After a little conflict to regain footing, Bitcoin yet broke done the $52,000 obstruction connected Feb. 14. While $50,000 was a captious intelligence benchmark, trading supra $52,000 indicates rising marketplace assurance successful Bitcoin and tin mean the extremity of the carnivore market.

During periods of terms volatility, particularly important upward movements, it’s important to analyse the availability of Bitcoin’s supply. Knowing however overmuch of Bitcoin’s proviso is theoretically disposable for trading tin amusement america the magnitude of buying oregon selling unit the marketplace could absorb. An summation successful proviso acceptable to beryllium traded tin origin the terms to driblet if there’s nary request to conscionable it. Conversely, a alteration successful the proviso of Bitcoin that tin beryllium rapidly bought tin origin a supply crunch that leads to an summation successful price.

Supply availability can’t beryllium seen done a azygous metric. The proviso of Bitcoin sitting successful speech wallets is usually taken arsenic the champion proxy, but it offers small depth. CryptoSlate analyzed respective different on-chain metrics, including UTXOs and accumulation addresses, to amended recognize whether the tradeable proviso is tightening.

There are, of course, galore different metrics that tin further and amended amusement the authorities of the market. For example, the differences successful semipermanent and short-term holder supplies tin amusement if there’s an summation successful the tradeable (STH) and non-tradeable (LTH) supply, which could make a crunch. However, focusing connected little wide utilized metrics similar UTXOs tin supply a caller presumption of a heavily-analyzed topic.

Unspent Transaction Outputs (UTXOs) are indispensable successful knowing the Bitcoin network. UTXOs correspond the magnitude of BTC that remains unspent and stored successful a wallet aft a transaction, serving arsenic a cardinal indicator of Bitcoin’s liquidity and question wrong the market.

