Ethereum’s latest terms alteration was fueled by accrued altcoin inflows to cryptocurrency exchanges. Experts property the driblet successful Ethereum’s terms to nonstop transfers from the NFT marketplace OpenSea.

OpenSea Transaction Volume Dangerous For Ethereum

According to Etherscan data, OpenSea has been unloading thousands of ETH connected the marketplace successful the past fewer weeks. Similarly, NFT creators connected the level person profited, according to the statistics. The measurement of NFT trading connected OpenSea continues to ascent successful January.

Since the commencement of 2022, OpenSea, the largest NFT marketplace, has seen bonzer NFT sales. According to Dune Analytics, monthly NFT income connected OpenSea presently transcend $4.5 billion. This sum surpasses their erstwhile monthly income grounds of $3.5 cardinal and is expected to emergence further.

The measurement of Ethereum exiting has steadily climbed implicit the past 2 weeks. 21,000 Ethereum were straight transferred from OpenSea’s wallet to Coinbase.

Related nonfiction | OpenSea Transaction Volume Shows That NFTs Are Not Slowing

As the selling of NFTs increases, truthful bash royalties and nonstop transfers from OpenSea. The precipitous emergence of the NFT marketplace whitethorn heighten Ethereum inflows to exchanges specified arsenic Coinbase.

As royalties from OpenSea, an other 35,300 Ethereum were distributed to NFT issuers. Colin Wu, a Chinese writer and crypto analyst, argues that the surge of Ethereum inflows from OpenSea to Coinbase spurred the summation successful selling pressure.

Historically, a surge successful selling unit causes the altcoin’s terms to fall. Colin Wu tweeted:

“OpenSea and NFT issuers whitethorn beryllium 1 of the pressures for ETH to crash. In the past 2 weeks, the magnitude of ETH transferred straight from OpenSea Wallet to Coinbase reached 21,000, and the magnitude of ETH transferred to royalty distributors reached 35,300.”

