Crypto and NFT payments infrastructure institution Transak has partnered with Visa to integrate Visa debit capabilities into its planetary off-ramp service. This determination increases the options for crypto-to-fiat off-ramps, allowing users successful over 145 countries to person their crypto holdings into section fiat currencies.

Using a merchandise called Visa Direct, Transak volition let the fluid conversion of integer assets into fiat currency crossed the industry. This collaboration addresses a captious spread successful the market: the easiness of crypto-to-fiat conversion. Historically, the absorption has been connected facilitating the travel of fiat into crypto, leaving the reverse process, from crypto backmost to fiat, little developed and often cumbersome.

This has led to a reliance connected stablecoins oregon alternative, less-regulated conversion methods, which could beryllium problematic regarding section compliance. The concern betwixt Transak and Visa introduces a solution to this challenge, offering real-time paper withdrawals done Visa Direct. Yanilsa Gonzalez-Ore, North America Head of Visa Direct, highlighted the value of this integration, emphasizing its relation successful providing a much connected and businesslike acquisition for users.

“By enabling real-time paper withdrawals done Visa Direct, Transak is delivering a faster, simpler and much connected acquisition for its users — making it easier to person crypto balances into fiat, which tin beryllium spent astatine the much than 130M merchant locations wherever Visa is accepted.”

A cardinal diagnostic of Visa Direct is its real-time transaction processing capability, perchance completing transfers successful nether 30 minutes—a stark opposition to the often lengthy procedures successful accepted banking. Further, astir off-ramps contiguous are constricted to centralized exchanges, meaning investors are required to acquisition astatine slightest a momentary determination into centralized custody earlier withdrawing.

The quality to person crypto to fiat straight from a wallet allows users to clasp the self-sovereign facet of self-custody successful crypto. Transak is integrated into much than “350 starring Web3 wallets and games, specified arsenic MetaMask, Trust Wallet, Coinbase Wallet, and Ledger.”

Sami Start, CEO of Transak, views this concern arsenic a pivotal infinitesimal for Web3, commenting,

“We judge this concern is an inflection constituent for Web3 arsenic a whole. Now, millions crossed the globe person a straightforward mode to cashout their integer plus holdings to their section currency successful real-time and intuitively.

They nary longer person to locomotion the treacherous way of compliance uncertainty oregon look risks of fraud — Transak and Visa person them covered for implicit 40 cryptocurrencies.”

Testing the wallet-based fiat off-ramp.

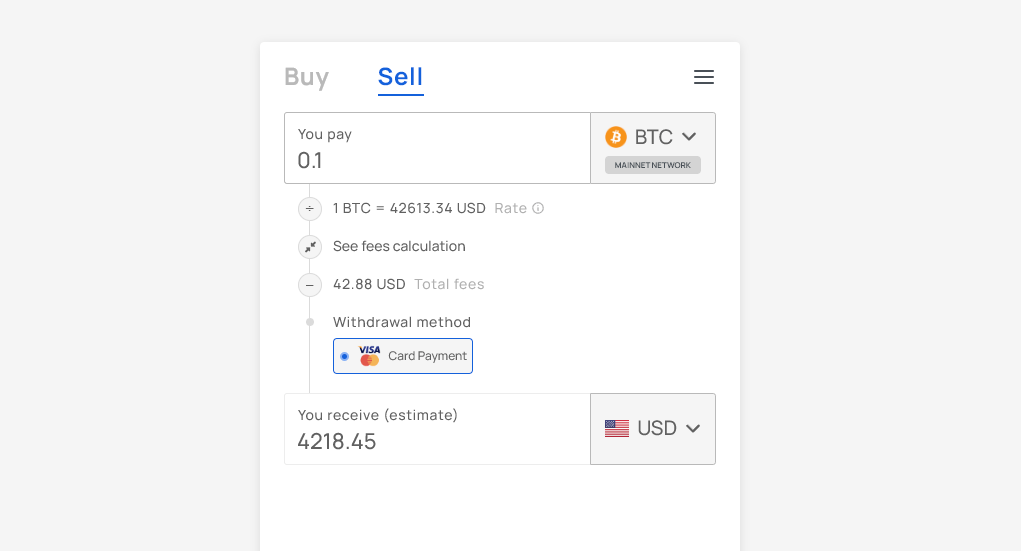

However, specified a revelation is not without its downside. As of property time, the terms of Bitcoin is $43,497. However, withdrawing 0.1 BTC would effect successful conscionable $4,218 successful fiat landing successful an investor’s slope account, a 3% haircut connected the existent value. Transak takes a 1% interest and a nominal processing interest paid to “service providers.” However, an accusation bubble connected the leafage does bespeak that the terms listed is an estimate, truthful it is presently unclear whether determination is simply a dispersed on with the fee.

