The U.S. indebtedness ceiling reached its $31.4 trillion bounds connected Jan. 19, prompting calls for extremist action, adjacent removing the ceiling altogether.

Bitcoin offers an alternate to the fiat system, which is destined to neglect arsenic a effect of the inherent request to grow the wealth proviso done wealth printing.

Although U.S. authorities BTC adoption volition ne'er apt happen, determination beryllium respective innovative solutions involving the usage of Bitcoin to tackle runaway debt.

U.S. indebtedness ceiling

The U.S. indebtedness ceiling refers to a legislative headdress connected the nationalist indebtedness incurred by the U.S. Treasury. In different words, it limits the wealth the U.S. tin get to work its bills.

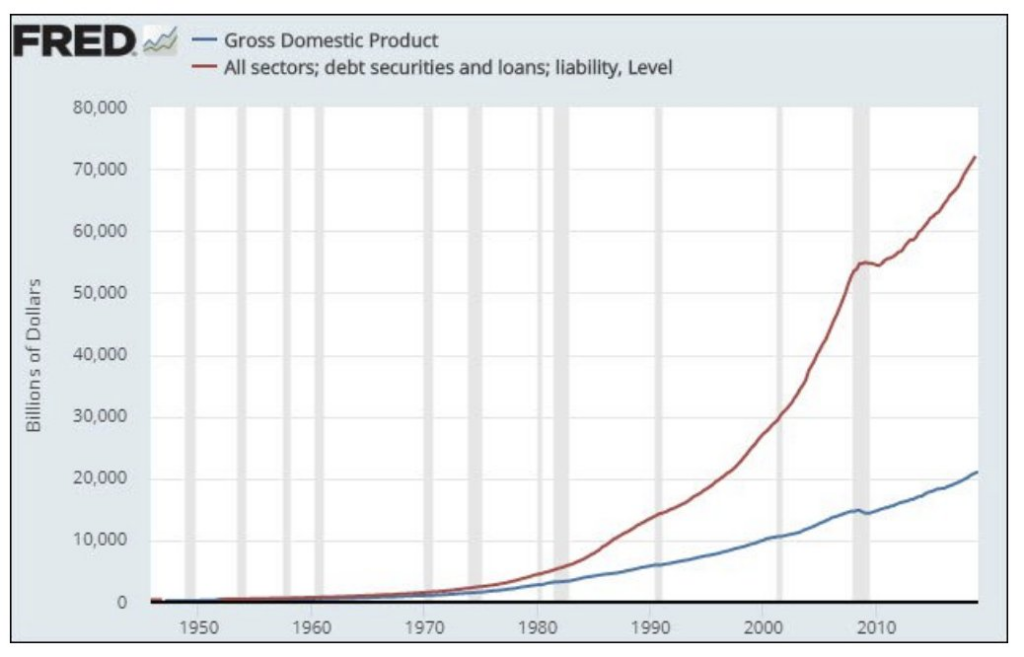

The illustration beneath shows U.S. authorities liabilities acold transcend Gross Domestic Product (GDP,) forcing the U.S. to rise further backing done the merchantability of Treasury Bonds. However, it should beryllium noted that the Second Liberty Bond Act (1917) prevents the merchantability of Treasury Bonds aft hitting the indebtedness ceiling limit.

Source: stlouisfed.org

Source: stlouisfed.orgRaising the indebtedness ceiling requires bipartisan approval. Recent instances of approaching the indebtedness bounds successful the past person been met with governmental posturing from some sides of the divide.

On Jan. 19, the $31.4 trillion ceiling was hit, promoting Treasury Secretary Janet Yellen to enact “extraordinary measures” by calling connected Congress to rise the bounds oregon suspend it temporarily to debar a authorities shutdown.

