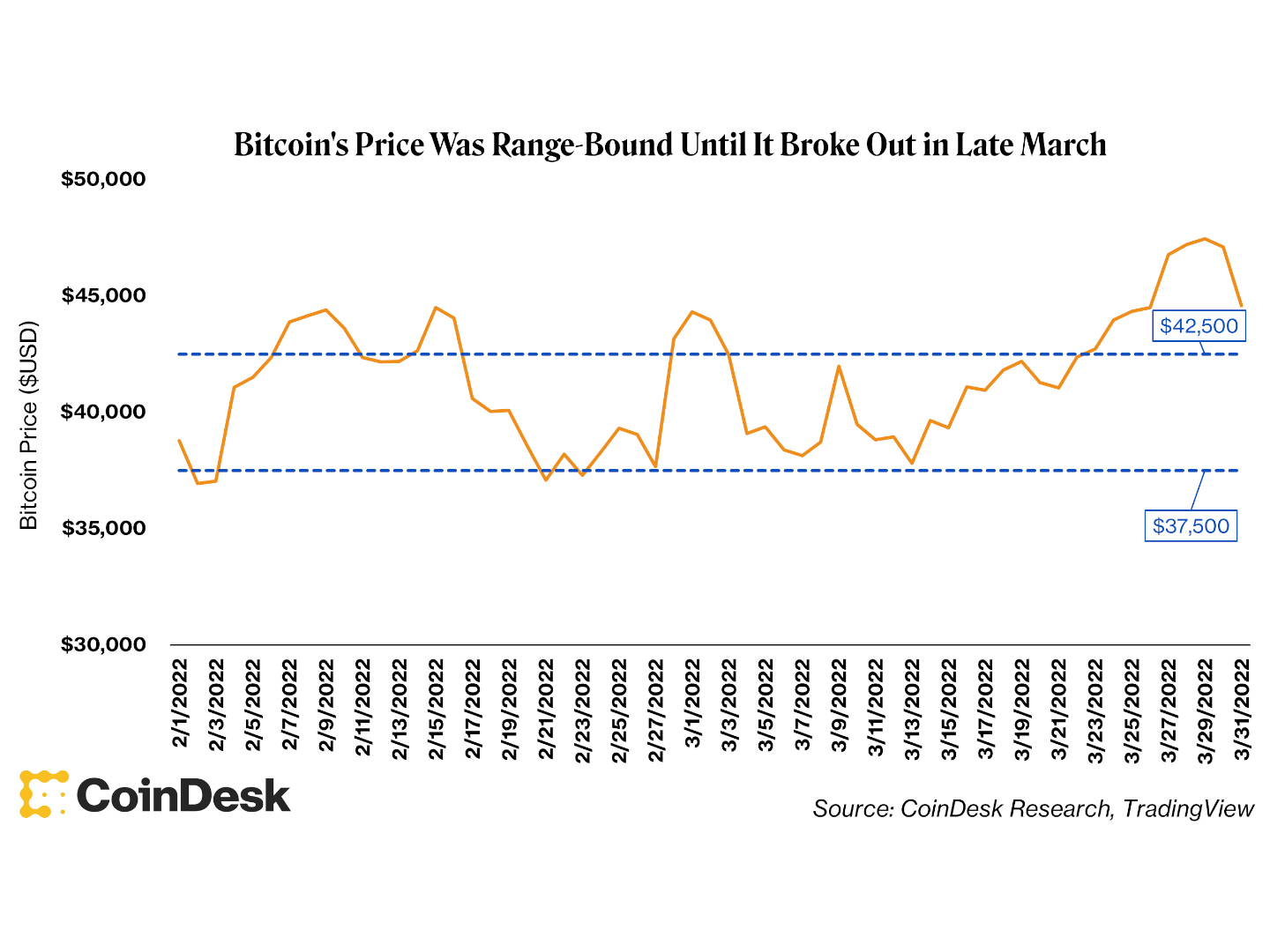

Calendar twelvemonth quarters supply an artificial breakpoint to bespeak connected what happened. The archetypal 4th of 2022 didn’t truly supply overmuch by mode of crypto marketplace question until it was fundamentally over. Since February until this past play the terms of bitcoin had been range-bound betwixt $37,500 and $42,500. Given the macro landscape, this was surprising. Russia invaded Ukraine, the Fed announced astatine least six complaint hikes and determination were tons of things happening successful U.S. and EU regulation.

