The bitcoin cash-and-carry strategy, the crypto market's equivalent of the alleged risk-free stake and 1 of the astir sought-after trades, has mislaid its radiance successful the aftermath of rising inflation.

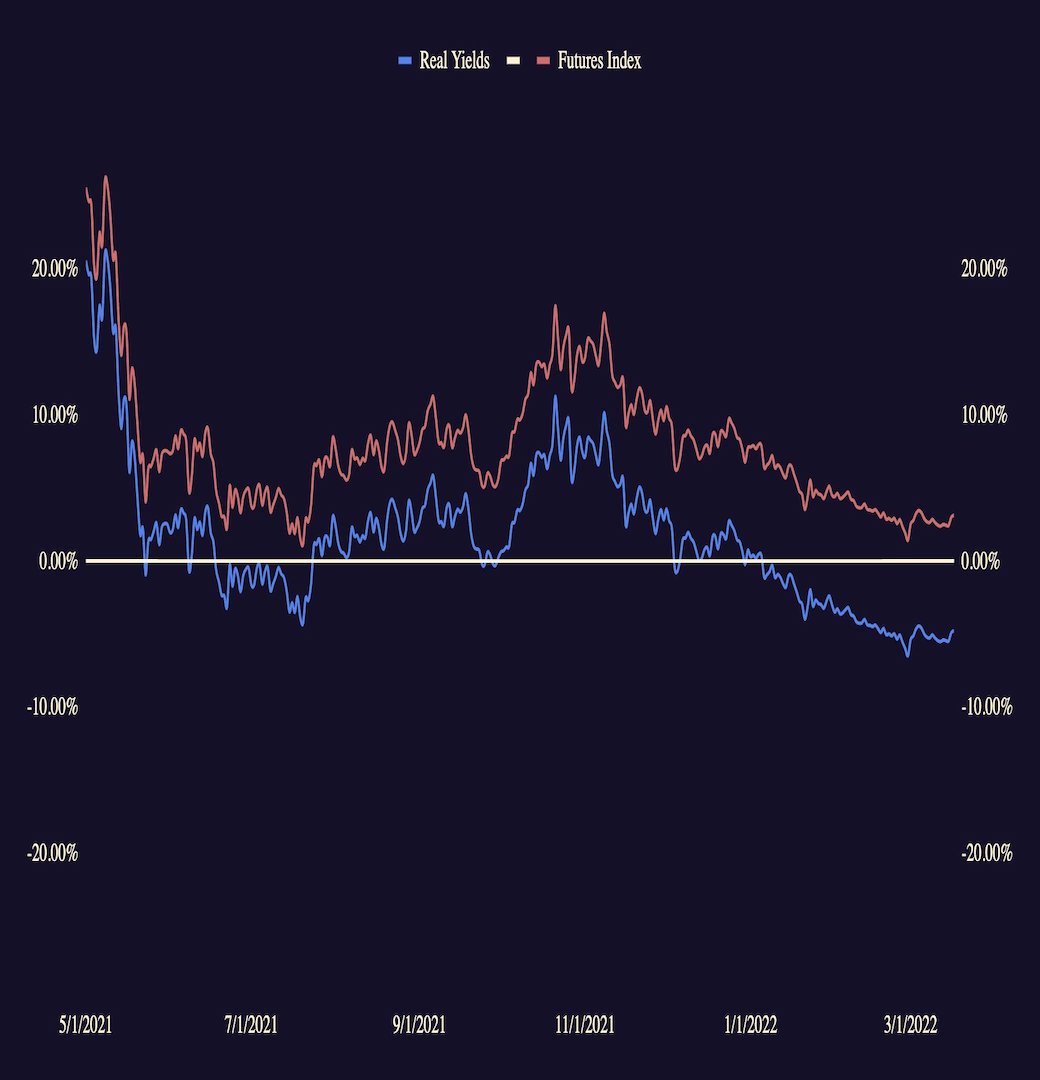

The market-neutral trade, which involves buying an plus successful the spot marketplace portion selling futures contracts to pouch the dispersed betwixt the 2 prices, present offers a antagonistic existent yield, oregon inflation-adjusted return. That's down importantly from a level of much than 10% a twelvemonth ago.

At property time, three-month futures traded astatine an annualized premium of astir 3% connected large exchanges, including the regulated Chicago Mercantile Exchange and Binance, the world's largest crypto speech by measurement and unfastened interest, according to information provided by Skew.

