Just erstwhile you deliberation the crypto-native developments person enactment the marketplace connected coagulated footing, macro factors endanger to marque the crushed shaky again.

Specifically, the surging inflation-adjusted and nominal authorities enslaved yields successful the U.S. and worldwide could complicate matters for hazard assets, including bitcoin and accepted store of worth assets similar gold.

According to the St. Louis Bank of Federal Reserve, the U.S. 10-year existent oregon inflation-adjusted Treasury output has risen to -0.38% this week, the highest since aboriginal June 2020. While the output remains negative, it has seen a near-90 grade emergence of 66 ground points successful 4 weeks.

"Another large limb up for golden and bitcoin volition apt hap erstwhile existent yields halt rising. We are not determination yet," Jeroen Blokland, laminitis and probe caput astatine concern probe level True Insights, tweeted.

Kaiko Research's play newsletter published Monday said, "typically rising borrowing costs wounded hazard assets specified arsenic tech stocks and crypto, which look little charismatic to investors than safe-haven bonds."

Bitcoin means galore things to galore people. For crypto believers, bitcoin is simply a integer mentation of golden and an alternate to the U.S. dollar, a planetary reserve currency. However, accepted marketplace investors mostly dainty it arsenic a risk-on plus akin to stocks. That's evident from its strengthening correlation with the S&P 500 and exertion stocks.

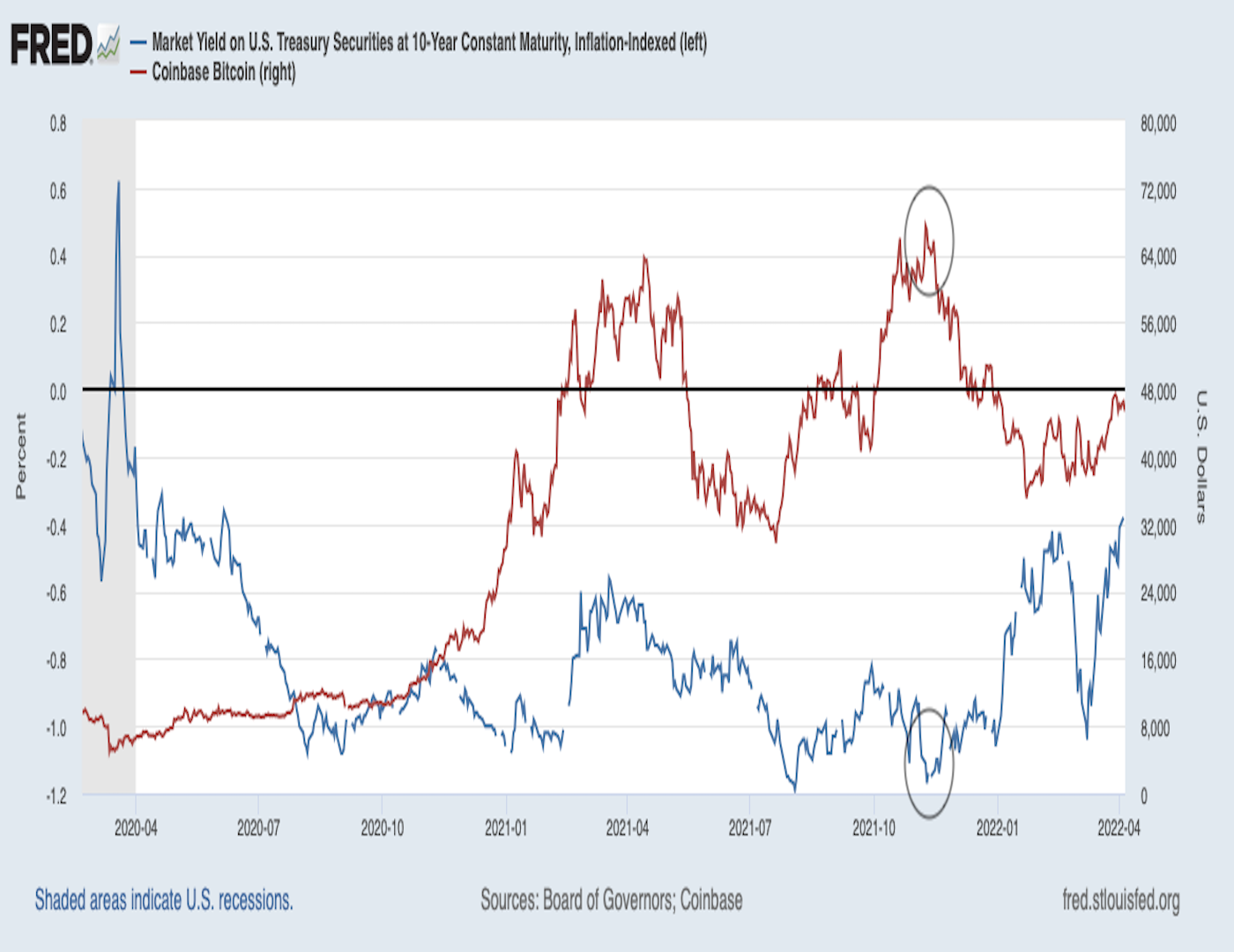

The illustration supra shows a deficiency of accordant correlation betwixt bitcoin and the existent yield. However, bitcoin's November highest coincided with a bottommost successful the 10-year existent yield. Perhaps macro traders, who accumulated bitcoin arsenic a store of worth plus successful the aftermath of the coronavirus-induced clang of March 2020, trimmed exposure, tracking the uptick successful the existent yield, arsenic one perceiver warned past year.

Hawkish Fed expectations and a continued emergence successful the nominal 10-year output person led to a crisp summation successful the existent yield.

