In Nov. 2021, bitcoin’s marketplace valuation managed to marque it into the apical 10 database of assets ranked by marketplace capitalization, arsenic it was the eighth largest marketplace headdress past twelvemonth connected Nov. 9. Since then, bitcoin is 75% little successful worth against the U.S. dollar and the starring crypto asset’s marketplace capitalization has dropped down to the 26th largest presumption among the astir invaluable assets and companies worldwide.

Bitcoin’s Market Cap Is Just Below Chevron’s and Just Above the Home Depot’s Market Valuations

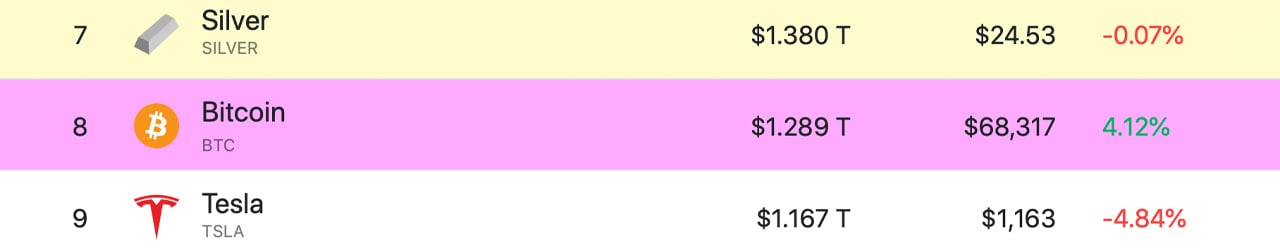

Just implicit a twelvemonth agone successful Nov. 2021, bitcoin’s (BTC) marketplace capitalization was the eighth largest retired of a myriad of companies and assets traded globally. At the time, connected Nov. 9, 2021, an archive.org snapshot collected from companiesmarketcap.com shows BTC’s marketplace valuation was $1.289 trillion arsenic each portion was swapping for conscionable implicit $68K.

Bitcoin’s presumption connected companiesmarketcap.com connected Nov. 9, 2021.

Bitcoin’s presumption connected companiesmarketcap.com connected Nov. 9, 2021.On that day, BTC’s marketplace headdress was beneath the precious metallic silver’s wide valuation, which was $1.380 trillion connected Nov. 9, 2021. The starring crypto plus was conscionable supra Tesla’s $1.167 trillion marketplace valuation recorded 395 days ago. Additionally, ethereum (ETH) was situated successful the apical 20 positions of assets ranked by marketplace capitalization arsenic ETH held the 15th largest marketplace headdress connected Nov. 9, 2021.

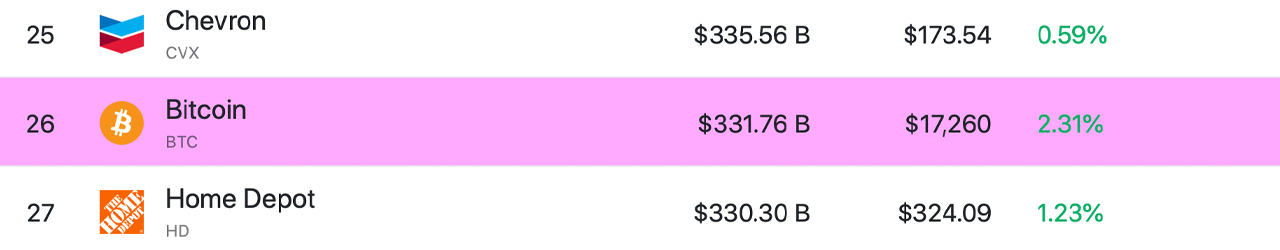

Bitcoin’s presumption connected companiesmarketcap.com connected Dec. 9, 2022.

Bitcoin’s presumption connected companiesmarketcap.com connected Dec. 9, 2022.At the time, ETH’s marketplace valuation was astir $570.45 cardinal arsenic ether was swapping for $4,839 per unit. Ethereum’s marketplace headdress was beneath the institution Tencent which had a marketplace valuation of astir $588.07 billion. The 2nd starring crypto asset’s marketplace headdress was supra JPMorgan Chase’s valuation which was $499.61 cardinal 395 days ago.

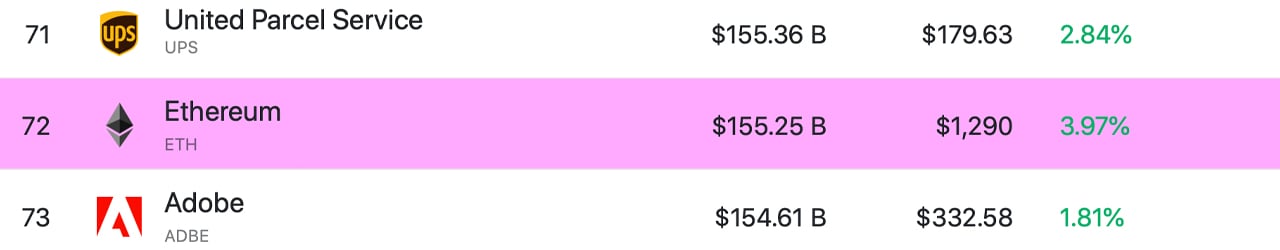

Ethereum’s presumption connected companiesmarketcap.com connected Dec. 9, 2022.

Ethereum’s presumption connected companiesmarketcap.com connected Dec. 9, 2022.Today, connected Dec. 9, 2022, the apical 2 starring crypto assets BTC and ETH person overmuch little valuations than they did a twelvemonth ago. Bitcoin is not represented successful the apical 10 standings of assets ranked by marketplace capitalization arsenic it’s present wrong the apical 30 positions and ranked astatine 26. The $331.76 cardinal marketplace headdress BTC holds contiguous is conscionable beneath Chevron’s marketplace headdress of astir $335.56 billion.

Further, bitcoin’s marketplace capitalization is conscionable supra the wide marketplace valuation of Home Depot, which is valued astatine $330.30 cardinal connected Dec. 9. Ethereum has slid a large woody from the 15th largest presumption arsenic it present holds the 72nd spot with a marketplace headdress of astir $155.25 billion. Ether’s marketplace headdress is beneath the United Parcel Service (UPS) which is $155.36 billion, and it’s conscionable supra the valuation of Adobe ($154.61B).

Ethereum’s existent marketplace terms is astir 73.7% little than it was 395 days agone connected Nov. 9, 2021. Though BTC and ETH person seen their marketplace caps driblet little during the past year, the aforesaid tin beryllium said for a ample fig of antithetic assets and companies. Some assets, similar gold’s wide marketplace valuation, conversely recorded increases implicit the past 12 months. Gold’s headdress successful Nov. 2021 was astir $11.605 trillion, and contiguous it’s worthy $11.910 trillion.

Microsoft was the second-largest plus a twelvemonth ago, but it’s present successful the 3rd presumption arsenic Microsoft’s valuation dropped from $2.53 trillion to today’s $1.844 trillion. Google’s oregon Alphabet’s marketplace headdress was astir $1.98 trillion and successful the 5th presumption 395 days agone connected Nov. 9, 2021, and connected Dec. 9, 2022, it’s down to $1.213 trillion. Silver’s presumption successful the apical 10 database moved up from the seventh to the 5th position, but the precious metal’s marketplace headdress inactive dropped from $1.38 trillion to today’s $1.316 trillion.

Tags successful this story

What bash you deliberation astir bitcoin’s autumn from the apical 10 astir invaluable assets and companies worldwide down to the 26th position? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, editorial photograph credit: companiesmarketcap.com

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)