Prediction markets are signaling skepticism that Donald Trump volition beryllium capable to crook the Federal Reserve to his volition this year, adjacent arsenic the U.S. President moves to occurrence a Fed Governor for what helium believes is conscionable cause.

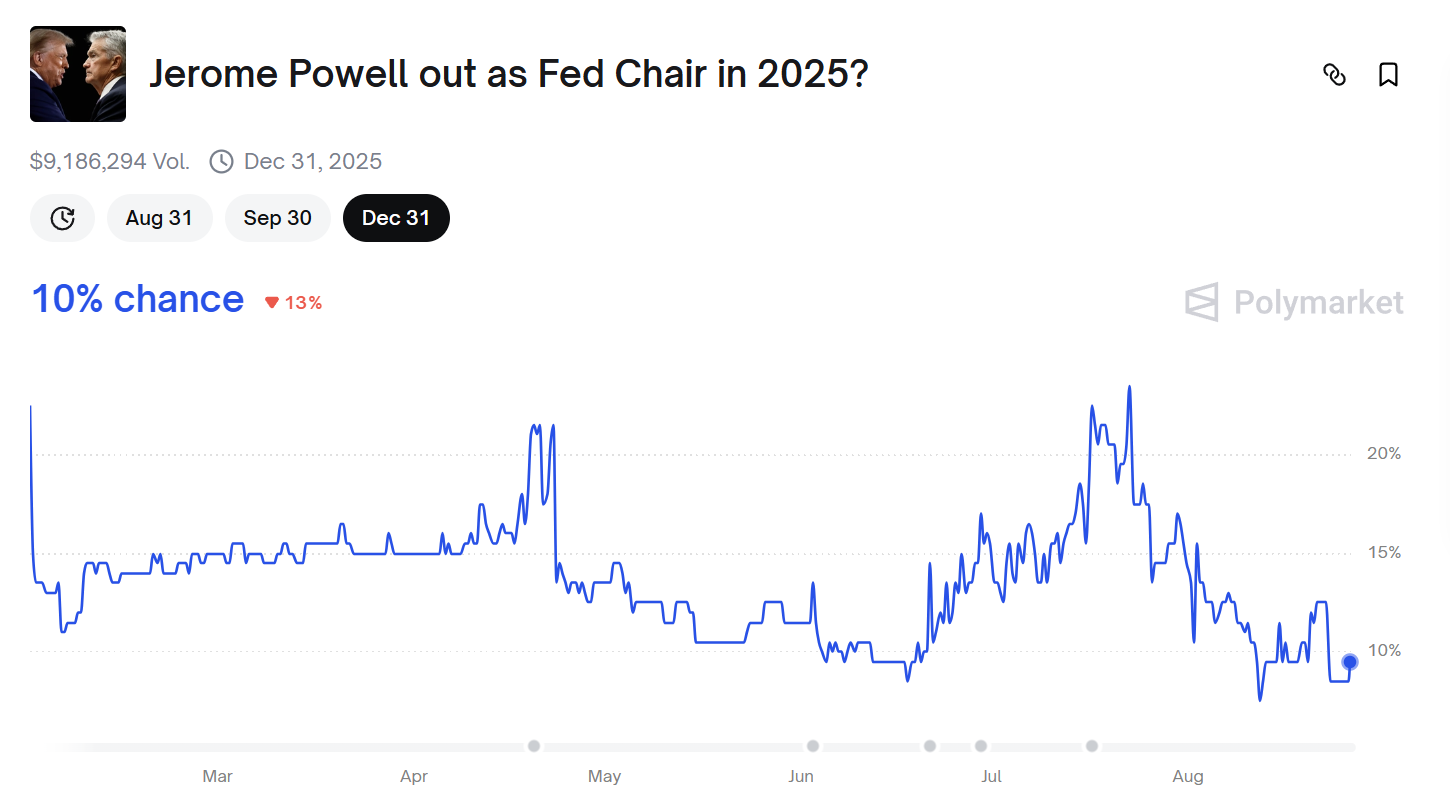

On Polymarket, bettors enactment the accidental of Jerome Powell being forced retired arsenic Fed Chair successful 2025 astatine conscionable 10%, suggesting investors don’t judge Trump tin override the cardinal bank’s independency earlier Powell’s word expires successful May 2026.

