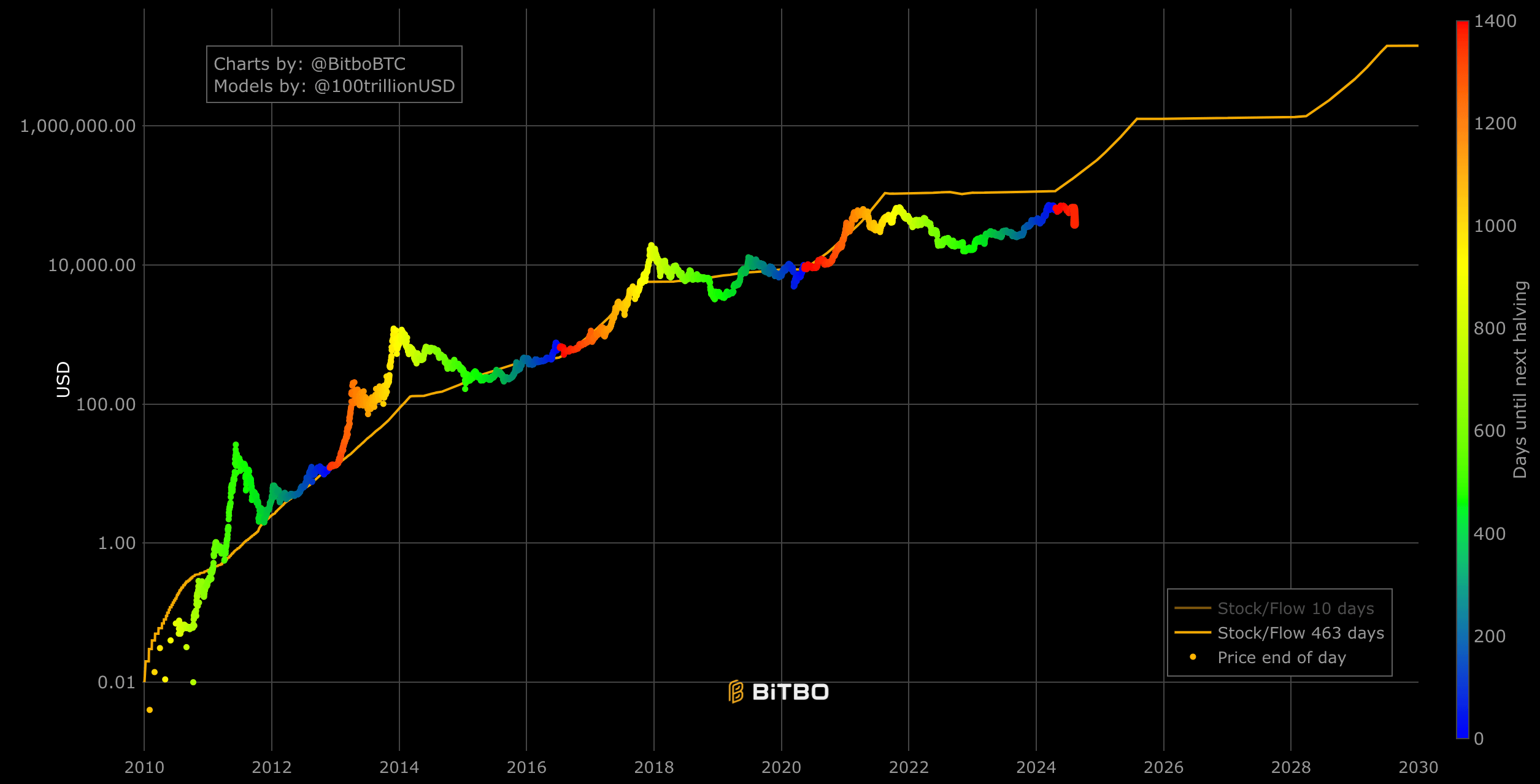

PlanB’s Stock-to-Flow (S2F) model, known for predicting Bitcoin’s terms based connected its scarcity, has faced scrutiny arsenic the integer asset’s worth has remained beneath the model’s expectations since 2021. The S2F model, which correlates the expanding scarcity of Bitcoin owed to halving events with terms appreciation, suggested a importantly higher terms than the existent marketplace worth implicit the past fewer years. As of caller data, the discrepancy has reached astir $130,000, continuing to rise questions astir the model’s reliability successful the look of unpredictable marketplace conditions. The exemplary predicts a terms of astir $180,000 astatine present, portion Bitcoin remains conscionable supra $50,000.

The S2F exemplary operates connected the rule that arsenic the travel of caller bitcoins decreases, the existing banal becomes much valuable, frankincense driving up the price. Until 2021, this exemplary historically aligned good with large terms movements, particularly astir halving events. However, the sustained divergence observed since 2021 indicates a break from this pattern.

