Bitcoin (BTC) sees a 16% driblet successful worth connected Monday, taking the marketplace person beneath $23,000 for the archetypal clip since December 2020.

Although bulls successfully defended $25,000 successful the aboriginal hours of Monday, a continuation of merchantability unit led to a interruption of that terms level astatine astir 08:00 GMT.

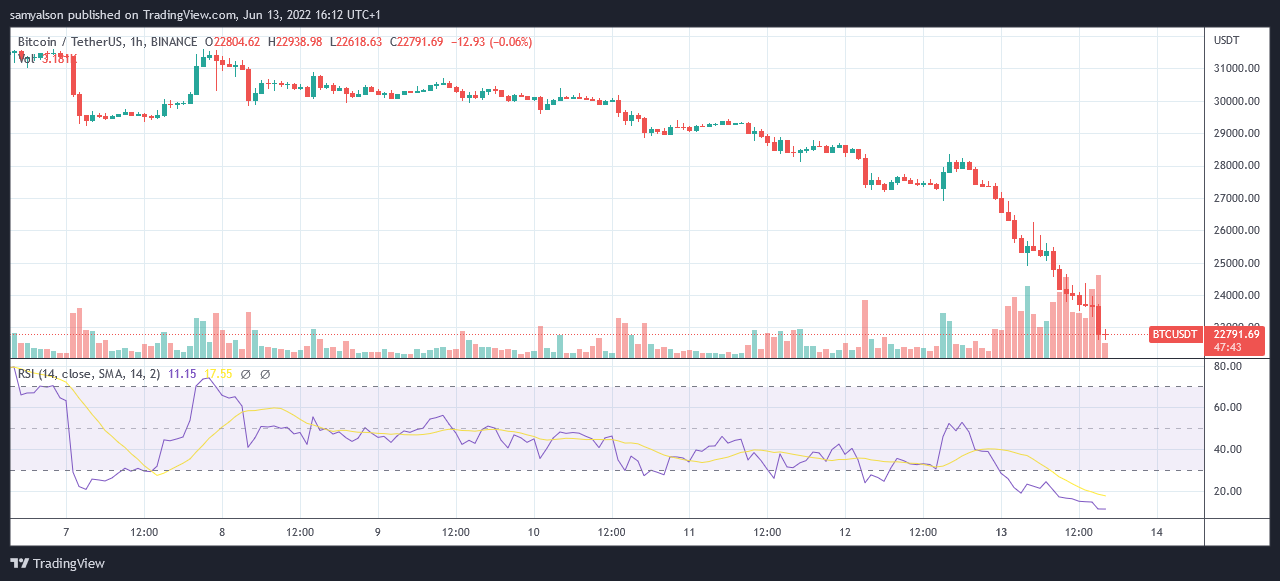

Source: BTCUSDT connected TradingView.com

Source: BTCUSDT connected TradingView.comMeanwhile, panic selling sunk the full crypto marketplace headdress arsenic debased arsenic $925 billion, marking a year-to-date nonaccomplishment of 58%. The dip was bought up to trigger an contiguous spike to $1.041 trillion.

But further merchantability unit has resulted successful a protracted drawdown successful the clip since the spike. The existent full marketplace headdress is hovering adjacent to the erstwhile section bottom, astatine $947 billion.

Weekend terms enactment saw a gradual downtrend successful Bitcoin. But Monday greeting Asian trading triggered a accelerated decline, falling from $28,000 to $22,600 astatine its lowest point.

Bitcoin sinks arsenic inflationary fears rise

On Friday, the U.S Labour Department released May’s Consumer Price Index figure, showing an summation of 0.3% from the erstwhile month, marking a 40-year precocious astatine 8.6%.

The quality triggered an contiguous sell-off successful Bitcoin, and the wider crypto markets, arsenic investors looked to follow much antiaircraft positions amid the likelihood of further quantitative tightening by the Fed.

Commenting connected this, Alex Kuptsikevich, a Senior Market Analyst astatine FxPro, said the CPI fig puts much unit connected the Fed to accelerate its hawkish position.

“A renewal of ostentation to 40-year highs volition surely pull the public’s attraction astatine the play and volition unit the Fed. Potentially, specified precocious speechmaking could trigger a tougher [Fed] stance successful the accompanying commentary.”

All of which spells occupation up for Bitcoin and different risk-on correlated assets. But the question is, however debased could BTC drop.

