Is a 10-fold terms instrumentality not doing it for you? How astir 90x?

The latest structured-finance alchemy from the crypto manufacture allows traders to get exponential returns connected the terms of ether (ETH), already 1 of the world's astir volatile assets.

Last week, the decentralized options protocol Opyn launched an ether derivative declaration linked to a caller scale called Squeeth – a connection play connected “squared-ether.” The scale tracks ether’s terms change, raised to the powerfulness of two. It takes leverage to the exponential degree.

There's adjacent a token for that: Traders tin instrumentality bullish vulnerability to the Squeeth scale by purchasing oSQTH connected the decentralized cryptocurrency speech Uniswap. The token, which is designed to way the index, is configured for the Ethereum blockchain nether the wide utilized ERC-20 standard.

The basal intent of the caller instrumentality is to springiness traders vulnerability akin to the highly leveraged bets they could get from trading options, but without the request to acceptable onslaught prices oregon find declaration expiration dates, according to a Jan. 9 blog post by Wade Prospere, caput of selling and assemblage astatine Opyn.

Squeeth turns the options commercialized into a perpetual declaration and tin beryllium utilized arsenic a hedge, Prospere told CoinDesk. On the agelong broadside – betting connected terms upside – the commercialized offers leverage without liquidations. Traders who instrumentality the abbreviated broadside – betting connected prices to enactment range-bound – tin cod premium yield, helium said.

“The perfect marketplace information to clasp Squeeth is erstwhile a trader has condemnation successful the upward terms question of ETH successful the short- to mid-term,” Wade Prospere, caput of selling and assemblage astatine Opyn, told CoinDesk.

