The unfastened futures involvement and the futures estimated leverage ratio metrics had reached their highest levels for implicit a month, which indicates an upcoming Bitcoin (BTC) volatility, according to Glassnode information analyzed by CryptoSlate.

Futures unfastened interest

The futures unfastened involvement metric reflects the USD worth of the full magnitude of funds allocated successful unfastened futures contracts.

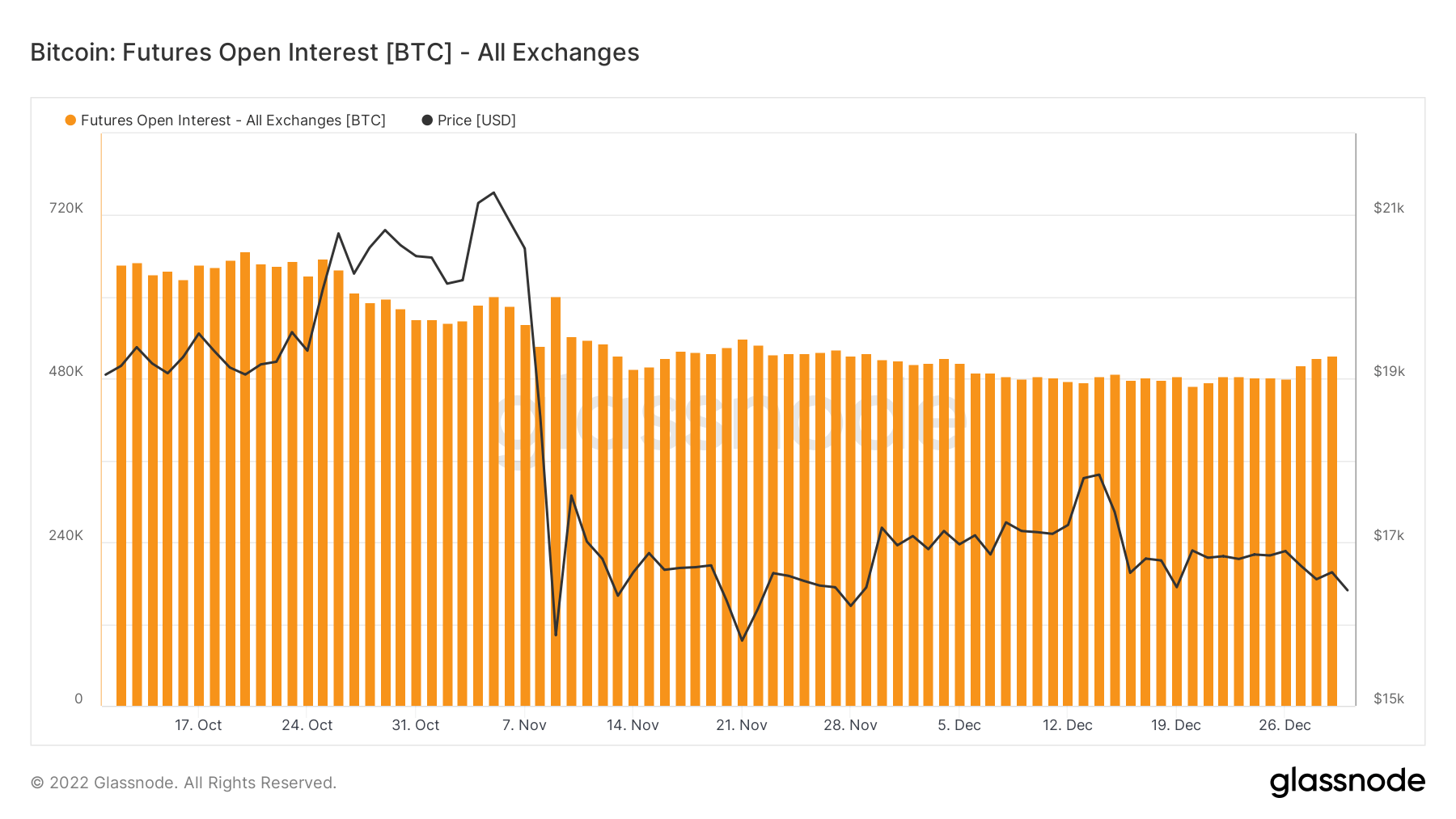

BTC Futures Open Interest

BTC Futures Open Interest The illustration supra shows the BTC futures unfastened involvement connected a regular ground since Oct. 17. As of Dec. 30, the metric exceeded implicit 500,000 BTC, marking its highest level for implicit a month.

Futures estimated leverage ratio.

The Futures Estimated Leverage Ratio is simply a metric that represents the ratio betwixt the unfastened involvement successful futures contracts and the equilibrium of the corresponding exchange.