It was adjacent much astonishing if we compared bitcoin’s terms successful that play to, well, everything else. Between Feb. 1 and March 14 the S&P 500 shed 8% and semipermanent (20-year) Treasurys dipped 7%; meanwhile, enslaved markets were ravaged, and we saw the terms of commodities, similar lipid and nickel, spike aggressively. (Side note: The communicative astir the London Metal Exchange and the nickel abbreviated squeeze is simply a indispensable read.)

Meanwhile, bitcoin didn’t truly bash anything.

(CoinDesk Research, TradingView)

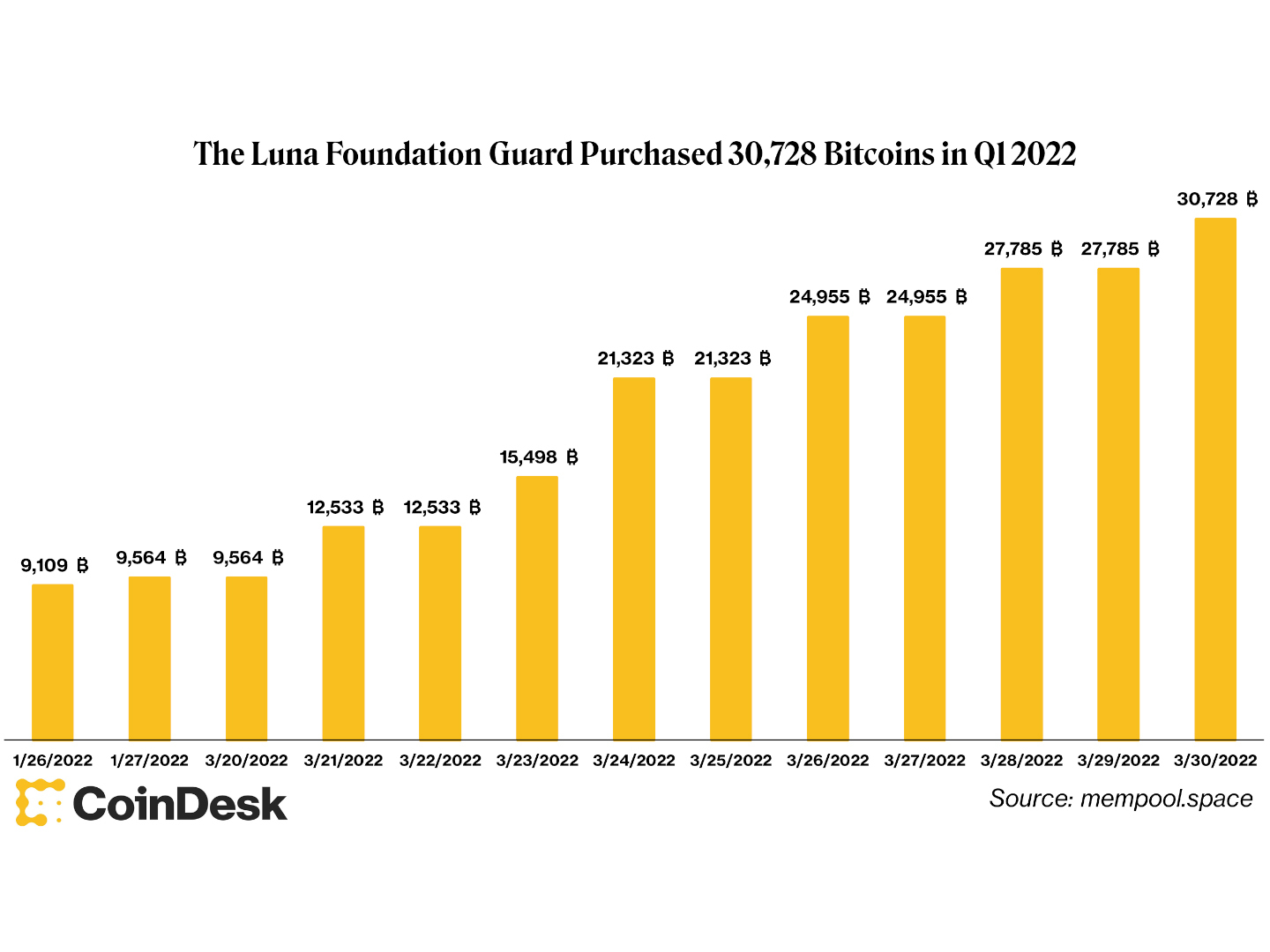

That was existent until past week. We rolled into that weekend, March 25, with bitcoin astatine $44,000 and by that Monday, March 28, it had brushed up against $48,000. This summation was partially catalyzed by the Luna Foundation Guard planning to bargain up to $10 cardinal of BTC to backmost its terraUSD (UST) stablecoin. The persistent bitcoin purchases by LFG has proved to beryllium a near-term tailwind for bitcoin price. Crypto investors, who are salivating astatine the imaginable of earning up to 19.62% involvement connected UST holdings using the Anchor protocol, look to hold arsenic Terra (LUNA), the token that powers UST, gained ~15% successful the past week of the archetypal quarter.

(mempool.space)

With the terms of bitcoin yet trending up, the bitcoin options market saw unfastened involvement (OI), the U.S. dollar magnitude allocated to bitcoin options contracts, deed a year-high ~$9.8 cardinal connected March 24, a time wherever much than $3 cardinal successful options expired. Since then, we've seen much than $1.3 cardinal successful options participate the market, marking a comparatively speedy recovery.

(skew)

