Polymarket is simply a prediction marketplace that enables users to speculate connected assorted events by trading connected their outcomes. It has positioned itself arsenic 1 of the most successful DeFi products this year, capitalizing connected the ever-growing request for real-world applications of decentralized platforms.

Polymarket users tin commercialized connected predictions astir thing from governmental elections to fiscal markets oregon adjacent much niche topics. The level operates connected the rule that marketplace prices bespeak the corporate cognition and sentiment of its users, with the result of each marketplace determined done a decentralized and transparent process.

The level supports 2 types of markets — CFT and antagonistic hazard (NegRisk) markets. Both service antithetic purposes and cater to chiseled types of events oregon outcomes. CTF markets are based connected the Conditional Tokens Framework, which allows users to make and commercialized tokens representing the result of circumstantial events. For example, successful a CTF marketplace predicting the result of a governmental election, users tin bargain oregon merchantability tokens that correspond the likelihood of a peculiar campaigner winning. These tokens summation oregon suffer worth arsenic the perceived probability of the result changes, and erstwhile the lawsuit concludes, the tokens are settled based connected the existent result.

On the different hand, NegRisk markets are designed for scenarios wherever users tin hedge against circumstantial risks by betting connected the occurrence oregon non-occurrence of an event. For instance, a idiosyncratic mightiness enactment successful a NegRisk marketplace to hedge against the hazard of a fiscal downturn by betting connected an economical indicator declining. If the indicator falls, the idiosyncratic profits, efficaciously offsetting losses elsewhere. The cardinal quality betwixt these markets is their focus: CTF markets mostly foretell outcomes with varying probabilities, portion NegRisk markets are much astir managing oregon hedging against circumstantial risks.

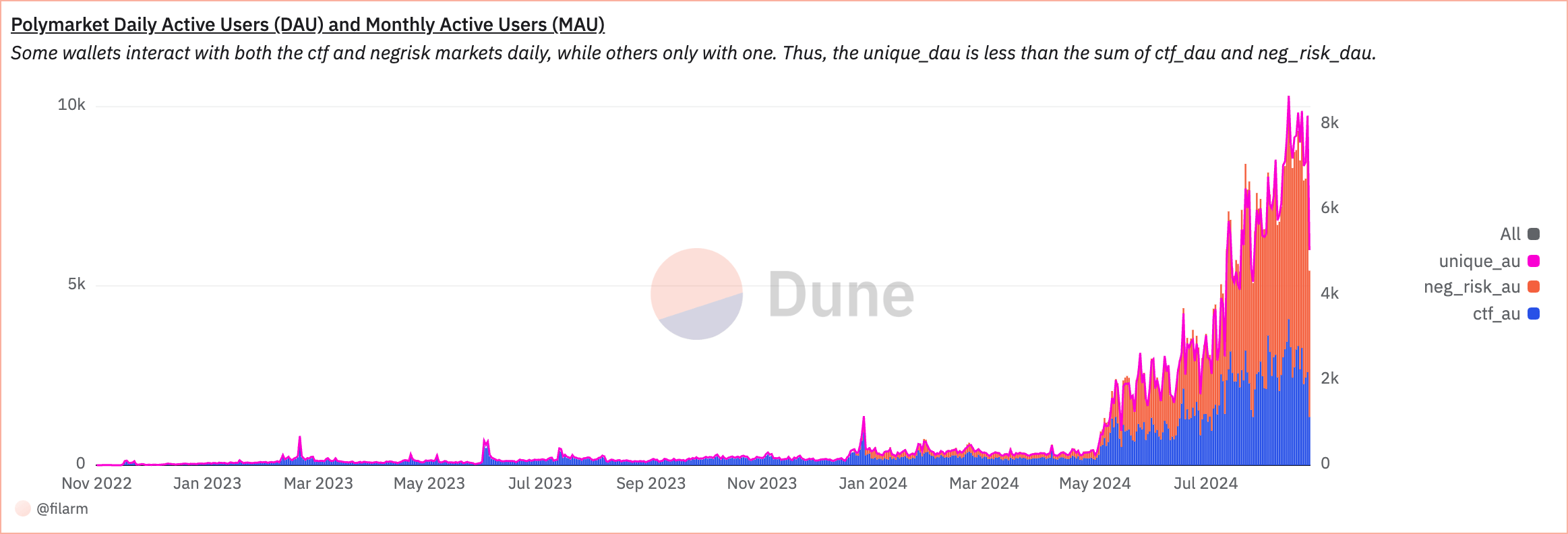

Polymarket’s unsocial progressive users peaked connected Aug. 23, with implicit 8,600 users interacting with the level that day. It represents a important summation successful idiosyncratic engagement, arsenic the level saw a accordant scope of 7,000 to 8,000 unsocial progressive users regular passim August. This surge successful enactment contrasts sharply with the archetypal fractional of the twelvemonth erstwhile the level had lone astir 150 unsocial progressive users regular for astir of May. The spike successful idiosyncratic numbers illustrates a increasing involvement and information successful the platform, astir apt driven by the hype surrounding the upcoming US statesmanlike elections.

