The Bitcoin derivatives marketplace experienced important volatility successful the past week. In summation to fluctuations successful unfastened involvement (OI), trading measurement fluctuated significantly.

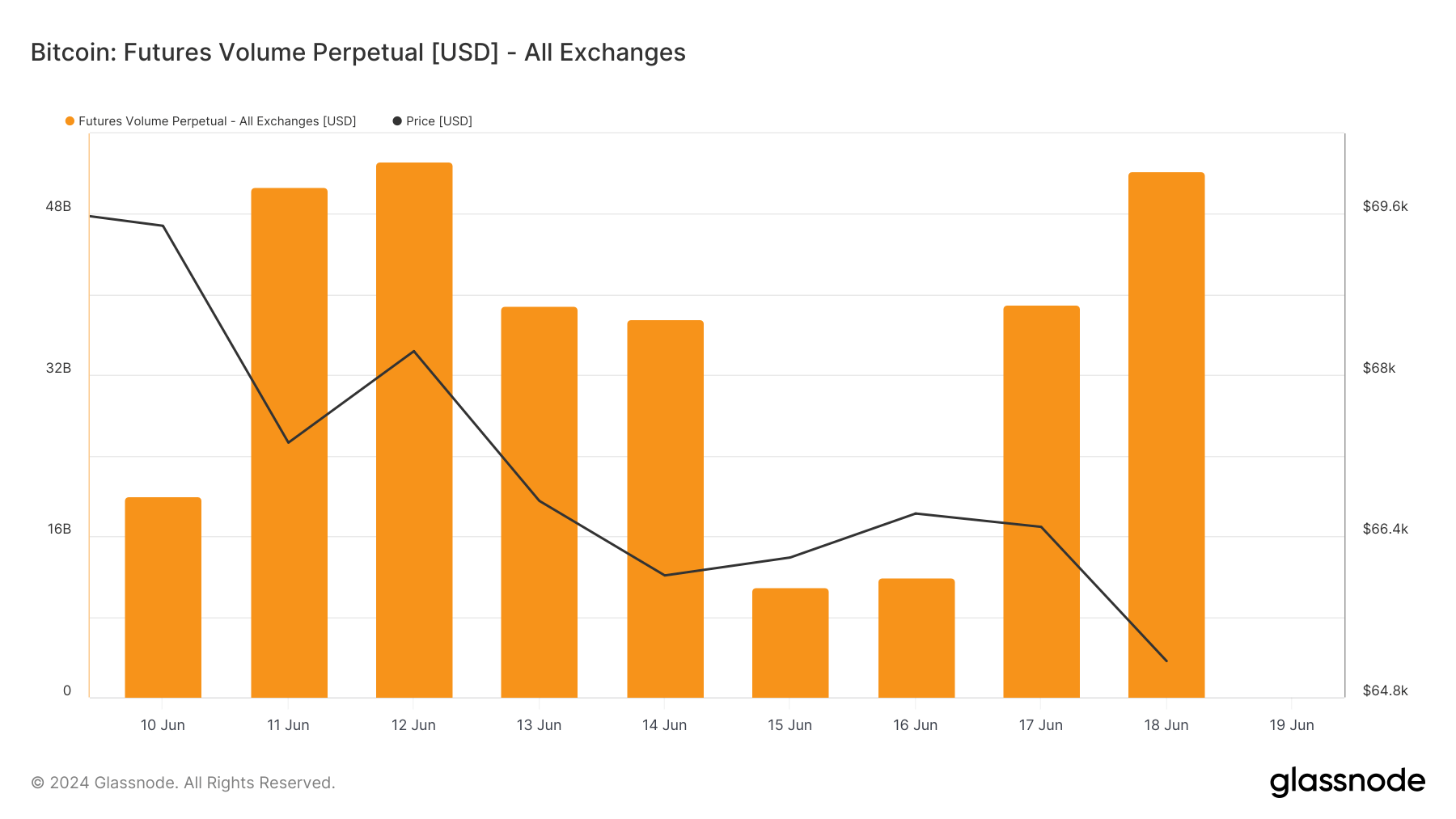

Data from Glassnode showed that the full 24-hour trading measurement for perpetual futures crossed each exchanges dropped from $53.156 cardinal connected June 12 to $10.910 cardinal connected June 15. Trading measurement rebounded to $51.239 cardinal by June 18.

When comparing these fluctuations with Bitcoin’s terms during the aforesaid period, which dropped from $68,237 connected June 12 to $65,160 connected June 18, we announcement that the trading volumes for perpetual futures bash not determination successful strict correlation with price. For instance, the trading measurement dropped importantly connected June 15 and 16 portion Bitcoin’s terms remained comparatively stable, indicating that trading volumes successful perpetual futures are influenced by factors different than conscionable terms movements.