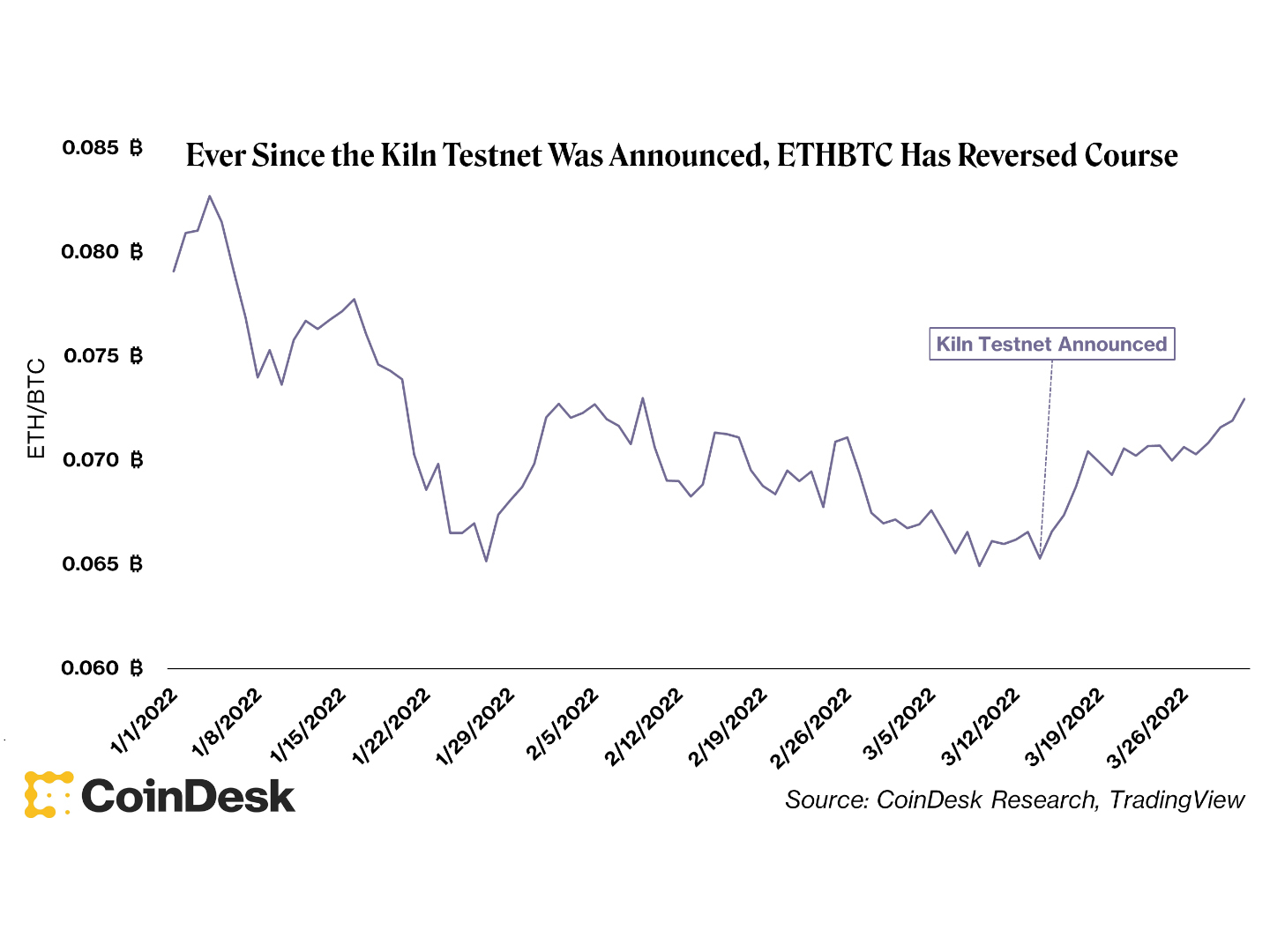

However, bitcoin wasn’t the lone plus that the marketplace has liked recently. In fact, the marketplace liked ether (Ethereum’s autochthonal asset) more, with ETH gaining 23% since Feb. 1 (compared to BTC’s 18%). ETH’s terms catalyst came connected March 14 erstwhile Ethereum successfully “merged” connected the Kiln testnet up of the blockchain’s eventual move to proof-of-stake. Ethereum changing its statement mechanics to proof-of-stake has been intimately watched by investors, and the palmy trial signaled to the marketplace that Ethereum mightiness really marque the modulation that has been successful the works since 2015.

On the taxable of ether, its terms compared to bitcoin’s (ETHBTC) has started to reverse. ETHBTC was connected a dependable ascent from 0.024 to arsenic precocious arsenic 0.087 successful 2021 (the portion is bitcoin per ether), but ETH’s marketplace headdress has mostly mislaid crushed to BTC this year, dropping from 0.083 to 0.065 betwixt Jan. 4 and March 14. Since then, ETHBTC has steadily walked up to 0.073.

(CoinDesk Research, TradingView)

