Bitcoin mounting a caller all-time precocious and breaking supra $72,000 is simply a important milestone for the market. Riding the question of accrued organization involvement successful spot Bitcoin ETFs, it smashed done the $68,000 ceiling established successful November 2021 aft a little correction to $59,000 and seems to beryllium gearing up for much gains this week.

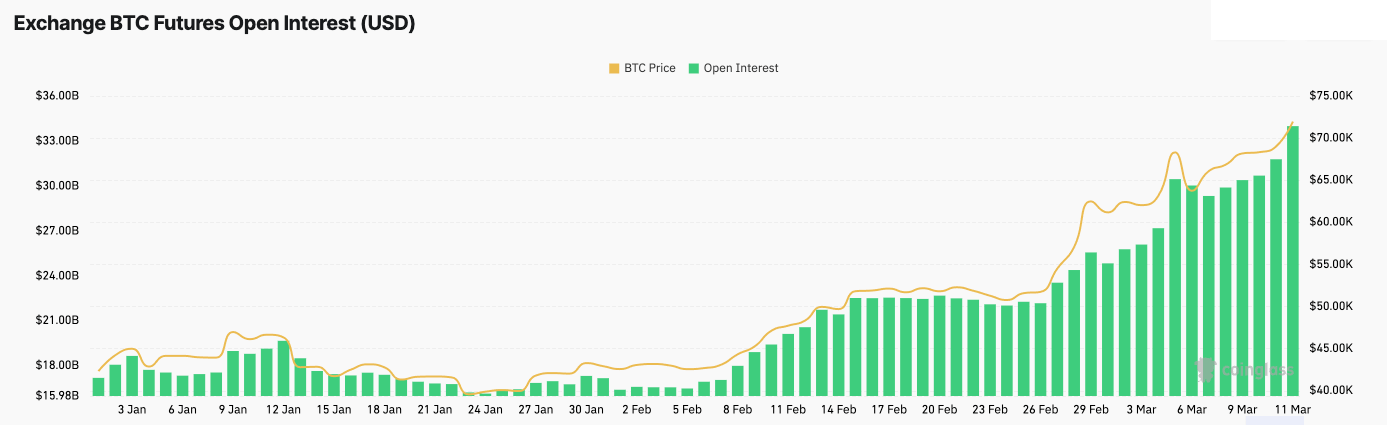

This week, the imaginable for much volatility is seen successful the derivatives market, which peaked arsenic Bitcoin touched $71,400. Since the opening of the year, Bitcoin futures and options markets person seen unprecedented growth, with unfastened involvement reaching caller highs connected Mar. 11. Analyzing unfastened involvement is important for knowing marketplace wellness and trader expectations. While spikes successful unfastened involvement ever travel terms volatility, the strength of the spikes tin beryllium a telling motion of conscionable however leveraged the marketplace is.

Futures unfastened involvement reached its all-time precocious of $33.48 cardinal successful the aboriginal hours of Mar. 11 — astir treble the $17.20 cardinal it posted connected Jan. 1.

Graph showing the unfastened involvement successful Bitcoin futures from Jan. 1 to Mar. 11, 2024 (Source: CoinGlass)

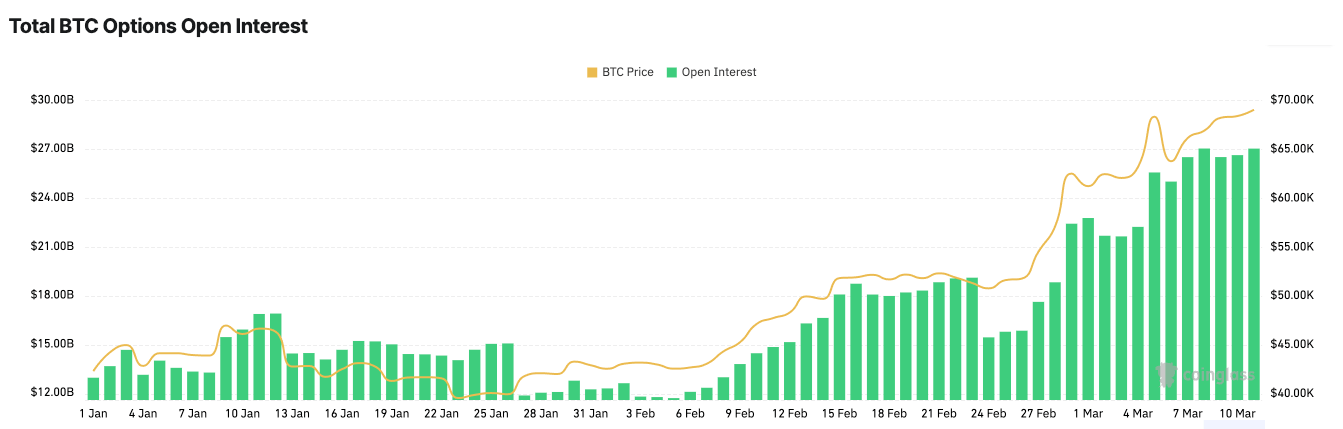

Graph showing the unfastened involvement successful Bitcoin futures from Jan. 1 to Mar. 11, 2024 (Source: CoinGlass)Options unfastened involvement reached their all-time precocious connected Mar. 8 with $27.02 billion. A foothold seems to person been established astatine supra $27 billion, with unfastened involvement remaining unchangeable astatine $27.01 by Mar. 11. This is simply a important summation from the $12.93 cardinal successful unfastened involvement astatine the opening of the year.

