In a ballot taking spot this week, crypto concern firms Polychain Capital and Arca are proposing output cuts to the Anchor Protocol, the largest decentralized finance (DeFi) lending protocol successful the Terra blockchain ecosystem.

Anchor Protocol advertises a 19.5% output and has grown its coffers to $12.7 cardinal successful full worth locked (TVL), a trajectory immoderate analysts and traders spot arsenic unsustainable. The fig makes Anchor the largest DeFi protocol by TVL successful the Terra ecosystem and the fourth-largest DeFi protocol across each blockchains, according to information from DeFi Llama.

The projected output cuts volition alteration Anchor’s payout by betwixt 2 percent points and 9.5 percent points of annualized output for users who deposit much than 100,000 of Terra's dollar-linked stablecoin UST into the protocol.

“After successfully bootstrapping UST adoption with a 20% Anchor Rate, it's clip to absorption connected protocol sustainability by bringing down the wide output earned by depositors and maintaining precocious yields for small-and-medium sized users,” the proposal stated.

Up to 100,000 UST | 19.56% [No change] |

Above 100,000 and up to 500,000 UST | 17.5% |

Above 500,000 UST | 10.0% |

TIERED PAYOUTS: For a depositor of 1,000,000 UST, the archetypal 100,000 is taxable to 19.56% APY, the adjacent 400,000 UST volition beryllium taxable to 17.50% APY, and the remaining 500,000 UST would gain 10.00% APY.

Polychain and Arca, which some person superior locked up successful Anchor, besides projected downward complaint revisions each 30 days for deposit amounts successful the 2 higher tiers, which would beryllium implemented implicit 1 and a fractional years opening connected April 1.

The proposal, introduced successful Anchor’s governance forum connected Feb. 25, officially went unrecorded for voting connected Thursday.

Although voting connected the connection is inactive successful advancement – the voting play ends adjacent Wednesday greeting – it appears the proposal’s chances of going done are slim.

As of property time, implicit 70% of Anchor token holders participated successful the voting, with 55% voting "No" and 16% voting "Yes."

Amid the marketplace sell-off, stablecoin farming has attracted ample swaths of crypto investors looking to get precocious yields with little marketplace risk. Unlike yield farming with riskier cryptocurrencies, holding the underlying stablecoins comes with fundamentally nary volatility for the main investment.

The connection comes arsenic critics of Anchor accidental its precocious output volition go unsustainable and is threatening the semipermanent viability of the protocol and the larger Terra ecosystem.

Anchor accepts UST stablecoin deposits and presently advertises a 19.57% yearly percent output (APY) connected those deposits, paid retired successful its autochthonal ANC token.

This fig is acold higher than comparable DeFi projects. For example, the fashionable decentralized stablecoin speech Curve is offering an APY of betwixt 4.7% to 11.8% for deposits successful its UST pool.

Anchor has besides spurred rabid request for UST stablecoins among yield-hungry investors, precocious sending UST’s sister token LUNA to a new all-time high, adjacent arsenic different layer-1 tokens person heavy sold off. Anchor’s autochthonal ANC token has besides seen a big terms rally this month.