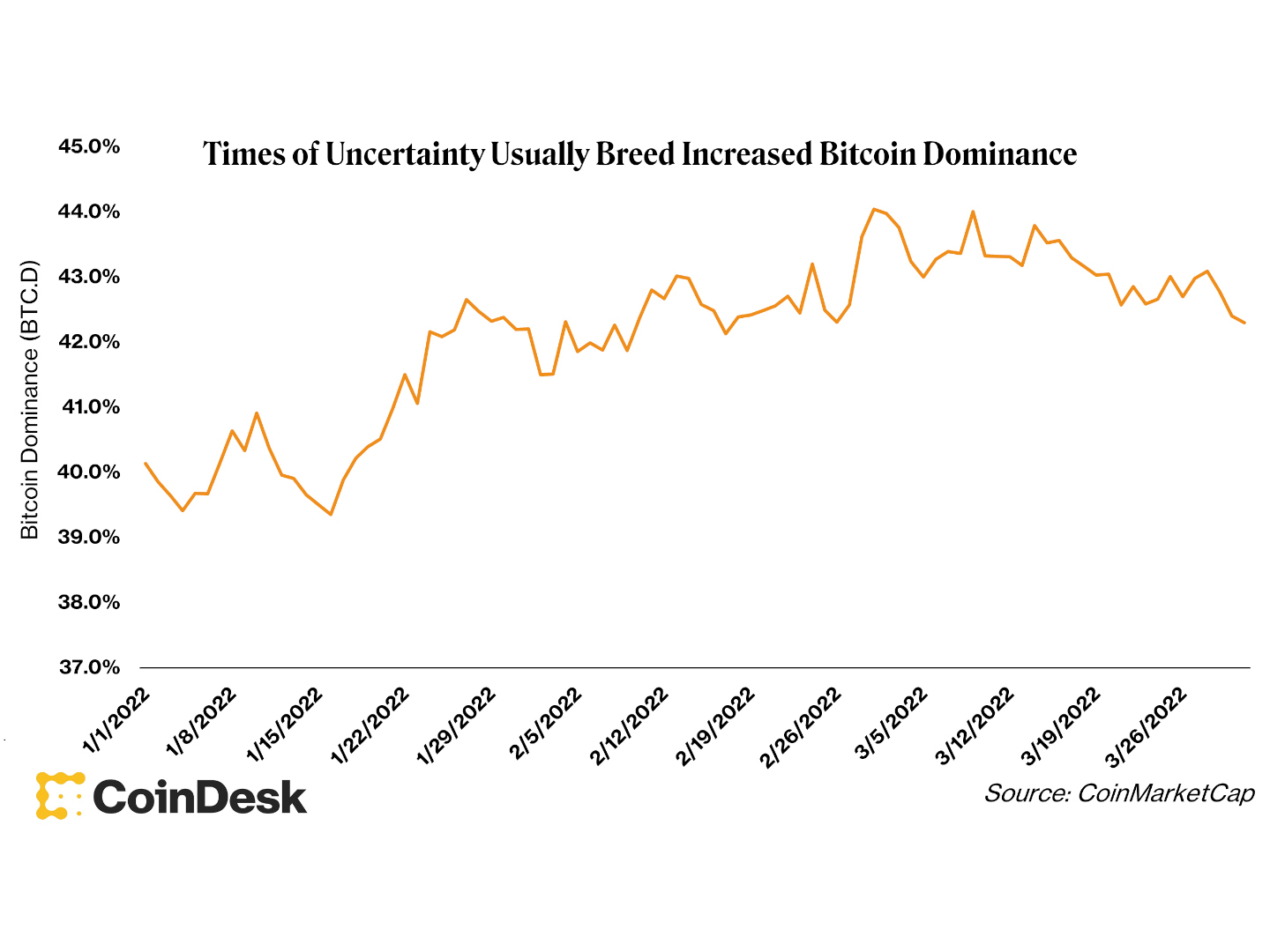

From here, it is earthy to look astatine bitcoin dominance, the measurement of BTC marketplace capitalization compared to the marketplace capitalization of each crypto assets. In times of uncertainty, bitcoin dominance tends to summation ground, and that has travel to carnivore truthful acold successful 2022. It has been a weird, pugnacious twelvemonth successful wide for the crypto market, adjacent with the caller run-up (bitcoin mislaid 2% successful the archetypal quarter).

(CoinMarketCap)

