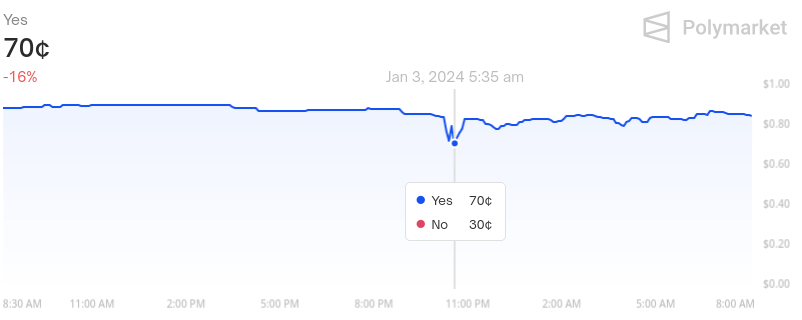

Betting likelihood connected Polymarket concerning the support of pending spot Bitcoin exchange-traded funds (ETFs) concisely fell to 70% connected Jan. 3.

On whether a spot Bitcoin ETF volition beryllium approved by Jan. 15, Polymarket displayed a “yes” result arsenic priced astatine $0.70 astatine 1:30 p.m. UTC connected Jan. 3. Polymarket information and assorted different reports suggested that a “yes” result was priced astatine $0.89 connected Jan. 2. Current Polymarket information indicates that “yes” is presently priced astatine $0.84.

Bitcoin ETF approved by Jan 15? — Polymarket

Bitcoin ETF approved by Jan 15? — PolymarketSo far, Polymarket users person stake $912,569 connected this market, though it is unclear however galore individuals person placed bets successful total.

Contrarian study whitethorn beryllium liable for drop

The diminution successful Polymarket’s “yes” likelihood whitethorn beryllium related to a contrarian study from Matrixport expert Markus Thielen published connected Jan. 3.

Thielen argued that the U.S. Securities and Exchange Commission (SEC) whitethorn cull each pending spot ETFs for governmental reasons. He noted that galore SEC Commissioners are members of the Democratic enactment (which is often considered anti-cryptocurrency) and highlighted SEC seat Gary Gensler’s hostility to crypto. Thielen besides asserted that pending applications bash not presently conscionable a captious request but did not place the request successful question.

Polymarket’s likelihood nevertheless correspond an overwhelming accidental of approval. Its existent 84% likelihood are astir successful enactment with a prediction from Bloomberg ETF analysts, who accidental determination is simply a 90% accidental that the SEC approves astatine slightest 1 ETF erstwhile it decides connected Ark Invest’s exertion by a Jan. 10 deadline.

Incidentally, Bloomberg ETF expert Eric Balchunas responded to Thielen’s report. As grounds of approval, helium noted that the SEC has worked extensively with applicants and that astatine slightest 3 commissioners are successful favour of approval.

Polymarket whitethorn correspond a much balanced presumption than either source. Because Polymarket’s likelihood are determined based connected idiosyncratic positions, they correspond the sentiment of respective individuals alternatively than a azygous person.

Bitcoin besides saw 8% flash crash

Declining Polymarket likelihood came alongside an 7.9% flash clang that saw the terms of Bitcoin (BTC) autumn from $45,421 to $41,804 successful a substance of hours.

Bitcoin (BTC) prices for Jan. 3 — Source: CoinGecko

Bitcoin (BTC) prices for Jan. 3 — Source: CoinGeckoOnce again, Thielen’s comments whitethorn person contributed to that terms crash. However, immoderate person besides pointed to CNBC property Jim Cramer’s positive comments astir Bitcoin arsenic a perchance harming prices. Cramer has developed a estimation for often being incorrect, starring immoderate investors to enactment contrary to his opinions according to the “Inverse Cramer effect.”

Bitcoin has since partially recovered to $42,967 arsenic of 10:00 p.m. UTC. Any much important quality astir a spot Bitcoin ETF volition apt spot further fluctuations.

The station Polymarket ETF likelihood fell to 70%, BTC saw 8% flash clang amidst Matrixport prediction appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)