Launching the spot Bitcoin ETF successful the U.S. caused rather a disturbance successful the crypto market. While astir of the enactment and volatility came from institutions and short-term holders, different important marketplace conception has begun showing rather bearish signs.

CryptoSlate investigation recovered extraordinarily crisp and assertive movements and enactment from semipermanent holders and whales. These cohorts are often seen arsenic the backbone of the market, arsenic their actions tin signify assurance oregon interest regarding Bitcoin’s future. A important question from these holders often indicates a large displacement successful sentiment oregon strategy.

Long-term holders are entities that clasp their Bitcoins for much than 155 days. Their concern strategy is usually characterized by a heavy condemnation successful BTC’s long-term value, which results successful a little propensity to merchantability during short-term marketplace fluctuations. Whales are entities that clasp a ample magnitude of Bitcoin, usually implicit 1,000 BTC. Monitoring whale enactment is important erstwhile analyzing the market, arsenic their transfers and traders tin importantly interaction Bitcoin’s terms owed to the sheer measurement of their transactions.

A captious indicator of marketplace sentiment and strategical shifts is the measurement of Bitcoin transferred to exchanges. Such transfers are pivotal arsenic they often precede selling, suggesting liquidity proviso oregon imaginable terms pressure. A heightened transportation measurement to exchanges tin bespeak a readiness among holders to instrumentality profits, chopped losses, oregon reposition their portfolios successful effect to marketplace developments.

Following the motorboat of Bitcoin ETFs successful the U.S., semipermanent holders and whales began adjusting and repositioning their positions. Bitcoin’s terms declined, dropping from $46,608 connected Jan. 10 to a debased of $41,769 connected Jan. 14 earlier somewhat recovering to $43,152 connected Jan. 16. This terms question coincided with important whale enactment and shifts among semipermanent holders.

