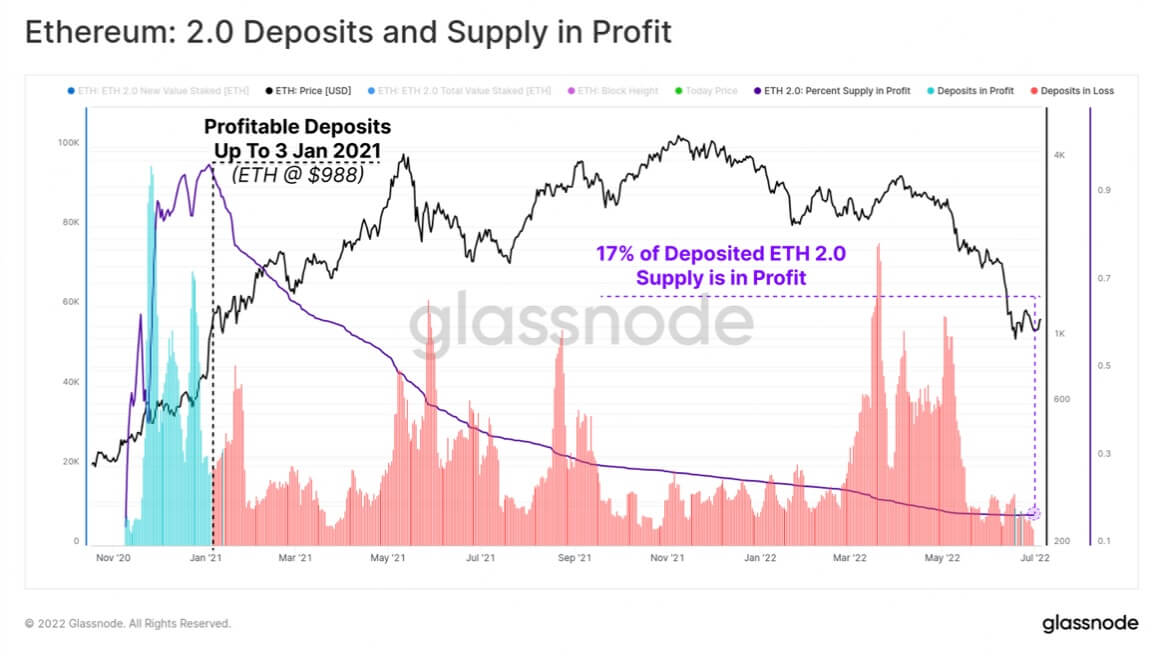

83% of Ethereum (ETH) stakers are underwater arsenic the integer plus continues to commercialized astatine astir $1000, Glassnode reported connected July 6.

Source: Glassnode

Source: GlassnodeParsec Finance laminitis Will Sheehan archetypal revealed this connected Twitter connected July 1 with a illustration that showed lone 17% of Ethereum validators were successful profit.

ETH stakers by introduction terms pic.twitter.com/iHiZRmz7ZU

— Will Sheehan (@wilburforce_) July 1, 2022

Glassnode corroborated this, saying astir each the deposits that are successful nett were made erstwhile ETH was trading nether $1000. The mean terms of ETH successful the deposit is $2390.

Dollar worth of staked ETH declined 65%

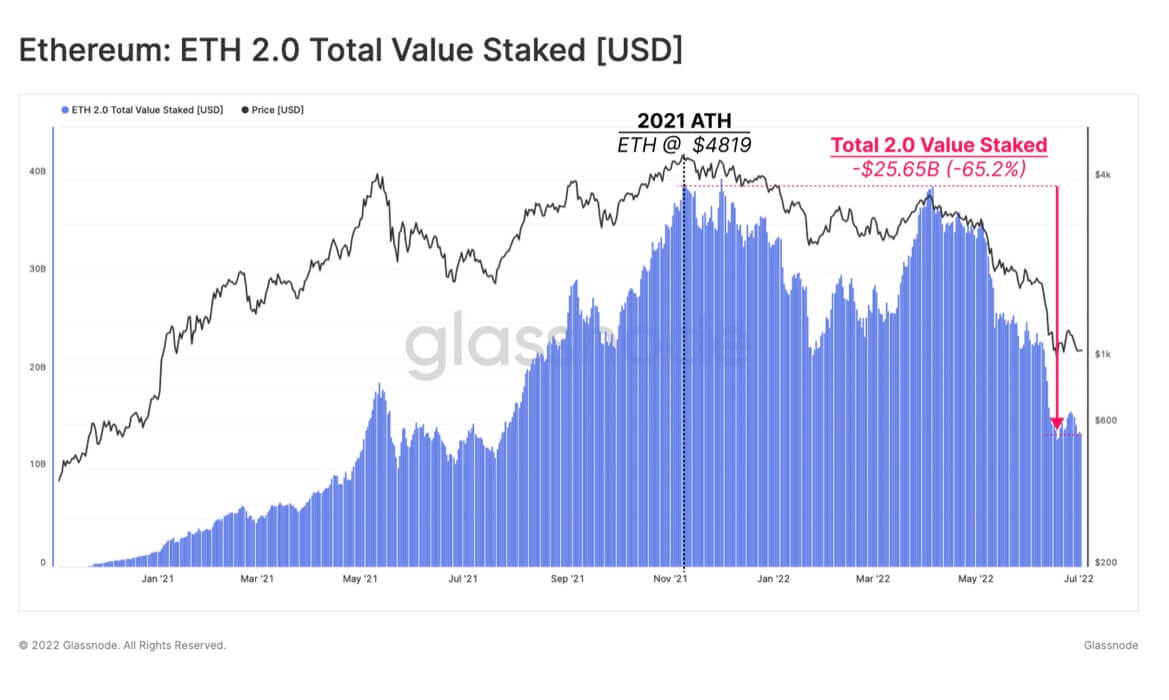

According to Glassnode, the dollar worth of staked ETH had dropped by 65% arsenic of June 30 contempt having much coin units than erstwhile it was astatine its all-time high.

