Entity-adjusted Bitcoin metrics supply a refined presumption of marketplace sentiment by filtering retired non-economic transactions. This is particularly important erstwhile analyzing nett unrealized nett and loss, specified arsenic the LTH-NUPL and STH-NUPL.

Non-entity-adjusted metrics tin amusement skewed, unclear, oregon incorrect information due to the fact that they see each transactions, adjacent interior transfers wrong the aforesaid entity. These “in-house” transactions bash not correspond existent economical enactment but tin artificially inflate oregon deflate the evident level of unrealized nett oregon loss.

For instance, ample interior transfers mightiness make the illusion of accrued marketplace enactment oregon profit-taking, resulting successful mendacious interpretations of marketplace tops oregon bottoms and yet causing inaccurate marketplace predictions.

Entity-adjusted LTH-NUPL is an precocious metric that considers the existent economical enactment of semipermanent holders by excluding these “in-house” transactions. This helps filter retired enactment from ample organization players that person go ubiquitous successful the manufacture since the motorboat of spot Bitcoin ETFs.

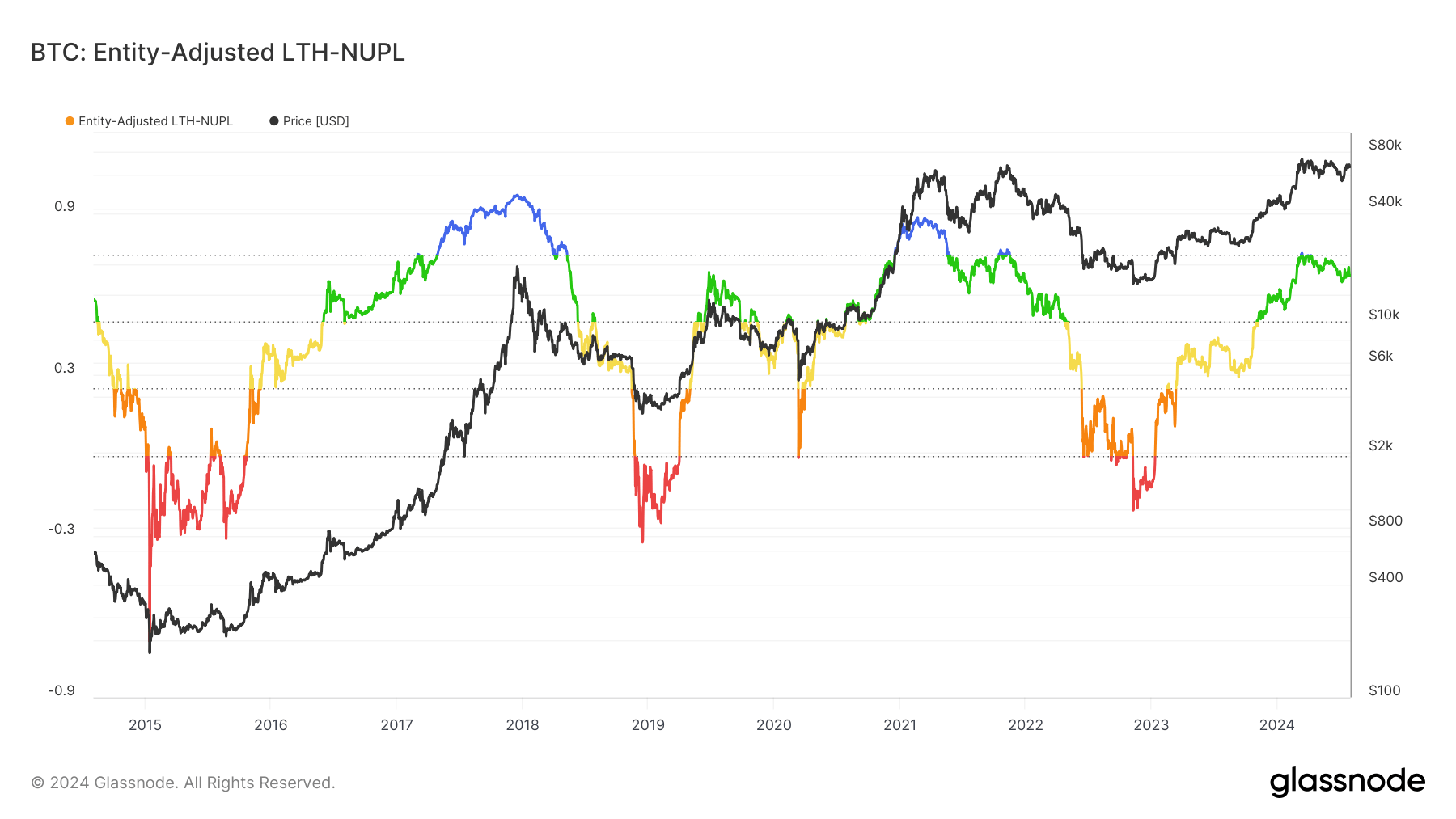

Historically, LTH-NUPL has been a reliable indicator of marketplace sentiment, peculiarly successful identifying marketplace tops and bottoms. When the LTH-NUPL crosses supra 0.7, it typically signals the opening of a euphoria oregon greed signifier successful the market. This signifier often correlates with marketplace tops arsenic semipermanent holders recognize important unrealized profits. Conversely, values betwixt 0.5 and 0.7 bespeak a content oregon denial phase, depending connected the terms direction.

Graph showing the entity-adjusted LTH-NUPL ratio from July 2014 to July 2024 (Source: Glassnode)

Graph showing the entity-adjusted LTH-NUPL ratio from July 2014 to July 2024 (Source: Glassnode)In 2024, LTH-NUPL has consistently remained supra 0.5, suggesting a beardown content successful the market’s upward inclination among semipermanent holders. The metric concisely crossed into the greed signifier from May 11 to May 13, showing a short-lived euphoria arsenic Bitcoin reached its caller all-time high.