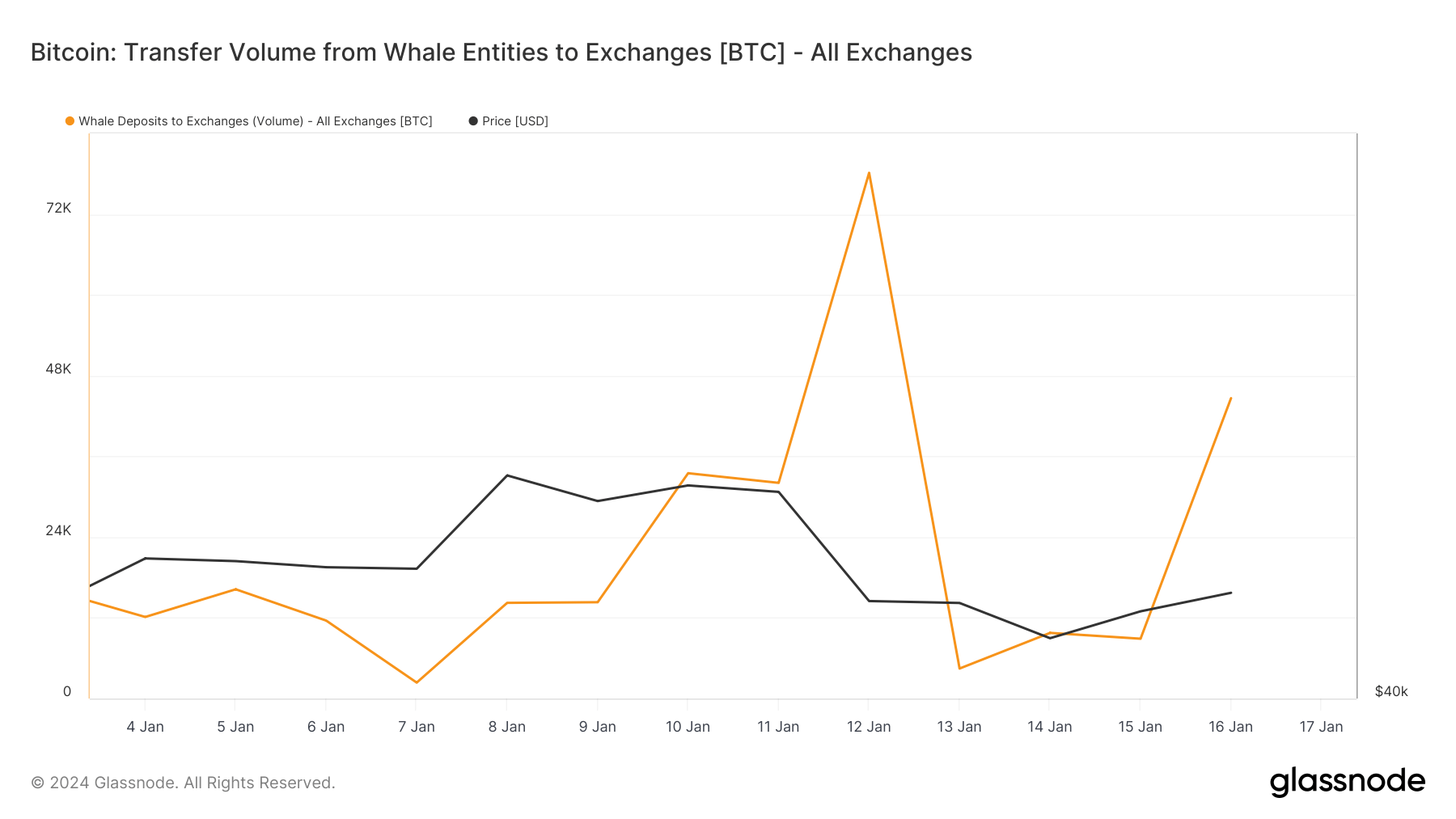

Whale deposits to exchanges showed a important summation successful this period. The measurement escalated from 14,315 BTC connected Jan. 9 to a highest of 78,140 BTC connected Jan. 12 earlier different important summation to 46,463 BTC connected Jan. 16. This suggests that whales were actively repositioning their holdings, perchance successful anticipation of marketplace reactions to the caller ETFs.

Graph showing whale deposits to exchanges from Oct. 20, 2023, to Jan. 16, 2024 (Source: Glassnode)