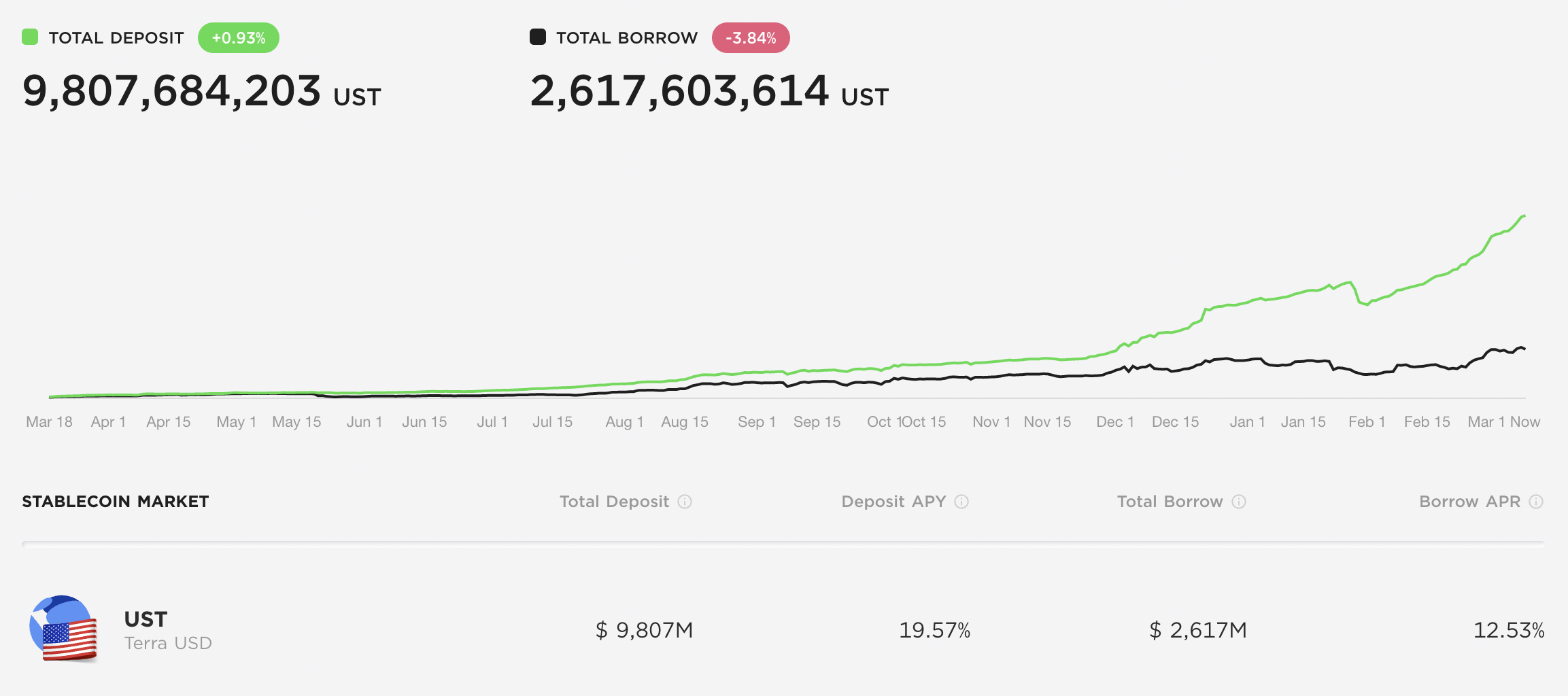

Anchor’s existent get complaint for UST present sits astatine 12.7%, a fig little than the 19.5% output Anchor is paying retired to its depositors. Additionally, the magnitude of UST deposited acold exceeds the magnitude of UST being loaned out.

UST borrowing and lending connected Anchor arsenic of Friday. (Anchor)

The connection has drawn aggravated treatment from the DeFi community, igniting debates ranging from imaginable loopholes to whether changes to Anchor’s existing codification basal projected by 3rd parties represent a valid governance proposal.

Many respondents successful the proposal’s governance thread highlighted concerns regarding a imaginable Sybil attack. Such an onslaught occurs if Anchor users with ample amounts of UST make aggregate wallets beneath the 100,000 UST threshold to proceed to cod the higher yield.

In effect to those critics, Polychain probe strategist Josh Rosenthal responded, “We are taking a calculated stake successful assuming that this wallet gamesmanship volition instrumentality spot connected the margins, but not astatine a magnitude that volition render this connection ineffective connected the whole.”

Another interest highlighted by Gabriel Shapiro (“@lex_node”), wide counsel astatine Delphi Labs, centered astir the deficiency of wide absorption regarding the proposal’s implementation.

Shapiro called the connection “intrinsically meaningless” and “impossible to evaluate,” pointing to the method legwork required if the connection were to pass.

Others took to Twitter to accidental that implementing the connection would beryllium a mediocre usage of Anchor’s precious developer resources.

Kanav Kariya, president of Jump Crypto, besides tweeted that Jump would ballot "No."

The connection besides touches upon a long-standing DeFi criticism, namely, that projects are speedy to rake up TVL by paying retired an unsustainable yield.

Eventually, the critics say, the flywheel volition collapse, starring to a wide exodus of capital, token crashes and tears. (The word “Ponzinomics” is present a staple of the crypto vernacular.)

It appears DeFi "degens" volition person to take betwixt higher short-term gains oregon longer-term sustainability of the protocol.

While Terra co-founder Do Kwon has remained soundless connected which broadside helium supports, Anchor Protocol’s authoritative Twitter relationship retweeted a station from a Twitter idiosyncratic voicing objections to the proposal.

Even if the connection fails, it appears that the effort is astatine slightest igniting much-needed treatment implicit the sustainability of Anchor, with some dissenters objecting to the connection successful its practice, but not successful its spirit.

“We should invited caller brains reasoning astir Anchor’s aboriginal and participating successful its governance,” Kwon tweeted.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)