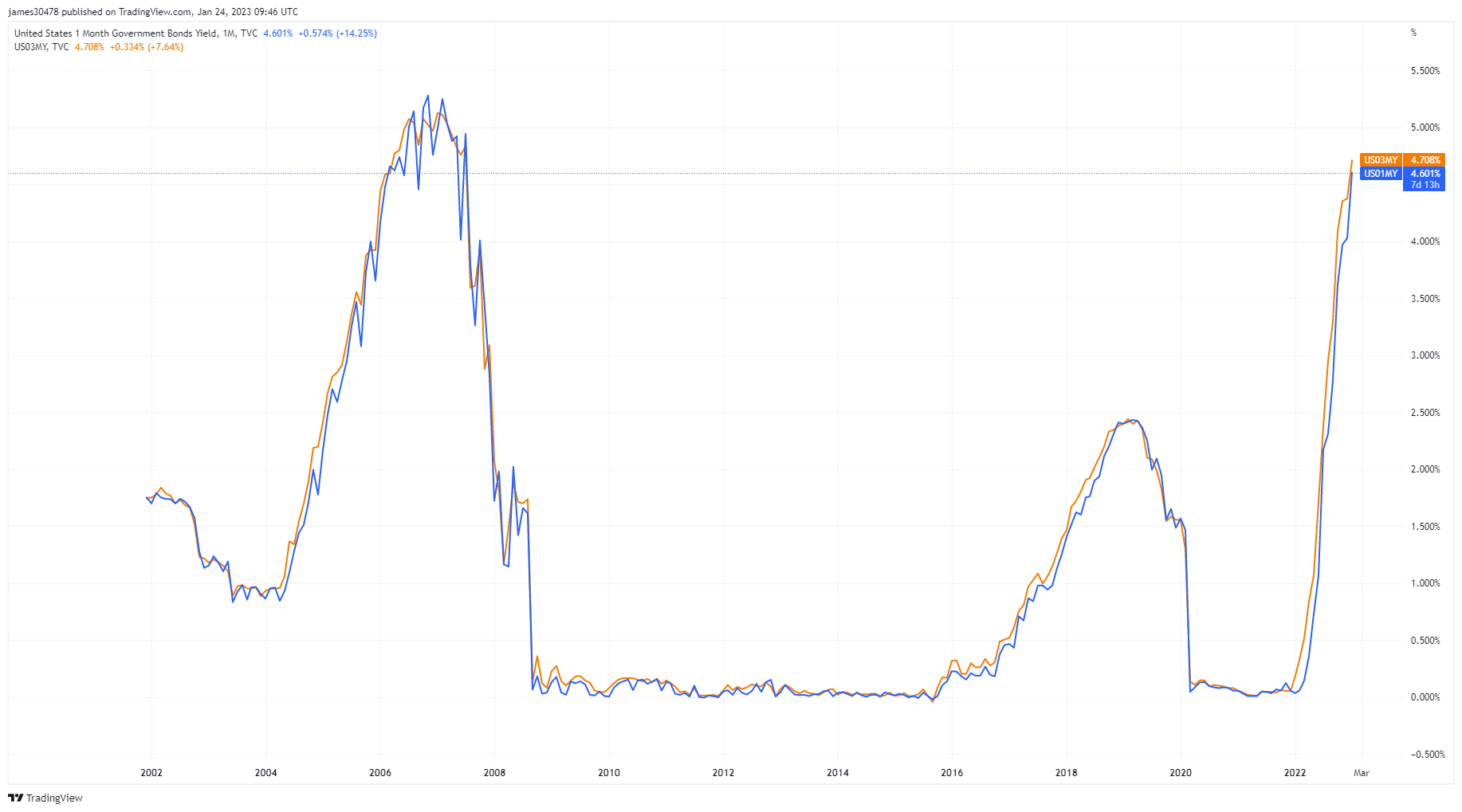

In the meantime, to support the Treasury ticking over, Yellen announced she intends to contented astir $335 billion successful short-term bills to support authorities operations.

1 – 3-Month Bonds: (Source: TradingView.com)

1 – 3-Month Bonds: (Source: TradingView.com)Failure to scope a timely statement whitethorn mean economical catastrophe successful delays to Social Security payments, unpaid subject personnel, and severely impacting families who trust connected benefits – not forgetting the imaginable interaction connected fiscal markets fearing a authorities default.

Bitcoin performance

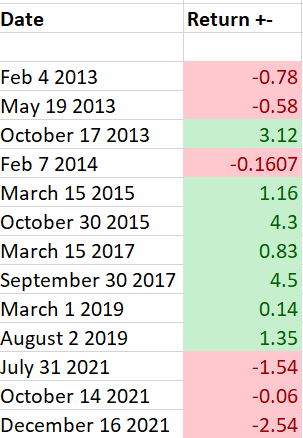

The array beneath documents the dates the U.S. indebtedness ceiling was reached during Bitcoin’s past and the coin’s intraday show connected that day.

It shows a mixed effect regarding whether indebtedness ceiling crises trigger a affirmative oregon antagonistic terms performance. Of the 13 dates, 7 yielded affirmative intraday returns, with Oct. 17, 2013, giving the champion show astatine 3.12% gains.

