In the 4th fourth of 2024, Polygon (formerly MATIC) experienced a important mixed show successful cardinal metrics, chiefly driven by the testnet motorboat of its interoperability protocol, Agglayer.

This caller inaugural aims to facilitate cross-chain token transfers and message-passing, enhancing the functionality and integration of assorted blockchain networks.

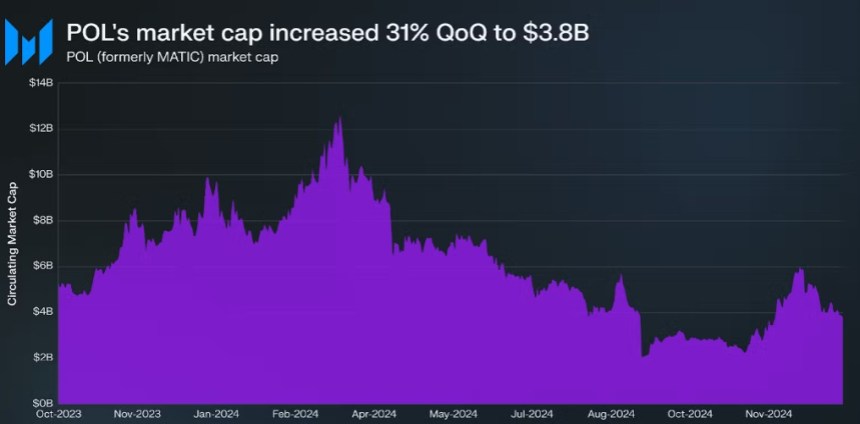

Polygon Market Cap Rebounds To $3.8 Billion

According to marketplace quality steadfast Messari, by leveraging zero-knowledge (ZK) proofs, Agglayer promises unafraid connection and plus transfers, positioning itself arsenic an innovative improvement akin to the instauration of TCP/IP successful the aboriginal days of the internet.

Agglayer is designed to unify disparate blockchain chains by aggregating proofs, verifying concatenation states, and settling transactions connected Ethereum (ETH). Among its captious features are a unified span for seamless plus connectivity and a pessimistic proof mechanism that prioritizes safety.

These advancements alteration low-latency coordination and harmless interoperability, allowing developers to ore connected task plan without the burdens of liquidity concerns.

Despite these promising developments, POL’s travel successful 2024 has been turbulent. After achieving an all-time high marketplace capitalization of $12.9 cardinal successful Q1, the consequent quarters saw a crisp decline, with the marketplace headdress plummeting to $2.9 cardinal by the extremity of Q3, marking a 47.2% quarter-over-quarter (QoQ) drop.

POL’s marketplace headdress maturation successful Q4. Source: Messari

POL’s marketplace headdress maturation successful Q4. Source: MessariThis downturn was partially owed to the ongoing modulation from MATIC to POL, which temporarily divided marketplace capitalization betwixt the 2 tokens.

However, arsenic marketplace conditions began to stabilize successful Q4, the migration of MATIC tokens—1.38 cardinal successful total—into POL resulted successful a 31% QoQ summation successful POL’s marketplace capitalization, which reached $3.8 cardinal by the extremity of the quarter.

Notably, 88.1% of the full proviso had transitioned to POL, solidifying its presumption arsenic the largest Ethereum Layer-2 token by marketplace cap.

DeFi And NFT Markets Struggle

The enactment of EIP-4844 connected the Polygon PoS mainnet successful Q1 2024 introduced blobs, starring to a important alteration successful the outgo operation for users. This update resulted successful lower transaction fees, which dropped to conscionable $0.01 during Q4.

However, contempt the reduced costs, full transactions connected the Polygon web fell by 2% QoQ, and progressive addresses saw a crisp diminution of 39.4%, averaging 523,000 regular users.

The alteration successful enactment tin beryllium mostly attributed to a downturn successful the gaming sector, which had antecedently been a important operator of idiosyncratic engagement. Average regular gaming progressive addresses plummeted to 54,000, marking a 66.7% QoQ decline.

Polygon’s DeFi scenery besides faced challenges, with full worth locked (TVL) ending Q4 astatine $871.5 million—down 4.9% QoQ and 2.6% YoY. This diminution saw Polygon gaffe from the tenth largest web by TVL to the twelfth.

Polygon’s TVL show successful USD and POL. Source: Messari

Polygon’s TVL show successful USD and POL. Source: MessariMoreover, NFT enactment connected the level suffered, with mean regular trading measurement falling to $822,500, down 38.4% QoQ. Average regular NFT income dropped to 21,000, a staggering 41.5% decrease.

The gaming sector, antecedently the fastest-growing country wrong Polygon, continued to conflict successful Q3 and Q4, mostly owed to a slowdown successful fashionable titles.

POL’s terms has besides faced notable challenges, with the token signaling a important 67% driblet year-to-date arsenic it presently trades astatine $0.30.

Featured representation from DALL-E, illustration from TradingView.com

9 months ago

9 months ago

English (US)

English (US)