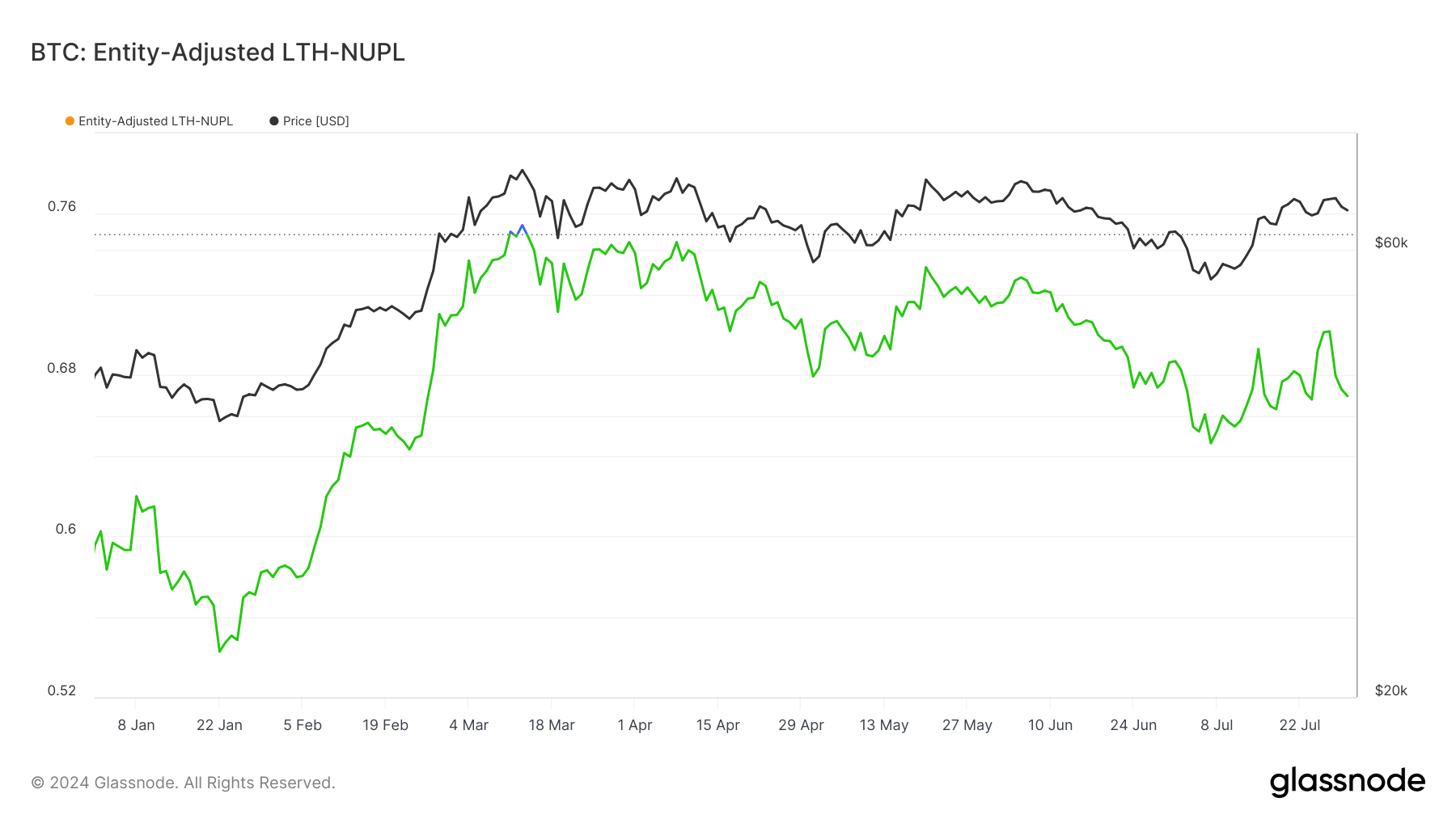

Since July, LTH-NUPL has been trending upwards with important volatility, reaching 0.70 connected July 27 earlier somewhat decreasing to 0.66 by July 31.

Graph showing the entity-adjusted LTH-NUPL ratio from Jan. 1 to July 30, 2024 (Source: Glassnode)

Graph showing the entity-adjusted LTH-NUPL ratio from Jan. 1 to July 30, 2024 (Source: Glassnode)This upward inclination successful LTH-NUPL reflects the assurance of semipermanent holders successful the ongoing marketplace rally contempt the occasional volatility. The metric’s resilience supra 0.5 passim the twelvemonth shows the cohort’s sustained belief.