However, nary of these events occurred nether utmost economical conditions, including a high-interest complaint and inflationary environment.

Source:

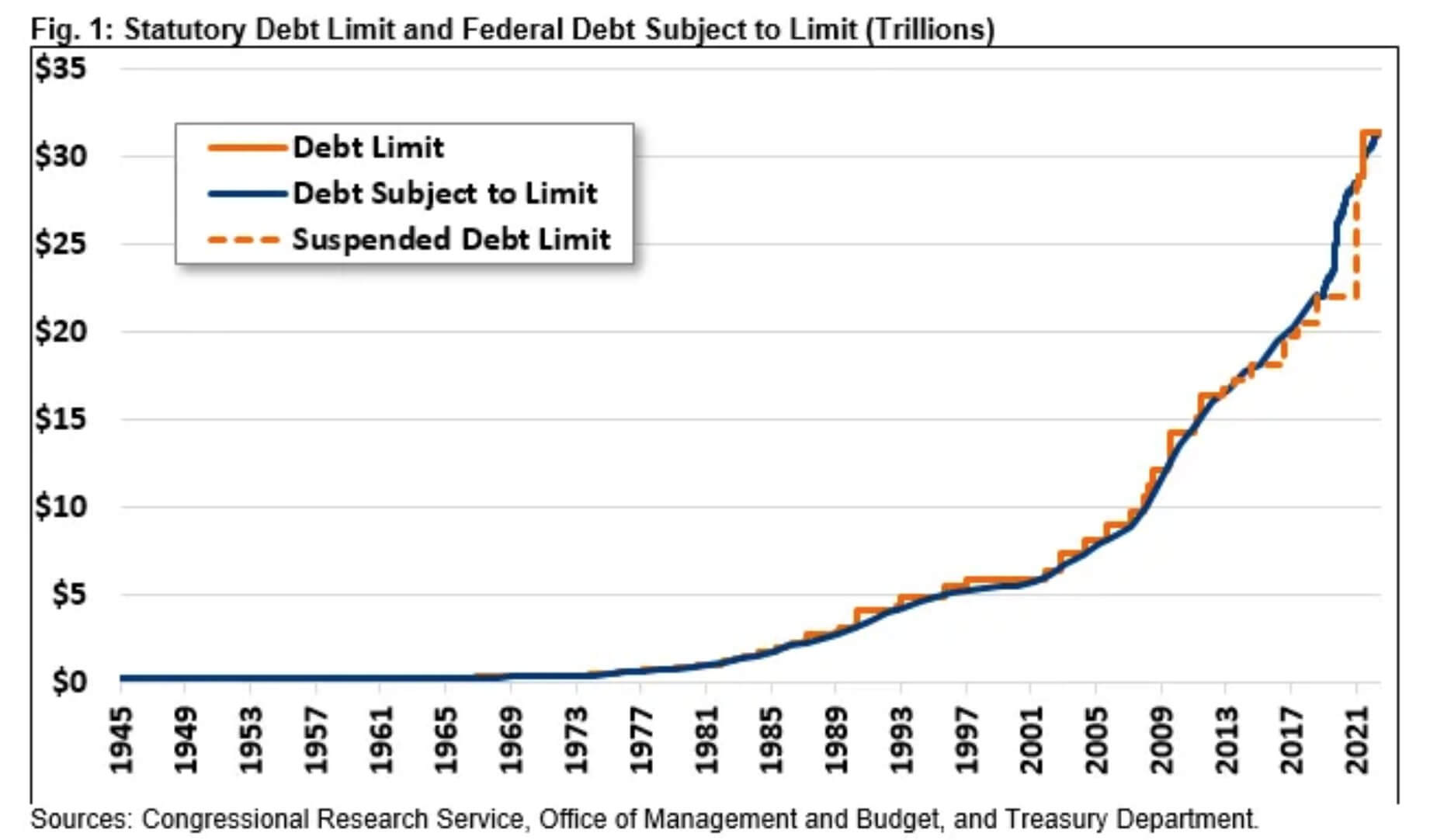

Source:The U.S. is facing a dilemma successful that the lone feasible solution is to widen the ceiling limit, arsenic it has done successful the past. As illustrated below, extensions person lone led to much reliance connected debt, compounding the occupation of ne'er being capable to wage it down.

