Whale momentum is thinning suggesting the Bitcoin terms volition proceed to range, if not autumn lower.

Samuel Wan • Mar. 14, 2022 astatine 8:00 p.m. UTC • 2 min read

Samuel Wan • Mar. 14, 2022 astatine 8:00 p.m. UTC • 2 min read

Cover art/illustration via CryptoSlate

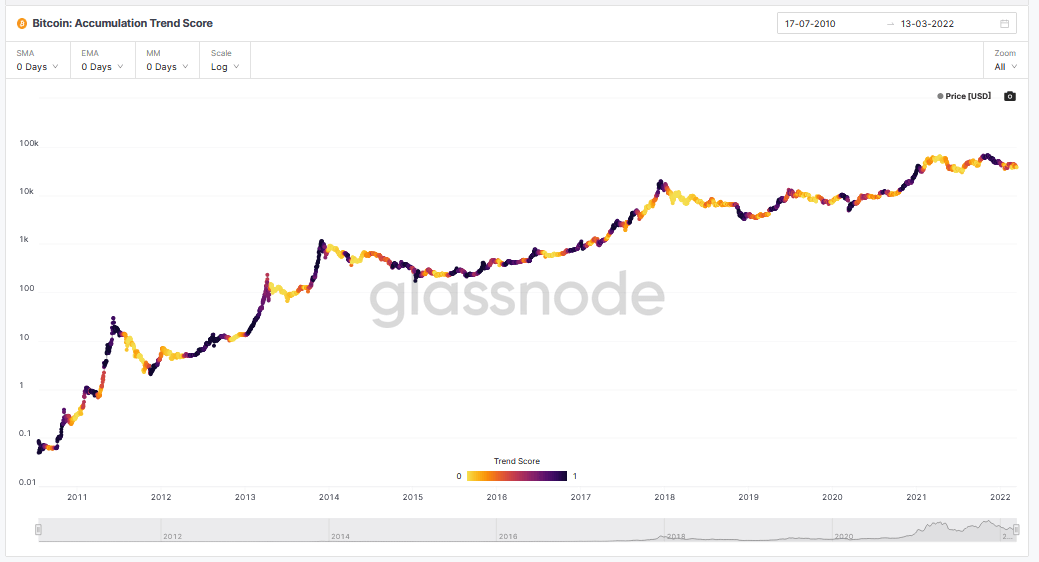

A caller metric from on-chain information analysts Glassnode looks astatine the comparative size of entities actively accumulating oregon distributing coins successful presumption of their Bitcoin holdings. In short, the “Accumulation Trend Score” measures whale activity.

The existent Accumulation Trend Score shows whales are enactment distributing tokens, suggesting a debased probability of reversing the caller terms slump, should this signifier persist.