Something off-the-wall arsenic we look toward Q2

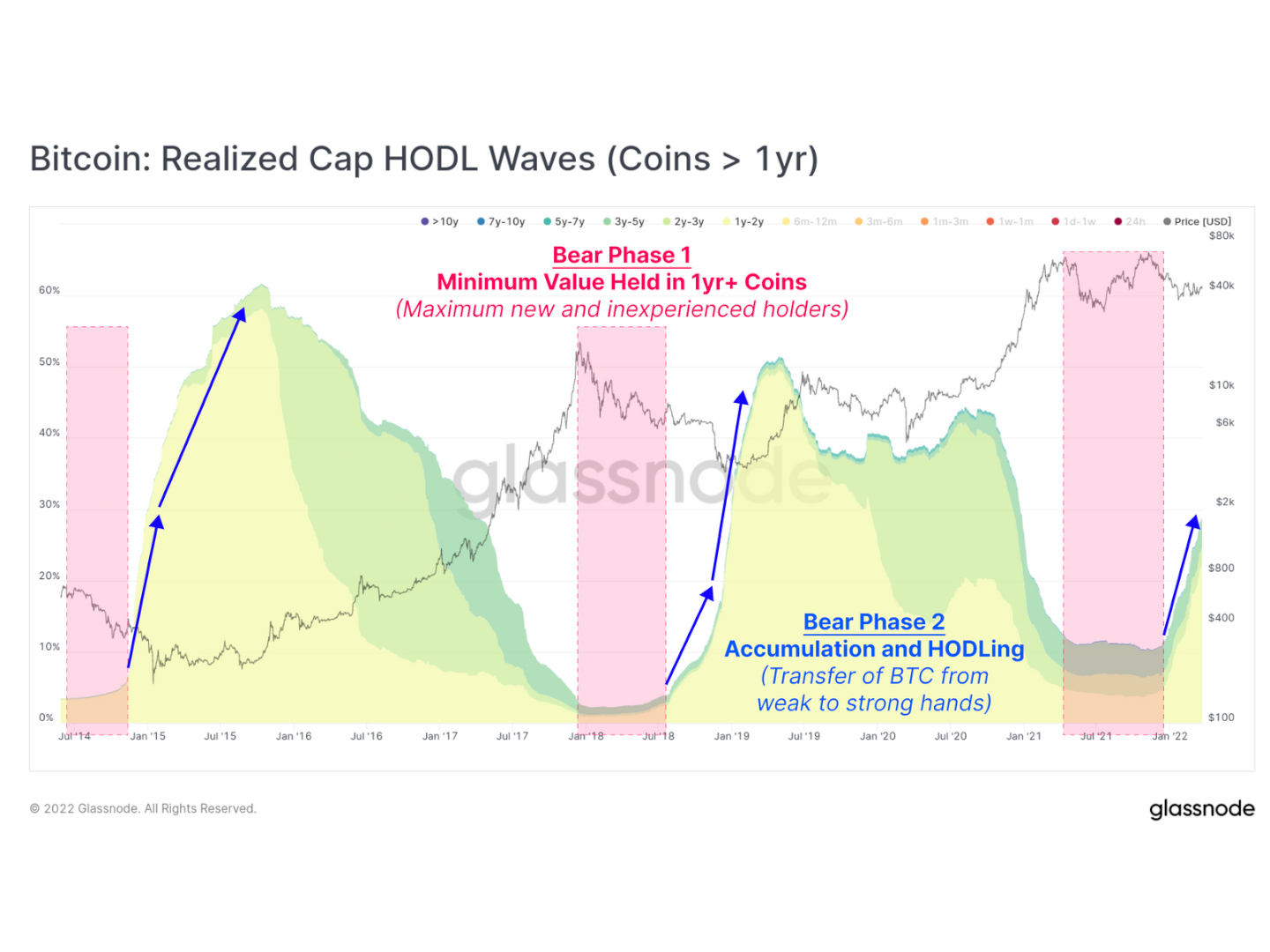

As we instrumentality a look towards the 2nd quarter, I privation to stock a elaborate (and esoteric) on-chain bitcoin illustration Glassnode published successful its most caller newsletter. The illustration is titled “Bitcoin: Realized Cap HODL Waves (Coins > 1yr).”

HODL Waves are groupings of bitcoins differentiated by the magnitude of clip those bitcoins person been held (e.g., bitcoins held for 2 years would beryllium successful the 2-3 y HODL Wave). If we past measurement those HODL Waves by “Realized Price,” the terms astatine which those bitcoins past moved, we tin usage the effect to analyse the U.S. dollar wealthiness held successful those bitcoins. If we filter retired coins little than a twelvemonth old, we get an absorbing visual.

(Glassnode)

If we see that carnivore markets travel successful 2 phases, the archetypal wherever a debased proportionality of wealthiness is held by older investors and the 2nd wherever the wealthiness disparity recovers powerfully arsenic much coins property into the one-year set astatine a higher outgo basis. That outgo ground should basal successful arsenic a higher level worth than the erstwhile cycle. We mightiness beryllium astatine a turning constituent successful this carnivore market.