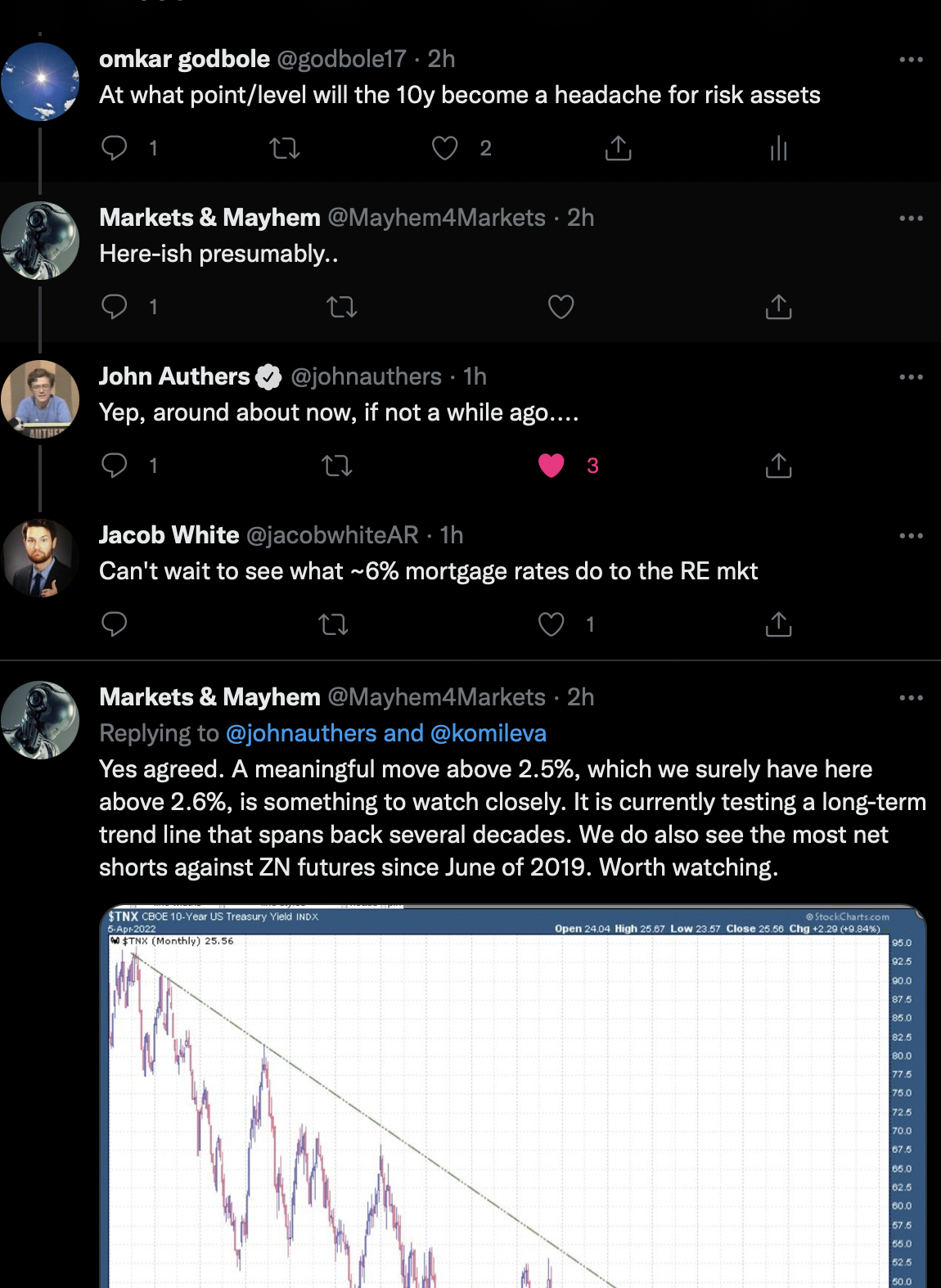

The nominal output stood astatine a three-year precocious of 2.6% astatine property time, accounting for a 40 ground constituent emergence since the Fed raised rates connected March 16, according to the charting level TradingView. The output is up much than 100 ground points connected a year-to-date ground and the rally is becoming a root of interest for obsevers.

"The emergence successful the 10-year Treasury output is continuing successful Asian trading. There've been plentifulness of enslaved marketplace mendacious alarms implicit the years, but this is opening to look a batch similar the long-feared break-out," John Authers, Bloomberg's elder exertion for markets, tweeted.

When asked what level connected the 10-year output could commencement becoming a headache for hazard assets, Authers replied, "Around astir now, if not a portion ago...."

Asian stocks traded little astatine property clip alongside losses successful the European equity futures, per Investing.com. On Tuesday, U.S. stocks fell much than 1% and the rally successful yields picked up the gait aft Fed Governor Lael Brainard said the cardinal slope could edifice to a accelerated equilibrium expanse runoff to bring U.S. monetary argumentation to a "more neutral position" aboriginal this year.

Bitcoin changed hands adjacent $45,500 arsenic of writing, according to CoinDesk data. Accumulation by Luna Foundation Guard (LFG) and an uptick successful banal markets possibly overshadowed the rising existent output and helped the cryptocurrency carve retired gains pursuing the mid-March complaint hike. LFG's confirmed bitcoin address shows the accumulation has slowed this month, making bitcoin susceptible to adverse macro developments.

"Now hazard aversion is gradually rising, and the dollar scale has reached its year-to-date highest level," Griffin Ardern, a volatility trader from crypto-asset absorption institution Blofin, said. "The liquidity contraction whitethorn beryllium accelerating. At 2 p.m. EST, details of the March FOMC gathering volition beryllium announced."

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)