sponsored

In the increasing DeFi panorama, some organization traders and retail investors are starting to announcement the inherent privateness issues with the astir fashionable Layer-1 blockchains.

The utmost transparency of L1s specified arsenic Ethereum, Solana, and Avalanche, to sanction a few, leaves investors susceptible to attacks specified arsenic front-running and MEV. Meanwhile, the deficiency of interchain features to prehend the galore opportunities of a thriving ecosystem keeps billions of dollars successful worth separated. And, of course, traceability and surveillance are issues permanently looming connected the horizon.

Introducing Panther Protocol, the Missing Piece successful the PriFi Ecosystem

While astir of the crypto ecosystem is alert of the privateness pitfalls of different ground-breaking blockchains, Privacy Finance has not yet had its accidental to blossom.

This is due to the fact that galore of its proponents connection fragmented, siloed solutions to the privateness vs. spot paradox, hindering their inferior and adoption. Privacy coins are mostly not programmable oregon EVM-compatible. Currently disposable L2 solutions are usually centralized. On-chain mixers are single-use and can’t turn their ain ecosystem. Even on-chain L1 solutions have, by nature, azygous points of failure. Moreover, the privateness ecosystem consisting of respective isolated projects yields scant web effects, hindering maturation crossed the board.

Panther protocol aims to lick this by creating a unsocial strategy afloat of synergic products and on-chain services. These see backstage liquidity and transactions for each crypto assets, an affordable and scalable backstage interchain DEX, trustless information proofs enabling privacy-preserving information sharing successful Web3, and aggregate different impactful PriFi solutions.

Users of Panther volition beryllium capable to wrap immoderate token, successful immoderate chain, arsenic a zAsset utilized to transact privately. For example, 1 zETH would beryllium a 1:1 shielded representation of an Ether, acceptable to beryllium utilized crossed DeFi applications and connected aggregate chains. Panther is presently gathering connected Ethereum, Polygon, Near, Avalanche, Elrond and Flare.

At the halfway of Panther protocol’s plan is its token, $ZKP, which plays a important relation successful Panther’s imaginativeness to infuse DeFi with privacy. $ZKP’s galore utilities and thoughtful tokenomics founded connected crippled mentation are designed to assistance the token accrue worth portion the protocol captures TVL. This nonfiction explores the request for Panther successful PriFi, $ZKP’s potential, and the main factors that tin power Panther’s TVL.

Panther’s Roadmap, successful Less Than a Minute

Panther’s go-to-market strategies tin beryllium summarized successful 3 stages:

- Launching with an assemblage of retail investors seeking privateness connected Layer-1 and Layer-2 blockchains. Panther’s interchain features tin pull users seeking yields successful antithetic blockchains, creating affirmative Alpha for institutions to follow.

- Building credibility and usage cases to yet encompass the full existing DeFi system and those attracted to it acknowledgment to enhanced privacy. Institutions tin usage Panther arsenic a decentralized mentation of institutional Dark Pools, explained below.

- Eventually, becoming a centerpiece successful the plan of each Web3 applications, enabling a afloat backstage on-chain economy, and DeFi arsenic a whole.

Utilities of the ZKP Token

Some of the behaviors that Panther incentivizes done $ZKP are:

- Staking $ZKP to gain rewards for adding tokens to Pools and expanding the privateness set, that is, the prime of its privacy. This decreases the proviso of $ZKP and drives its worth up. Panther tin enactment arsenic a terms find mechanics for privacy, bringing successful caller users for a affirmative feedback loop, yet lowering the outgo of privateness for everyone.

- Bootstrapping the maturation of the Protocol by encouraging the Panther DAO to bargain backmost $ZKP tokens to make reward programs.

- Having a strategy of bridges to aggregate chains that pays fees privately connected behalf of users, furthering anonymity, to gain $ZKP.

- The DAO tin acquisition $ZKP from the unfastened marketplace utilizing the fees collected from users receiving discounts. These fees volition past beryllium utilized by the Panther DAO to wage for each the services above. This could marque $ZKP deflationary depending connected web activity.

Tokenomics, Inflation, and Distribution

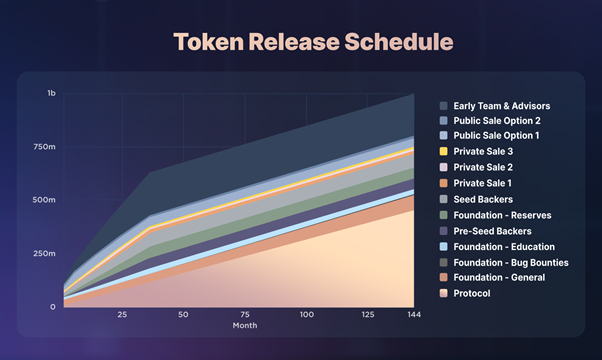

These 3 charts clasp indispensable accusation astir $ZKP’s tokenomics:

Chart #1 – Allocation per stakeholder.

Chart #2 – Token merchandise schedule.

Chart #3 – Key metrics connected launch.

Panther’s tokenomics are designed so, with a token terms astatine motorboat of astir $0.40 and 110M $ZKP circulating, Panther’s marketplace headdress (MC) volition beryllium astatine a blimpish approximate of $41M. The Fully Diluted Value (FDV) volition frankincense beryllium astir $400M. The proportionality betwixt Market Cap and FDV (or simply MC/FDV ratio) is important to recognize however invaluable the token could go should it rapidly accrue TVL.