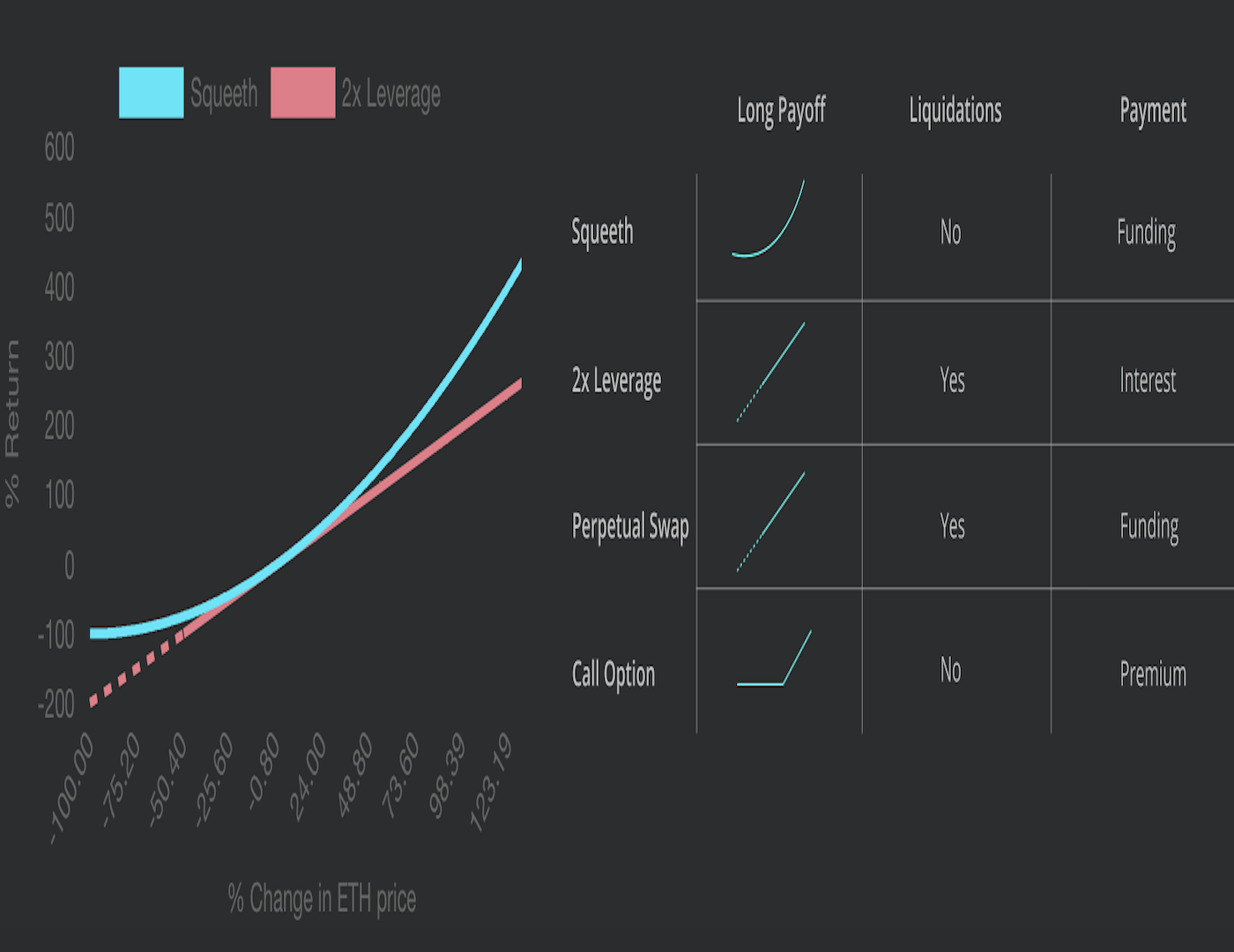

One opposition is with the ETH-2X flexible leverage index – a operation merchandise offering 2X leverage wherever traders simply get treble the underlying returns; deliberation exponential versus geometric; a two-times oregon "2x" multiplier turns a triple into a sextuple; but a "squared" instrumentality turns a triple into a nonuple.

Holders of Squeeth volition marque much erstwhile ETH goes up and suffer little erstwhile ETH goes down.

Say a trader purchases $1,000 worthy of the Squeeth tokens. If the terms of ether triples from $3,000 to $9,000, the Squeeth would spell up triple-squared, oregon 9-fold – to $9,000 successful this example. On the contrary, if ether halves to $1,500, Squeeth volition spot a less-than-linear decline, arsenic represented by the curved payoff enactment below:

Squeeth payoff vs 2-x leverage payoff. (Opyn)

A cardinal drawback is that Squeeth backing rates – the outgo of holding agelong positions – are expected to beryllium higher than a 2x leveraged presumption owed to the product’s vulnerability to axenic convexity. The changeless backing bleed from the agelong presumption results successful the oSQTH’s underperformance comparative to the Squeeth index.

So acold the merchandise has received a lukewarm reception from the crypto community, according to Opyn.

"On time 1, we saw immense Squeeth trading activity,” Opyn CEO Zubin Koticha told CoinDesk successful an email. "There was immense buy-side demand."

"Because of this, much radical were trading Squeeth than ETH-2x flexible leverage index, adjacent though that excavation is 6x bigger,” Koticha added.

In cryptocurrency trading, it's each astir the x's.

Uniswap has seen implicit $12 cardinal of the oSQTH tokens alteration hands since inception. Further, the ether-Squeeth liquidity excavation (ETH/oSQTH) connected Uniswap has raked successful $6 cardinal successful full worth locked – the astir commonly utilized metric to measurement the size of collateral invested successful decentralized concern protocols. Traders providing liquidity person fees, according to the official blog.

There is nary escaped luncheon successful finance

While Squeeth provides a importantly higher upside than different instruments, it besides charges a comparatively precocious backing complaint – a interest longs wage shorts for maintaining the bullish exposure.

In the "perpetuals market" – a wide adopted crypto-markets innovation designed to springiness traders casual leverage – agelong traders wage backing to abbreviated traders erstwhile the perpetual declaration trades supra the scale price, and vice versa. The backing mechanics is designed to assistance support the perpetuals terms tethered to the terms of the underlying asset.

Those costs inactive beryllium with Squeeth, but they're a spot tougher to see: The equivalent marketplace terms of oSQTH astir ever trades supra the Squeeth index, implying a premium – a de facto outgo for traders who are going long.

At property time, the estimated backing complaint was 0.29%. It doesn't dependable similar a lot, but that's a regular rate, truthful implicit the people of 365 days, compounded, the yearly complaint works retired to astir 65% – a costly vig that tin devour into returns implicit time.

As such, the merchandise is amended suited for traders anticipating a large rally successful a abbreviated period. Even Opyn's executives are speedy to constituent retired the dynamic.

“Holding a agelong Squeeth presumption for an extended play (> 1 year) during which ETH trades sideways oregon goes down successful worth volition apt origin a nonaccomplishment successful ETH-squared vulnerability of the agelong Squeeth presumption owed to in-kind backing paid to abbreviated Squeeth sellers," Opyn’s Prospere told CoinDesk.