The favoritism betwixt wallets interacting with the Conditional Tokens Framework (CTF) and NegRisk markets is important successful knowing idiosyncratic activity. Since immoderate wallets prosecute with some marketplace types daily, the full fig of unsocial regular progressive users is little than the combined regular progressive users from the CTF and NegRisk markets.

Among these, NegRisk regular progressive users signifier the majority, with betwixt 5,000 and 6,000 users engaging with NegRisk markets regular since the opening of August. It suggests that the NegRisk markets are peculiarly appealing to users, possibly owed to the quality of the events they screen oregon the perceived risk/reward illustration of these markets.

Chart showing the fig of unsocial progressive users and progressive users for CFT and NegRisk markets connected Polymarket from Nov. 23, 2022, to Sep. 3, 2024 (Source: Dune Analytics)

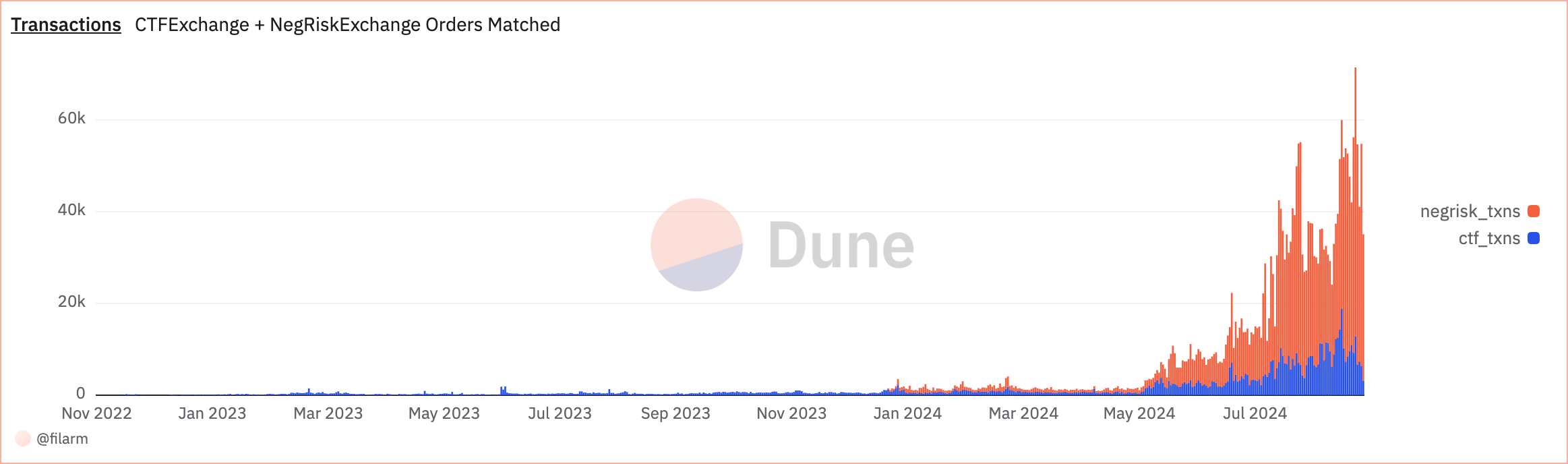

Chart showing the fig of unsocial progressive users and progressive users for CFT and NegRisk markets connected Polymarket from Nov. 23, 2022, to Sep. 3, 2024 (Source: Dune Analytics)In presumption of transaction activity, NegRisk transactions besides predominate the platform. On Aug. 30, the level peaked astatine implicit 58,000 transactions wrong NegRisk markets, compared to 12,700 transactions successful CTF markets. This disparity highlights the popularity and enactment levels wrong NegRisk markets.

However, it is besides notable that the full fig of transactions crossed the level decreased by astir fractional successful the archetypal fewer days of September from the highs seen successful August. Despite this decline, Polymarket inactive processes astir 35,000 transactions daily, indicating sustained idiosyncratic engagement adjacent arsenic wide enactment levels normalize.

