Crypto prices were crushed this past week and erstwhile specified events happen, galore question retired a culprit.

We’ve been noting that request for bitcoin and ether was drying up (“Of course, this doesn’t mean muted markets tin past forever, but successful the coming days oregon weeks, 1 shouldn’t beryllium amazed if prices drift south,” I warned successful last week’s column). That answered the question “what?” but not “why?”

One persistent, communal story astir crypto whitethorn look perfectly tenable but doesn’t clasp up erstwhile the information is analyzed. That story is that cryptocurrencies commercialized intimately with tech stocks and surely much truthful than with the wide market.

At archetypal blush, there’s a batch of reasons wherefore that would marque sense. Buying cryptocurrencies – not conscionable bitcoin, but immoderate of them – is simply a stake that the exertion volition beryllium adopted by much users. Something that is the aboriginal of wealth (and creation and information absorption and …) that has less than 40 cardinal non-zero balances arsenic bitcoin does volition lone spell up from there, since the world’s colonisation is 198 times that amount, the reasoning goes.

Thus, 1 would expect the caller exertion communicative to acold outweigh the ostentation hedge narrative, which is an integral portion of bitcoin's root story. Yet is that truly the case?

The information says … not exactly.

The favored proxy for the tech sector, the Nasdaq 100, is packed with giants successful the space: Apple, Microsoft, Amazon, Meta (aka Facebook), Tesla and Alphabet (aka Google), which accounted for 43% of the index’s worth arsenic of Dec. 31. And portion determination are different sectors like user services oregon healthcare, adjacent those are tech-heavy. Activision Blizzard, Electronic Arts and Netflix are categorized arsenic “communication services,” for example.

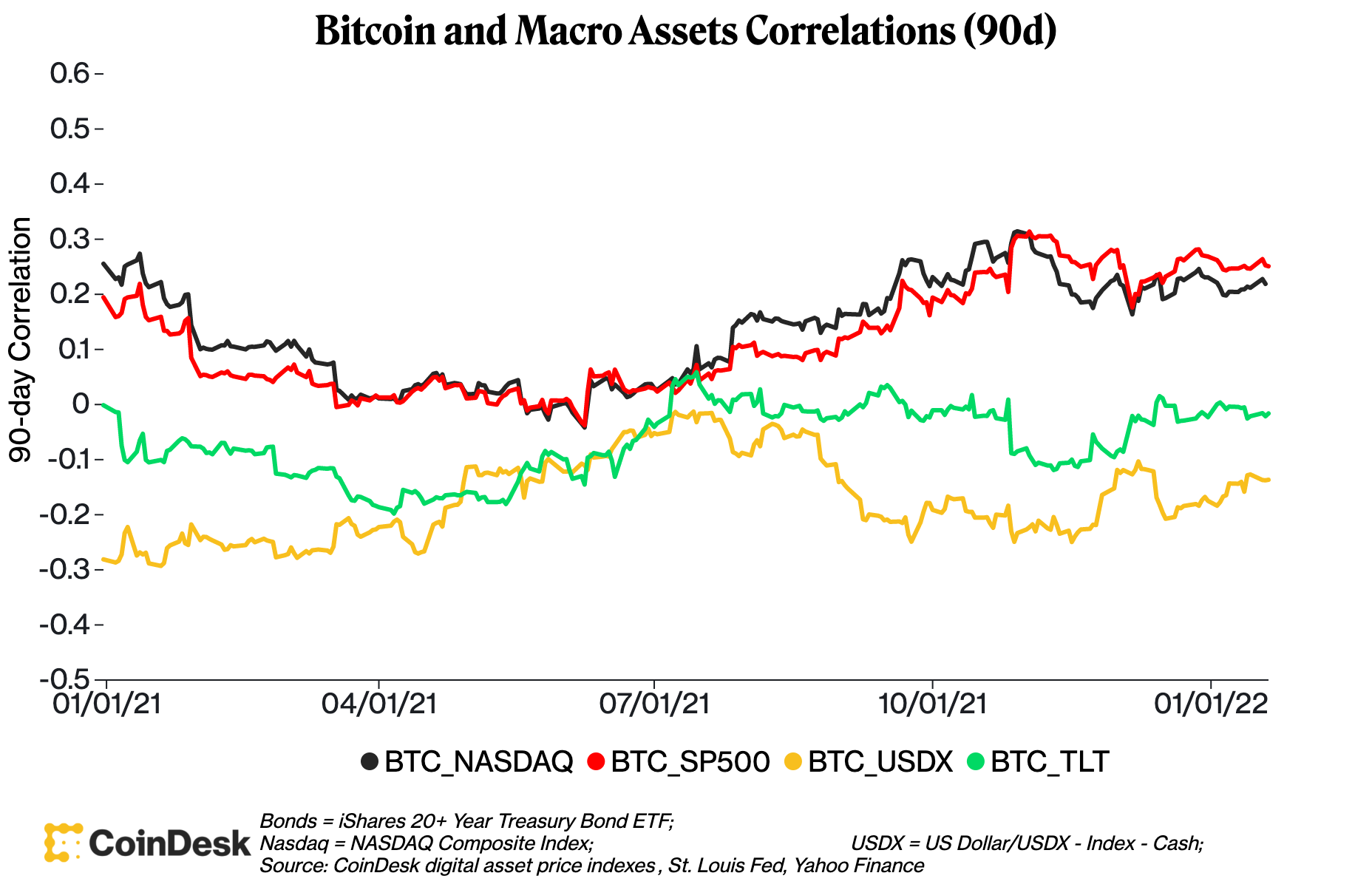

Bitcoin and Macro Assets Correlations (90d)

Using bitcoin arsenic a proxy for crypto wide – not perfect, but carnivore with maine – we spot the correlation coefficient betwixt the largest cryptocurrency by marketplace headdress and the Nasdaq Composite (using a 90-day set) is 0.22. That’s positive, but weak.

Yet the communicative of bitcoin offsetting the devaluing dollar is adjacent weaker than the 1 astir it being a tech-related investment. The correlation coefficient betwixt bitcoin and the U.S. Dollar Index is conscionable -0.13. Against U.S. bonds, represented by the iShares 20+ Year Treasury Bond ETF (TLT), it is conscionable -0.02. In different words, nary narration astatine all.

All this is to accidental that determination are apt different factors that tin explicate the existent authorities of the crypto markets. For example, fixed the large moves successful the past twelvemonth person each tied with regulatory enactment successful China, it’s hard not to spot the transportation betwixt those events and bitcoin’s terms path.

For the clip being astatine least, 1 could accidental bitcoin’s prices are a operation of immoderate planetary hazard appetite and a batch of the marketplace dynamics successful China (and the aftermath of restrictions there). Those factors’ influences aren’t static, but they explicate a batch much than watching the Fed’s each move.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)