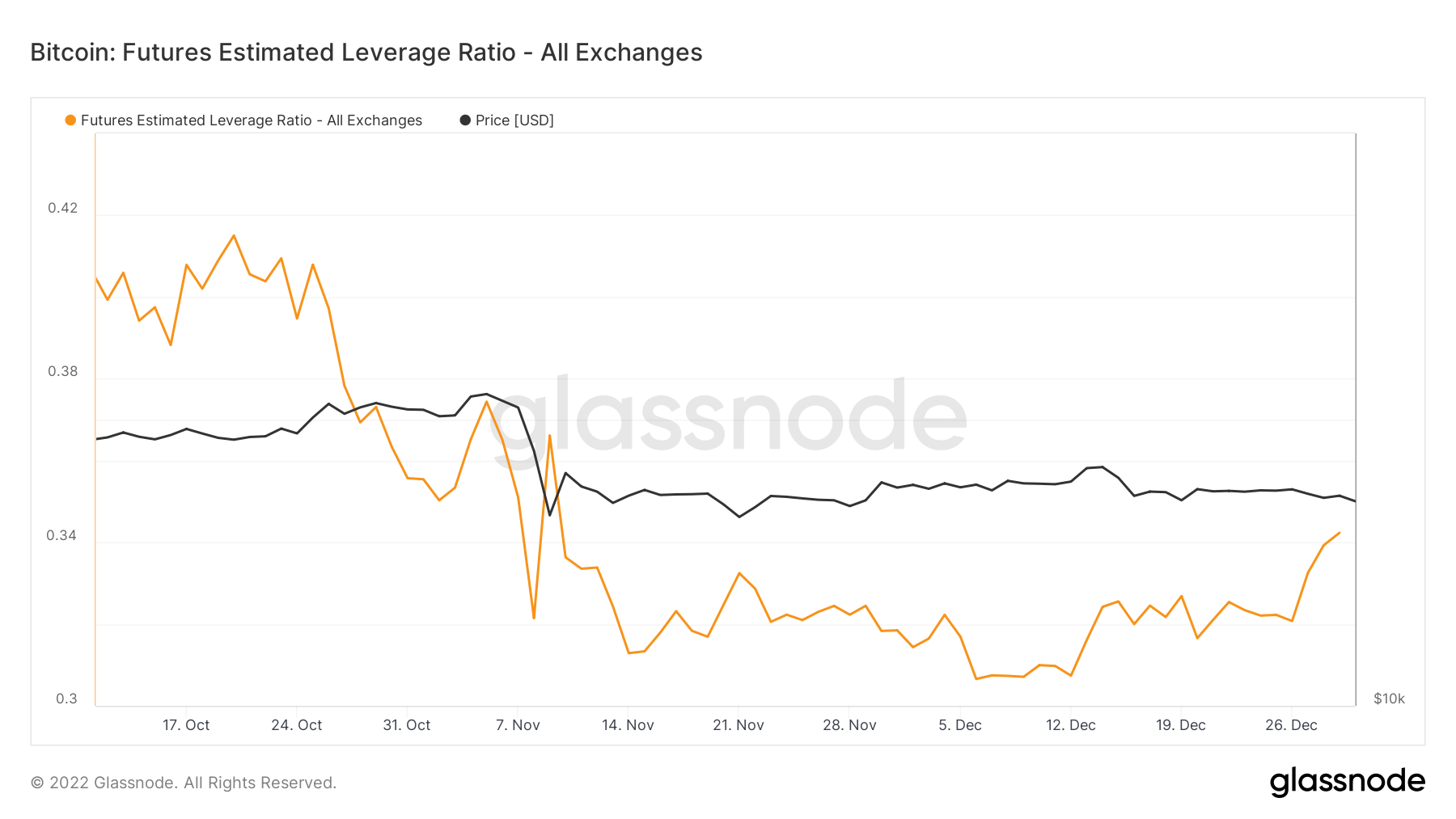

BTC Futures Estimated Leverage Ratio

BTC Futures Estimated Leverage RatioThe estimated leverage ratio fell arsenic debased arsenic 0.3 connected Dec. 5 aft the FTX collapse. However, it rapidly started to retrieve aft Dec. 12. The ratio astir accrued by astir 10% successful 20 days to spot 0.34 connected Dec. 30.

Binance liquidations

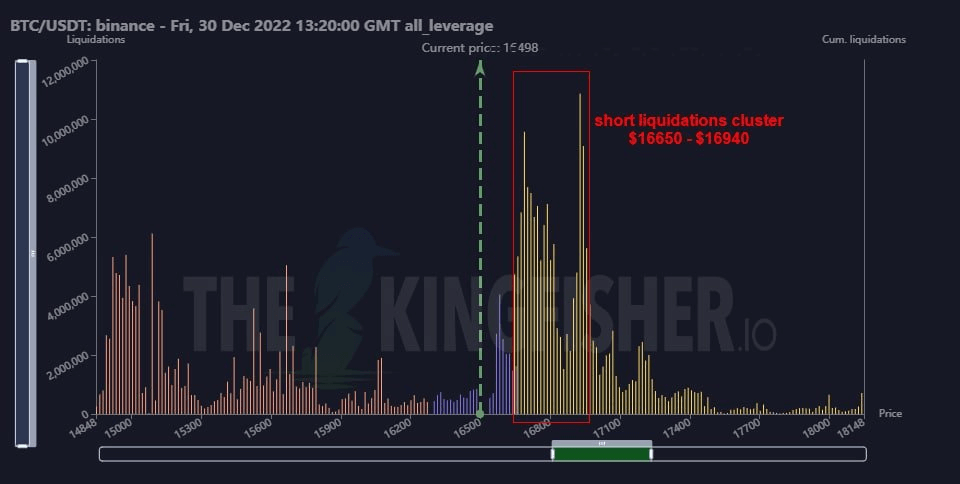

In summation to metrics signaling imaginable volatility, information from Binance indicates that Binance volition lend to the terms swings.

A abbreviated liquidations clump has formed successful Binance betwixt the prices of $16,650 and $16,940. The existent BTC terms lingers astir $16,547 astatine the clip of writing, lone $100 distant from entering the clump zone.

The station On-chain metrics awesome upcoming BTC volatility appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)