Chart showing the fig of regular transactions for CFT and NegRisk markets connected Polymarket from Nov. 23, 2022, to Sep. 3, 2024 (Source: Dune Analytics)

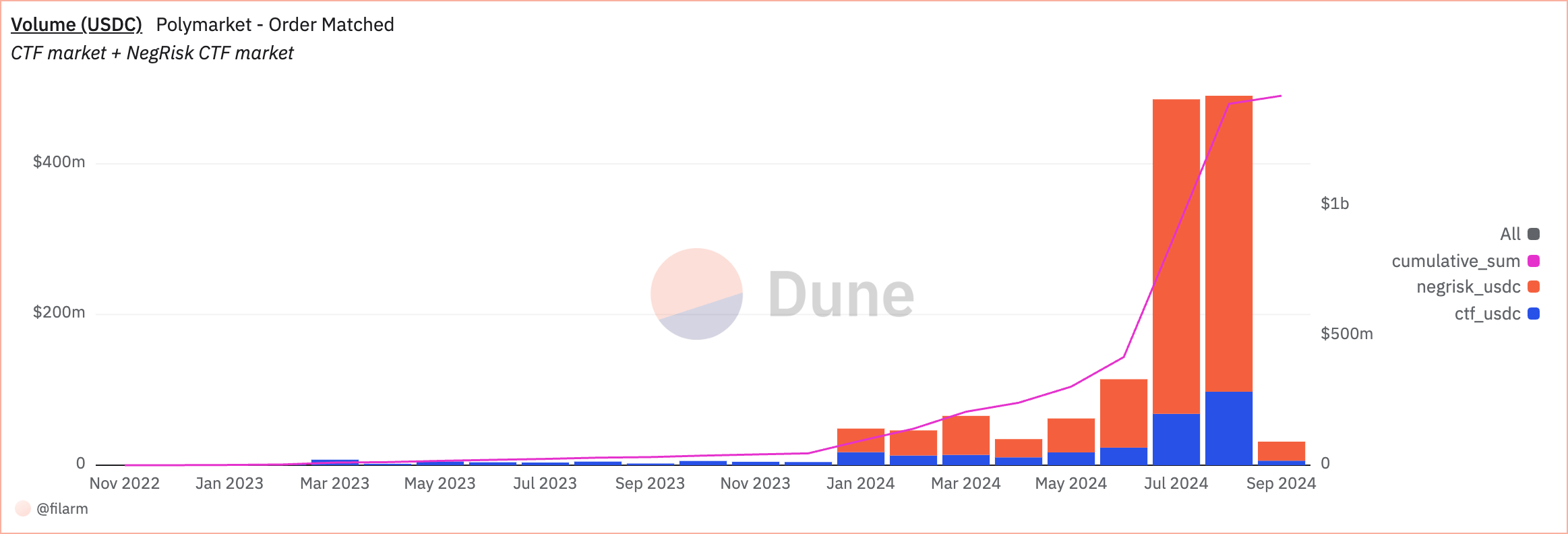

Chart showing the fig of regular transactions for CFT and NegRisk markets connected Polymarket from Nov. 23, 2022, to Sep. 3, 2024 (Source: Dune Analytics)The measurement shows that Polymarket has processed a cumulative full of $1.424 billion. On Aug. 1 alone, the level recorded a full measurement of $490.331 million, with a important $392.762 cardinal coming from NegRisk markets. The precocious measurement successful NegRisk markets shows their value wrong Polymarket, perchance reflecting the larger stakes oregon higher frequence of bets placed wrong these markets.

Chart showing the trading measurement processed by Polymarket from Nov. 23, 2022, to Sep. 3, 2024 (Source: Dune Analytics)

Chart showing the trading measurement processed by Polymarket from Nov. 23, 2022, to Sep. 3, 2024 (Source: Dune Analytics)The mean stake amounts supply further penetration into idiosyncratic behaviour connected the platform. The wide mean stake magnitude successful CTF markets crossed each users was 146 USDC, portion successful NegRisk markets, the mean stake magnitude was notably higher astatine 301.49 USDC. The quality successful mean stake sizes betwixt the 2 marketplace types could suggest that users comprehend NegRisk markets arsenic either much lucrative oregon necessitate larger bets to unafraid meaningful positions.

The correlation coefficient betwixt the mean magnitude stake successful CTF markets and the mean magnitude stake successful NegRisk markets is 0.18, indicating a anemic affirmative narration betwixt the stake sizes crossed the 2 types of markets. This debased correlation suggests that the factors driving idiosyncratic behaviour successful these markets mightiness differ, with users perchance adjusting their stake sizes based connected the circumstantial characteristics oregon risks of each market.

The station Polymarket processes $1.4B arsenic NegRisk outshines CTF markets appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)