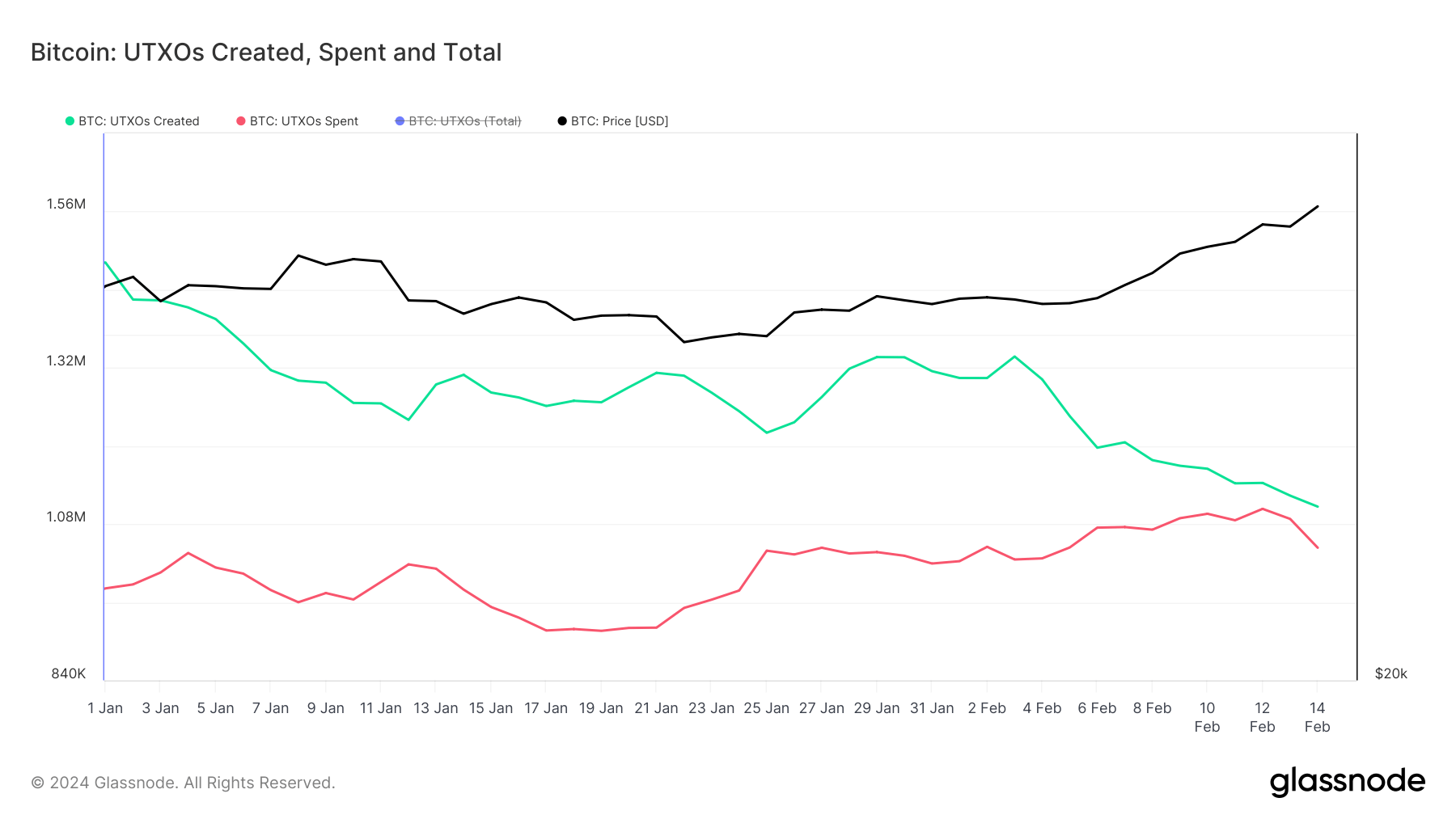

On Feb. 1, the fig of created UTXOs stood astatine 1.304 million, which decreased to 1.106 cardinal by Feb. 14. Concurrently, the fig of spent UTXOs remained comparatively stable. This driblet suggests that determination has been a alteration successful the willingness to transportation BTC betwixt addresses.

Graph showing the fig of created (green) and spent (red) UTXOs from Jan. 1 to Feb. 14, 2024 (Source: Glassnode)

Graph showing the fig of created (green) and spent (red) UTXOs from Jan. 1 to Feb. 14, 2024 (Source: Glassnode)This inclination tin beryllium seen arsenic the archetypal motion of a imaginable liquidity crunch, which could importantly interaction Bitcoin’s terms successful the coming weeks.

The motorboat of spot Bitcoin ETFs successful the US was 1 of the astir important milestones for Bitcoin erstwhile it comes to organization adoption, introducing a regulated, mainstream concern conveyance for Bitcoin exposure. These ETFs, which person seen implicit $4.1 cardinal successful flows since they began trading conscionable implicit a period ago, usage OTC desks to get BTC. This method of acquisition, antecedently analyzed by CryptoSlate, has a important effect connected proviso availability.