Source: Glassnode

Source: GlassnodeThe dollar worth of staked ETH peaked astatine $39.7 cardinal successful November 2021 erstwhile the coin reached its all-time precocious of $4878, and the Beacon Chain had 263,918 validators.

Since then, Ethereum’s terms has declined by implicit 75% from its all-time high, pushing down the dollar worth of the staked ETH.

Daily validators’ deposits drop

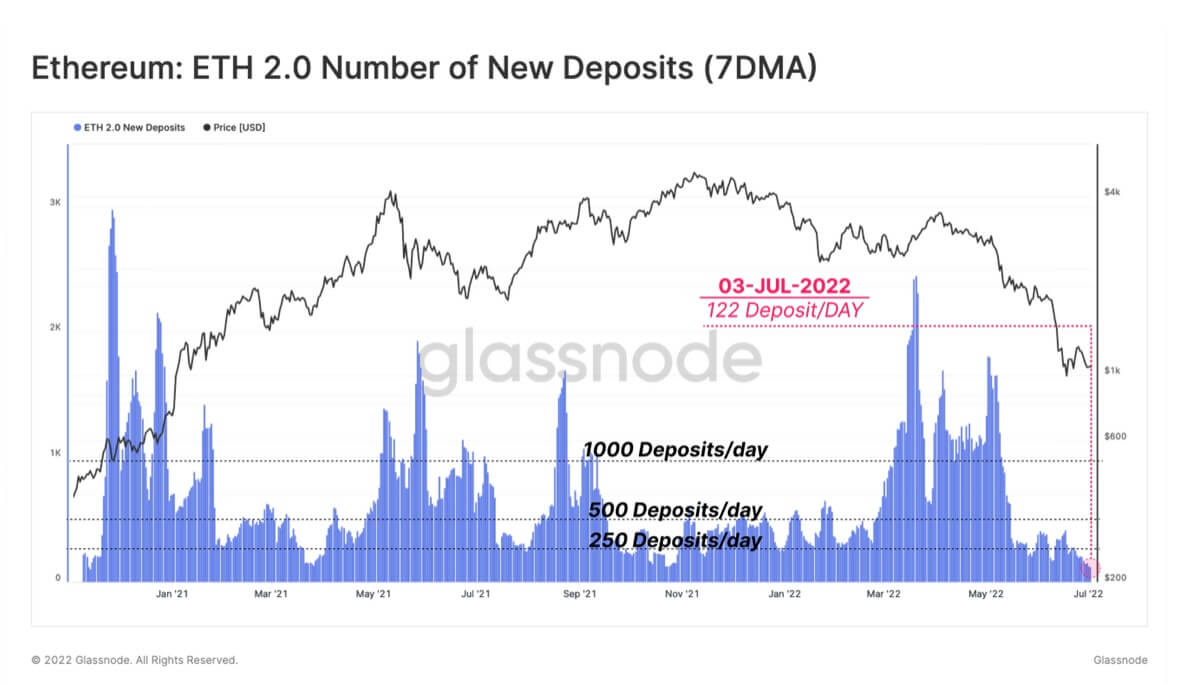

The declined worth of ETH has led to a driblet successful the regular validators deposits. Previously, the web experienced “500 – 1000 caller deposits of 32 ETH per day.”

Source: Glassnode

Source: GlassnodeThat fig has present dropped to an mean of 122 per time — the lowest connected record.

Over 12 cardinal units of ETH are successful the contract, which is implicit 10% of the full Ethereum successful circulation.

According to Glassnode, the diminution successful regular deposits mightiness not beryllium due to the fact that of the existent fear, uncertainty, and uncertainty permeating the market.

There are concerns astir the profitability of staking ETH arsenic it is intolerable to retreat staked ETH until the Merge is completed.

However, request for staking derivatives similar LIDO remains precocious due to the fact that they tin beryllium utilized arsenic collateral successful DeFi applications.

When Ethereum Merge?

Ethereum’s modulation to a proof-of-stake blockchain draws nearer arsenic the web completes the Merge proceedings of the Sepolia testnet.

Sepolia summary:

– Merge modulation itself was a occurrence

– 25-30% of the validators went offline soon aft the merge

– The offline validators were owed to incorrect configs

– Since then, the offline parties person updated their configs, and validators are up

(cont)

— terence.eth (@terencechain) July 6, 2022

Meanwhile, a developer identified issues with the Sepolia Merge, similar validators going offline due to the fact that of incorrect configurations. But helium added that the “hiccups volition not hold the Merge.”

According to disposable information, the last proceedings of the Ethereum Merge tin beryllium expected to hap connected the Goerli Network successful the adjacent fewer weeks, which would precede the Merge connected the Ethereum mainnet.

The station Only 17% of Ethereum stakers are successful nett arsenic validator deposits decline appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)