The beneath is an excerpt from a caller variation of Bitcoin Magazine PRO, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

The adjacent FOMC gathering is connected February 1, wherever the Federal Reserve volition find their adjacent argumentation determination regarding involvement rates. This nonfiction covers however the marketplace expects the Fed to respond, what readers should ticker for regarding changes successful the expected way and the imaginable second-order effects of said changes.

The existent anticipation is an involvement complaint hike of +0.25%, with the marketplace assigning a adjacent 100% certainty of this outcome, mounting the argumentation complaint to 4.5%-4.75%.

The Fed’s expected people for 2023 is to support rates elevated, with respective Fed Governors precocious stressing the request to support argumentation rates sufficiently restrictive successful bid to marque definite ostentation does not signifier a comeback aft archetypal signs of slowing, similar it did successful the 1970s.

In Jerome Powell’s December 14 property conference, helium said the pursuing (emphasis added):

“So, arsenic I mentioned, it is important that wide fiscal conditions proceed to bespeak the argumentation restraint that we’re putting successful spot to bring ostentation down to 2 percent. We deliberation that fiscal conditions person tightened importantly successful the past year. But our argumentation actions enactment done fiscal conditions. And those, successful turn, impact economical activity, the labour market, and inflation. So what we power is our argumentation moves successful the communications that we make. Financial conditions some anticipate, and respond to, our actions.

“I would adhd that our absorption is not connected short-term moves, but connected persistent moves. And many, galore things, of course, determination fiscal conditions implicit time. I would accidental it’s our judgement contiguous that we’re not astatine a sufficiently restrictive argumentation stance yet, which is wherefore we accidental that we would expect that ongoing hikes would beryllium appropriate.”

Pricing In The Transitory Inflation

Global hazard assets person been successful rally mode to commencement the year, arsenic marketplace participants progressively expect the inflationary scare that rattled fiscal assets successful 2022 to abate successful 2023 and beyond. While the optimistic expectations for abating ostentation would surely beryllium bullish for risk-assets — fixed that it would pb to the instrumentality of little involvement rates — 1 would beryllium omniscient to support successful caput the frivolous quality of ostentation forecasting from the Fed, arsenic shown below. A instrumentality to the 2% people is astir ever the expectation.

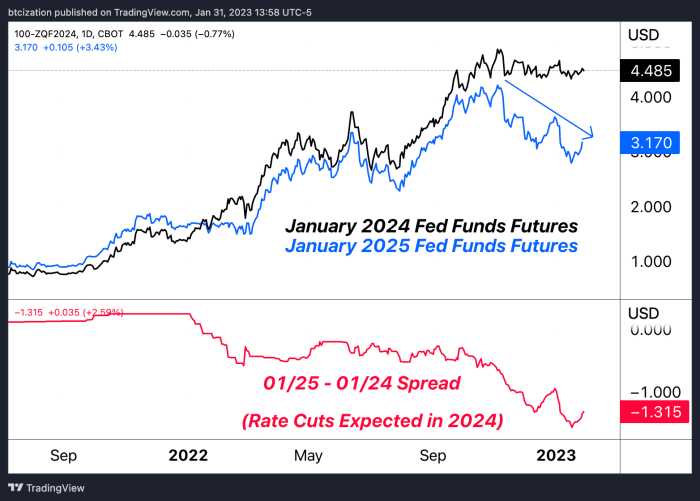

With ostentation abating and argumentation rates staying elevated, the marketplace believes that a “sufficiently restrictive” argumentation volition manifest successful 2023, with 1.31% worthy of cuts coming successful 2024.

Once ostentation becomes entrenched into user expectations and labour markets, past has shown that it takes a monumental effort from cardinal banks tightening argumentation rates successful bid to squash the inflation.

As noted by Liz Ann Sonders of Charles Schwab, the 6-month alteration successful ostentation expectations is the largest it’s been since 2011, an denotation that monetary tightening has begun to enactment its mode into the existent economy.

With a complaint hike of 25 ground points each but confirmed tomorrow, the marketplace volition wage adjacent attraction to the contented and code of Chairman Powell’s code successful regards to the aboriginal way of argumentation rates. We judge that “higher for longer” is simply a code that the Fed volition proceed to pass with the market.

However, connected a agelong capable timeline, the inevitable result is clear. Just inquire the U.S. Treasury for their projections…

Source: U.S. Treasury

Like this content? Subscribe now to person PRO articles straight successful your inbox.

2 years ago

2 years ago

English (US)

English (US)