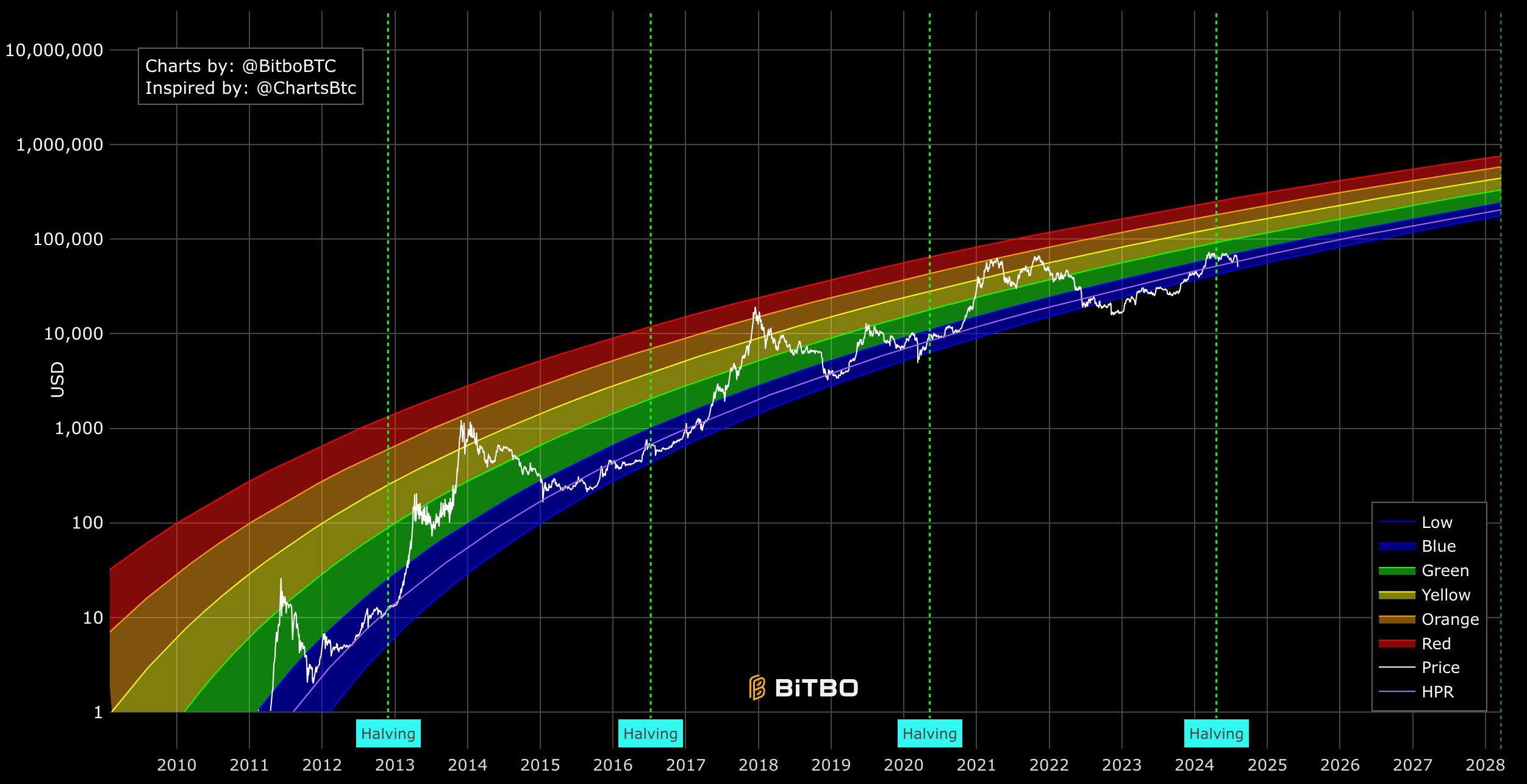

In opposition to the S2F model, different analytical tools, specified arsenic the Rainbow Price Chart and Power Law Model, person provided antithetic perspectives connected Bitcoin’s valuation. The Rainbow Chart, which categorizes terms levels by marketplace sentiment bands ranging from “Low” to “High,” has depicted Bitcoin mostly trading wrong mean bands since 2022. This indicates a play of unchangeable maturation without reaching speculative peaks, which the S2F exemplary mightiness person overestimated. At contiguous Bitcoin is moving toward the little bound of the rainbow chart, thing which it broke passim 2022 and 2023. At $50,000, Bitcoin is $220,000 beneath its precocious limit.