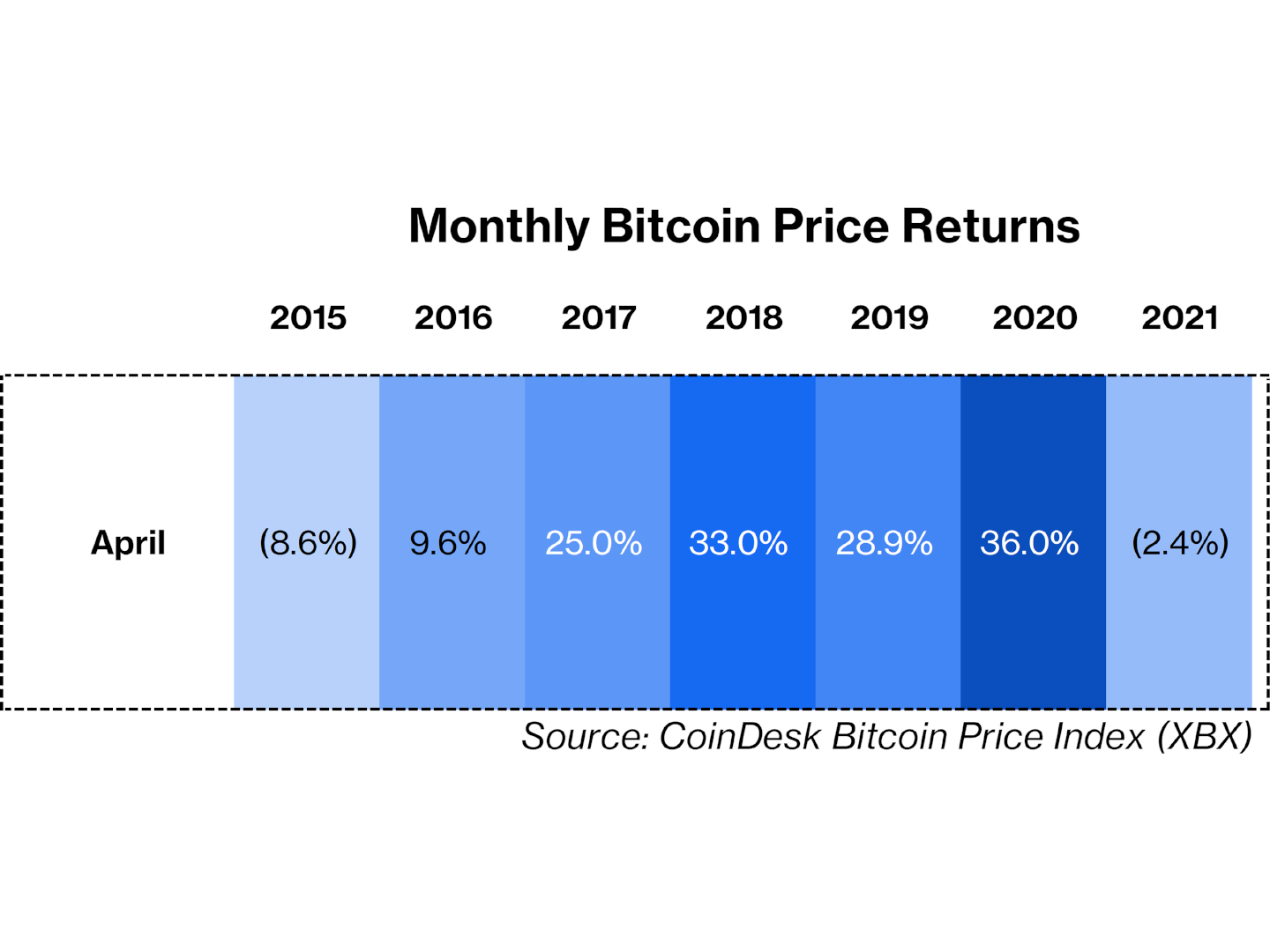

Lastly, portion the past is not indicative of the future, knowing the past tin assistance america expect what mightiness happen. Looking back, we cognize that it sometimes snows successful April connected the bitcoin market. But usually bitcoin performs good successful April, with an mean summation of astir 17% implicit the month. So, who knows, possibly we’ll adjacent the publication connected the carnivore marketplace successful the adjacent 27 days. But possibly not.

(CoinDesk Bitcoin Price Index (XBX))

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)