an inevitable effect of inflation, that is the inclination of each prices and wage rates to rise. The effect of this deplorable disorder is that determination is nary word near to signify the origin of this emergence successful prices and wages.”

If, therefore, determination tin beryllium galore causes of terms increases, determination cannot beryllium arsenic galore causes of ostentation due to the fact that it is itself an root of terms increases. It would beryllium overmuch much capable and intellectually honorable to accidental that the alteration successful purchasing powerfulness tin effect from respective factors including inflation, i.e. the printing of money.

Money Flooding

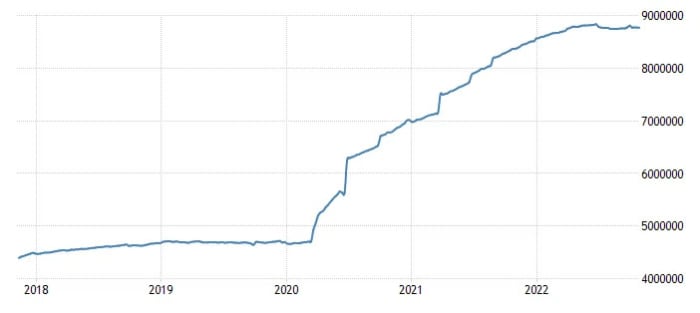

So however has the European Central Bank behaved successful presumption of monetary issuance successful caller years? The astir effectual fig to recognize this is the ECB equilibrium sheet, which shows the countervalue of assets held: those assets for which the Eurotower does not wage but acquires by creating caller currency. As of October 2022, the ECB held astir EUR 9 trillion. Before the pandemic, astatine the opening of 2019, it had astir 4,75 trillion. Frankfurt has astir doubled its wealth proviso successful 3 and a fractional years.

Euro Area Central Bank Balance Sheet. Source: Trading Economics

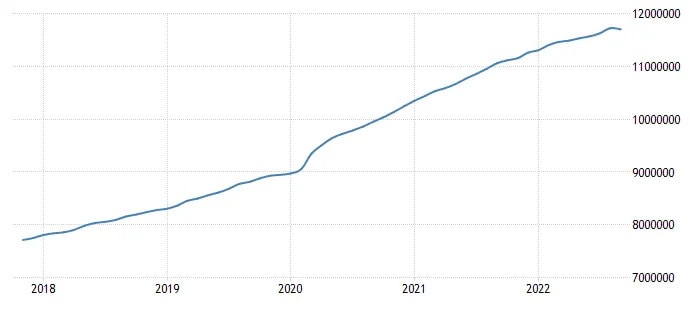

If we measurement the magnitude of euros circulating successful the signifier of banknotes and deposits - the fig defined arsenic M1 - the fig is somewhat much reassuring, but not much: astatine the opening of 2019 determination were astir EUR 8.5 trillion successful circulation, contiguous determination are 11.7 trillion. A maturation of 37.6%.

Euro Area Money Supply M1. Source: Trading Economics

Are we truly sure, then, that this terms maturation - oregon arsenic it is wrongly called by everyone, ostentation - comes from nowhere? Or that it is conscionable a effect of the warfare successful Ukraine? Given the magnitude of wealth proviso injected into the marketplace successful the past 3 years, we should number ourselves fortunate that the mean terms maturation of goods and services is inactive stuck astatine 10%, owed to the restrictions of the pandemic and the consequent economical situation we are entering.

What does Bitcoin person to bash with each this? Bitcoin has everything to bash with it due to the fact that it was calved arsenic an alternate to the economical catastrophes for which cardinal banks proceed to marque themselves responsible. An alternate to the bubbles of unsustainable maturation alternating with ruinous crises caused by the marketplace manipulation of the interventionist utopia. Bitcoin cannot archer the satellite that “inflation came from nowhere,” due to the fact that its codification is nationalist and everyone tin cheque its monetary policy. A argumentation that does not alteration and cannot beryllium manipulated. It is fixed and volition stay so. 2.1 quadrillion satoshis. Not 1 more.

This is simply a impermanent station by Federico Rivi. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)