Russia’s battle connected Ukraine deed fiscal markets connected Thursday, with stocks and futures markets successful Europe and Asia falling 2% and the crypto marketplace losing astir 9%.

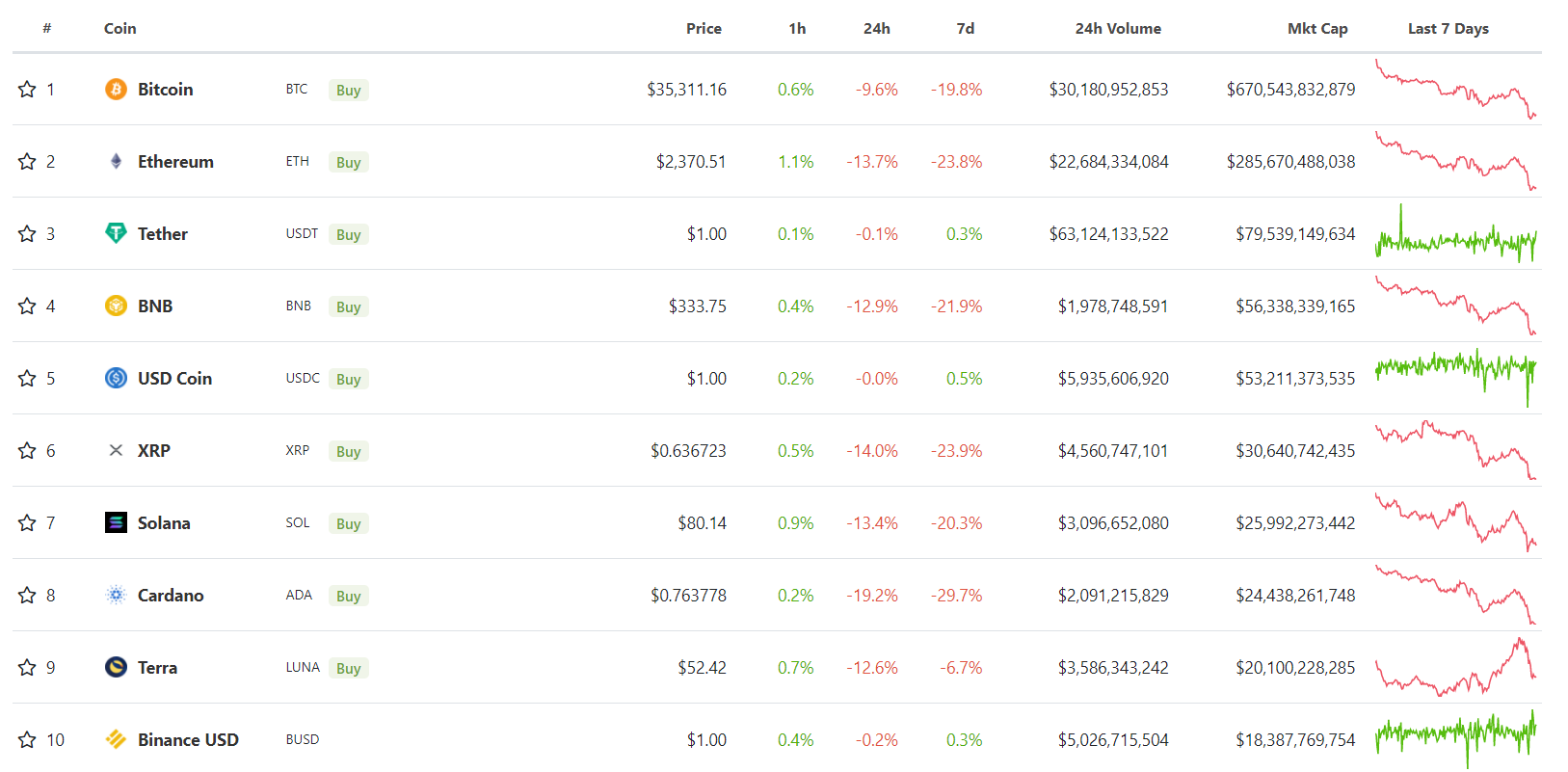

Bitcoin fell 9% successful the past 24 hours, touching play lows of $34,725 successful aboriginal Asian trading. Other large cryptocurrencies besides slumped, with ether losing 13%, Solana’s SOL 15%, and Cardano’s ADA 18% – the astir among the biggest cryptos by marketplace capitalization.