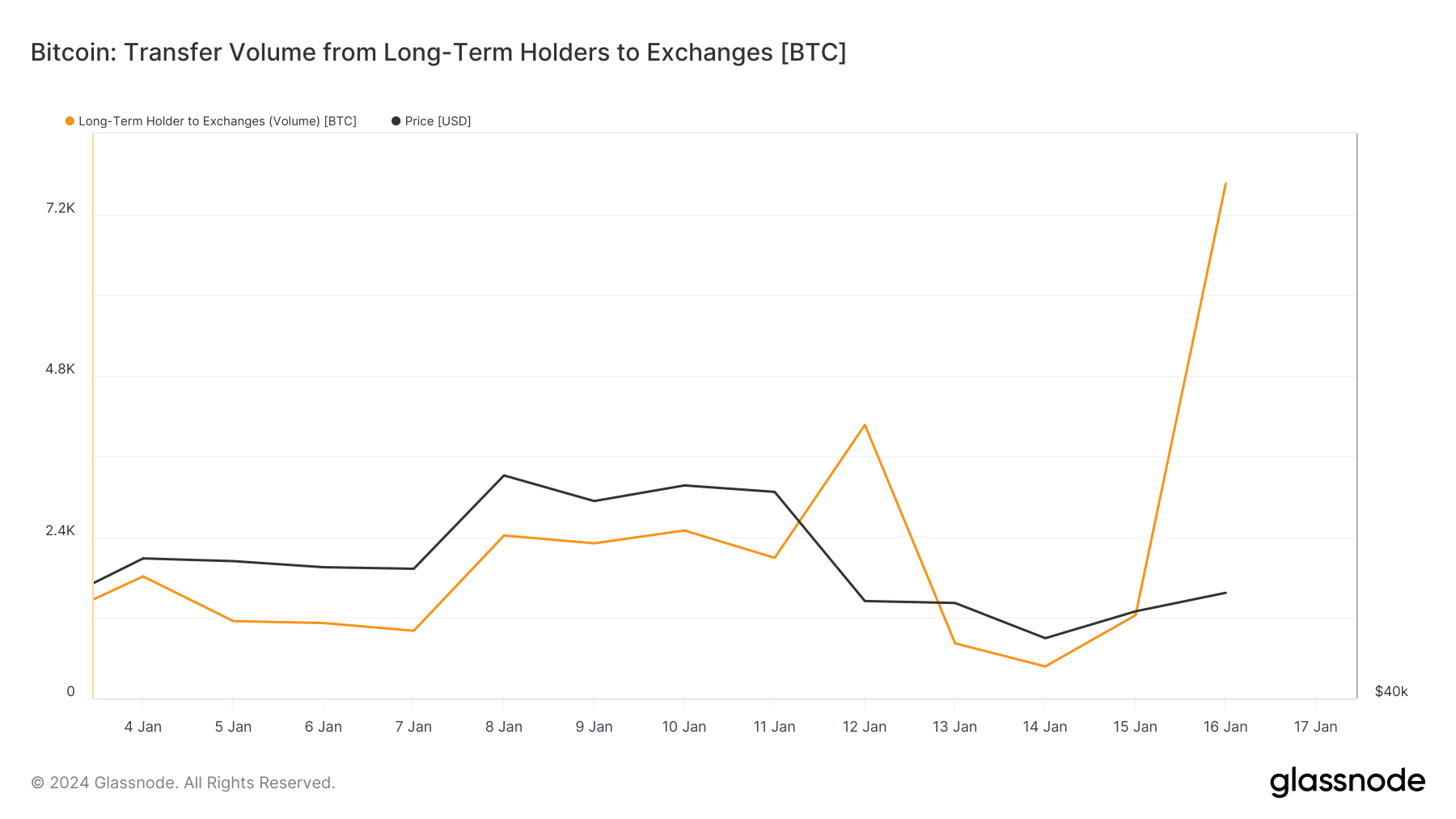

Graph showing whale deposits to exchanges from Oct. 20, 2023, to Jan. 16, 2024 (Source: Glassnode)Concurrently, semipermanent holders besides altered their behavior. The regular transportation measurement from these holders to exchanges accrued notably, peaking astatine 7,652 BTC connected Jan. 16.

Graph showing the regular transportation measurement from semipermanent holders to exchanges from Jan. 4 to Jan. 16, 2024 (Source: Glassnode)