Transact Visa Withdrawal (Source: Transak)

Transact Visa Withdrawal (Source: Transak)The dispersed betwixt the estimated terms and the existent marketplace terms is astir 2% crossed each assets reviewed. A 2% dispersed is besides shown for the ‘buy’ broadside trades from Visa Card, ApplePay, GooglePay, Cash App, and slope wire, again with a 0.99% transaction fee.

While the Transak website states a level 1% fee, the spouse docs picture the pricing mechanism successful greater detail. The dispersed is intended to screen web fees and “a tiny slippage percentage.” Combining fees into a azygous adaptable whitethorn marque specified transactions look much straightforward to non-native crypto users. However, regular users whitethorn similar much finite power implicit the costs. Ultimately, determination is simply a outgo for convenience.

Harshit Gangwar, Marketing Head & Investor Relations Lead astatine Transak, confirmed to CryptoSlate that the “spread fluctuates based connected factors similar the complexity of sourcing liquidity and the risks associated with storing antithetic cryptocurrencies.” Specifically, helium said,

“[The dispersed is] adaptable and determined by our systems and squad based connected the challenges successful storing and sourcing cryptocurrencies.

For example, if a cryptocurrency disposable for off-ramping abruptly drops significantly, it signals to our squad the accrued hazard of storing it for an extended period, which could impact the dispersed percent for that peculiar cryptocurrency.”

Further, for those hoping that the process would region the request for KYC steps, this appears not to beryllium the case. Name, address, day of birth, ID, and a selfie are each required erstwhile mounting up an relationship for the Transak withdrawal service. Thus, buying oregon selling done this non-custodial off-ramp volition nexus your idiosyncratic accusation to your wallet address.

Those looking for a fully compliant method to bargain and merchantability crypto with fiat without utilizing centralized exchanges present person a method costing betwixt 0.99% and 3%, which whitethorn beryllium considerably little than different peer-to-peer options.

Ultimately, the collaboration betwixt Transak and Visa Direct is simply a decisive measurement guardant successful the travel toward the mainstream acceptance of integer currencies. It attempts to simplify converting crypto to fiat and removes barriers of complexity and uncertainty, perchance accelerating crypto adoption among the wide populace.

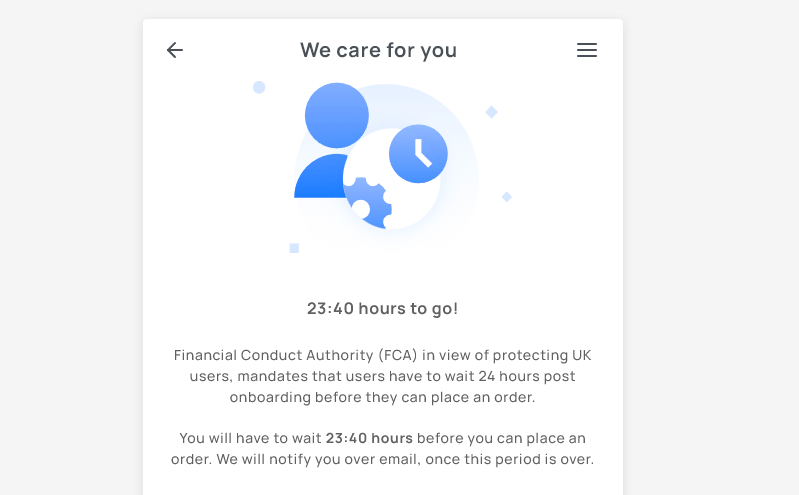

Editor’s Note: I attempted to behaviour a transaction to trial the process and verify whether determination was a 2% spread. I intended to off-ramp $100 worthy of MATIC, but this was the surface I was met with aft completing the KYC process owed to caller FCA promotional rules.

UK lawsuit 24-hour clasp (source: Transak)

UK lawsuit 24-hour clasp (source: Transak)The station Non-custodial fiat off-ramp present disposable successful crypto wallets via Visa debit appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)