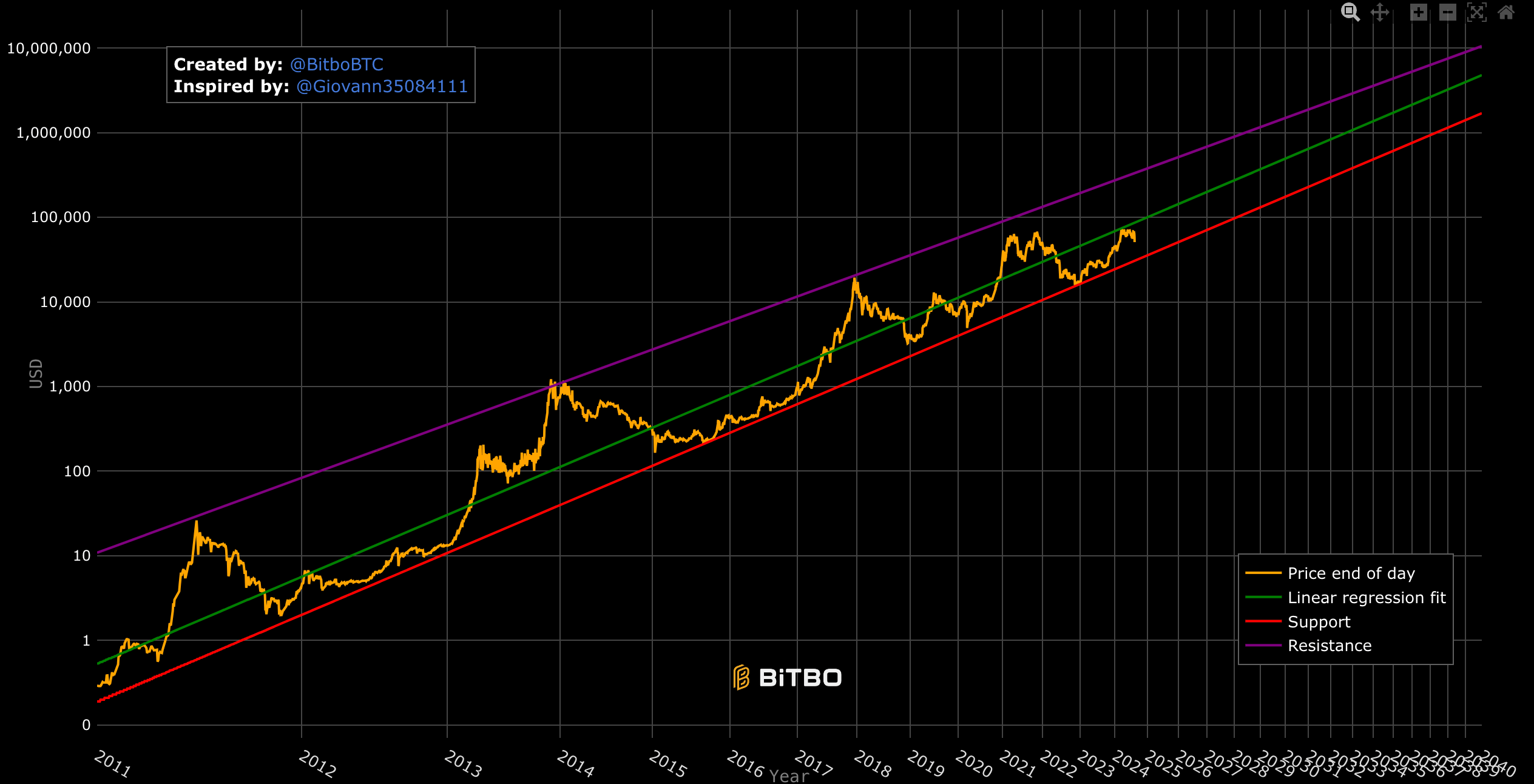

The power law exemplary is simply a statistical exemplary that describes relationships betwixt quantities wherever 1 quantity varies arsenic a powerfulness of another. The Bitcoin powerfulness instrumentality exemplary refers to the narration betwixt the terms and time. It projects a long-term price transmission with defined enactment and absorption levels. Bitcoin’s caller terms movements person adhered much intimately to this model’s projections, maintaining an upward trajectory wrong the transmission but often encountering absorption astatine higher levels.

According to the powerfulness instrumentality model, Bitcoin is inactive good wrong normal limits and conscionable $40,000 beneath the regression fit, oregon just price.

These discrepancies item the complexity of predicting Bitcoin’s price. While the S2F exemplary has been a fashionable model for anticipating marketplace trends, its perceived shortcomings suggest that it whitethorn not afloat relationship for the divers and dynamic factors influencing Bitcoin’s value. The deviation of up to $130,000 from the model’s forecast illustrates the request for a much nuanced knowing of marketplace forces, including the interaction of capitalist sentiment, technological developments, and broader economical conditions. Further, the powerfulness law, which besides appears successful quality and different man-made phenomena, appears to align much intimately with Bitcoin, a currency that is correlated straight to its vigor usage.

The station PlanB’s Stock-To-Flow exemplary disconnected by $130k, Bitcoin trades beneath inclination since 2021 appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

![Why Crypto Market Is Going Up Today [Live] Updates, Reasons & Price Action](https://image.coinpedia.org/wp-content/uploads/2025/11/11142238/Crypto-Market-Today-Bitcoin-Holds-Around-105K-Altcoins-Stay-Cautious-While-UNI-WLFI-TRUMP-Thrive-1024x536.webp)

English (US)

English (US)