Cryptos saw double-digit percent drops. (CoinGecko)

“The menace of warfare had already been hanging implicit investors,” said Susannah Streeter, a markets expert astatine Hargreaves Lansdown successful an email to CoinDesk. “The daze of the penetration sent the terms of lipid hurtling up by much than 7% mode supra $100 a barrel, reaching much [than] $103 earlier falling backmost a notch.”

“Market volatility has accrued since the opening of the year, stoked by rising involvement rates, and today’s quality has added substance to the marketplace turbulence,” she said.

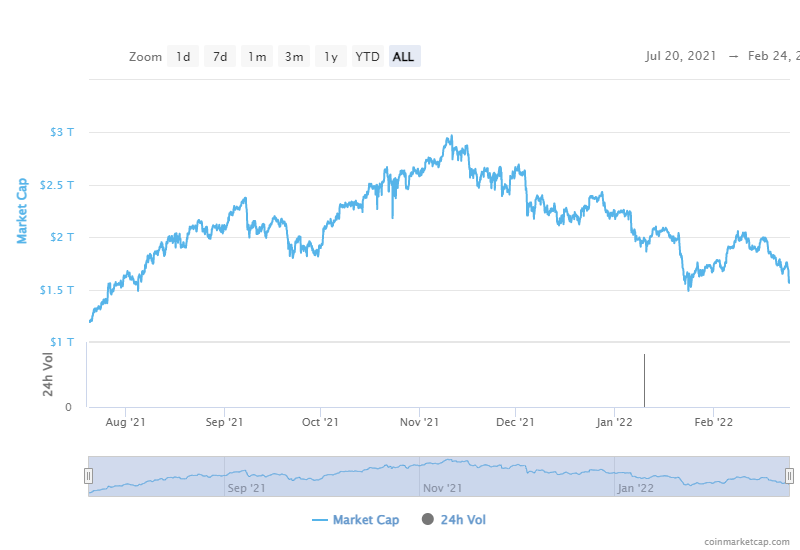

Some analysts noted that geopolitical tensions person been among the large cardinal reasons for a descent successful cryptocurrencies, which person shed astir $1.4 trillion successful worth from November 2021 highs, according to information from CoinMarketCap.

Market capitalization has fallen astir $1.4 trillion since November. (CoinMarketCap)

“The imaginable of geopolitical escalation has been the main operator of terms moves successful the broader hazard plus spectrum for the past mates of weeks,” said Anto Paroian, main operating serviceman astatine crypto concern money ARK36, successful an email to CoinDesk. “Now that the warfare betwixt Russia and Ukraine has go reality, investors are rushing to instrumentality hazard disconnected the table, and banal markets globally are seeing large declines.”

Meanwhile, traders said bitcoin was much lucrative arsenic an plus compared with different large cryptocurrencies, contempt the drop.

“Right now, the markets person the highest request for liquid instruments, making bitcoin somewhat little of a hazard than altcoins,” said Alex Kuptsikevich, a elder fiscal expert astatine FxPro, successful an email to CoinDesk.

“It is apt that a further deterioration successful the fiscal concern could payment the archetypal cryptocurrency arsenic a means of superior savings for investors from Ukraine, Russia, and immoderate adjacent countries,” helium said.

Kuptsikevich cautioned much declines could beryllium coming. “The continued formation from risky assets, including equities, could temporarily destabilize altcoins, truthful it is imaginable that we volition spot double-digit losses successful altcoins much than erstwhile successful the coming days,” helium said.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)