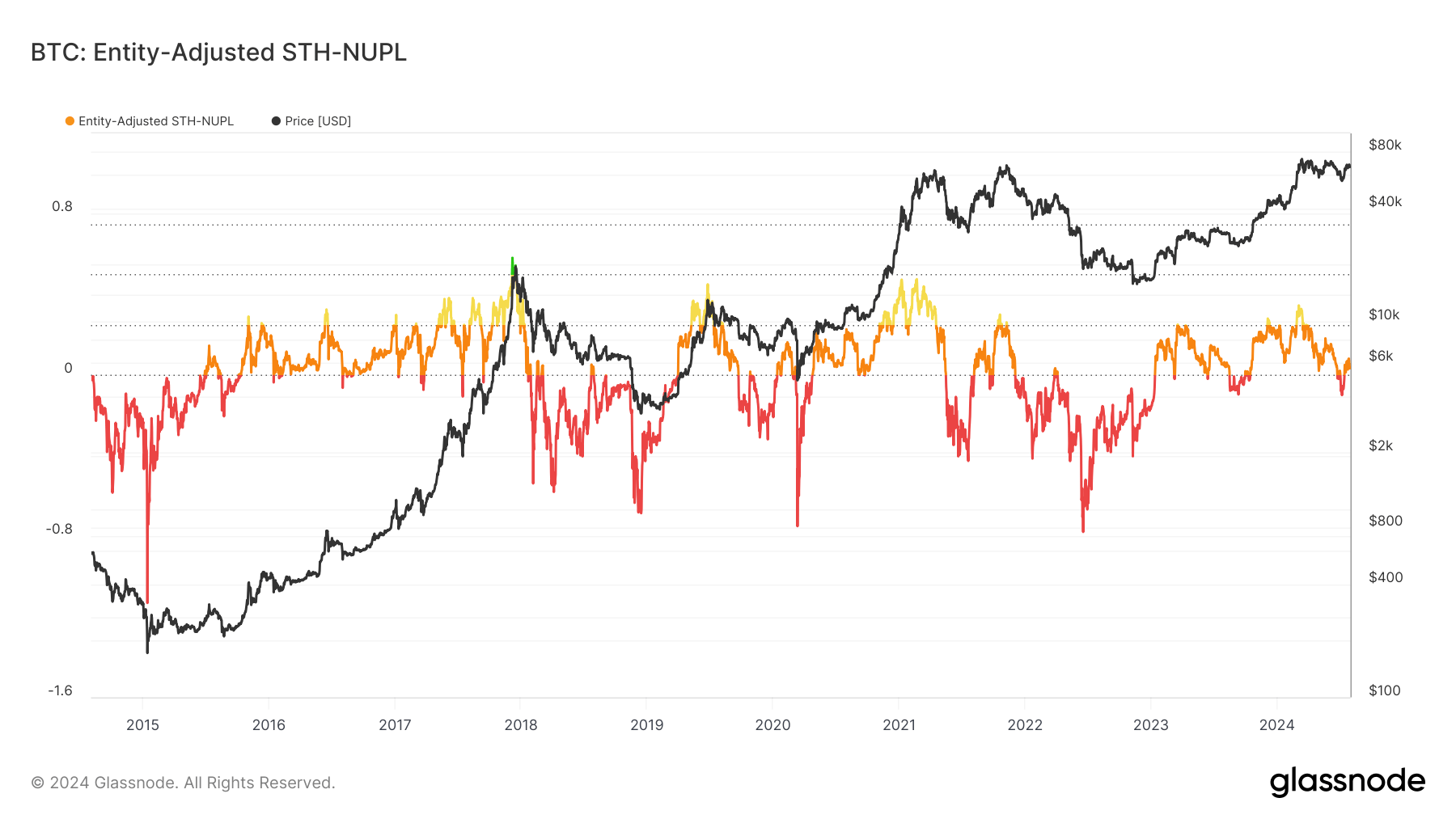

Entity-adjusted STH-NUPL, connected the different hand, measures the nett unrealized nett oregon nonaccomplishment of short-term holders, defined arsenic entities holding Bitcoin for little than 155 days. Historically, STH-NUPL has been little effectual successful predicting marketplace tops and bottoms than LTH-NUPL.

During Bitcoin’s bull tally successful December 2017, STH-NUPL concisely entered the belief/denial phase. However, it has mostly ranged betwixt 0 and 0.24, indicating a authorities of anticipation oregon fearfulness among short-term holders, with utmost volatility corresponding to terms movements.

Graph showing the entity-adjusted STH-NUPL ratio from July 2014 to July 2024 (Source: Glassnode)

Graph showing the entity-adjusted STH-NUPL ratio from July 2014 to July 2024 (Source: Glassnode)This year, STH-NUPL saw arsenic overmuch volatility arsenic its LTH counterpart. The ratio entered the optimism class supra 0.24 successful March, lone to driblet into capitulation territory beneath 0 successful precocious June and mid-July. This driblet reflects the market’s terrible correction and the ensuing panic among short-term holders.