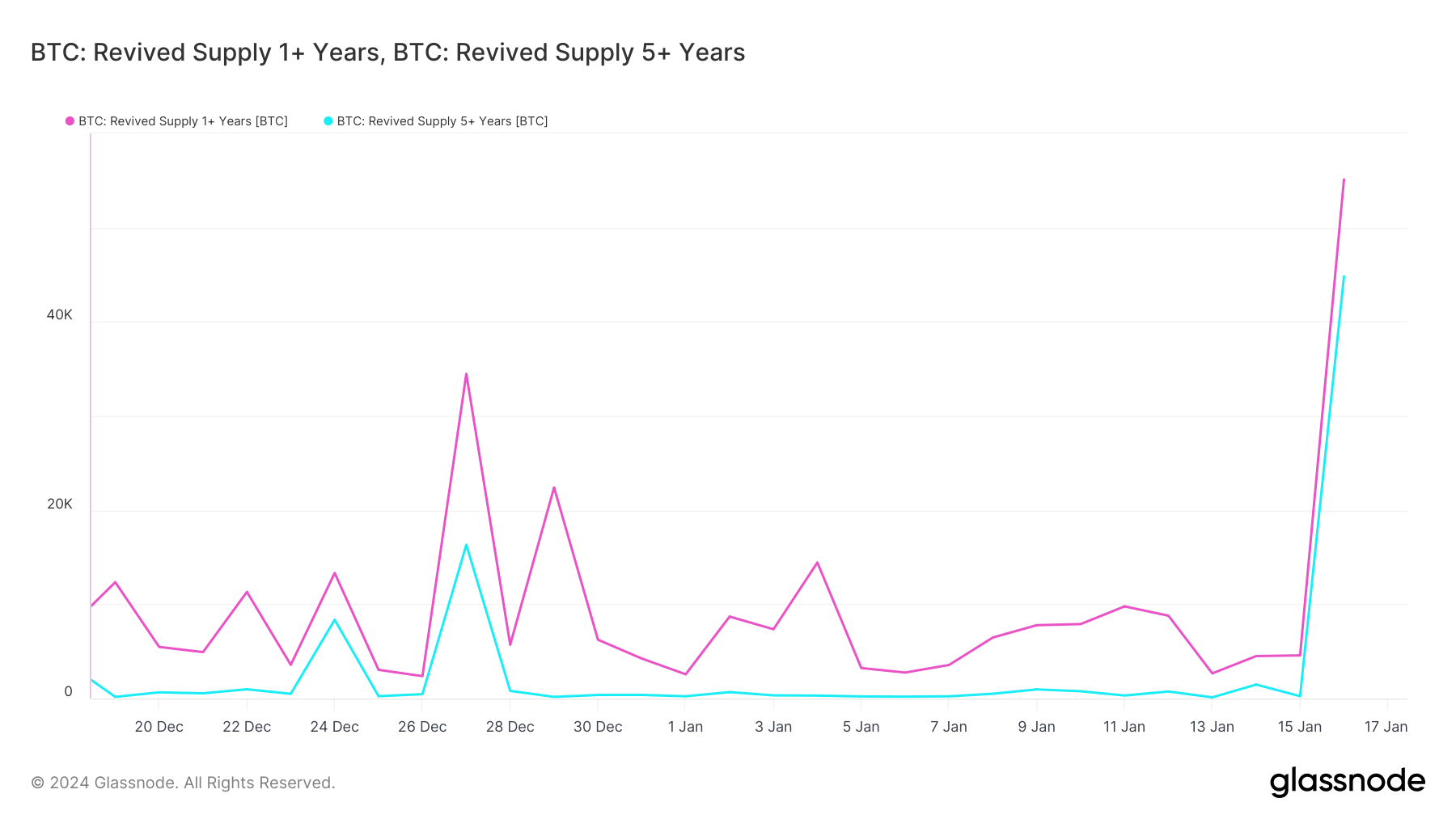

Graph showing the regular transportation measurement from semipermanent holders to exchanges from Jan. 4 to Jan. 16, 2024 (Source: Glassnode)The transportation measurement of coins antecedently dormant for implicit a twelvemonth reached 55,108 BTC connected Jan. 16, the highest since July 2023. Moreover, coins that person been dormant for implicit 5 years tallied 44,821 BTC successful transfers connected the aforesaid day, the highest since February 2022. This awakening of aged and hodled Bitcoin indicates a important displacement among semipermanent holders, who mostly defy selling adjacent successful volatile markets.

Graph showing the transportation measurement of coins antecedently dormant for much than a twelvemonth (pink) and much than 5 years (blue) from Dec. 19, 2023, to Jan. 15, 2024 (Source: Glassnode)

