Bitcoin has dropped implicit 20% from its three-year precocious reached soon aft the U.S. Securities and Exchange Commission (SEC) approved the archetypal spot Bitcoin exchange-traded funds (ETFs) successful January. Analysts mention a operation of profit-taking aft the long-awaited lawsuit and broader marketplace uncertainty arsenic reasons for the correction.

Bitcoin Retreats Post-ETF Approval Surge

The terms surge successful anticipation of the ETF support saw Bitcoin scope astir $49,000 connected January 11th. However, since the greenish airy for the ETFs, the cryptocurrency has retreated steadily, trading astatine astir $39,500 astatine the clip of writing.

According to immoderate analysts, they person seen a classical “sell the news” script unfold. Investors had mostly priced successful the ETF support for months, and erstwhile it really happened, immoderate took the accidental to fastener successful profits, they added.

While astir $4 cardinal has flowed into the caller spot ETFs, a important portion, analysts note, came from existing funds similar Grayscale which transitioned into an ETF, suggesting little nett caller concern than what the header numbers mightiness imply. Additionally, the ongoing liquidation of assets from bankrupt crypto speech FTX has added downward unit connected prices.

Yuya Hasegawa, crypto marketplace expert astatine Japanese bitcoin speech Bitbank, said:

“It seems that the seemingly ample magnitude of regular outflows from GBTC is affecting the marketplace successful a intelligence way.”

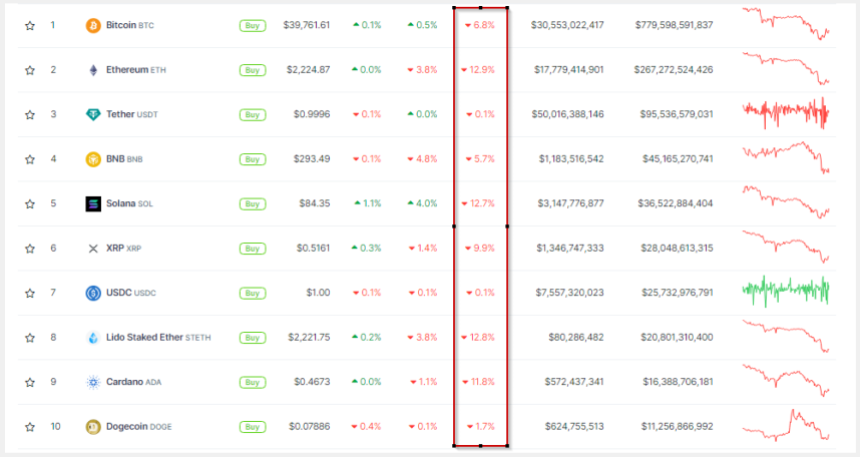

The downturn extends beyond Bitcoin, with different major cryptocurrencies besides experiencing losses. Ether, the world’s second-largest cryptocurrency, is down astir 4%, portion Solana and different altcoins person seen akin declines. The terms dips person besides impacted crypto-related stocks, with Coinbase shares falling astir 4% successful pre-market trading.

Top 10 cryptos drenched successful reddish today. Source: Coingecko

Top 10 cryptos drenched successful reddish today. Source: Coingecko

Despite the caller terms correction, analysts stay divided connected the near-term outlook for Bitcoin. Some judge the pullback whitethorn beryllium nearing its end, with enactment levels astir $36,000 apt to hold. Others judge further downside is imaginable earlier a sustained rebound.

BTC terms enactment successful the past week. Source: Coingecko

BTC terms enactment successful the past week. Source: Coingecko

Bitcoin: Volatility Persists, Long-Term Outlook Strong

Bitcoin has experienced important corrections aft large quality events successful the past. However, the semipermanent fundamentals stay strong, and galore judge Bitcoin is inactive connected way for a caller all-time precocious successful 2024.

The caller marketplace volatility highlights the risks progressive successful investing successful Bitcoin and different cryptocurrencies. While the imaginable for precocious returns exists, investors should beryllium alert of the important terms swings and uncertain regulatory scenery earlier entering the market.

As the post-ETF aftermath unfolds, the cryptocurrency marketplace finds itself submerged successful a oversea of red. The volatility underscores the sensitivity of integer assets to marketplace sentiment and regulatory developments.

Featured representation from Shutterstock

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

2 years ago

2 years ago

English (US)

English (US)