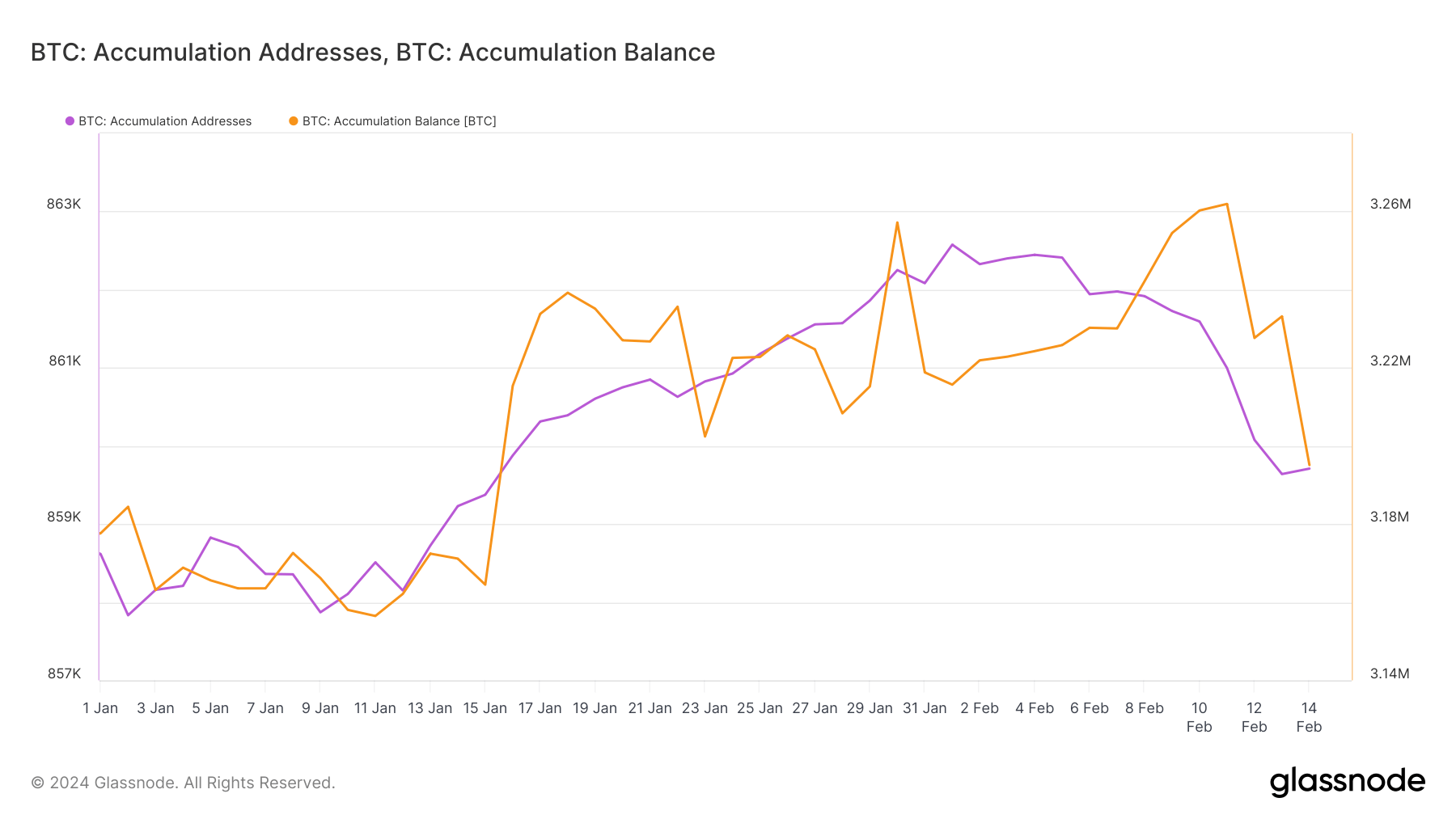

Namely, determination has been a notable alteration successful the magnitude of Bitcoin held successful accumulation addresses, from 3.215 cardinal BTC connected Feb.1st to 3.195 cardinal BTC by Feb. 14, and a insignificant simplification successful the fig of these addresses.

Graph showing the magnitude of Bitcoin held successful accumulation addresses and the full fig of these addresses from Jan. 1 to Feb. 14, 2024 (Source: Glassnode)

Graph showing the magnitude of Bitcoin held successful accumulation addresses and the full fig of these addresses from Jan. 1 to Feb. 14, 2024 (Source: Glassnode)This diminution tin suggest a strategical mobilization of long-held BTC. With a accordant summation successful semipermanent holder supply, this could beryllium attributed to the emergence successful selling to OTC desks, which cater to the increasing request from ETFs.