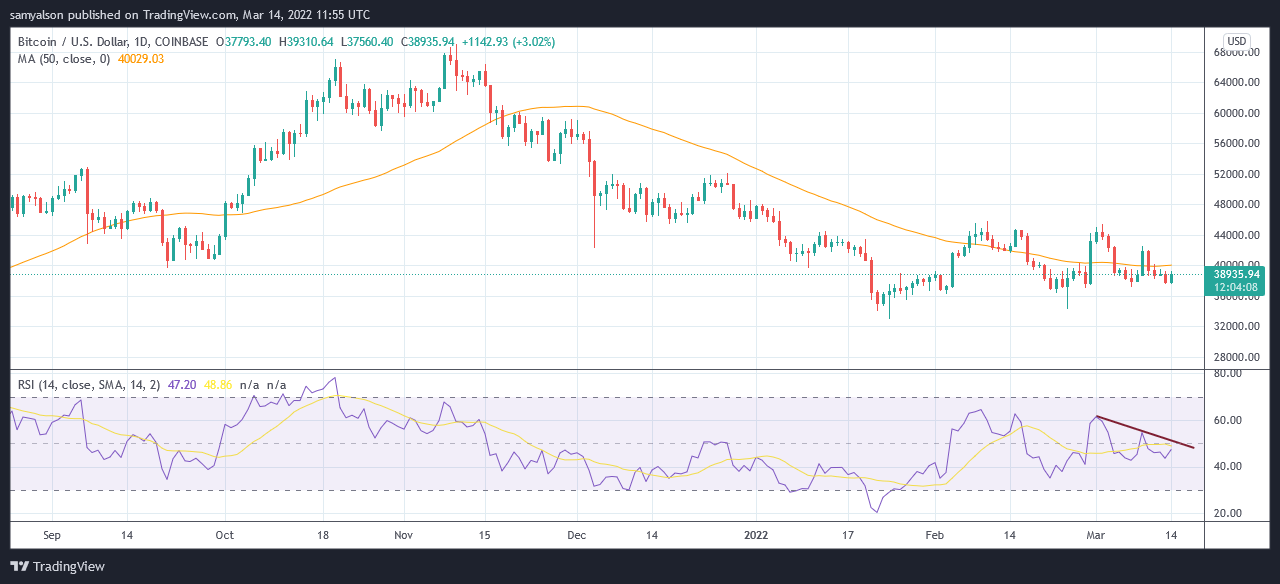

Since November, Bitcoin has been trending downwards, having peaked astatine $69,000. Early February saw a interruption of the downtrend, but $BTC has been moving sideways ever since, posting a debased of $34,300 during this period.

This limbo authorities has divided sentiment connected whether we are successful a carnivore marketplace oregon not. However, against a backdrop of economical uncertainty, sentiment is skewed to the former.

Today’s terms enactment sees a 3% summation accompanied by an upturn successful the Relative Strength Index (RSI), to 46% astatine the clip of writing. Although this shifts momentum towards the overbought territory, it remains to beryllium seen if bulls tin interruption the momentum downtrend.

Source: BTCUSD connected TradingView.com

Source: BTCUSD connected TradingView.comAccording to the data, with whales successful a organisation phase, signs constituent to further ranging if not a terms driblet from here.

What is the Accumulation Trend Score?

The Accumulation Trend Score represents the size of the entities’ equilibrium (their information score) and the fig of caller coins acquired/sold implicit the past period (their equilibrium alteration score).

The people falls on a standard of 0 to 1. A people person to 0 means larger entities are connected equilibrium distributing, not accumulating, portion a people person to 1 shows larger entities are accumulating, not distributing.

However, a people of 1 doesn’t needfully correlate with surging terms oregon vice versa. For example, mid-April 2021 saw the terms of $BTC highest astatine $65,000 (the highest terms successful 2021). But the Accumulation Trend Score was hovering astatine the debased end, with April 4, 2021, showing a people of 0.

The commencement of 2022 opened with a people of astir 0.7, indicating whales chiefly were accumulating. The existent people is 0.027, showing a implicit turnaround successful sentiment.

Source: studio.glassnode.com

Source: studio.glassnode.comSmall food are snapping up Bitcoin

Data from on-chain analysts Ecoinometrics supports the presumption that whales are selling. However, their investigation besides included examining what “small fish” are doing, and contrary to the whales, retail investors are presently buying Bitcoin.

They reason that the likelihood of a determination higher is debased fixed that the whales are retired of the picture.

“#Bitcoin whales and tiny fish… 2 antithetic worlds close now. The tiny food are accumulating similar determination is nary time portion the whales are distributing. Without the whales, I uncertainty determination is capable momentum for a sustained inclination upward.”

The FOMC meeting volition instrumentality spot either this coming Tuesday oregon Wednesday. Analysts expect U.S involvement rates volition emergence by 0.25%-0.5%. While immoderate accidental this volition person small interaction connected surging inflation, the Fed indispensable besides see the effect of raising rates excessively high.

All eyes are connected what the Fed volition bash next.

Get your regular recap of Bitcoin, DeFi, NFT and Web3 quality from CryptoSlate

It's escaped and you tin unsubscribe anytime.

Get an Edge connected the Crypto Market 👇

Become a subordinate of CryptoSlate Edge and entree our exclusive Discord community, much exclusive contented and analysis.

On-chain analysis

Price snapshots

More context

3 years ago

3 years ago

English (US)

English (US)