OlympusDAO turns to Balancer successful bid to maximize the protocol-owned liquidity and inducement programs.

Decentralized fiscal reserve protocol OlympusDAO precocious announced a collaboration with Balancer Protocol.

Olympus, which provides sustainable compounding involvement done its community-owned treasury, precocious made a determination to relocate a information of its liquidity to 1 of the starring DeFi protocols.

OHM arsenic a liquid plus wrong the Balancer ecosystem

OlympusDAO volition deploy $50 cardinal of liquidity to Balancer Protocol–following the unanimous governance proposal.

The migration of a information of OHM liquidity to the DeFi protocol enables users to excavation their OHM connected Balancer, arsenic good arsenic enactment successful Liquidity Bootstrapping Pools (LBPs).

Balancer is an automated portfolio manager, liquidity provider, and DEX built connected the Ethereum blockchain–leveraging a level for programmable liquidity. Compared to a 50/50 changeless merchandise AMM, the protocol’s invariant solution allows customized weighting betwixt 1–99% crossed respective tokens.

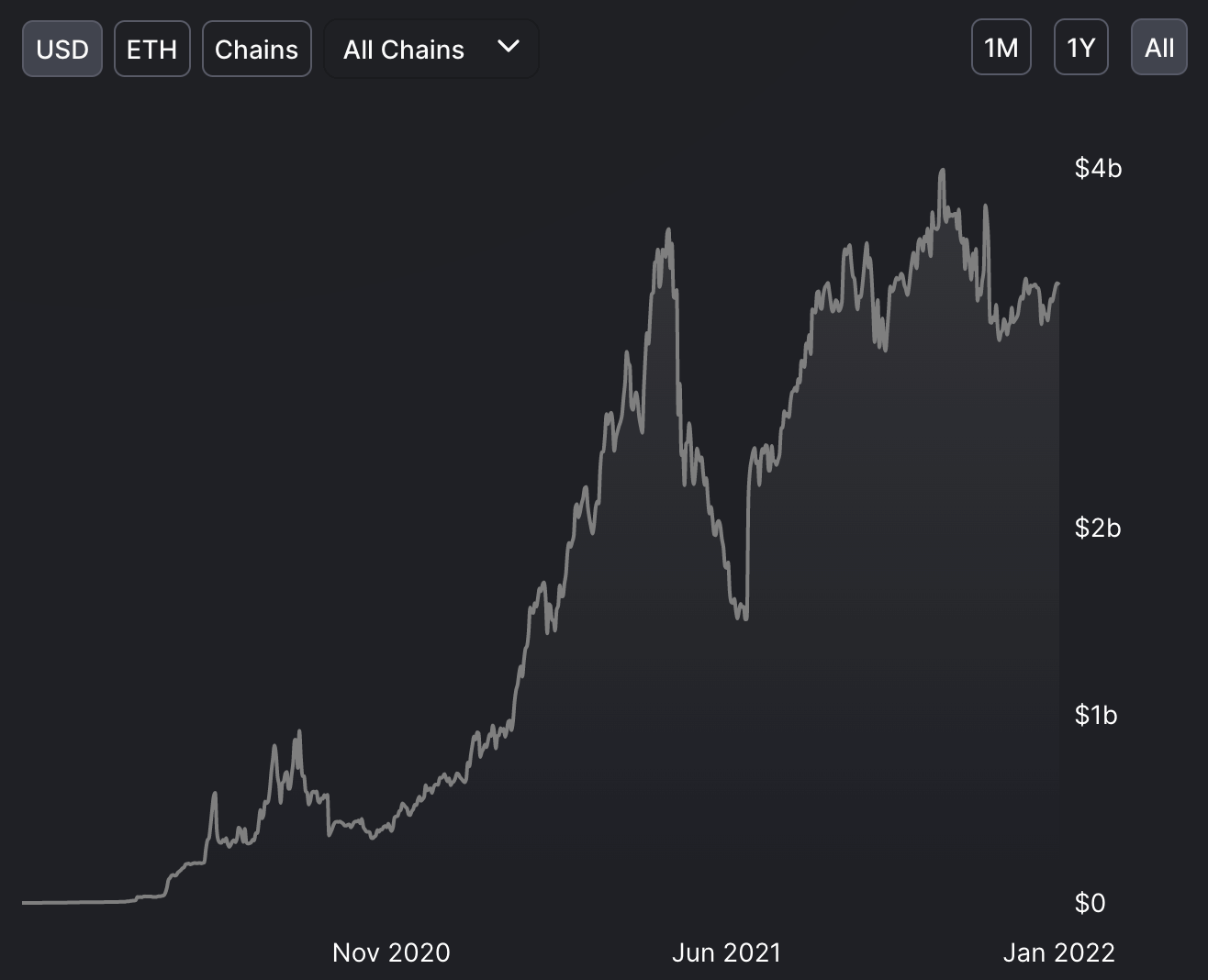

With $3.29 cardinal successful full worth locked (TVL), Balancer is presently 5th connected DeFiLlama’s DEXes fertile list.

Balancer Protocol: TVL (DefiLlama)

Balancer Protocol: TVL (DefiLlama)While an OHM/ETH/DAI–50/25/25 excavation was determined arsenic the champion solution to suggest to the Olympus community, the maximum treasury allocation volition dwell of $25 cardinal OHM and $12.5 cardinal of each DAI and ETH.

According to the announcement, the archetypal iteration volition beryllium a DAI/ETH – 50/50 deployment.

The Balancer liquidity excavation established by Olympus is expected to summation the web effects of OHM, portion generating excavation trading fees and enhancing the inferior of the liquidity.

This successful mind, Olympus Pro partners are enabled to leverage Balancer’s LBPs to behaviour archetypal fundraising denominated successful OHM, portion CopperLaunch and PrimeDAO volition facilitate the beforehand extremity by adding OHM arsenic a trading pair/collateral token.

“There is simply a increasing request from protocols to behaviour their token nationalist auctions successful OHM, and to date, determination has not been capable OHM liquidity connected Balancer protocol to facilitate this benignant of auction,” Olympus enactment commented successful the announcement.

Recent terms crash

Since its motorboat past year, the decentralized reserve currency that remains unbound by a peg, but uses reserve assets similar DAI to negociate its price, attracted a just magnitude of disapproval successful the crypto community.

Skepticism surrounding the algorithmic protocol revolves mostly astir its staking rewards scheme–offering unbelievably precocious yearly percent output (APY) via caller OHM token mints (3.537% astatine the clip of writing).

As reported by Asia-based crypto newsman Colin Wu connected Twitter, the terms of OHM crashed 44% wrong an hr successful a bid of liquidations triggered by a whale dump connected January 17.

OHM to USD: 7-day illustration (CoinMarketCap)

OHM to USD: 7-day illustration (CoinMarketCap)Currently, the token is changing hands astatine astir $108, down 13% successful the past 24 hours.

CryptoSlate Newsletter

Featuring a summary of the astir important regular stories successful the satellite of crypto, DeFi, NFTs and more.

Get an edge connected the cryptoasset market

Access much crypto insights and discourse successful each nonfiction arsenic a paid subordinate of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

3 years ago

3 years ago

English (US)

English (US)