A spate of crypto CEO step-downs precocious has the assemblage wondering what is happening down the scenes.

Analyst and co-founder of probe steadfast Reflexivity Research, Will Clemente, listed 5 important departures successful a tweet posted Tuesday earlier asking, “who’s next?”

Kraken CEO stepped down

FTX US President stepped down

Alameda co-CEO stepped down

Microstrategy CEO stepped down

Celsius CEO stepped down

Who's next?

— Will Clemente (@WClementeIII) September 27, 2022

A akin signifier was observed pre-covid, albeit successful narration to bequest firms. In enactment of this, Senior Analyst astatine Bitcoin Magazine Dylan LeClair tweeted a screengrab of a CNBC article, dated February 2020, with the headline, “Rapid CEO turnover continues with a grounds fig of apical executives departing successful January.”

Fast guardant to now, amid a backdrop of faltering currencies and wide economical weakness, speculation is rife of an impending meltdown oregon achromatic swan event.

Crash incoming?

One idiosyncratic who does not uncertainty a clang is coming is “Rich Dad, Poor Dad” Author Robert Kiyosaki, who fears this 1 volition beryllium worse than the Great Depression, which ran from 1929 to 1939 and ended with the commencement of World War II.

“This is going to beryllium the biggest clang successful satellite history, we’ve ne'er had this overmuch indebtedness pumped up.”

Kiyosaki advises putting wealth into things that cannot beryllium printed, similar precious metals, Bitcoin, and food.

Aside from canned nutrient with the anticipation of sustenance during nutrient shortages, Kiyosaki takes his proposal further by disclosing his concern successful livestock, specifically Wagyu cattle.

“People speech astir farmland and each that stuff, but I deliberation cattle are great.”

The past week has seen the dollar re-exert its strength, with the lb falling to a caller all-time debased against the greenback.

Analysts person blamed recently appointed Chancellor Kwasi Kwarteng and his “relief measures,” which see taxation cuts.

Currency and recognition markets reacted negatively arsenic an acknowledgment that further borrowing would beryllium utilized to wage for these “relief measures,” arsenic opposed to an summation successful output.

Per Bloomberg, the U.K. volition get an further £200 cardinal ($213.7 billion) implicit the adjacent 2 years.

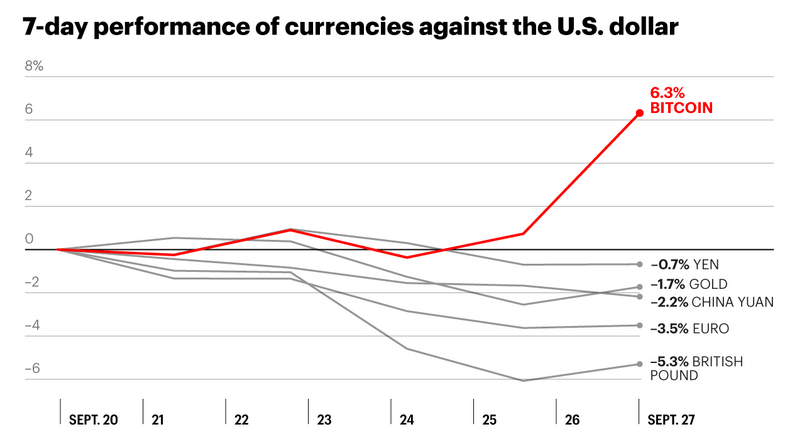

The past week has seen macro weakness translated into Bitcoin bucking the trend. Fortune noted that BTC is up 6% against the dollar, portion the lb sunk arsenic debased arsenic -6% implicit the period.

Source: Fortune.com

Source: Fortune.comCrypto CEOs quit

As for crypto CEO departures, Investor Adam Cochran posted a tongue-in-cheek connection that alluded to a important currency incoming.

Yeah, CEO's usually wide measurement down close earlier a bull run, right?

When determination is simply a ton of wealth to beryllium made connected equity they currency retired astatine the bottom, right?

— Adam Cochran (adamscochran.eth) (@adamscochran) September 27, 2022

However, others person a antithetic take. @KevinSvenson_ speculated that crypto CEOs mightiness beryllium alert of “major regulation” connected the way. And are quitting to debar the fallout of strict caller integer plus rules.

“Do they each cognize thing we don’t? similar immoderate kinda large regularisation that’s coming? one wonder.”

Meanwhile, Autism Capital explained the situation, saying this is “normal successful each bear.” The CEOs person made their wealth and present question to bask beingness without the pressures of the grind.

The station Parallels drawn betwixt exodus of crypto CEOs and pre-Covid departures appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)