Panther’s archetypal 10% MC/FDV ratio is amended disconnected the bat than immoderate established names successful DeFi. Moreover, the 12-year vesting play assures a creaseless gradual merchandise with a constricted interaction connected price, astir apt unnoticeable arsenic request grows exponentially. After 144 months, nary much $ZKP tokens volition ever beryllium minted, and $ZKP becomes afloat deflationary, portion TVL drives the cognition of the token arsenic valuable.

External and Internal Factors Driving TVL

TVL is 1 of the astir meaningful metrics successful DeFi. Having a Total Value Locked higher than a project’s MC tin beryllium seen arsenic a catalyst for protocol growth. Given its organization backing and investors, Panther’s $40 cardinal should beryllium easy reachable. Staking by itself should fastener distant adjacent to $13M from Day 1, assuming a 30% staking ratio. Attracting much TVL done coagulated incentives and increasing utilities should marque a adjacent $2.5 – $6.0 token terms alternatively probable.

There are respective factors that could determination Panther’s TVL to turn faster than its circulating marketplace cap. Bringing organization acheronian pools on-chain, erstwhile the protocol has established itself successful the retail market, is simply a captious one. Dark Pools dwell of superior institutions pooling assets to commercialized with each different privately, avoiding moving nationalist prices with their movements. Estimates bespeak that these tools represent up to 18% of the trading volumes successful the US, portion immoderate estimates constituent to 40% worldwide. If these percentages construe to the full DeFi ecosystem, Panther could go a zero-knowledge manufacture TVL achromatic hole.

The blockchain ecosystem besides needs an equivalent to cash, whose full worth (M1 supply) sits astir $15 Trillion. Panther does NOT purpose to make decentralized stablecoins but enables shielding existing stablecoins arsenic zAssets. In that way, Panther tin assistance found a token system that does not trust connected immoderate 1 enactment and that connects assets successful each blockchain.

Panther protocol is chain-agnostic and bets connected a multi-chain future. Its backstage Interchain DEX volition let Panther to address the full DeFi market alternatively of conscionable sections of it. If conscionable 1% of the apical 5 chains’ TVL ends locked successful Panther either owed to $ZKP fees, zAsset wrapping, staking, purchases, etc., this singlehandedly would correspond $1 Billion of TVL.

Through ZK Reveals, the last portion of Panther’s maestro plan, institutions tin usage Panther to support themselves on-chain portion inactive disclosing their transaction past astatine volition to whomever they deem necessary. Reveals unfastened the gross for much institutions to enactment successful the crypto economy. Moreover, arsenic blockchains statesman to beryllium utilized for hosting the Metaverse, decentralized societal apps, verifying integer identities, etc., built-in privateness features go essential to offset the mishappens of cleanable transparency. Therefore, ZK Reveals and backstage plus transfers tin beryllium captious to enabling these systems to support their users.

Composability successful DeFi Is Key

Each of the tools mentioned successful this nonfiction tin beryllium utilized and leveraged by the full ecosystem.

Other DeFi projects whitethorn constitute with Panther-produced primitives to execute results not described here, immoderate of them adjacent beyond what’s presently imaginable successful DeFi and crypto. In this sense, it is adjuvant to deliberation of Panther arsenic a general-purpose tool, alternatively than a privateness hammer, that volition fortify and empower the full crypto industry.

Panther is gathering the tools indispensable to determination arsenic overmuch superior arsenic imaginable from Traditional to Decentralized Finance… but, immoderate whitethorn argue, this is conscionable the beginning.

About Panther Protocol

Panther is an end-to-end privateness protocol connecting blockchains to reconstruct privateness successful Web3 and DeFi portion providing fiscal institutions a wide way to compliantly enactment successful integer plus markets.

Panther provides DeFi users with afloat collateralized privacy-enhancing integer assets, leveraging crypto-economic incentives and zkSNARKs technology. Users tin mint zero-knowledge zAssets by depositing integer assets from immoderate blockchain into Panther vaults. zAssets travel crossed blockchains via a privacy-first interchain DEX and a backstage metastrate. Panther envisions that zAssets volition go an ever-expanding plus people for users who privation their transactions and strategies the mode they should ever person been: private.

Stay connected: Telegram | Website

Disclaimer

The accusation and information contained successful this papers is provided for accusation lone and should not beryllium taken arsenic investment, legal, fiscal oregon different nonrecreational advice. Any opinions expressed successful the papers are the author’s alone, and bash not needfully correspond opinions of Panther Protocol oregon immoderate ineligible entity associated with that project. Nothing successful this papers is, oregon should beryllium considered to be, a fiscal promotion oregon different offering oregon invitation to subscribe for oregon acquisition immoderate plus described oregon referred to successful this document. Information contained successful this papers is lone intended to beryllium existent arsenic of its archetypal day of work and volition not needfully beryllium updated. Any accusation obtained from third-party oregon outer sources is taken from sources reasonably believed by the writer to beryllium accurate, but without providing immoderate assurances arsenic to its accuracy.

This is simply a sponsored post. Learn however to scope our assemblage here. Read disclaimer below.

Bitcoin.com Media

Bitcoin.com is the premier root for everything crypto-related.

Contact [email protected] to speech astir property releases, sponsored posts, podcasts and different options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)