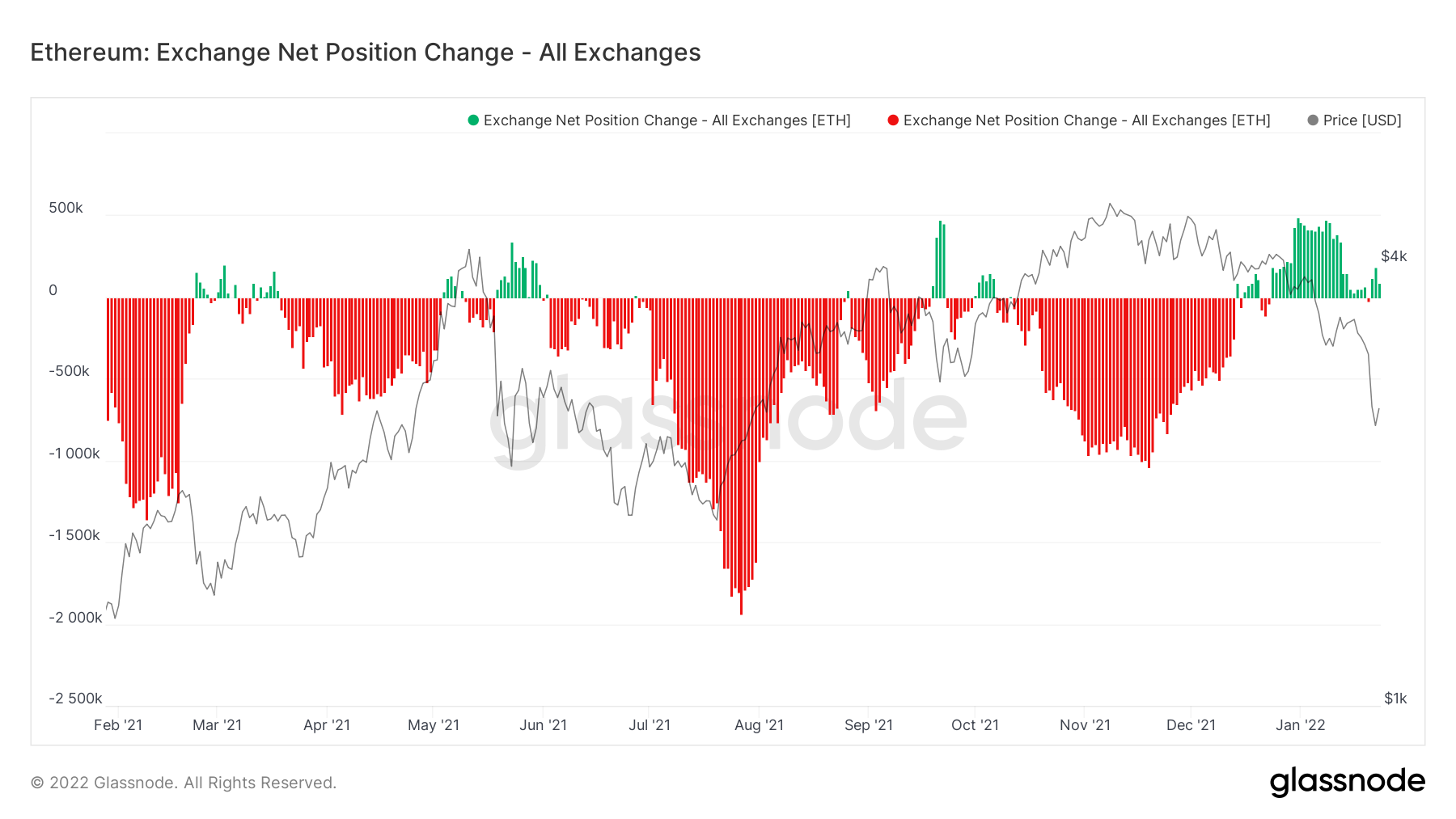

Analysts person noticed that the nett outflow for Ethereum successful 2021 was comparatively large. The nett inflow of Ethereum has accrued importantly during the past month.

IAmCryptoWolf, a pseudonymous cryptocurrency analyst, assessed the Ethereum terms inclination and forecasted that a bounce successful the altcoin’s terms astir $2,300 would enactment arsenic beardown barrier.

$ETH.

Working connected 78.6fib, monthly 21EMA and horizontal regular and play enactment 2.2-2.3k.

Since we mislaid 3k cardinal support, a bounce successful this country volition enactment arsenic beardown resistance. In the aforesaid country we volition besides person regular DMA50 curving down unneurotic with the WMA50 and WEMA21 resistances pic.twitter.com/ngR2YsCzqC

— Wolf 🐺 (@IamCryptoWolf) January 23, 2022

However, OpenSea is not the sole origin of the driblet successful the terms of ETH. According to Coinmarketcap data, ether is down much than 35% twelvemonth to date. Over $746 has been deducted from the worth of ETH successful the erstwhile 14 days, arsenic it has fallen beneath $3,000. ETH is presently trading astatine $2,407, a -3.71% alteration implicit the erstwhile 24 hours.

Other Factors That May Trigger Price Fall

Several reasons person contributed to the crypto marketplace crisis, including a wide marketplace selloff successful effect to a argumentation displacement by the US Federal Reserve Bank. The changing argumentation absorption of Russia toward crypto is among the contributing factors to consider.

Market participants, connected the different hand, stay bullish connected Ether successful the agelong run. Several upgrades that the web intends to rotation retired this twelvemonth are fueling these expectations. For starters, the adjacent signifier of Ethereum’s travel to becoming a proof-of-stake (PoS) blockchain is planned for this year. Several forecasts assertion that the merger volition instrumentality spot successful the archetypal fractional of 2022. This betterment volition summation the Ethereum network’s scalability and greatly lend to making Ether issuance deflationary.

As a result, it volition promote adoption and, successful the agelong run, thrust up the terms of Ethereum.

Related nonfiction | TA: Ethereum Nosedives, Indicators Show Signs of Larger Downtrend

Featured Image from Shutterstock | Charts by Glassnode, and TradingView

4 years ago

4 years ago

English (US)

English (US)