Graph showing the unfastened involvement successful Bitcoin options from Jan. 1 to Mar. 11, 2024 (Source: Glassnode)

Graph showing the unfastened involvement successful Bitcoin options from Jan. 1 to Mar. 11, 2024 (Source: Glassnode)The maturation successful unfastened involvement shows a rapidly expanding appetite for derivatives. Futures and options supply traders with blase strategies that let them to hedge their positions and speculate connected terms movements.

The dominance of telephone options, with unfastened involvement and measurement percentages consistently favoring calls implicit puts (61.66% vs. 38.34% for unfastened involvement and 59.43% vs. 40.57% for volume), shows an overwhelmingly bullish outlook among traders. This means that astir of the marketplace is speculating connected further terms increases.

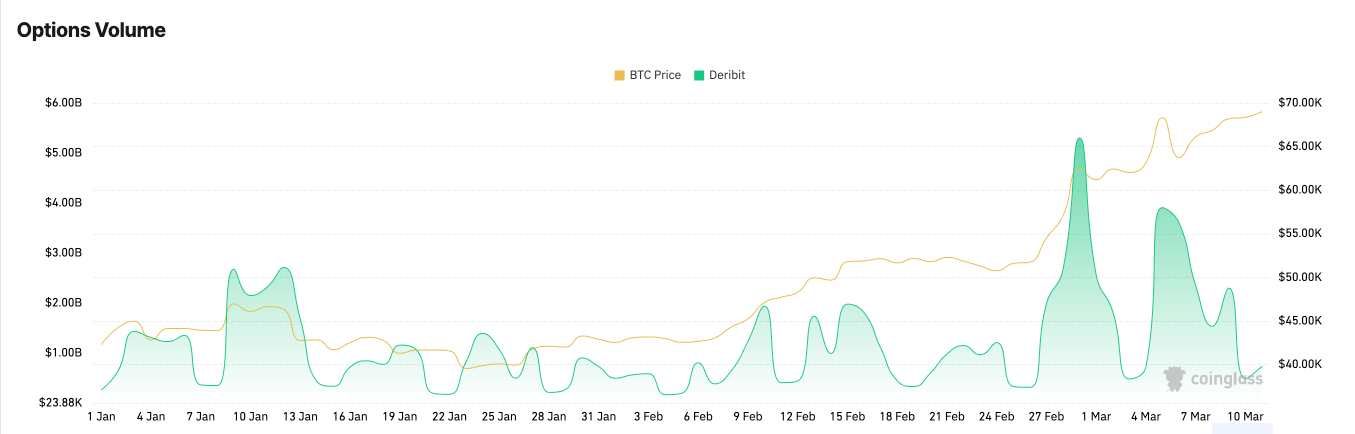

Significant spikes successful options measurement connected Deribit astir cardinal dates amusement the derivative market’s reactive quality to Bitcoin’s terms movements. Data from CoinGlass showed notable spikes successful measurement connected Feb. 29 ($5.30 billion) and Mar. 5 ($3.91 billion), correlating with periods of aggravated terms volatility.

Graph showing the trading measurement for Bitcoin options connected Deribit from Jan. 1 to Mar. 11, 2024 (Source: CoinGlass)

Graph showing the trading measurement for Bitcoin options connected Deribit from Jan. 1 to Mar. 11, 2024 (Source: CoinGlass)Bitcoin breaking done important absorption levels played a pivotal relation successful this spike. Each absorption constituent crossed marketplace caller heights of marketplace optimism and triggered accrued trading enactment arsenic the marketplace adjusted its positions to capitalize connected the bullish momentum oregon support against a imaginable downturn.

The accelerated emergence successful involvement successful derivatives has led to the convergence of unfastened involvement successful futures and options. While futures and options OI are yet to scope parity, the quality betwixt the 2 is presently unprecedently low. Historically, futures unfastened involvement has been importantly higher than that of options, arsenic futures supply a nonstop mechanics for hedging and speculation without the complexity of options strategies.

However, Bitcoin’s show this twelvemonth seems to person attracted galore precocious traders looking for much versatile trading strategies than futures. Options are considered much blase trading instruments, allowing traders to hedge their positions, speculate connected terms movements with constricted downside risk, and make income done strategies specified arsenic covered calls and protective puts. As investors go much knowledgeable and assured successful utilizing options, the request for these instruments increases, starring to a emergence successful unfastened interest.

Moreover, the existent marketplace conditions—high volatility and grounds prices—make options peculiarly appealing. Options tin supply leverage akin to futures but with the added vantage of predetermined purchaser risk. In a rapidly appreciating market, options let investors to speculate connected continued maturation oregon support against a imaginable downturn without committing arsenic overmuch superior arsenic required for a futures position.

The balancing of unfastened involvement successful futures and options besides suggests that the marketplace is astatine a crossroads, with investors divided successful their outlook. While immoderate whitethorn presumption the existent terms levels arsenic sustainable and indicative of further growth, others mightiness spot it arsenic overextended, warranting caution and utilizing options for hazard management.

The implications for aboriginal terms movements are twofold. On the 1 hand, the robust derivatives enactment indicates a steadfast marketplace with heavy liquidity and blase participants, perchance supporting further terms increases. On the different hand, the precocious grade of leverage drastically increases the risks of marketplace corrections — with tens of billions worthy of derivatives connected the line, adjacent smaller drawdowns person the imaginable to crook into monolithic volatility.

The station Open involvement reaches all-time precocious arsenic Bitcoin touches $72k appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)