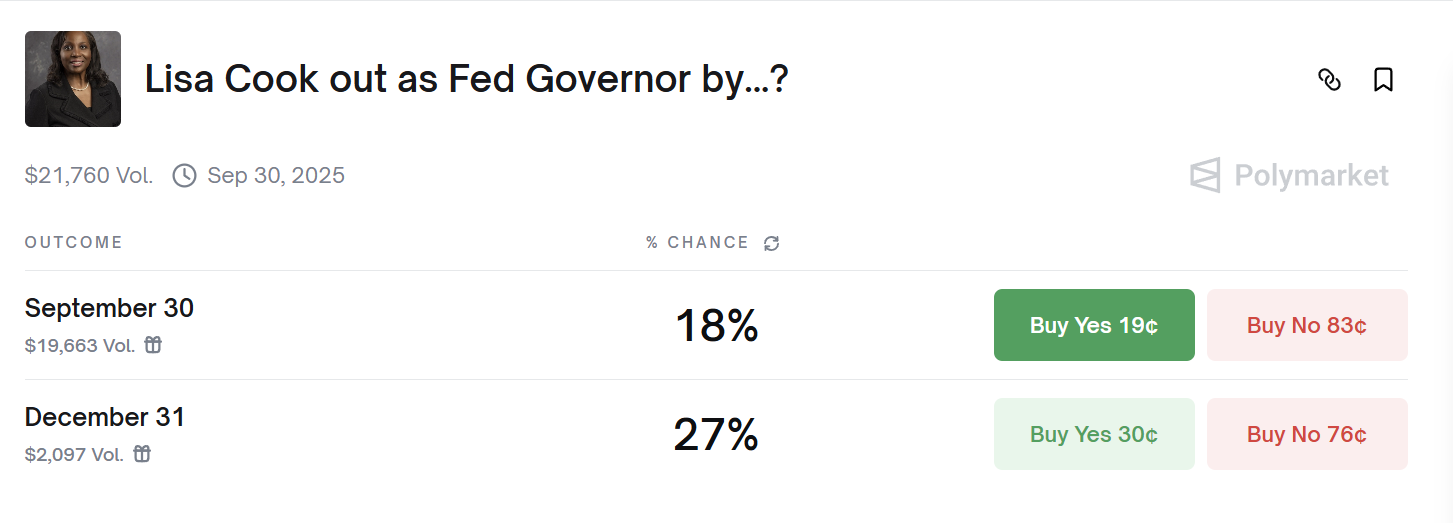

Trump’s propulsion to occurrence Fed Governor Lisa Cook tells a antithetic story. He wants her removed implicit allegations of owe fraud, per a missive posted connected Truth Social, making her the archetypal sitting politician ever targeted by a statesmanlike dismissal.

Cook, however, has refused to measurement down, arguing that “for cause” removals indispensable use to misconduct successful office, not backstage fiscal dealings predating her appointment.

Markets are pricing a 27% accidental of Cook's ouster by December 31, indicating immoderate hazard of ineligible oregon governmental fallout but inactive a beardown anticipation she survives the challenge.

History shows that erstwhile Presidents person besides pressured the Fed, with the Cato Institute pointing retired successful an October 2024 portion that it's much communal than immoderate would pb you to believe.

Harry Truman pushed retired Chairman Thomas McCabe successful 1951 to unafraid wartime indebtedness financing, Lyndon Johnson famously berated William McChesney Martin astatine his Texas ranch for raising rates during the Vietnam War, and Richard Nixon leaned heavy connected Arthur Burns successful the aboriginal 1970s a run economists aboriginal tied to runaway inflation.

A 2013 Cato study by Thomas F. Cargill and Gerald P. O’Driscoll Jr. argues that Federal Reserve independency is much story than reality, noting that some parties person interfered erstwhile politically expedient.

If Trump were to region Powell, it would beryllium surely controversial, but markets mightiness invited it if seen arsenic clearing the mode for easier monetary policy. A Fed much aligned with the White House could chopped rates faster, weaken the dollar, and assistance hazard assets broadly creating a supportive backdrop for bitcoin (BTC).

Beyond the near-term rally, Powell’s firing would underscore 1 of crypto’s halfway arguments: that fiat systems are inherently governmental and taxable to capture, portion bitcoin remains extracurricular those pressures.

For bitcoin, that operation looser liquidity conditions positive a reinforced “hard money” communicative could beryllium a almighty catalyst for adoption.

A changing of the defender astatine the Fed would evidently beryllium a bullish communicative for bitcoin, which is wherefore the market's absorption to Trump's determination connected Cook reflects a statement that this is mostly blistery air.

Bitcoin hardly moved connected the news, up 0.3% successful the contiguous aftermath, with the largest integer plus inactive down 2.6% on-day according to CoinDesk marketplace data.

The CoinDesk 20, an scale tracking the show of the largest crypto assets, is trading beneath 4,000, down 5.3% by mid-day Hong Kong time.

1 month ago

1 month ago

English (US)

English (US)