Technical analysis

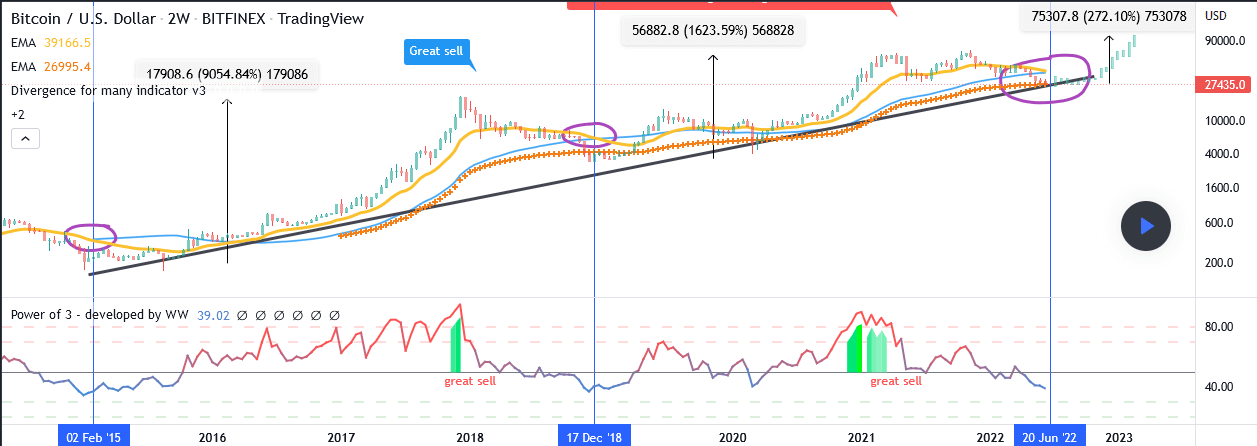

Trader without_worries shared his investigation utilizing a 2-week Bitcoin chart, saying the marketplace bottommost is “a batch person than you think.”

Supporting his sentiment is the imminent “2-week decease cross,” scheduled to hap connected June 20. At this point, the 21-week exponential moving mean enactment volition transverse beneath the 50-week elemental moving average.

He adds that erstwhile instances of this happening person “called the marketplace bottoms perfectly.”

Source: TradingView.com

Source: TradingView.com“what you person present is the 2-week decease cross. That is the 2-week/21-week EMA (yellow line) crossing down the 2-week/50-week SMA (blue line). A decease volition people connected June 20th.”

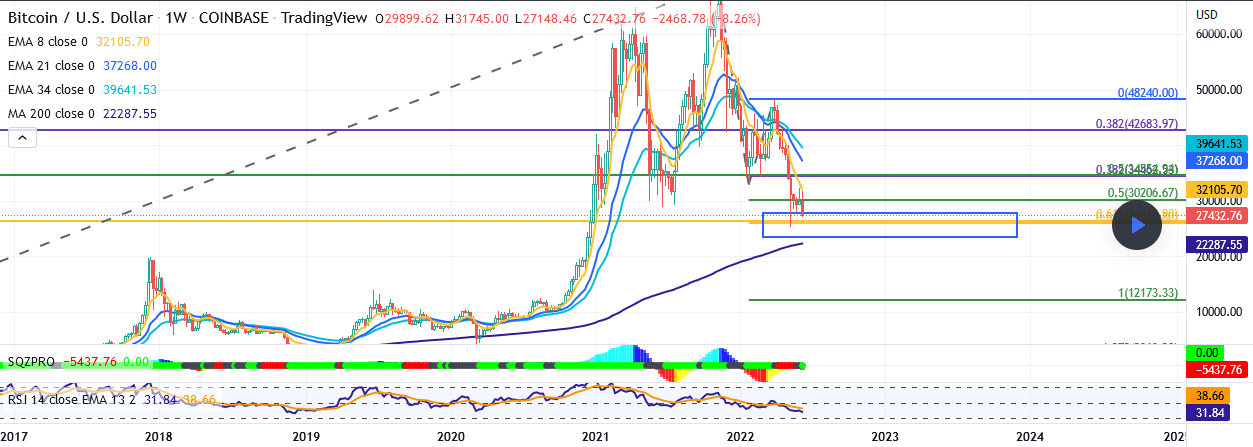

Meanwhile, Burning-Theta uses “a elemental Fibonacci projection” to telephone a $12,200 bottom, which helium expects to play retired according to past large question cycles.

Source: TradingView.com

Source: TradingView.com“When the archetypal limb of the correction is projected from the highest of the carnivore rally high, a people of 12,173 is the constituent astatine which some large waves of the correction person equality / proportionality—a common, but not guaranteed, spot for a correction to end.”

It’s important to enactment that a communal disapproval of method investigation is that it does not instrumentality into relationship the macroeconomic landscape.

The station Plummeting crypto markets spot nary reprieve arsenic Bitcoin loses $23,000 appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)