That means a trader buying bitcoin successful the spot marketplace and selling futures contracts would fastener successful a 3% annualized instrumentality successful nominal terms. With the U.S. user terms scale (CPI) astatine 7.9%, that corresponds to a nett output of -4.9% successful existent terms.

"Yields are precise debased astatine the moment, some successful inflation-adjusted presumption and nominal terms," Vetle Lunde, a marketplace probe expert astatine Arcane Research, said. "The contracted yields are natural, pursuing the highly potent and unsustainable yields from past year."

"Cash and transportation was apt a large root of request successful the spot market, particularly past spring, with the marketplace reaching a 50% annualized ground successful April," Lunde said.

The cash-and-carry arbitrage was rather fashionable among institutions and sophisticated participants last twelvemonth and enactment upward unit connected spot marketplace prices.

With futures trading astatine a 25% oregon much premium connected the CME and offshore exchanges and CPI astatine 4% past April, galore institutions locked successful double-digit inflation-beating returns utilizing the strategy. Even though futures premiums dropped successful the 2nd half, with Binance and FTX cutting leverage, transportation traders inactive pocketed astatine slightest 5% existent instrumentality successful precocious October and aboriginal November. However, a continued emergence successful ostentation since past has coupled with a bearish marketplace to propulsion existent yields into antagonistic territory.

The stablecoin lending marketplace has seen akin developments. "Stablecoin farms are bleeding and accelerated arsenic radical aren't truly paying attraction to what matters. Your dollar yields NEED to beryllium adjusted against inflation," Split Capital's Zaheer Ebtikar tweeted.

While the existent output from the cash-and carry-arbitrage has turned negative, it's inactive higher than the inflation-adjusted risk-free complaint of instrumentality successful accepted markets.

According to Investopedia, the output the U.S. three-month Treasury measure is wide considered a proxy for risk-free returns. That output was 0.398% astatine property time, amounting to a CPI-adjusted risk-free complaint of -7.5%. For the 10-year Treasury, the existent complaint comes to -5.75%, besides underperforming the crypto cash-and-carry return.

The crypto market's comparative attractiveness volition proceed to gully accepted marketplace money, according to Split Capital's Ebtikar.

"Even though stablecoin output and currency and transportation are yielding antagonistic successful crypto, determination are inactive billions that are yielding adjacent much antagonistic extracurricular of crypto that volition proceed to travel into crypto," Ebtikar told CoinDesk successful a Twitter chat. "The USD implied backing complaint from futures minus USD ostentation is the lowest it's ever been, basically."

According to quantitative trading steadfast and liquidity supplier Folkvang Trading's Jeff Anderson, determination is inactive involvement successful the currency and transportation arbitrage, besides known arsenic the ground trade, but the absorption has shifted to different crypto sub-sectors similar the non-fungible tokens (NFTs).

"We spot caller entrants each week who are trying ground arb," Anderson said successful an email. "The wealth for the past six months, though, has not been focused connected coins. Retail flows person been directed astatine NFTs portion organization currency is funneled into VC land."

Arcane Research's Lunde foresees superior moving into crypto market-making activities oregon volatility trading.

"What perchance whitethorn pull tradfi [traditional marketplace investors] astatine the moment, I'd presume, is liquidity proviso and marketplace making, oregon adjacent the debased volatility," Lunde said successful a Twitter chat. "Decentralized enactment vaults (DOV) person contributed to lowering the implied volatilities (IV) successful the options market, and contrarian volatility bets mightiness go a much communal strategy, offsetting the DOV unit connected the IV."

DeFi enactment vaults became fashionable successful the past 4th of 2021 and person contributed to the dependable diminution successful bitcoin and ether implied volatilities, arsenic noted successful the First Mover newsletter dated Jan. 10. That has reduced yields connected options selling. Implied volatility has a affirmative interaction connected the option's price.

However, according to Shiliang Tang, main concern serviceman of crypto hedge money LedgerPrime, determination are inactive pockets of bully output successful immoderate decentralized concern pools and options.

"The elemental decentralized concern pools are debased azygous digits, but immoderate much analyzable pools similar connected [AVAX-based stableswap platform] Platypus oregon [scaling solution] Cosmos are inactive ~ 20%," Tang said successful a Telegram chat. Cash and transportation arbitrage and trading out-of-the-money higher onslaught telephone options were LedgerPrime's preferred strategies successful the archetypal fractional of 2021.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)