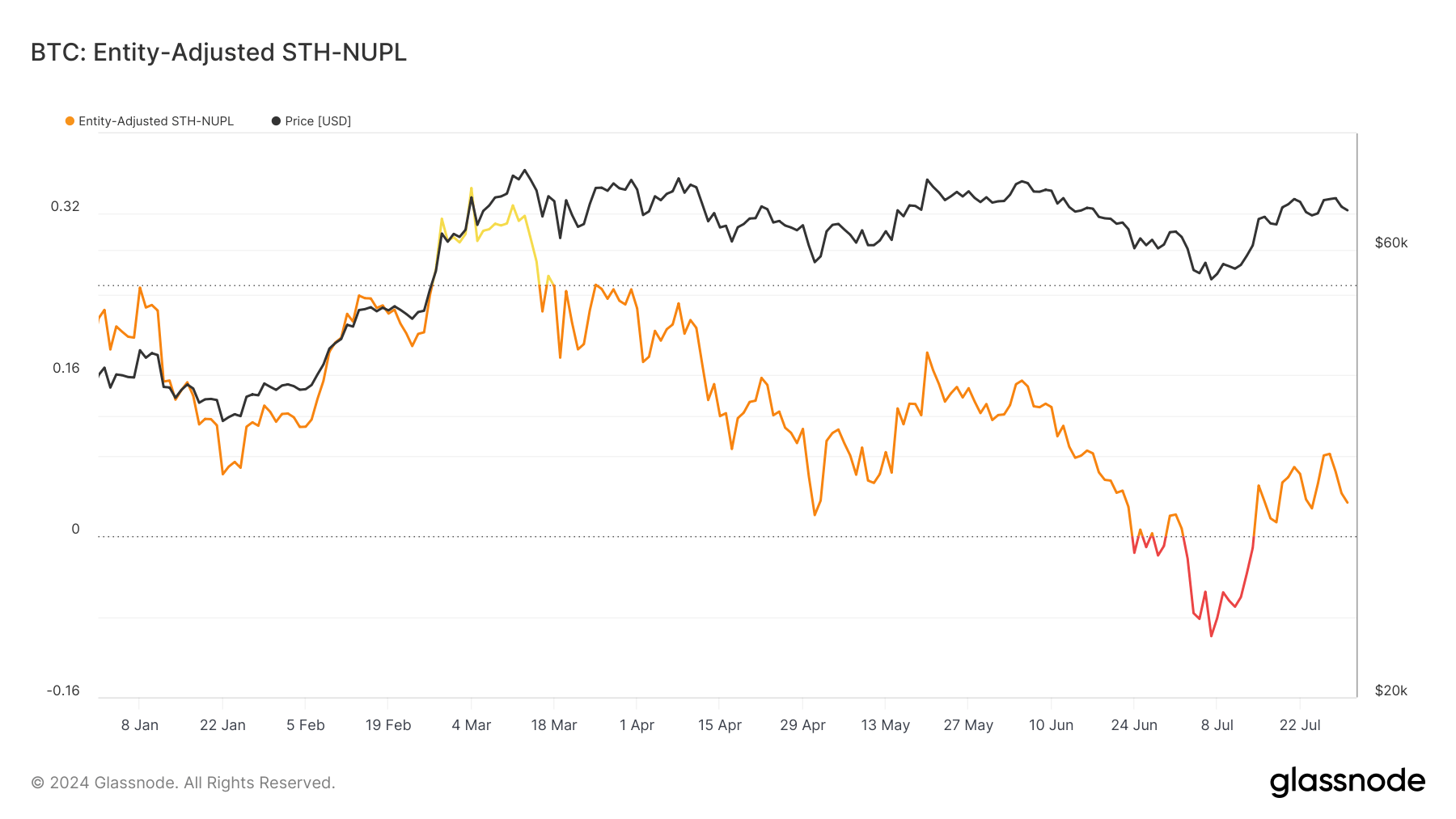

Since July 7, STH-NUPL has been trending upwards, breaking supra 0 and entering the anticipation class connected July 15. As of July 31, the metric stands astatine 0.033, a flimsy alteration from a caller precocious of 0.081 connected July 27. This upward inclination indicates a gradual betterment successful marketplace sentiment among short-term holders, though it remains cautious and uncertain.

Graph showing the entity-adjusted STH-NUPL ratio from Jan. 1 to July 30, 2024 (Source: Glassnode)

Graph showing the entity-adjusted STH-NUPL ratio from Jan. 1 to July 30, 2024 (Source: Glassnode)The disparity betwixt LTH-NUPL and STH-NUPL highlights semipermanent and short-term holders’ contrasting behaviors and sentiments. LTH-NUPL’s higher and much unchangeable values suggest a stronger and much accordant content successful the market’s semipermanent potential. Having held their assets done assorted marketplace cycles, semipermanent holders grounds greater resilience and confidence, contributing to the metric’s effectiveness successful predicting marketplace tops and bottoms.

In contrast, STH-NUPL’s little values and higher volatility bespeak the short-term holders’ sensitivity to marketplace fluctuations. Short-term holders are much apt to respond to contiguous terms movements, starring to predominant shifts betwixt hope, fear, and capitulation phases. This reactive behaviour makes STH-NUPL a little reliable indicator of semipermanent marketplace trends.

LTH-NUPL’s quality to awesome marketplace tops is rooted successful the behaviour of semipermanent holders during euphoric phases. When LTH-NUPL exceeds 0.7, it indicates that semipermanent holders are sitting connected important unrealized profits. Historically, this has led to profit-taking activities, subsequently triggering marketplace corrections oregon tops.

The station NUPL ratio shows wherefore semipermanent holders are amended marketplace apical indicators appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)