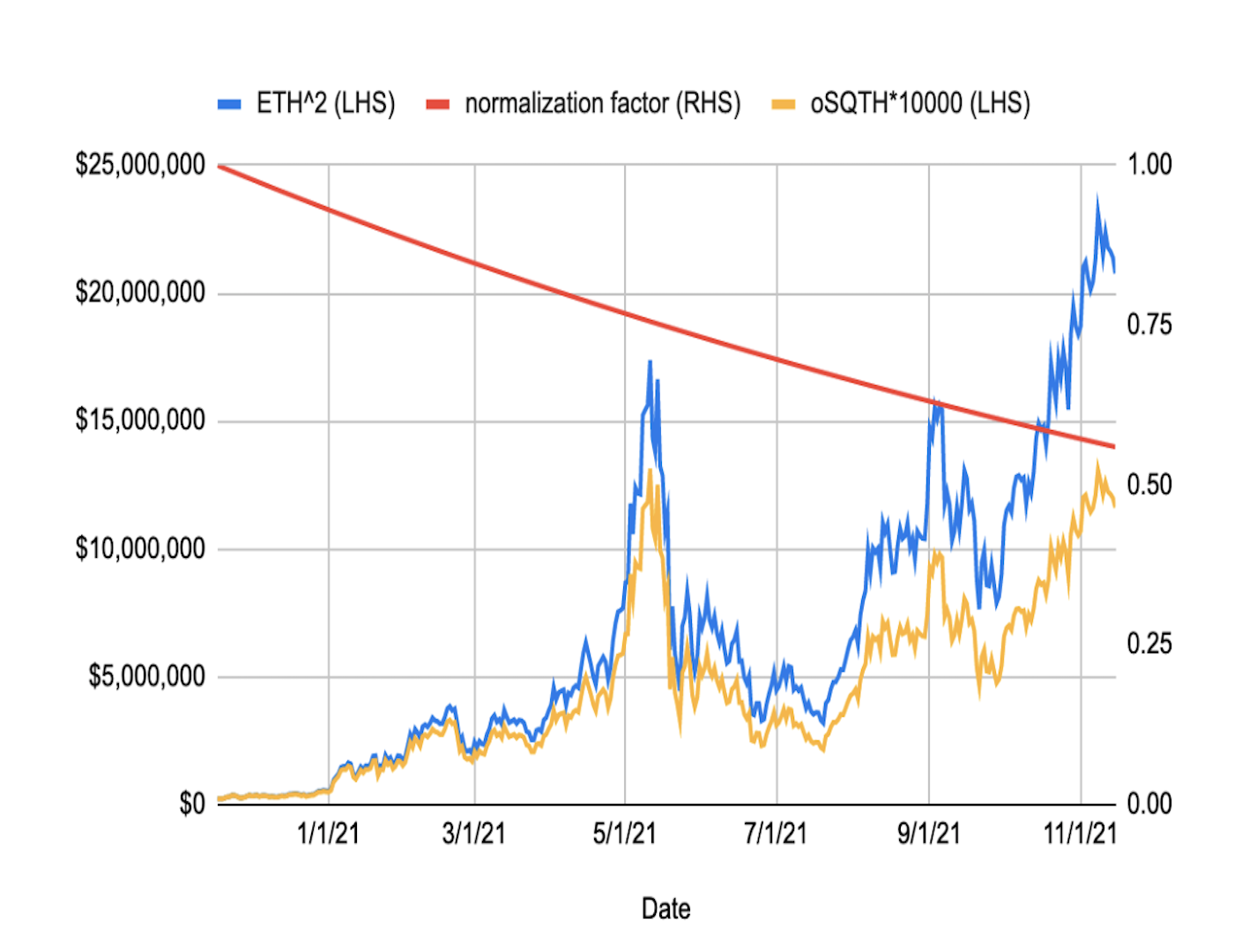

Simulations tally by Opyn, assuming changeless volatility and backing rate, to exemplify the interaction of in-kind funding, amusement that portion the Squeeth roseate 90-fold successful the twelvemonth to November 2021, the oSQTH token tracking the scale roseate 50-fold (graph below).

Squeeth simulations tally by Opyn assuming changeless volatility and backing rates. (Opyn)

Blockchain information researcher Mudit Gupta said the merchandise is "great for short-term trades, arsenic it offers higher upside and little downside."

According to Joseph Clark, a mechanics decorator astatine Opyn, Squeeth tin besides beryllium used arsenic hedge on with ether derivatives connected the decentralized speech Uniswap V3.

Shorts prone to liquidations

While the changeless in-kind backing collected from agelong positions ensures determination are nary liquidations owed to borderline calls, traders with abbreviated positions are inactive liable to having their bets forcibly closed out.

Traders shorting Squeeth are efficaciously abbreviated the oSQTH token and agelong ether collateral. That’s due to the fact that they archetypal request to deposit ether connected Opyn’s level arsenic collateral – successful bid to mint the oSQTH tokens earlier shorting them connected Uniswap. These traders gain a backing complaint for taking connected this position, paid by Squeeth holders.

If ether’s terms abruptly were to jump, the borderline telephone required to support the squared abbreviated presumption afloat collateralized would transcend immoderate summation successful the worth of the ether collateral – starring to liquidation oregon forced closure of the abbreviated presumption by the protocol.

"Large regular moves successful the ETH terms go overmuch larger erstwhile they are squared," Prospere said. "If the ETH terms is increasing, users could request to apical up collateral to debar being liquidated."

At the recommended collateralization ratio of 200%, the perfect marketplace information to abbreviated Squeeth is erstwhile traders are convinced that the marketplace is overpricing aboriginal terms volatility – successful different words, erstwhile the traders spot less chaotic terms swings up than successful the prevailing views of the market.

So selling Squeeth is simply a stake connected little volatility. Of course, that doesn't mean it won't beryllium volatile trading Squeeth itself.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)