Ethereum (ETH) has been showing a coagulated show lately, leaving investors some ecstatic and wary. The world’s second-largest cryptocurrency, boasting a marketplace capitalization of astir $480 billion, precocious surpassed the coveted $4,000 people for the archetypal clip since December 2021, igniting a flurry of bullish predictions. But is this a genuine resurgence, oregon are we witnessing a impermanent blip earlier a imaginable correction?

Let’s dissect the forces astatine play. Proponents of a sustained uptrend constituent to a confluence of affirmative factors. The long-awaited support of a US-based Ethereum ETF is simply a blistery topic, with speculation swirling that a greenish airy could trigger a important influx of organization capital, perchance injecting billions into the Ethereum ecosystem.

Additionally, the upcoming Bitcoin halving, an lawsuit that cuts Bitcoin’s mining reward successful half, is expected to person a affirmative spillover effect connected the full cryptocurrency market, perchance propelling Ethereum further.

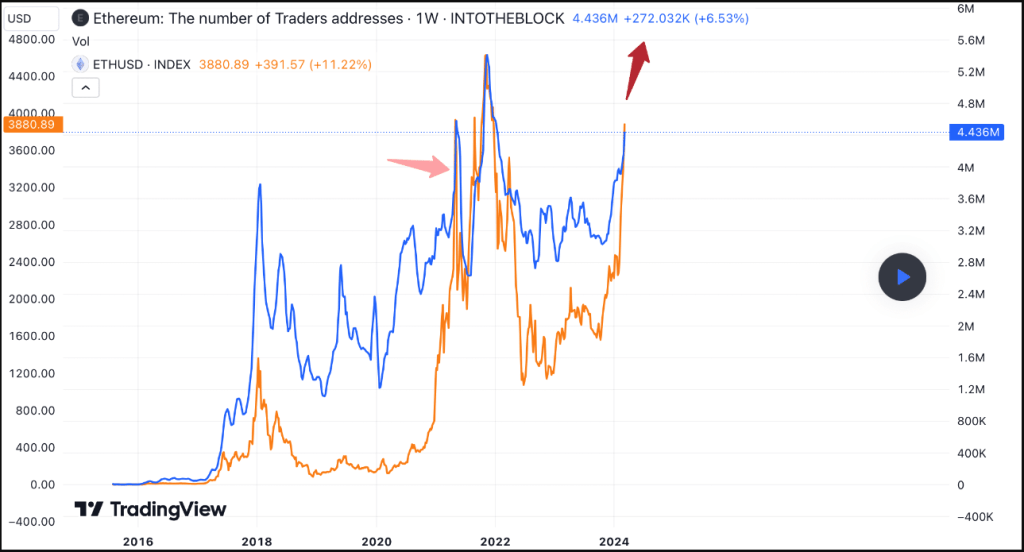

Surge In Short-Term Ethereum Holders Signals Optimism

This optimistic outlook is bolstered by a surge successful on-chain activity. Data from IntoTheBlock reveals a important summation successful the fig of short-term Ethereum holders.

Historically, this trend, with its 60% monthly terms surge for ETH, aligns with bull markets, signifying an influx of caller users entering the crypto abstraction and actively participating successful the network. Think of it arsenic a crowded enactment – the much radical amusement up (currently approaching the highs of the past bull cycle), the livelier the ambiance becomes (and perchance the higher the terms goes).

But, there’s much to the story. A person inspection of method indicators paints a somewhat antithetic picture. The Relative Strength Index (RSI) and Chaikin Money Flow (CMF) are presently hovering successful overbought territory, with RSI specifically nearing the 70 mark.

In simpler terms, this suggests that Ethereum’s terms at somewhat supra $4,000 might beryllium stretched a spot bladed and owed for a imaginable pullback. Imagine a leap enactment contention – if you’re swinging excessively hard and accelerated (like an RSI implicit 70), yet you’ll travel yourself up.

Source: Coingecko

Source: Coingecko

Ethereum’s Future: Balancing Act

Adding a furniture of intrigue, the sentiment among investors seems geographically divided. While the “Coinbase Premium,” a metric reflecting buying pressure, is thriving successful the US, its Korean counterpart indicates ongoing selling activity.

This determination disparity could beryllium attributed to divers marketplace dynamics and capitalist preferences. Perhaps American investors, with a greenish Coinbase Premium, are much optimistic astir the regulatory scenery surrounding crypto, portion their Korean counterparts, with a reddish Korea Premium, are taking a much cautious approach.

So, what does this each mean for Ethereum’s future? The answer, unfortunately, isn’t arsenic clear-cut arsenic we’d like. The confluence of affirmative factors similar imaginable ETF approval, accrued web enactment with a surge successful short-term holders, and a imaginable Bitcoin halving boost overgarment a bullish picture.

However, method indicators hinting astatine an overbought marketplace and contrasting capitalist sentiment crossed regions present a enactment of caution. Ethereum is presently walking a tightrope – volition it support its momentum oregon look a world cheque successful the signifier of a terms correction? It’s anybody’s guess.

Featured representation from Pixabay, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)