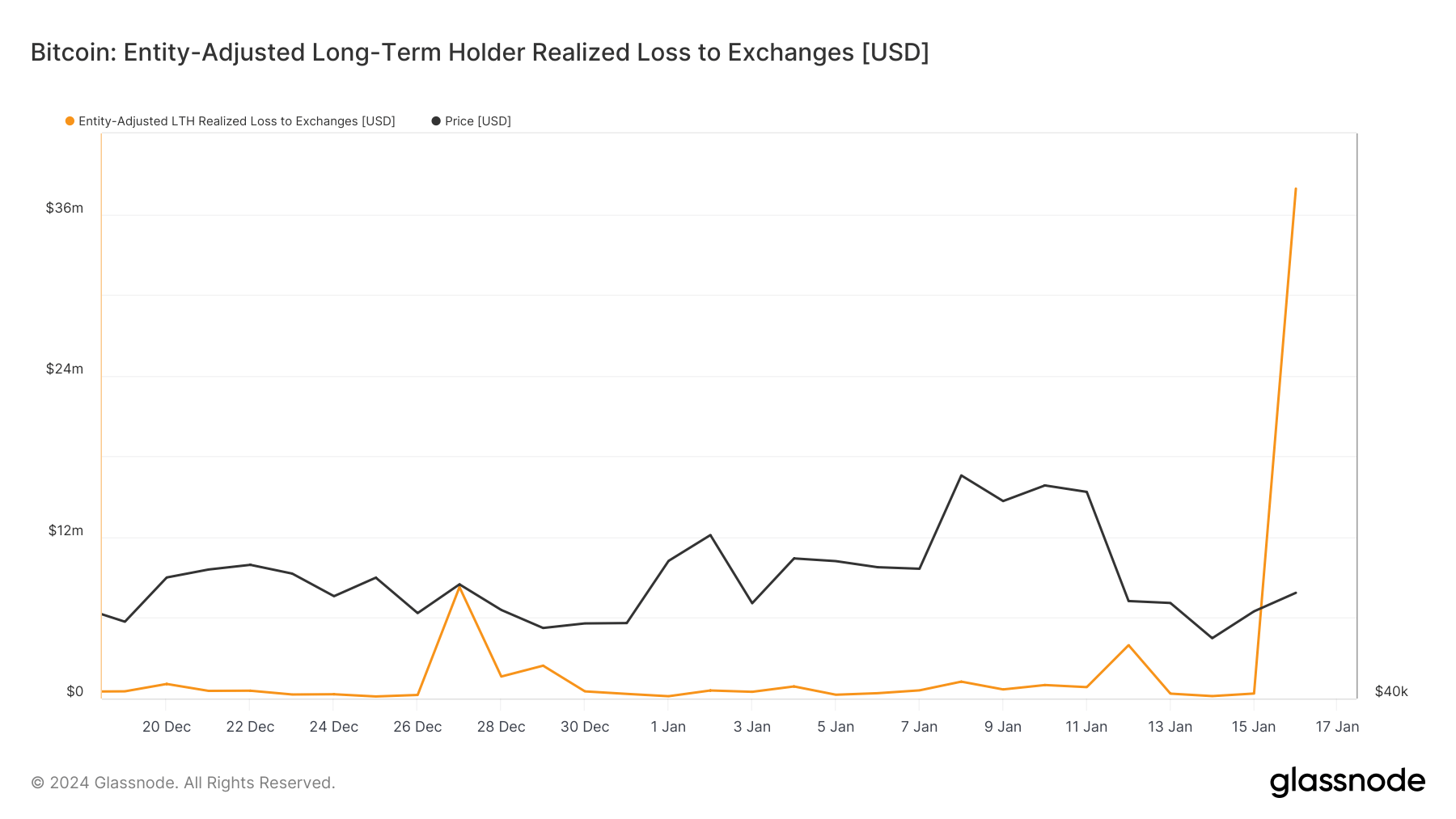

Graph showing the transportation measurement of coins antecedently dormant for much than a twelvemonth (pink) and much than 5 years (blue) from Dec. 19, 2023, to Jan. 15, 2024 (Source: Glassnode)In presumption of losses, the marketplace saw a melodramatic summation successful realized losses, peculiarly among semipermanent holders. The entity-adjusted realized nonaccomplishment for this radical escalated to $37.89 cardinal connected Jan. 16, a sizeable summation from the erstwhile days and suggestive of a important strategical displacement oregon sentiment alteration among these Bitcoin holders.

Graph showing the entity-adjusted realized losses for semipermanent holders from Dec. 19, 2023, to Jan. 16, 2024 (Source: Glassnode)

Graph showing the entity-adjusted realized losses for semipermanent holders from Dec. 19, 2023, to Jan. 16, 2024 (Source: Glassnode)The convergence of these trends—increased whale deposits to exchanges, heightened transportation volumes from semipermanent holders, and the realization of important losses—indicates a marketplace successful a authorities of flux. Nonetheless, it’s important to enactment that semipermanent holders inactive marque up astir 86% of Bitcoin’s full supply, with 76.3% sitting connected unrealized profits. Long-term holders besides made up lone 10% of full speech transfers connected Jan. 16, with conscionable nether 9% transferring their coins astatine a loss.

A spike successful enactment among semipermanent holders and whales is simply a regular occurrence successful times of accrued volatility. Despite being dwarfed by short-term holder activity, these movements are statistically important and are often seen arsenic precursors to large terms upticks.

The station Old and HODLed Bitcoin is connected the determination with whales active appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)