US Debt Limit: (Source: Congressional Research Service)

US Debt Limit: (Source: Congressional Research Service)Intraday show aside, Bitcoin advocates reason that BTC is simply a imaginable solution to spiraling debt, arsenic it is not beholden to monetary enlargement oregon governmental and authorities control.

For example, connected Oct. 7, 2021, arsenic the Senate approved a $480 cardinal summation to the ceiling, Senator Cynthia Lummis said the dangers of irresponsible indebtedness absorption person consequences, including devaluation.

“In the lawsuit that contingency occurs, I privation to marque definite that non-fiat currencies, not issued by governments, not beholden to governmental elections tin grow, let radical to save, and beryllium determination successful the lawsuit that we neglect astatine what we cognize we person to do.”

Taking things a measurement further

In presumption of utilizing Bitcoin successful innovative ways to tackle the indebtedness problem, respective solutions exist, including issuing bonds denominated successful BTC alternatively of the dollar, enabling the authorities to rise backing without adding to the indebtedness ceiling.

Similarly, incorporating BTC into monetary argumentation successful a hybrid exemplary would offset the effects of nonaccomplishment of purchasing powerfulness done expansion.

Fiat wealth is doomed to inflation

The cardinal occupation with fiat wealth is it relies connected perpetual growth, meaning the strategy indispensable support printing to support the Ponzi alive. Currency debasement oregon a simplification successful the currency’s spending powerfulness occurs erstwhile the wealth proviso increases without a corresponding summation successful economical output.

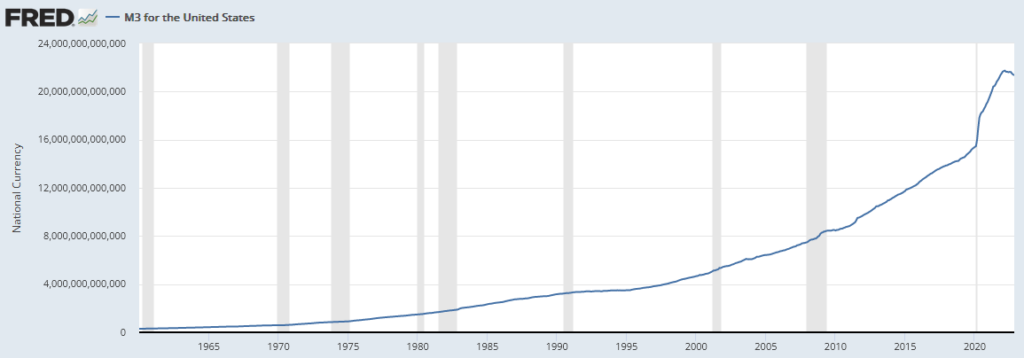

U.S. M3 money, which refers to the money successful circulation positive checkable slope deposits successful banks, savings deposits (less than $100,000), wealth marketplace communal funds, and clip deposits successful banks, has been connected the emergence since records began.

The illustration beneath shows a important uptick successful the M3 wealth proviso since 2001. The covid situation prompted a near-vertical increase, which has since tapered off, having peaked astatine $21.7 trillion successful February 2022. 40% of the dollars successful beingness were created during this period.

The caller flip to quantitative tightening has since led to a downtrend successful the M3 wealth supply. But, inevitably, the Fed volition yet beryllium forced the crook the printing presses backmost connected to stimulate economical activity.

Source: fred.stlouisfed.org

Source: fred.stlouisfed.orgGross Domestic Product (GDP) information from the St. Louis Fed showed a 13% summation successful economical output betwixt Q1 2020 and Q1 2022 – acold beneath the enlargement successful the M3 wealth supply.

MicroStrategy Chair Michael Saylor called Bitcoin the scarcest plus connected satellite Earth. His reasoning boils down to the token’s 21 cardinal fixed supply, meaning it cannot beryllium debased, dissimilar the dollar.

In theory, arsenic the M3 wealth proviso grows, the terms of BTC successful dollar presumption volition summation arsenic dollar debasement kicks in, i.e., much dollars are needed to bargain the aforesaid BTC.

However, successful reality, lawmakers mostly are wary of cryptocurrencies. For example, Yellen has publically denounced them connected aggregate occasions, astir precocious successful a statement calling for “more effectual oversight” successful the aftermath of the FTX collapse.

As such, the U.S. government’s adoption of BTC is improbable to happen. But, staying the people and amassing much indebtedness and much nonaccomplishment of purchasing powerfulness tin lone pb to further erosion of dollar hegemony.

The station Op-ed: Bitcoin could beryllium the reply to the US’ spiraling debt appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)