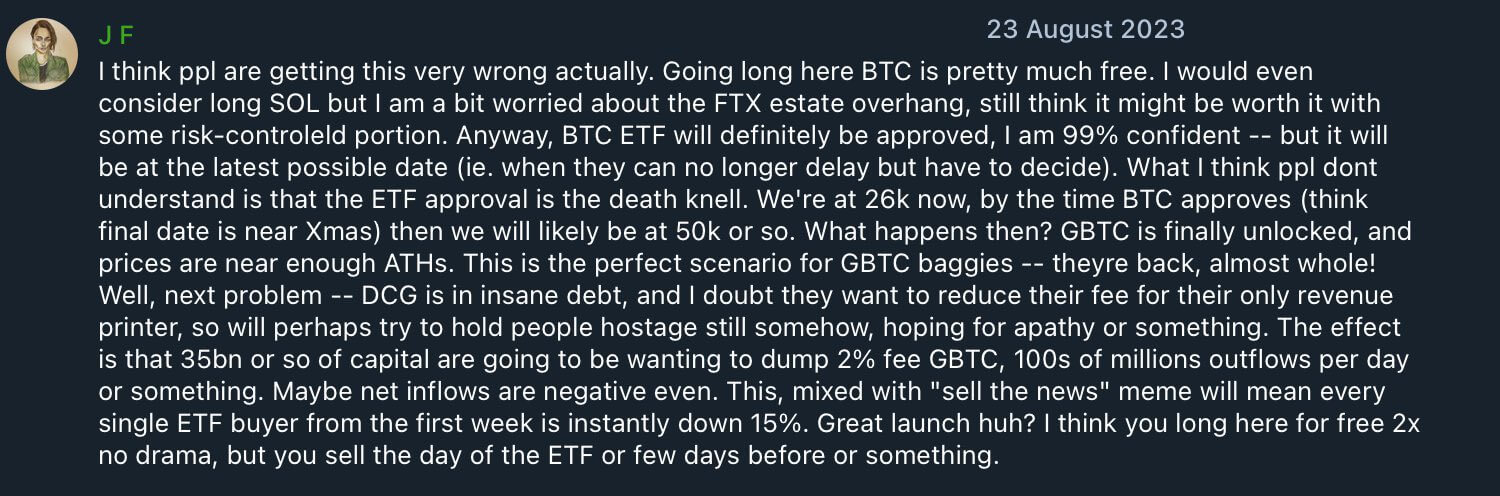

Cobie, a salient fig successful the crypto trading circles known for his insightful and often close predictions, made a post connected Aug. 23, 2023, that outlined the spot Bitcoin ETF script to a frighteningly close degree.

Cobie’s post, which delved into the intricacies of Bitcoin (BTC) and the anticipated support of a Bitcoin ETF, showcased his heavy knowing of the marketplace dynamics.

His prediction of a important emergence successful BTC’s price, perchance reaching $50,000 by the year’s end, alongside a elaborate investigation of the imaginable interaction of the ETF approval, reflects a level of investigation that fewer successful the tract tin match.

Foresight

The trader besides predicted erstwhile the SEC would approve the ETFs and said astatine the clip that it was fundamentally “free” to agelong Bitcoin until past and recommended selling erstwhile the support came in, oregon soon earlier that.

Cobie wrote:

“Anyway, BTC ETF volition decidedly beryllium approved, I americium 99% assured but it volition beryllium astatine the latest imaginable day (ie. erstwhile they tin nary longer hold but person to decide).”

He added that erstwhile the ETFs were approved, it would beryllium a “death knell” which would apt thrust the terms down owed to precocious levels of merchantability unit coming successful from Grayscale’s GBTC holders, who person been waiting for an opportunity to sell erstwhile they are adjacent to being full again.

Considering the terms action, pursuing that proposal would person been the champion determination successful hindsight. This has drawn wide admiration from crypto Twitter. However, Cobie feels the admiration is undue.

Cobie’s reflective response

In a candid response to the societal media ruckus, Cobie emphasized fiscal predictions’ dynamic and often uncertain nature.

“I can’t adjacent remember, man,” helium began, highlighting the situation of keeping way of ever-changing marketplace views. He pointed retired however casual it is to find past predictions that look close successful hindsight, fixed the predominant shifts successful opinions and marketplace conditions.

He cautioned against over-reliance connected isolated predictions, stating:

“The screenshot successful isolation ‘looks cool’ but doesn’t mean precise overmuch successful reality, you know, misses fundamentally fractional a twelvemonth of crap and different factors that pollute the thinking.”

His comments connection a humble reminder of the transient quality of marketplace analysis. Despite his analysis, helium said helium did not instrumentality to that thesis successful the ensuing months. Cobie added:

“The world (at slightest for me) is that it’s beauteous casual for maine to void my ain opinions 3 weeks later, travel up with caller ideas that I consciousness antagonistic them, etc., truthful it’s conscionable a full messiness of uncertainty and indecision and worldly on the way.”

This position resonates profoundly successful the cryptocurrency community, wherever accelerated changes and volatility are the norms. Cobie’s reflection connected the process of forming and reforming opinions successful effect to caller accusation and marketplace shifts highlights the complex, non-linear quality of fiscal forecasting.

Cobie’s afloat station is disposable to work below:

Cobie Bitcoin Prediction (Source)

Cobie Bitcoin Prediction (Source)The station Old Cobie station surfaces predicting the Bitcoin ETF tally up script astir connected the dot appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)