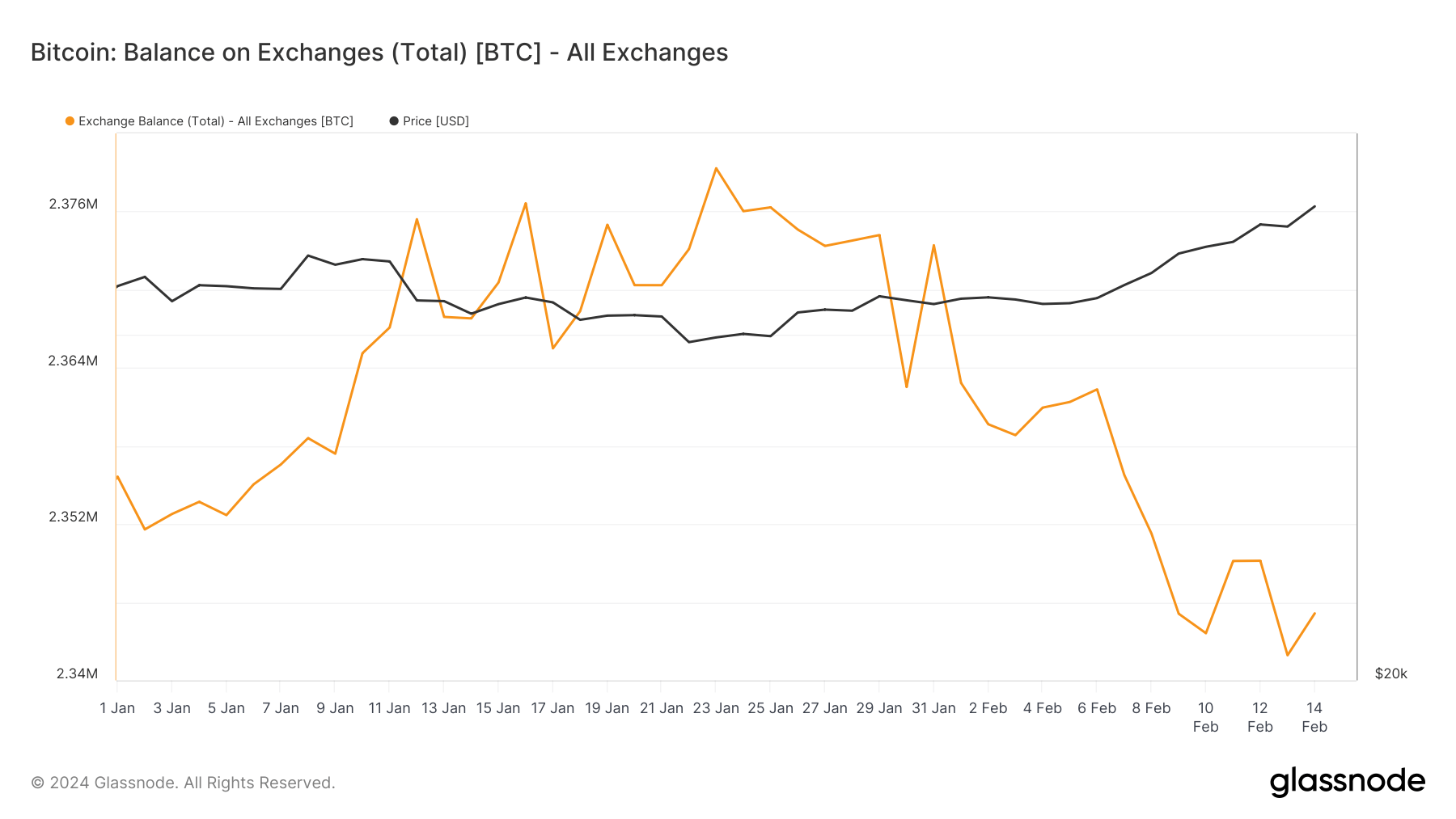

Furthermore, determination has besides been an observable alteration successful the magnitude of Bitcoin held successful speech wallets, dropping from 2.363 cardinal BTC connected Feb. 1 to 2.345 cardinal BTC connected Feb. 14. While this is simply a continuation of a year-long trend, it shows that there’s a precise tangible tightening of the proviso disposable for trading.

Graph showing the magnitude of Bitcoin held successful speech wallets from Jan. 1 to Feb. 14, 2024 (Source: Glassnode)

Graph showing the magnitude of Bitcoin held successful speech wallets from Jan. 1 to Feb. 14, 2024 (Source: Glassnode)The compounded factors of a driblet successful UTXO creation, a simplification successful Bitcoin held successful accumulation addresses, a diminution successful speech balances, and important inflows into spot Bitcoin ETFs amusement a important alteration successful the market. This alteration tin perchance origin an adjacent further alteration successful the proviso disposable for trading against a backdrop of expanding demand, peculiarly from organization investors done ETFs.

The station On-chain information shows Bitcoin proviso is tightening appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)