Chart showing the 24-hour trading measurement for Bitcoin perpetual futures crossed each exchanges from June 10 to June 18, 2024 (Source: Glassnode)

Chart showing the 24-hour trading measurement for Bitcoin perpetual futures crossed each exchanges from June 10 to June 18, 2024 (Source: Glassnode)Looking astatine the trading measurement for BTCUSDT perpetual futures connected Binance, we observe a akin signifier of fluctuation, with a precocious of $22.65 cardinal connected June 12, a debased of $4.79 cardinal connected June 15, and past a emergence to $21.82 cardinal by June 18. This is much successful enactment with the wide marketplace trend, showing however important Binance’s relation is successful the perpetual futures market.

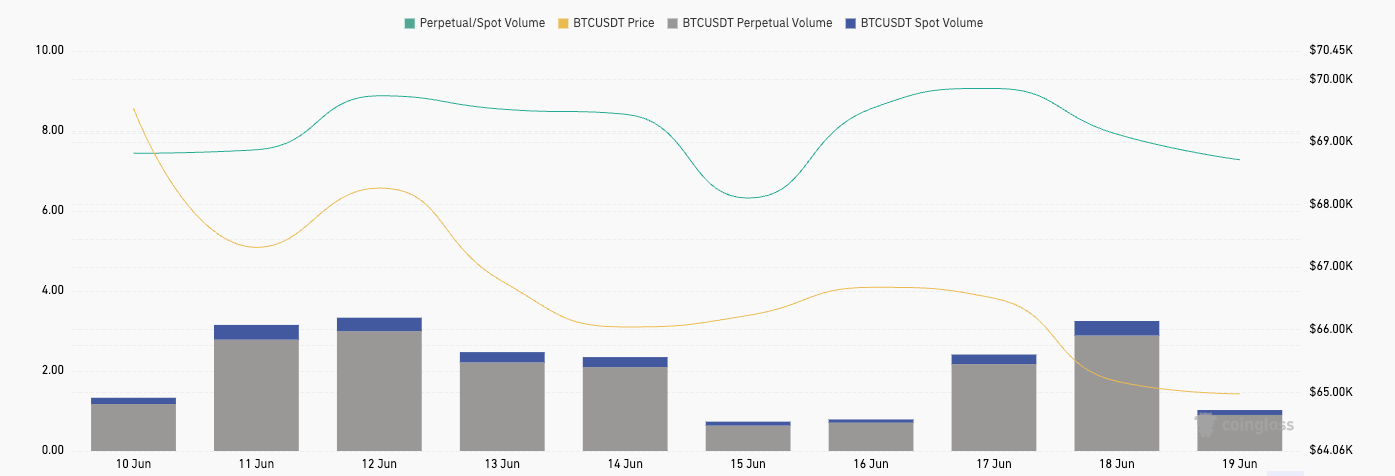

Another discrepancy arises erstwhile comparing the perpetual futures trading measurement connected Binance with the spot trading measurement for the BTCUSDT pair. The spot trading volumes are importantly lower, peaking astatine $2.75 cardinal connected June 18 compared to the perpetual futures’ $21.82 cardinal connected the aforesaid day. The perpetual-to-spot measurement ratio, which varies from 6.32 connected June 15 to 9.06 connected June 17, shows a persistent penchant for trading perpetual futures implicit spot trading connected the exchange.

Graph showing the trading measurement for spot BTCUSDT (blue) and BTCUSDT perpetual futures (gray) from June 10 to June 18, 2024 (Source: CoinGlass)

Graph showing the trading measurement for spot BTCUSDT (blue) and BTCUSDT perpetual futures (gray) from June 10 to June 18, 2024 (Source: CoinGlass)The quality betwixt debased spot measurement and precocious perpetual futures measurement tin beryllium indicative of the information that caller wealth is not entering the marketplace astatine a important rate. Spot trading, which involves the existent acquisition and merchantability of Bitcoin, is mostly associated with caller marketplace entrants looking to get the plus directly. A diminution oregon stagnation successful spot measurement suggests that determination whitethorn beryllium less caller investors buying Bitcoin, which could connote a deficiency of caller superior flowing into the market.

On the different hand, perpetual futures are typically favored by much experienced and blase investors looking to leverage their positions to maximize gains from terms movements. Experienced traders mightiness similar perpetual futures owed to their quality to hedge positions and the accidental to amplify returns done leverage. Market makers and organization players could besides beryllium liable for the precocious volumes we’ve seen. They often usage derivatives to negociate hazard and supply liquidity, importantly influencing the measurement successful perpetual futures markets.

Another important origin to see is the acute authorities of the market. In a marketplace characterized by uncertainty oregon a deficiency of wide direction, similar we’ve seen successful the past week, traders mightiness similar the liquidity and flexibility of derivatives. The quality to rapidly participate and exit positions successful the futures marketplace allows traders to respond to quality and marketplace changes much efficiently than they mightiness successful the spot market.

The station Perpetual futures trading measurement surges arsenic Bitcoin spot trading lags appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)